Market Overview

In these battered markets, anyone with a positive persuasion will try and hang on to anything that might suggest a bottom is in place. Sadly I do not see one as being sustainably in place, even though near term support may be coming in. Wall Street was not sharply lower into last nights close, and whilst that might not sound much, with oil off over 5% on the day this is something. We are seeing Dollar/Yen and Gold forming some consolidation in their recent gains and it looks as though despite sharp losses in the Asian markets that were open (Nikkei down another 2.3% although that was as the market was playing catch up on yesterday’s Yen strength), the European markets are around the flat-line in early moves. Markets are supported as they prepare for Janet Yellen’s testimony before Congress which is likely to give clues as to the monetary policy reaction from the Fed. A dovish Yellen could provide sentiment with some much needed support. There have also been gains in oil overnight too with the suggestion now that two of the world’s biggest oil producers, Iran and Saudi Arabia, could be willing to discuss production.

In forex markets, aside from slight Yen strength, trading looks to be fairly mixed and lacking direction so far. The gold price continues yesterday’s consolidation, whilst oil is just over 2% higher.

Aside from Janet Yellen’s testimony which begins at 1500GMT and will dominate the afternoon in Europe, there is UK Industrial Production to look at form0930GMT with a +1.0% year on year expectation. The EIA also gives its weekly crude oil stocks report at 1530GMT with an expectation of a further inventory build of 3.7m barrels (last week 7.8m).

Chart of the Day – USD/CAD

The US dollar is under selling pressure which is negative for USD/CAD, however does a breakdown in oil mean that this downside will be limited? For now it seems as though the weak dollar is still a driving force for the pair however it will now be interesting to see how it moves. In isolation the outlook for USD/CAD is still corrective as the chart continues to unwind for the past three weeks. There was a breakdown of the uptrend dating back to October last week and this old uptrend is now acting as the basis of resistance (today at 1.3990) as the series of lower highs continues. There was a rally that fell over at 1.4325 in late January, a bearish engulfing candle which left resistance at 1.4100 and now following an intraday sell-off yesterday the outlook has turned bearish once more to leave resistance at 1.3975. The chart looks to be continuing a retreat back towards the support of a longer 9 month uptrend which is currently in around 1.3540, with a key breakout support from late 2015 in around 1.3450. Momentum indicators are mixed with the RSI still falling but the Stochastics have turned up. Could the Stochastics be the early sign of a recovery? The hourly chart shows corrective momentum with slight bearish divergences on the recent rebound high on the RSI and MACD. A break of the support at 1.3785 would continue the correction and with the trend of lower highs intact this is my favoured play.

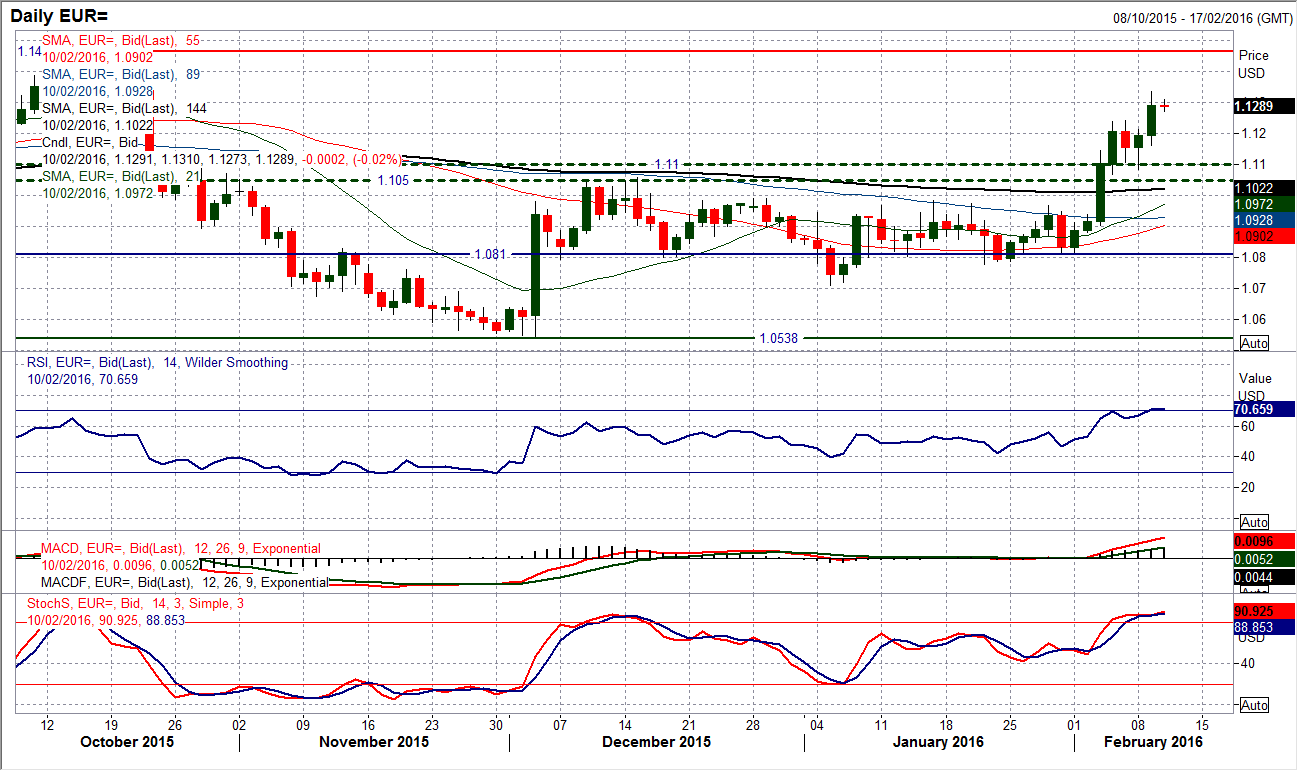

EUR/USD

The consolidation that we have seen since the breakout above $1.1100 has now broken once more to the upside. This continues with my expectation of a move higher towards the upper reaches of the trading band up to $1.1460. The momentum is strong with the RSI up at 70, whilst MACD and Stochastics are rising bullishly. The move has pushed through initial resistance at $1.1300 and aside from a minor high at $1.1385 from October there is little real resistance until the range highs. I continue to see corrections as buying opportunities with the hourly chart bullishly configured. The near term breakout level at $1.1240 is now supportive with further support at $1.1165. The support at $1.1070 is now key.

GBP/USD

I spoke yesterday about the importance of the support at $1.4350 (price level, 23.6% Fibonacci retracement and 21 day moving average) and this has remained intact as Cable has consolidated. This comes after two days of strong losses and means the bulls still hold an argument for being in control. The marginally bullish candle helps and today’s early move is also mildly higher. This is helping to maintain positive momentum with RSI at 50 and Stochastics interestingly starting to shallow their slide. The hourly chart is an interesting gauge for the bulls as the hourly RSI is bumping up around 60 and the hourly MACD has turned positive. Cable needs to breach the sequence of lower highs over the past few days with Monday’s high at $1.4545 a possible trigger for the bulls to get on a run again. There is a band of support now at $1.4350/$1.4375 to help bolster the consolidation.

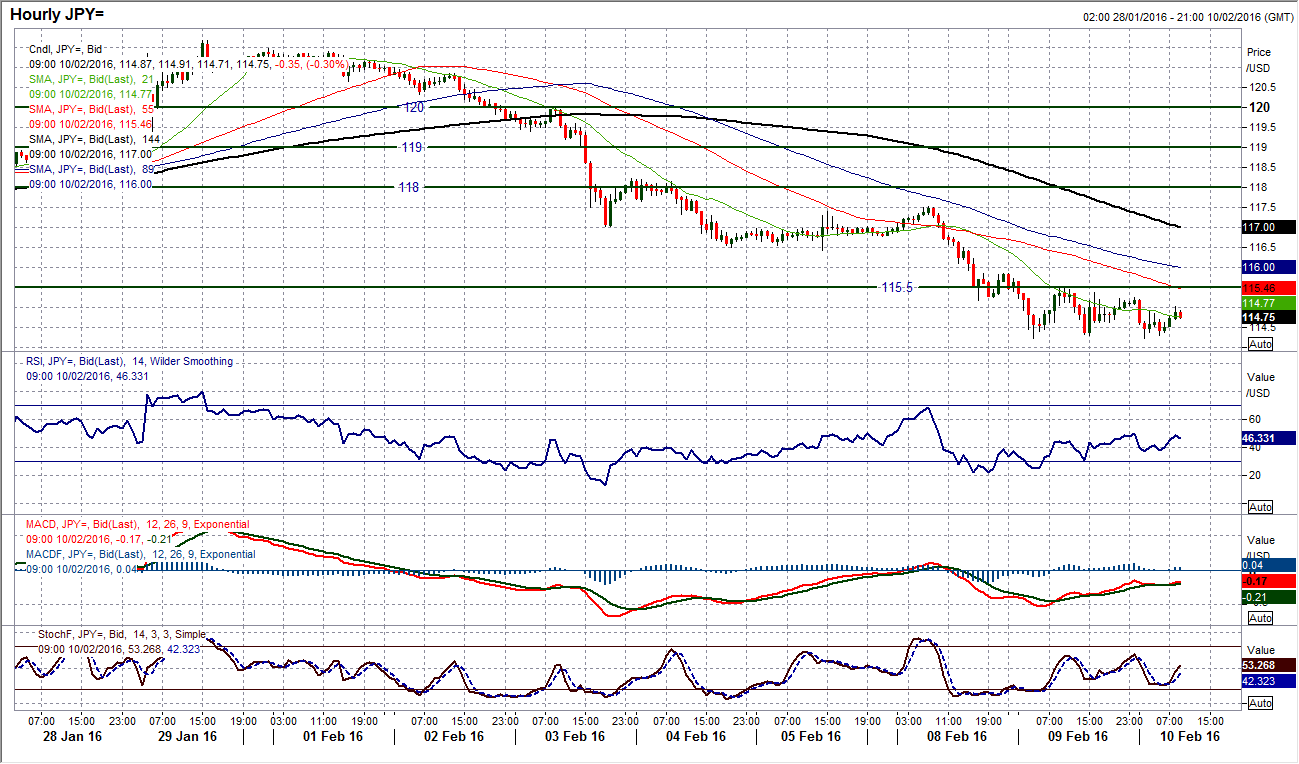

USD/JPY

The deterioration in the outlook for Dollar/Yen over both the medium and longer term outlook has been remarkable. I have spoken previously of the 115.55 support from December 2014 being a key level and with the huge selling pressure in the past few days this level has been decisively breached. A closing breakdown yesterday has continued today and the longer term implications of this move could be huge, with a potential move back towards 107.50. The concern also is that there is very little support too, with the first real level not coming in until around 110.00. The trouble is that there has been such a significant sell-off over the past 8 sessions that there is the increasing prospect of a near term technical rally. There seems to be something of a consolidation in the past 24 hours and it will be interesting to see how this develops. For now you would say the trend is your friend, but we need to watch out for the near term reversal signals. There is now a band of resistance 115.50/115.85, with further resistance up around 116.50. I would say that rallies are still a chance to sell as stretched momentum unwinds. Yesterday’s low at 114.20 has held overnight but a breakdown would simply continue the sell-off.

Gold

We are now entering a difficult stage of trading on gold as the big strong run higher is beginning to consolidate. The fact that this is coming as Dollar/Yen is also consolidating is also of interest. Is this a top or just a pause for breath? I have been contemplating for a couple of days how sustainable this run higher is as it has accelerated upwards. With the RSI reaching levels not seen since September 2012 the upside potential is looking limited from here. The $1200 level seems to have become a bit of a barrier in the past couple of days too, which has led to the first closing day lower in in almost two weeks, with a candle that is not far from being a shooting star. I would concentrate on yesterday’s low now at $1185, as a breach (and preferably close below) could start some profit taking. The hourly chart is interesting as it shows a consolidation in the price now over the past two days which is unwinding momentum. However if the hourly RSI starts to break below 40 and the hourly MACD lines move below neutral this would be a sign for me that the bulls have lost control and that profit taking could set in. Support comes in at $1171 and $1163. Above $1200.60 is resistance at $1205 and $1232.

WTI Oil

I was wondering yesterday about how long the bulls could hang on to the key support at $29.25 for. Well it turns out, not long enough as a sharp sell-off through the key near term support has scuppered the recovery, completed and top pattern and also has rather negative implications for market sentiment too. The problem is that a decisive breach now completes a head and shoulders top pattern which implies over $5 of downside projection. This means that a retest of the $26.20 key January multi-year low is now on and also further downside beyond that. The momentum indicators are bearishly configured showing the MACD lines crossing lower and the Stochastics in continued bearish decline. The hourly chart shows a series of lower highs with the latest at $31.40 and the reaction high at $30.60, whilst the$29.25 old support is new resistance. Also hourly momentum suggests that any unwinding towards 50 on the hourly RSI is seen as a chance to sell.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD fluctuates near 1.0700 after US data

EUR/USD stays in a consolidation phase at around 1.0700 in the American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold keeps consolidating ahead of US first-tier figures

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.