The dollar is on an unpleasant correction this week, which drives all the G10 currencies higher. The best performers of the week were Swedish Krona, Norwegian Krone and Euro.

The greenback has been hit this week by negative economic data came out, among of them the Retail Sales for March and other news shows a weak Housing Construction and a soft Industrial sector. Retail Sales dropped unexpectedly to a five-year low at 1.3% from 1.9% before, showing a decrease in the private consumption. Housing Starts and Building Permits came out worried the investors. Building Permits number is to a five-month low and the number of Housing Starts, despite that is higher the previous month print, is very low compared to the last year’s average. The Industrial Production for March, on a yearly basis, has plunged to 2.0% from 3.47% before, the lowest print in the last one and a half year. Capacity Utilization also slowed down to 78.4%, below than anticipated; the lowest figure since January 2014.

EUR/USD managed to break above 1.0700

The shared currency surged above the psychological level of 1.0700, posting its largest incline against the greenback in two weeks. If the price manage to remain above the latter level will mark the fourth consecutive positive session following the aggressive rebound from the 1.0520 level. The rally over the last days has been particularly aggressive, so this could suggest that we are in a more serious retracement instead of a small correction after the price rebounded from the psychological level of 1.0500. The 1.0800 level continues to be a barrier, as moving averages continue to fall and are looking like providing a strong resistance to the price action, especially the 200-period Simple Moving Average.

GBP/USD approaches the 1.5000 ahead of jobs report

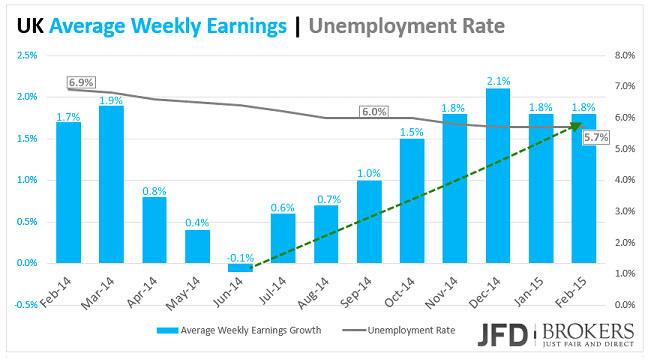

The British pound is continuing to push higher against the U.S. dollar, recording a fifth consecutive day of gains at the start of the week. The last five days have seen GBP/USD adding more than 400 pips following the strong rebound from the 1.4565 region. The pair approached the psychological level of 1.5000 and it could break that critical obstacle following the UK jobs report today, which is expected to improve. The claimant count rate is forecast to drop by another 28,000 in March. The unemployment rate is expected to fall to a fresh 6-year low of 5.6 percent in the three months through February, compared with 5.7 percent in the November to January period. Therefore, traders should watch this closely as the psychological level of 1.5000 could be a turning point for the pair.

USD/JPY fails the 120.30; remains in a sideways channel

The U.S. Dollar nudged slightly lower against the Japanese yen, as the greenback in facing a correction the last couple of weeks following the failed attempt above the 120.30 level. For over an entire month now, USD/JPY has been consistently trending higher above the psychological level and turning point of 118.00, however the greenback remains negative for the month -0.94 percent, following a +0.50 percent in March. In the bigger picture, the long-term path of USD/JPY remains to the sideways since we cannot identify a clear trending structure.

Loonie added to its gains after BoC meeting

The Canadian dollar added to its gains +3.07 against the U.S. dollar after the Bank of Canada Interest Rate decision met expectations to remain stable at 0.75%. The plunge in oil prices stalled the economy and dragged down its growth. However the Central Bank stated in its monthly statement that expects economy to be boosted by the eased credit conditions caused by the interest rate drop in January and the US increasing demand, which is forecasted to recover after a recent slowdown. The Canada’s real GDP growth is expected to rebound about 2.5% in the second quarter and continue to strength on a quarterly basis until the middle of 2016. The forecasts are 1.9% in 2015, 2.5% in 2016, and 2.0% in 2017. In addition, the inflation rate is predicted to be close to 2.0% around the end of 2016 from 1.0% now.

The USD/CAD escaped from its range channel which started back in mid-January and is now trading in more positive territory below the strong zone of 1.2350 – 1.2390. Today’s data is likely to have a significant impact on the CAD, including the CPI figures for March.

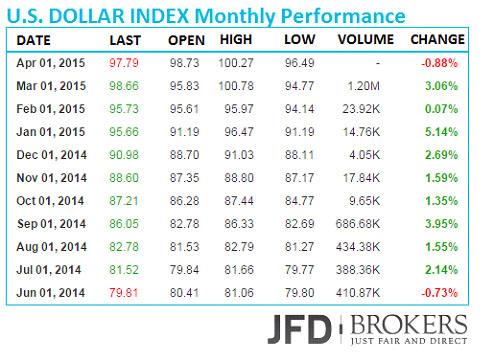

U.S. Dollar Index

The U.S. dollar index, a measure of the U.S. currency against a basket of six major rivals, was down -1.80% to 97.81 this week as the dollar depreciates, after last week when the index gained 2.89%. Following nine consecutive positive months for the U.S. dollar index the buyers lost the battle around the psychological level of 100.00 area and suffered a serious dip below that level as well as below the 98.50 level, which includes the 50-period SMA and the 200-period SMA on the 1-hour chart. In addition, the index moved below the 50-period SMA on the 4-hour chart which is very significant for the medium term. The index is now threatened to record its first month in a loss since June 2014 when the index lost -0.73% of its value.

Economic Indicators

Today is a CPI day, since United States, Eurozone and Canada will announce both their CPIs and their Core CPIs for March. Another concern for the traders is the two meetings scheduled for today. The central bank governors of the G20 major economies scheduled its standard meeting to discuss important issues in the global economy. The IMF meeting is the other meeting on the agenda. International Monetary Fund meeting consist of the member countries to discuss stabilizing international exchange rates and facilitating development.

In UK, the ILO Unemployment Rate and the Average Earnings release will attract considerable attention since are both closely monitored by BoE. In addition, the Claimant Count rate that measures the number of unemployed people is coming out.

In US, further to the CPI release, University of Michigan will publish their survey’s results for the Consumer Sentiment, the Current Conditions and the Inflation Expectations for April. From Canada, the Retail Sales are also expected.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

GBP/USD remains on the defensive below 1.2450 ahead of UK Retail Sales data

GBP/USD remains on the defensive near 1.2430 during the early Asian session on Friday. The downtick of the major pair is backed by the stronger US Dollar as the strong US economic data and hawkish remarks from the Fed officials have triggered the speculation that the US central bank will delay interest rate cuts to September.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Israel vs. Iran: Fear of escalation grips risk markets

Recent reports of an Israeli aerial bombardment targeting a key nuclear facility in central Isfahan have sparked a significant shift out of risk assets and into safe-haven investments.