West Texas Intermediate (WTI) is looking bullish at the moment as is trading above the psychological level of $50.00. It’s remarkable that for the last five weeks the US crude added more than $10.00 a barrel as it rose for a fifth consecutive week after rebounding from the $42.00 level.

WTI for April traded up +18.50 percent at $56.40 a barrel, after touching a 2015 peak at $57.40 following a -8.71 percent in March. In a monthly report, OPEC said demand for its oil this year would be 80,000 barrels per day higher than previously thought as lower prices curb supplies in the United States and other non-member countries.

Oil prices plunged in the six months from June 2014 to January 2015, pushing WTI down more than 65 percent to almost $40 a barrel. However, the oil market has gradually recovered the last couple of months (Feb +4.13 percent) as lower prices have discouraged production, especially in United States and Europe.

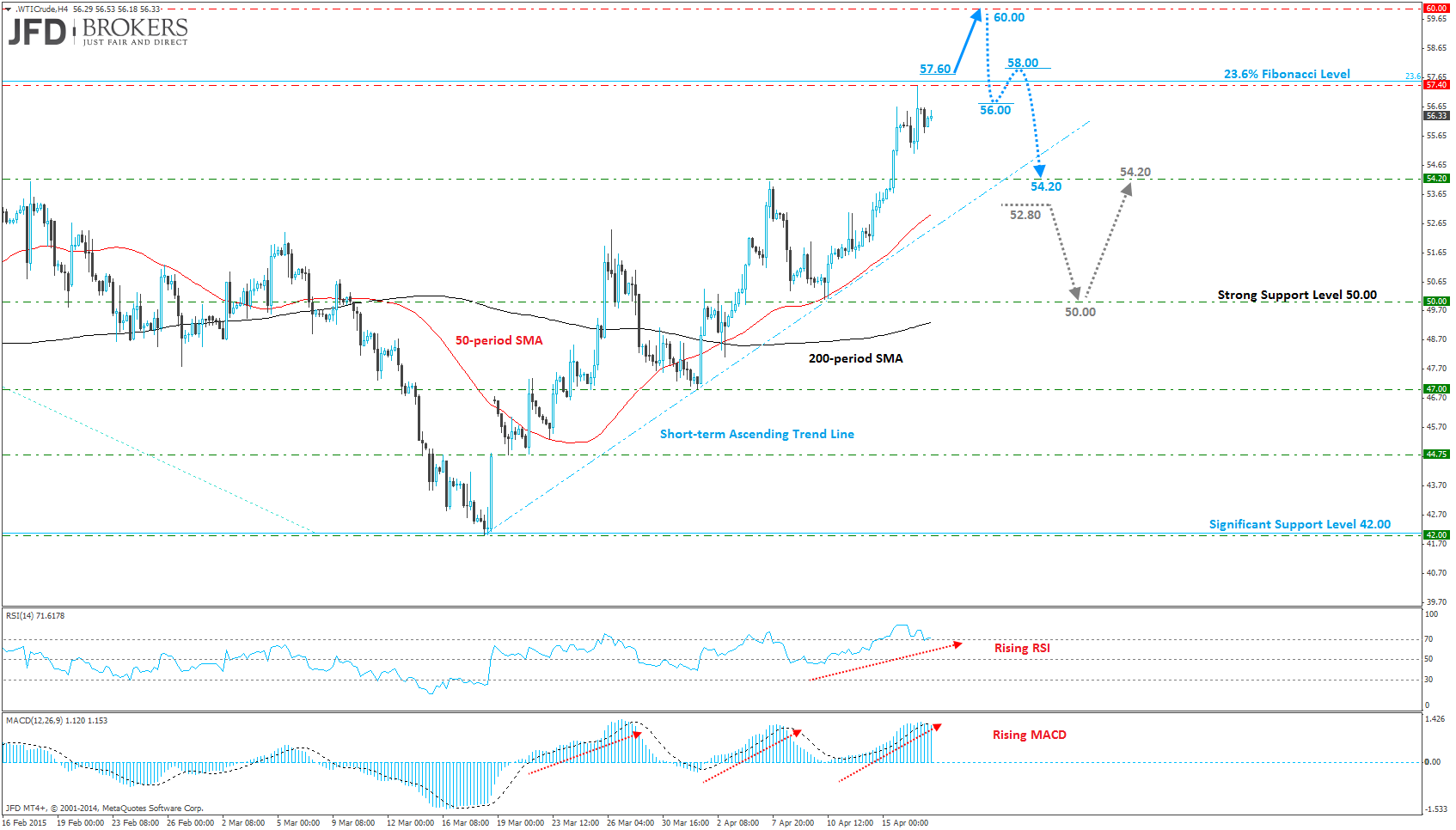

Technically, the medium term and long term trend remains a downtrend since the price still lies below the 200-period SMA, on both timeframes (daily and weekly charts). The break above the strong resistance level of $54.20 did not come as a surprise, following the powerful rally in the US crude after rebounding from the $42.00 region few weeks ago, which has seen it break through many significant resistance levels including $44.75, $47.00 and more recently the psychological level of $50.00.

The price is currently testing the 23.6% Fibonacci retracement level from the June 2014 high to March 2015 low. For now, I would expect the bulls to remain in control and to push the price further up and towards the psychological level of $60.00. Both oscillators support the notion since the MACD is rising in a bullish territory above its trigger line while the Relative Strength index is also rising above 50. The $60.00 level will be a crucial for the bulls as a break above there could suggest that we are in a more serious retracement, prompting a more aggressive move towards the $70.00 level, slightly above the 38.2% Fibonacci Retracement level.

Alternatively, if the bulls fail to break above the $60.00 level then I would expect the bears to drive the price back below the $54.20, plunging the price below the short-term ascending trend line and around the psychological level of $50.00.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

US economy grows at an annual rate of 1.6% in Q1 – LIVE

The US' real GDP expanded at an annual rate of 1.6% in the first quarter, the US Bureau of Economic Analysis' first estimate showed on Thursday. This reading came in worse than the market expectation for a growth of 2.5%.

EUR/USD retreats to 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated to the 1.0700 area. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.