Market Overview

The downward pressure on the dollar may have taken a pause for breath in the overnight trading, but this is more to do with the upcoming Non-farm Payrolls report than any sense that the dollar bulls are going to fight back. The shift in sentiment away from the dollar has been remarkable and it will be interesting to see if today’s Non-farm Payrolls report can do anything to reverse the move. The report announced at 1330GMT is calling for 190,000 jobs, an estimate that interestingly has not budged even in the wake of a stronger than expected ADP number on Wednesday. However markets will also be interested in the average hourly earnings which again disappointed last month, with expectation of +0.3% for the month which would do little to improve the year on year trends. Markets tend to spend the run up to Non-farm Payrolls in cautious mode and that seems to be again the case with the early moves today on forex and equities. The big question is that would a positive payrolls report do anything more than give the dollar bears another selling opportunity?

Wall Street managed to squeeze out slight gains into the close last night with the S&P 500 up 0.2%, however Asian markets have been mixed to lower with the Nikkei 225 down 1.3% as the yen continues to strengthen. European markets are taking the cautious route in light of the payrolls report with slight early losses. In forex markets the dollar is managing to claw back some of the recent losses, trading positively against most of the major currencies (with the exception of slight gains for the Loonie). Gold and silver are broadly flat, whilst the oil price is also seeing some early consolidation.

Other than the payrolls report, traders will be looking out for the US Trade Balance which is forecast to deteriorate slightly to -$43.0bn (from -$42.4bn) although the focus will be on how the exports are doing in the face of the net strength on the dollar.

Chart of the Day – DAX Xetra

I spoke about a week ago of the crucial role that the Fibonacci retracements continue to play, with the 61.8% retracement of 8355/12390 lending resistance at 9897. The subsequent turnaround has now brought the DAX back once more to the key lows and 76.4% Fibonacci level at 9307. This means this is a crucial support because a decisive breach would suggest the DAX was open for a full retrace to 8355. The intraday breach to 9270 subsequently found some intraday buyers willing to back a rebound and once again the 76.4% Fib level could be acting as a key floor. However the overhead resistance around 9600 will need to be quickly reclaimed in the coming days otherwise the pressure will mount on the downside. Momentum indicators re in bearish configuration with the Stochastics in decline having bearishly crossed and also the RSI at 36 providing further downside potential. The hourly RSI shows how bearish the near term outlook is with the hourly RSI not having pushed above 55 in the past week as rallies continue to be sold into. The bulls have their work cut out to prevent a significant bearish development.

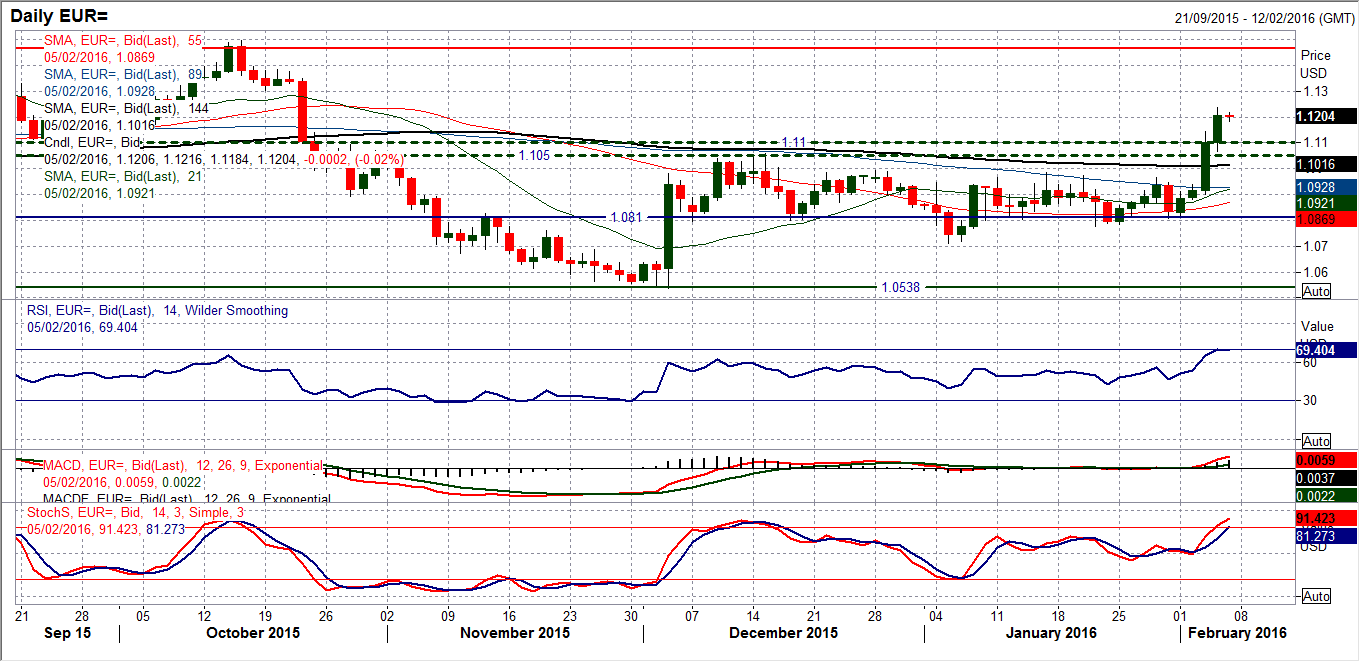

EUR/USD

The euro has added over 330 pips in just two days prior to a slight consolidation that has set in overnight. This is a move that has pulled it well clear of the top of the old pivot band $1.1050/$1.1100 and opens the upside for the next resistance around $1.1300, whilst the top of the long term trading range around $1.1460 should not be ruled out. The key feature here is the momentum, with the RSI into the high 60s, this is consistent with the key moves that have continued to run higher. I would be looking to use weakness as a chance to buy now. The hourly chart shows a slight drift lower overnight as some of the near term overbought position unwinds, however there is now good near term price support around $1.1150, with further support back at $1.1070, whilst the old pivot levels at $1.1050 and $1.1100 will also provide key levels. It is Non-farm Payrolls so a positive report could drag the euro lower but I would not see it as a game changer, more likely to be an opportunity to buy again.

GBP/USD

Mark Carney and the Bank of England tried desperately to talk sterling lower through yesterday’s Inflation Report. The resulting candle was a sort of “spinning top” candlestick that lends the chart some uncertainty. However, the recent strong move higher has driven stronger momentum with longer term improvement in the RSI and Stochastics also more positive. The momentum has just tailed off a touch this morning and with Non-farm Payrolls today this is not to be unexpected. I am looking at the Fibonacci retracements of the big December/January sell off from $1.5278/$1.4079 and the 50% Fib level at $1.4659 was yesterday’s high almost to the pip. So watch 38.2% Fib at $1.4522, whilst 23.6% Fib at $1.4353 is already a key pivot area. The set up of the momentum would suggest there is more upside in this recovery and that corrections should be seen as a chance to buy. The 61.8% Fib is an overhead target around $1.4800 being an old pivot level too.

USD/JPY

What an incredible turnaround on the chart following last week’s gains from the BoJ easing. It is almost the perfect storm for Dollar/Yen to go lower when a significant bout of dollar weakness is driven through concerns over the US economy. The pair has dropped sharply to once again test the support around 116.50. The old level was 116.46 of the August spike low but this was tested on several occasions in January (including one occasion being intraday broken). The bears will point to the lowest close in 13 months and a move that is backed by strongly deteriorating momentum (Stochastics especially). The spike January low was 115.96, but a close below 116.50 would surely open the critical support around 115.55 which marks the neckline of a huge head and shoulders top pattern. The bulls desperately need a strong payrolls report, whilst the BoJ looks on with considerable concern. There is initial resistance around 117.00 with further resistance in the 118.00/118.25 range.

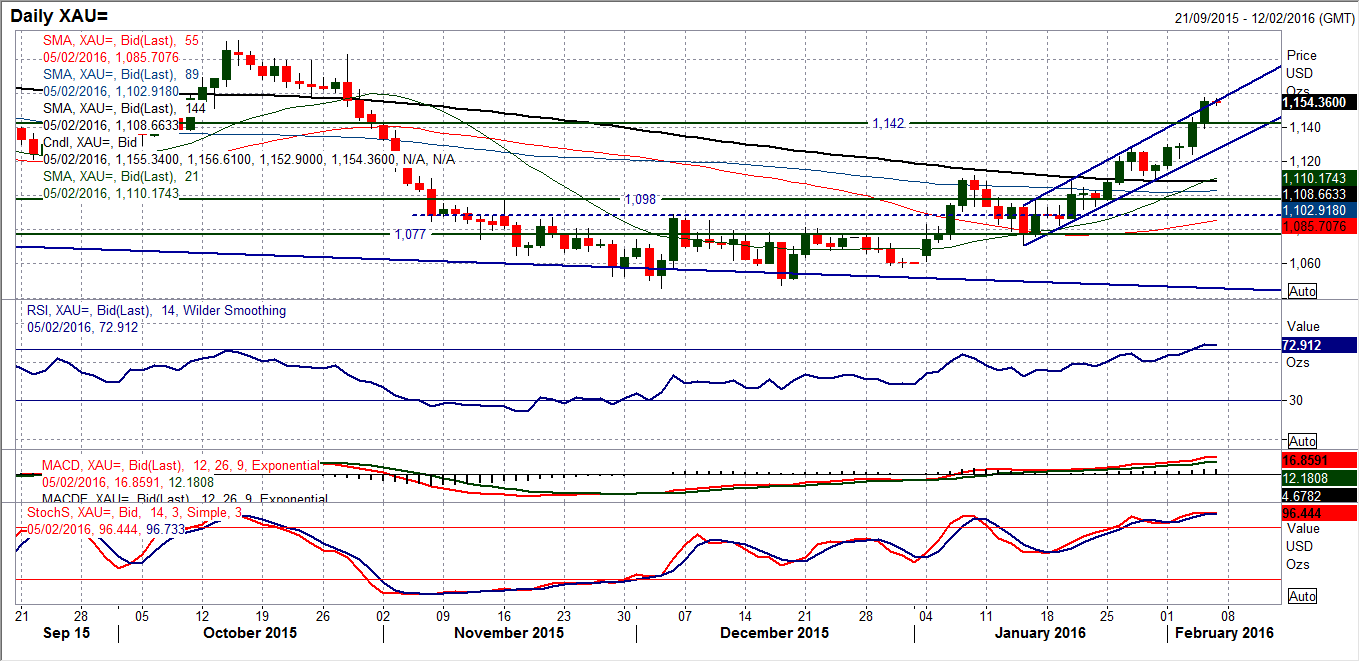

Gold

An strong run higher continues, adding as much as $24 in the past two days. The move is also now breaking through the top of the uptrend channel. The upside targets that I am looking at continue to be breached, with the next real resistance being the October highs between $1182/$1190. The consistent strength of the momentum is certainly commendable, but we now have a situation where the RSI is above 70 which is the highest for over a year. This can either mean the market is overstretched and due a correction, or is a reflection of the trend strength. For now I am happy to back this as a run higher, as the trend is your friend, however I am also aware that the price is beginning to trade outside the Bollinger Bands, something which occurred just prior to sharp reversals of strong moves in August and October. This could leave gold vulnerable to some profit taking. The hourly chart has support at $1140/$1145. Also watch for possible reversal signals on the hourly momentum. Gold tends to be volatile on Non-farm Payrolls day.

WTI Oil

Somewhat unbelievably we are suddenly looking at a WTI price that is really testing the resistance of its 3 month downtrend, however once again I debate how sustainable the move is. This incredible turnaround has come simply on the back of a weaker US dollar (and not any improvement in oil price fundamentals). The big question is whether this rally should be trusted then? I still have my doubts as momentum indicators (daily RSI) still look to be calling this a bear market rally. However if the oil price can push and hold the RSI above 50, then a downtrend break is a possibility. There is still some significant overhead supply resistance in a band between $34.20/$34.80 and this is significant and now yesterday’s high at $33.60 adds to the resistance. The hourly chart shows a minor pivot level around $31.30 which if the bulls can hold on to then they will stay in near term control and begin to eye that overhead supply. Below $31.30 re-opens the psychological $30 again and the key support at $29.25. Right now though, nothing surprises me with oil with volatility still elevated. Non-farm Payrolls will only add to that today.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.