Last Friday, the base consumer price index in the USA made it clear to investors that the economy still has started to recover from the recession in the first quarter again, on these news traders reacted immediately with the sell of the euro against the dollar USA. Also at the weekend Greece doubted whether it will be enough money to pay off the I Also at the weekend Greece doubted whether it will be enough money to pay off the IMF in the next month. Let me remind you that Greece has to make a payment to IMF in the amount of 1.6 billion euros from 5 to 19 June. On Monday, there was a weak volatility due to the fact that the markets in Germany, the UK and the US are closed for the holidays.

Today publication of important US data is planned, if the economy will continue to grow, is guaranteed a further decline of the currency pair.

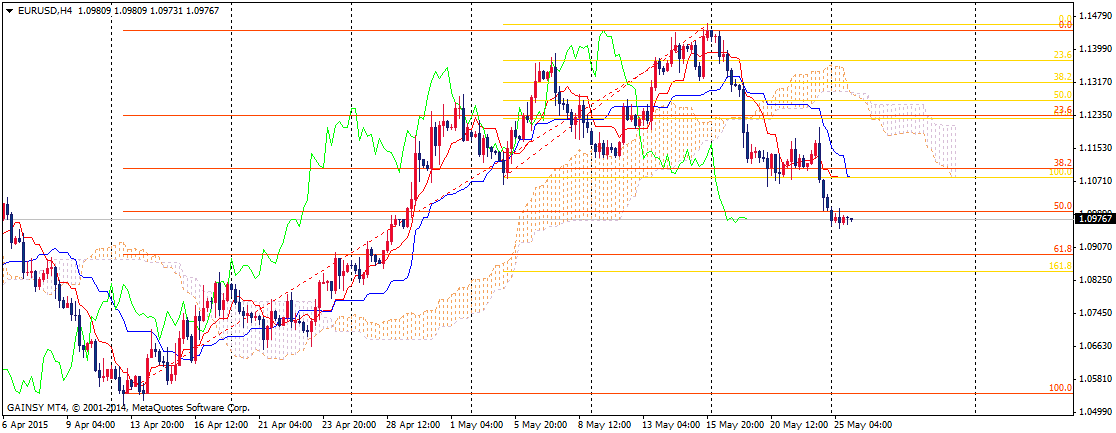

Sell couple should be from the resistance level 1.1000, profit target set at support levels 1.0955; 1,0900; 1.0860.

If the currency pair can break and consolidate above 1.1000 resistance, it is possible to buy with take profit at the following levels 1.1060; 1.1100.

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.