The Canadian dollar is trading slightly lower against the euro as traders anxiously awaited today’s Bank of Canada policy meeting. The market expects the BoC to maintain its policy rate unchanged at 0.75%. Earlier, the loonie rose to a month-high vs euro, boosted by better-than-expected GDP data, which came at 2.4% qoq, a bit slower than the pace seen in the previous quarter but better than what analysts were expecting of 2.0%.

From the end of 2010, the interest rates were risen and kept at the level of 1.0%. In their last meeting, the BoC decreased its interest rates to a historical low of 0.75% in response to falling oil prices. This rate cut, was a measure to avoid the risk of deflation. Inflation fell to 1.0% in January from 1.5% in the previous month and 2.0% in December. The continuous fall of oil price, keep the traders alarmed as it directly affects the value of the Canadian dollar.

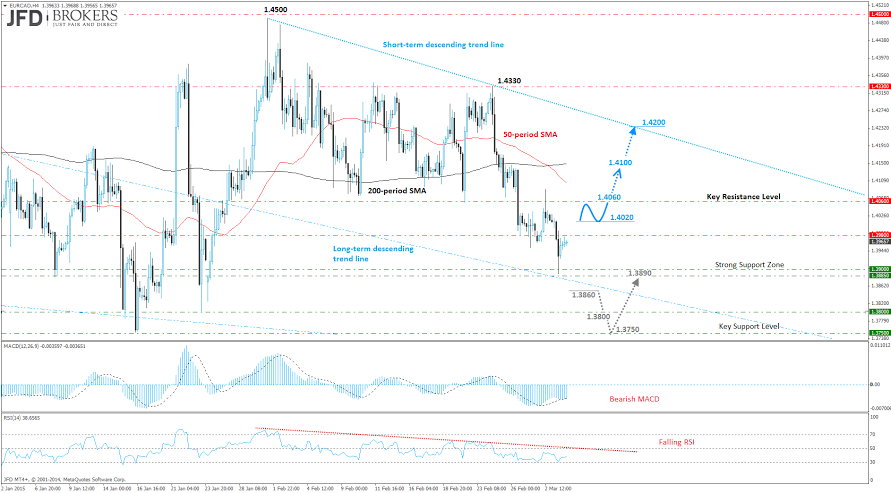

Technically, the EUR/CAD pair found strong support yesterday just below the psychological level of 1.3900, where the descending trend line which started back in May 2014, propped it up. This was also a previous resistance so there was clearly plenty of support around this key level. On the upside, the pair is expected to face a hurdle near 1.4100, which includes the 50-period SMA as well as the 200-period SMA on the 4-hour chart.

Going forward, the 1.3980 is providing sufficient resistance to the pair but I do not expect this to hold much longer. The key level here will be the 1.4060 for me. If this level is broken in the next few hours, it would suggest that the market has turned more bullish, opening up a move towards the 1.4200 barrier. A break above here, then it would open the way towards the 1.4330 region. All in all, the bias will remain bullish as far as the 1.3885 – 1.3900 zone is intact.

Alternatively, if we see a break lower, which I do not foresee at the moment, the pair should find support around the key support level of 1.3800 and 1.3750.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

GBP/USD stays weak near 1.2400 after UK Retail Sales data

GBP/USD stays vulnerable near 1.2400 early Friday, sitting at five-month troughs. The UK Retail Sales data came in mixed and added to the weakness in the pair. Risk-aversion on the Middle East escalation keeps the pair on the back foot.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Israel vs. Iran: Fear of escalation grips risk markets

Recent reports of an Israeli aerial bombardment targeting a key nuclear facility in central Isfahan have sparked a significant shift out of risk assets and into safe-haven investments.