The Reserve Bank of New Zealand (RBNZ) is to announce its benchmark interest rate and publish its rate statement, which outlines economic conditions and the factors affecting the monetary policy decision. None of the economists polled expect a change in rates so the focus will be on the statement. The RBNZ kept the official cash rate unchanged at 3.5% on January 28th, however, Governor Wheeler said that the bank will hold its rate to 3.5%, as headline inflation would probably stay below the bank's target of 2.0% in 2015. Moreover, the cash rate could be lowered or raised depending on the flow of economic data coming up in the next couple of weeks.

GDP for Q4 - March 18

CPI for Q1 - April 19

Unemployment rate for Q1 - May 05

New Zealand’s annual inflation rate fell further below 1% to 0.8% in the year to the December 2014 quarter, marking its second consecutive decline after recording 1.6% in mid-June 2014, which is below the Reserve Bank's 1-3% target. However, lower fuel prices are likely to keep inflation in low levels over 2015, thus I would expect the RBNZ to remain on hold for a considerable period.

Technically, despite the recent sell-off seen the last couple of months on the NZD/EUR pair, the kiwi is still considered high against the three majors (USD and GBP). The NZD/USD pair clears support at 0.7400 as WTI finds support near the $43.00. Few days ago, WTI surged 1.57% and managed to close above the psychological level of $50.00, but the move was halted by the 50-period SMA on the daily chart, as well as the $53.50 barrier.

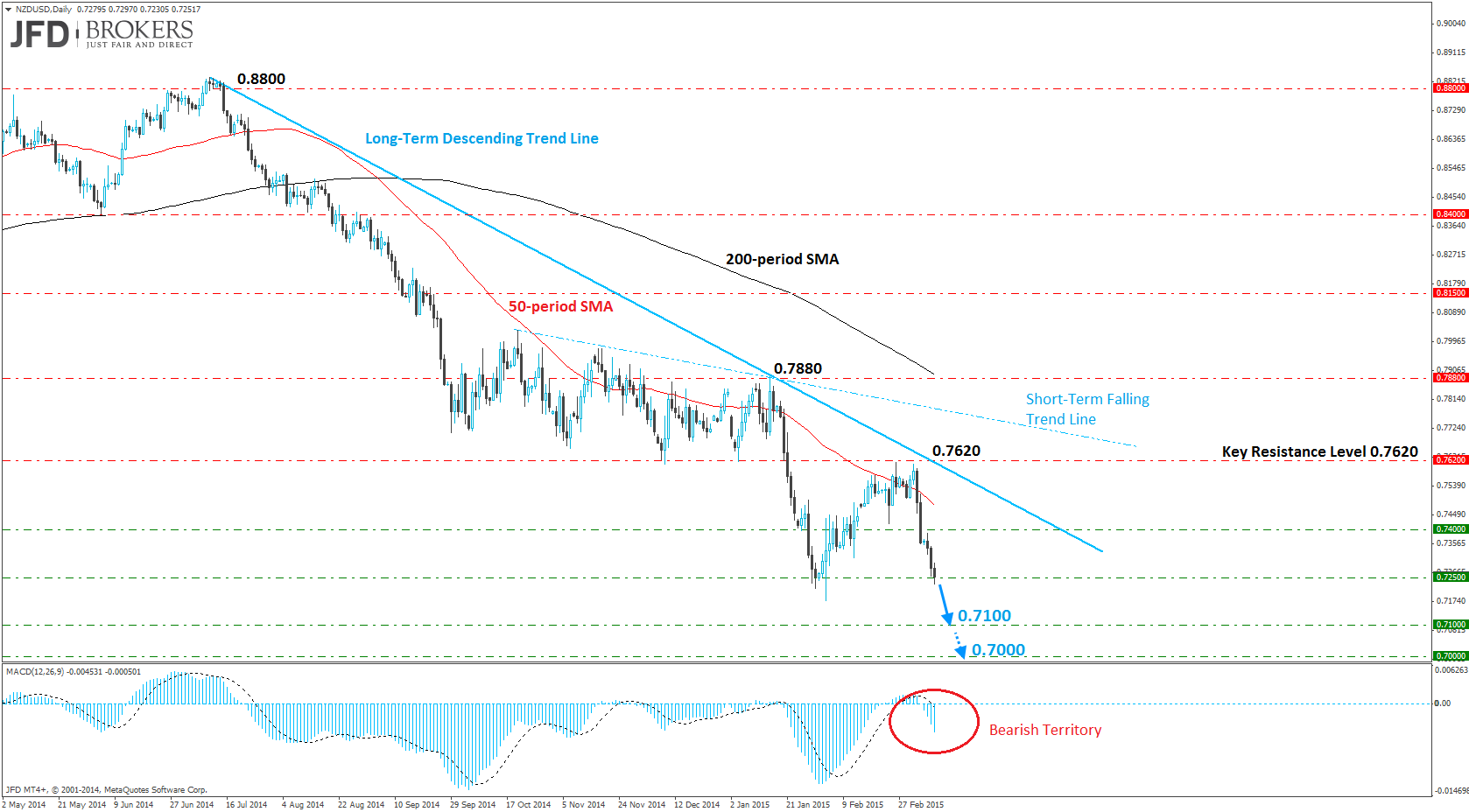

On the daily chart, the NZD is trading lower against the USD, following four consecutive winning weeks. The rally over the last five days has been particularly aggressive, pushing the price below the 50-period SMA and also preventing the bulls from breaking above the long-term descending trend line, around the psychological level of 0.7400.

That said, if the pair turns lower in the coming days and breaks below the strong support level of 0.7250, which is pretty close at the moment, we could then see further extensions towards the 0.7100 and 0.7000 levels. MACD agrees with the bearish scenario since it moved lower below both its zero and trigger lines.

The GBP/NZD pair is still struggling to break above the 2.0800 level. The longer term bias in the market certainly appears to be more bullish, following the break of the massive resistance level at 2.0000, which means all we are seeing now is another strong bullish move above some significant obstacles including the 200-period SMA as well as the 2.0500 level. With this in mind, if we see some more buying pressure, the next key resistance level will come at 2.1400.

Finally, the euro pair is looking weak against the New Zealand dollar over the past couple of weeks as the pair is forming lower highs and lower lows. It’s remarkable that the pair record its sixth consecutive negative week after reaching the key resistance level of 1.5800, which includes the 50-period SMA on the weekly chart. Therefore, the weekly chart suggests that we are due to some further NZD strength.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 after German IFO data

EUR/USD stays in a consolidation phase at around 1.0700 in the European session on Wednesday. Upbeat IFO sentiment data from Germany helps the Euro hold its ground as market focus shifts to US Durable Goods Orders data.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold price trades with mild negative bias, manages to hold above $2,300 ahead of US data

Gold price (XAU/USD) edges lower during the early European session on Wednesday, albeit manages to hold its neck above the $2,300 mark and over a two-week low touched the previous day.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.