In the early part of the week there was a noticeable growth of USD in relation to other currencies. It was caused by an exit of final indicators on change of volume of GDP of the USA in the last quarter. Gross domestic product of America was registered by increase for 2,2% against an old index of 2,6%, having justified the predicted growth by 2,2%. The main CPI confirmed expectations, having kept balance on a mark of 1.1%.

It is probable that this week the American dollar will a little lose its positions on the eve of a release of data on employment in the USA for February, it is connected with the fact that traders are in expectation.

At the beginning of a week across New Zealand there was a number of positive news, in particular the publication of data on the import and export prices which was higher than one had expected: -1,80% against -4,5% before it, expectation of -3,1% and 0,20% against -0,10% before it, the forecast of -0,40% respectively. Despite that the exit of an index of trade conditions in New Zealand was published better than expected: -4,4% earlier, the forecast of - 3,0%, nevertheless NZD went down in comparison with the American dollar.

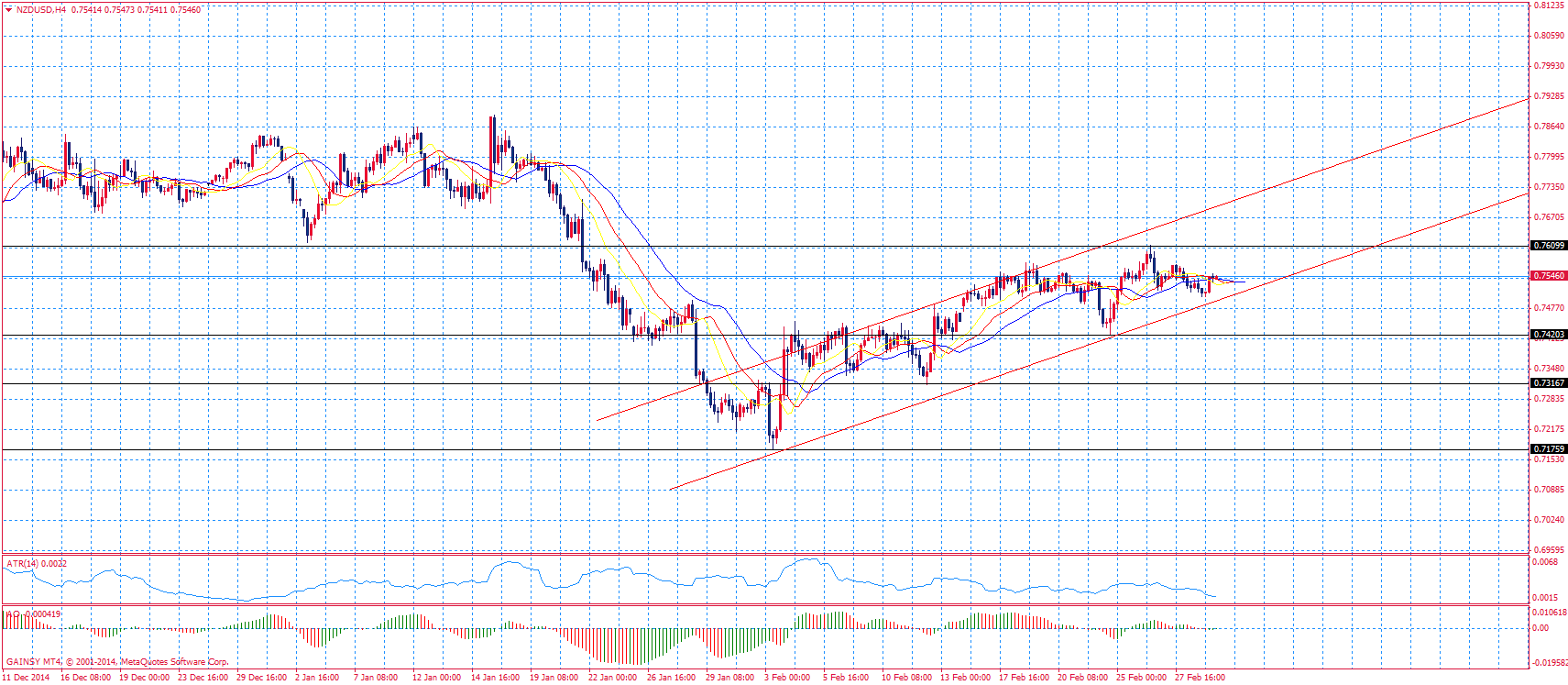

Support level for a currency pair of NZD/USD is now 0.7500. Resistance level — 0.7600. Currency pair is traded in the ascending trend 0.7500-07670.

Recommendations:

NZD/USD continues the slow descending movement towards a correctional point 0.7400 . The rebound from this level will give support to "New Zealander", and will promote a correction level raising to 0.7600. In turn fixing of a course below 0.7400 will give the chance to predict falling of the price to 0.7230.

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 after German IFO data

EUR/USD stays in a consolidation phase at around 1.0700 in the European session on Wednesday. Upbeat IFO sentiment data from Germany helps the Euro hold its ground as market focus shifts to US Durable Goods Orders data.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold price trades with mild negative bias, manages to hold above $2,300 ahead of US data

Gold price (XAU/USD) edges lower during the early European session on Wednesday, albeit manages to hold its neck above the $2,300 mark and over a two-week low touched the previous day.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.