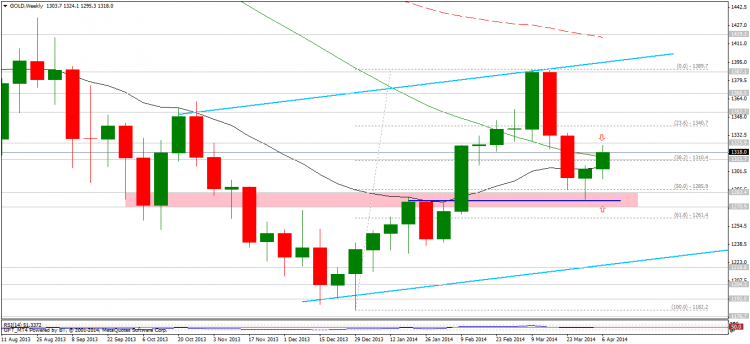

Weekly chart: The bounce from the support at $1280 resulted in further gains and the precious metal arrived at the $1325 resistances. The momentum of this climb is a bit lacking compared to the usual upmoves, but regardless of this further gains are expected above the resistance. If the $1300 level fails to hold then Gold might be sold off to the previous lows.

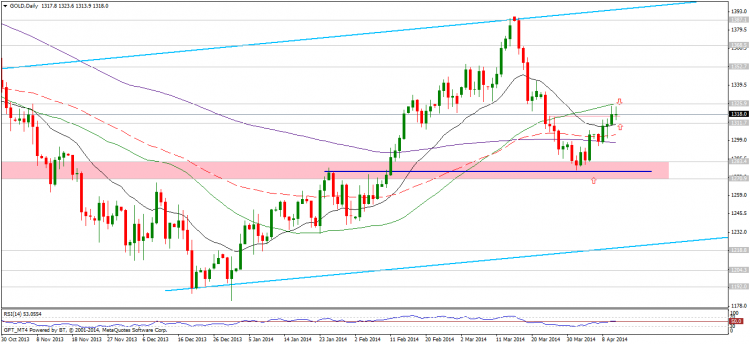

Daily chart: Following the breakthrough of the 200 day moving average Gold continued its climb all the way to the 50 day moving average which resides currently at the $1325 support. These are major resistances which will bar the precious metal from further gains until it manages to break through them with a lot of force and momentum. Until then we might see it drop back towards the 200 day moving average however.

Marketprog Ltd. excludes any liability for any damages resulting from the use of data and information representing the published content or the company website. Analytical reports, evaluations and selections available on the website and as published content are exclusively for informational purposes; they cannot and shall not be considered to represent investment advice or analysis from Marketprog Ltd. or a public offer. Neither shall the content of the website or otherwise published content be considered a call encouraging investment in products researched by the Software embedded in the website or in any published content. All liability and risk in connection with making any investment decision shall be borne by the user irrespective of how the use of the Software embedded in the website, or any published content might have influenced such decision.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.