Market Overview

Despite the lack of a decisive steer from from Wall Street or the Asian session, market sentiment in the early European session moving into the report is actually fairly positive ahead of the Non-farm Payrolls report. However, will this last as traders traditionally view the report as driving volatility following the release, and this could curb the bullishness as the session moves on. Wall Street was able to claw back earlier losses to basically close flat (S&P 500 was up 0.2%), with Asian markets also mixed (Nikkei up 0.1%). The oil price bouncing again and a slightly positive risk steer on the forex markets could be part of the reason for the move.

Non-farm Payrolls will always get the attention in the first week of the month and especially now given the fact that the line from the Fed members suggests that a hike is well and truly on the table but is data dependent. The expectation for the headline figure is 203,000 which would be an improvement on the 173,000 last month (which could easily be subject to revisions as August data is notoriously under accounted). However the keen eyes will be watching the other elements of the report for signs of improvement, in areas such as Participation Rate and average hourly earnings.

Forex markets show a mixed performance on the dollar, with slight gains against the euro, but sterling has just ticked slightly higher. With marginal gains on the commodity currencies and the yen marginally weaker, there is a very slight positive risk bias, but nothing that would justify taking a view ahead of the data. Gold is slightly weaker, whilst the oil price has hit the bid which may be the source of some of that positivity.

The Non-farm Payrolls are released at 1330BST and the headline data is expected to be 203,000, with unemployment expected to stick at 5.1% and average hourly earnings are forecast to be +0.2% for the month which would maintain the 2.3% growth for the year. In other data out today there are the factory orders at 1500BST which are expected to show a drop of -1.2% on the month.

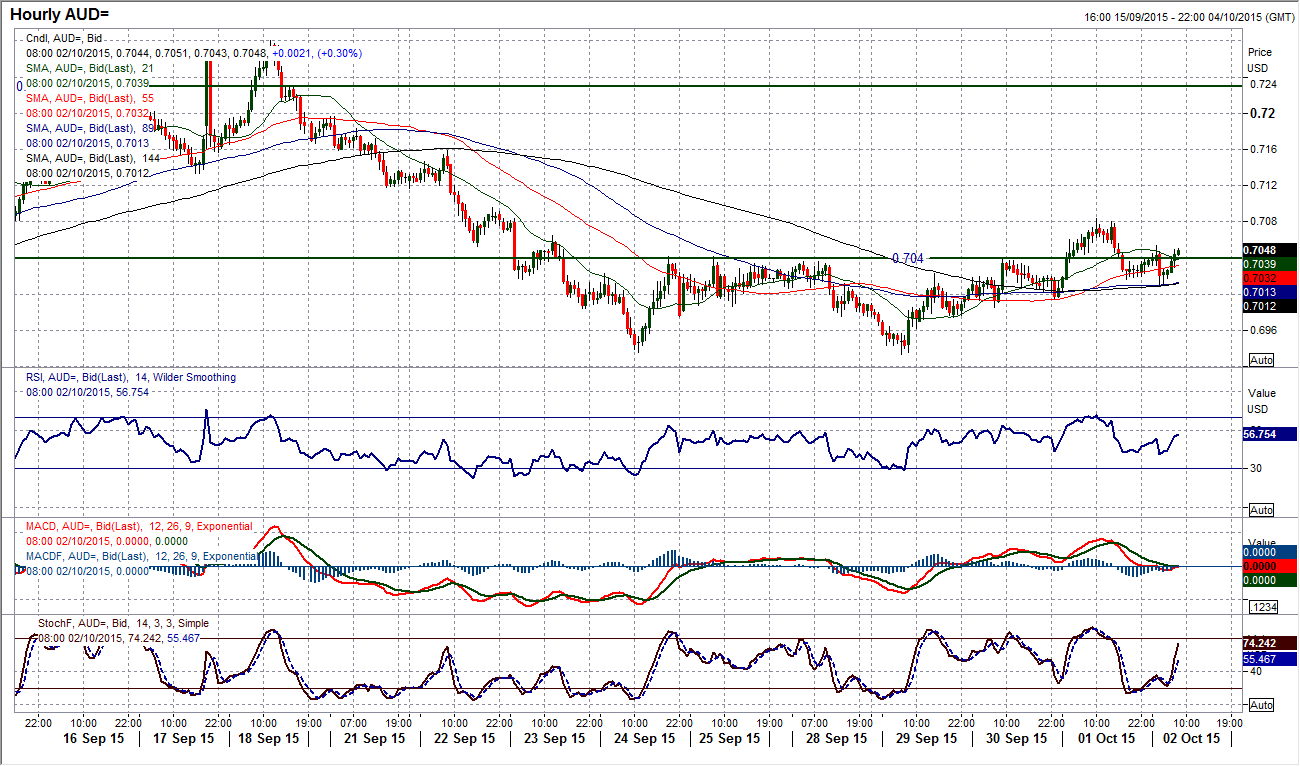

Chart of the Day – AUD/USD

As we move into the crucial Non-farm Payrolls report markets will often look to consolidate. This is exactly what the Aussie has done overnight and it has unfortunately turned what looked to be a burgeoning base pattern into something that is far less certain. Around lunchtime yesterday the Aussie was looking to consolidate a break above the initial resistance at $0.7040. However the bulls failed to hold the break and in drifting back a rather neutral looking almost doji candle was formed. The disappointment lies in the fact that this was a potential reversal that would have implied $0.7150 but also bolstered the support of the lows at $0.6935 and the September low of $0.6893. The fact that overnight another attempt to push the Aussie higher has hit the buffers at $0.7040 again is not a great sign and suggests the caution as we move into payrolls. Initial support to watch is yesterday’s low at $0.6995 as if this is breached it could quickly unravel back towards the support at $0.6935. Resistance on an intraday level above $0.7040 comes in at yesterday’s high at $0.7085.

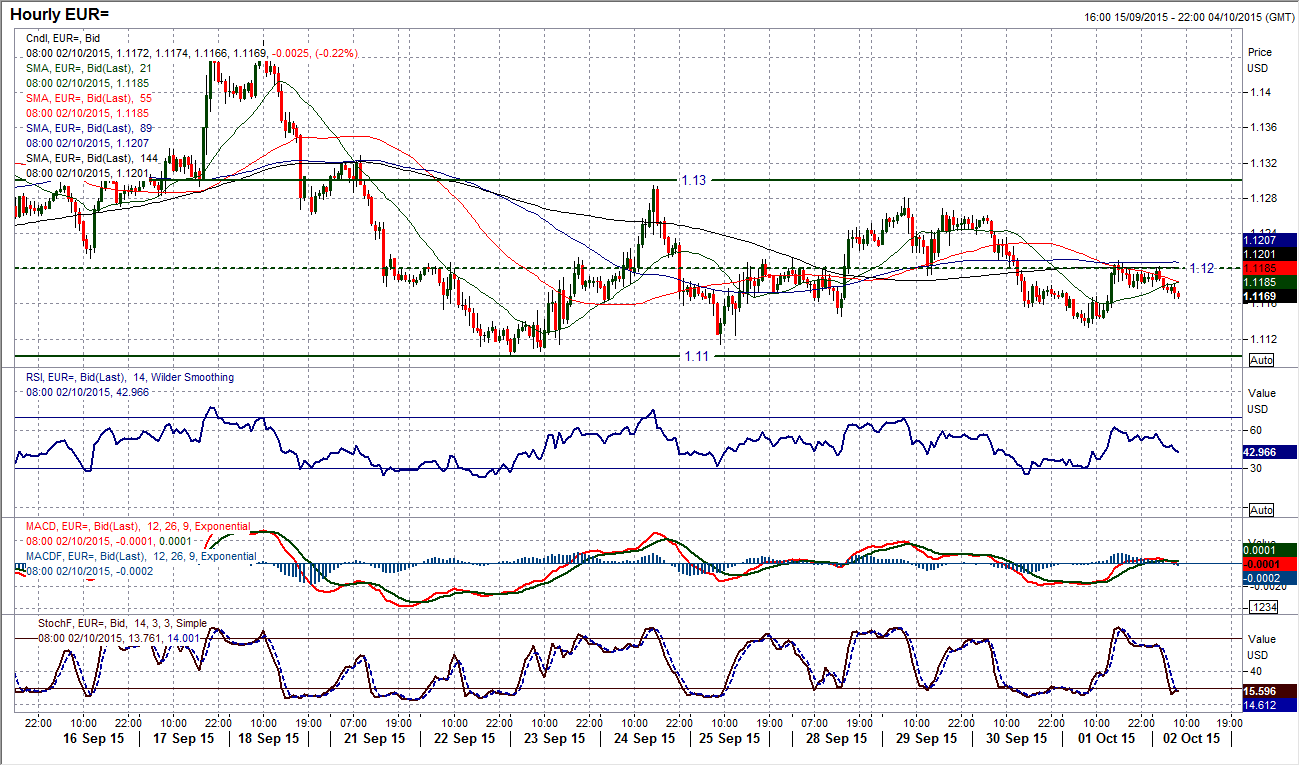

EUR/USD

Coming into the Non-farm Payrolls report, the technical outlook on the euro is increasingly neutral. The pivot band at $1.1100 has provided great support for the past 6 weeks and with daily momentum indicators rather benign, the outlook looks to be stable now as we go into the key data. The past week has seen the euro settling into a trading band of less than 200 pips between $1.1100/$1.1295 and the intraday hourly chart is showing an interesting near term pivot around $1.1200 which happens to be pretty much bang in the middle of the band. The market has clearly taken it that it is better to watch for the data and then take a view. Historically the euro moves into the report all but flat on the day and I expect this to again be the case. The $1.1100 support is still key and a breach initially opens the $1.1050 pivot band low with $1.1015 as further support. Above $1.1295 re-opens the $1.1465 range high. My expectation is a fairly indeterminate report, a volatile reaction with little real direction.

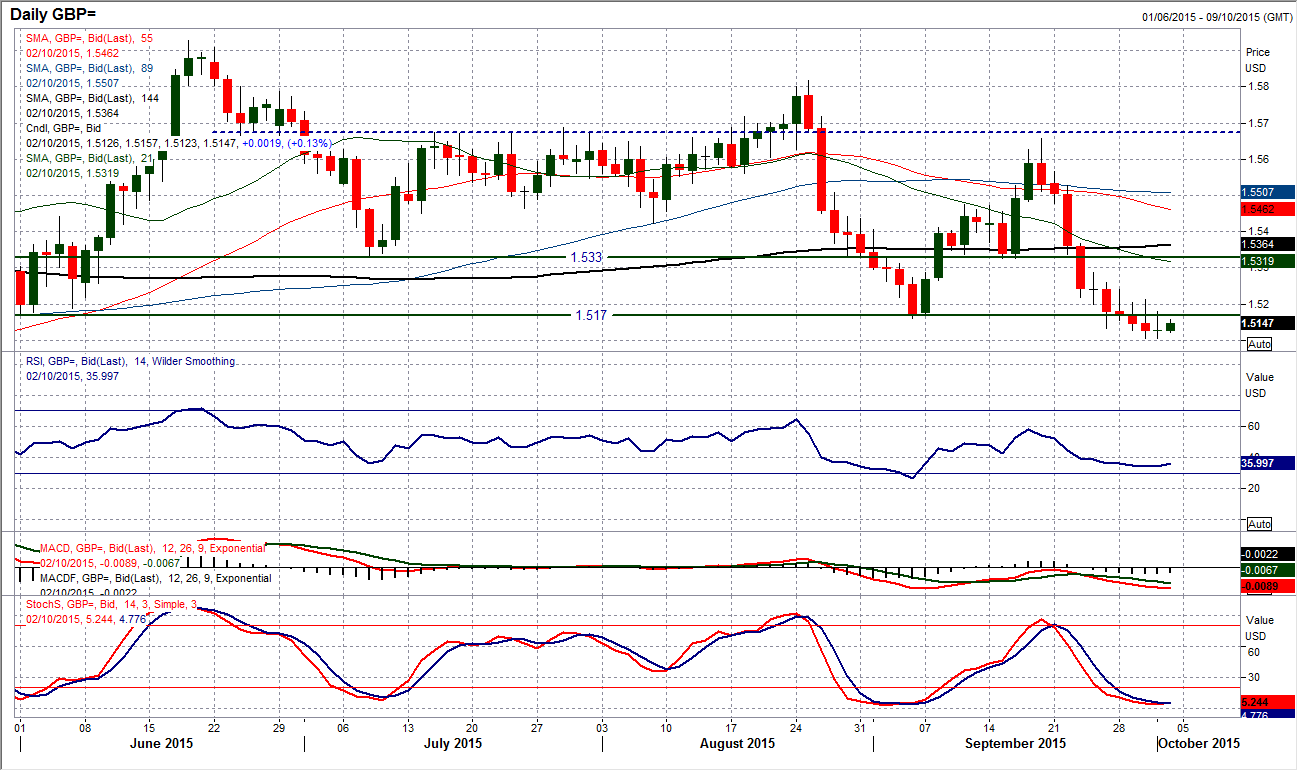

GBP/USD

I have been talking about the sell-off slowing down now for several days and it has done. Yesterday the price failed to close lower for the first time in 10 sessions. If I did not know that it was Non-farm Payrolls today, I would be looking at the “doji” candle and saying that it suggests uncertainty with the prevailing trend and that it is a warning sign, especially with the slight gains in early Asian trading. I agree with all that, apart from the fact that markets do tend to generally consolidate ahead of Non-farm Payrolls so this detracts a touch from the relevance of the doji. However I still look at the daily RSI which is bottoming still and also suggests a slowing of momentum. The hourly chart shows continued lower highs in place and the bulls will certainly be eying the initial resistance of note at $1.5212. I would be getting interested in a move above $1.5240 should the payrolls data come out dollar negative. The support is at $1.5105 and then $1.5088 which protects the next key low at $1.5000.

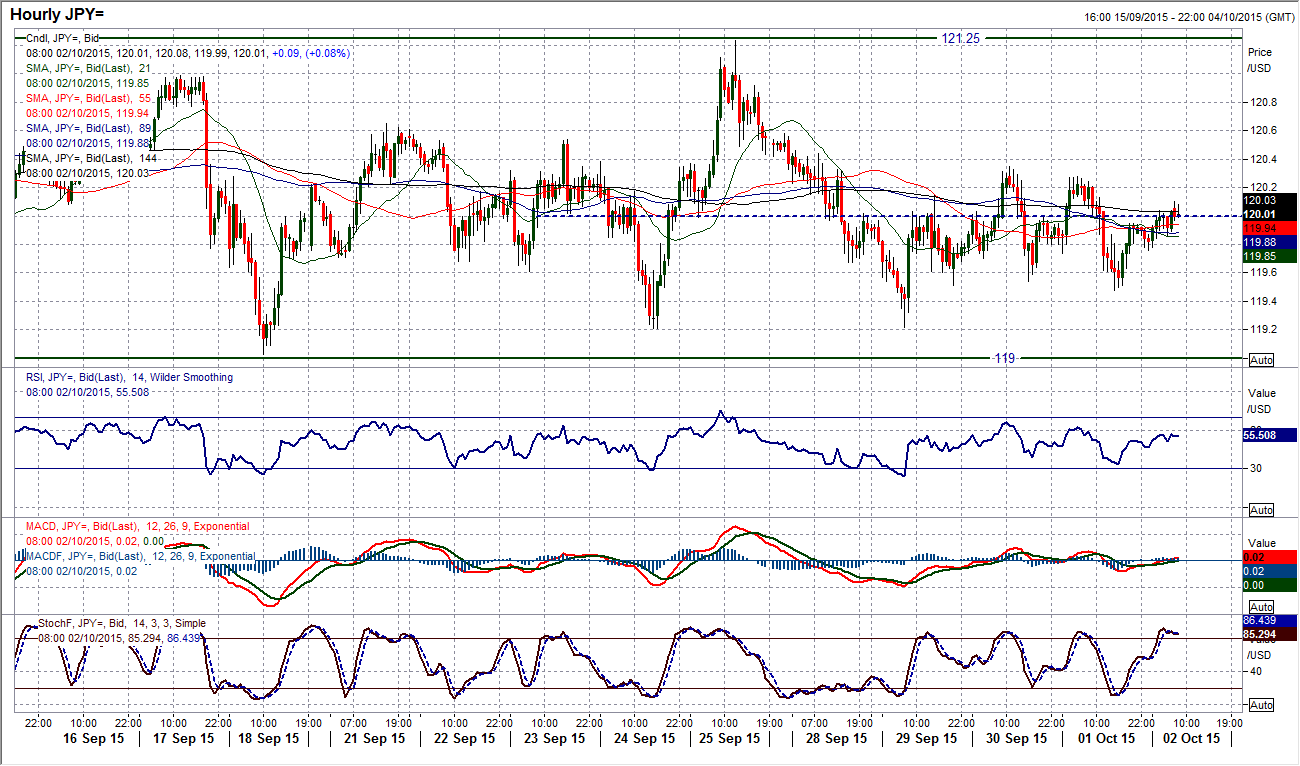

USD/JPY

As we move into the Non-farm Payrolls report, Dollar/Yen remains rangebound and stuck in this band between 119.00/121.30 and with the candle bodies getting smaller and smaller once again the outlook is very neutral with little real signals to speak of on the daily chart. Looking on the intraday hourly chart there is a near term pivot formed around 120.00 and whilst not perfect it is interesting that this is pretty much in the middle of the range. Hourly indicators are neutral too with moving averages flat and the RSI still suggesting near term trades can be triggered by using the extremes of the bands (buying on signals around 30 and selling on signals around 70). Initial support is at 119.20 with resistance now coming in at 120.35/60 and 121.25.

Gold

The break back below $1121 support was a key indication that the bears are in control moving into payrolls. The momentum indicators on the daily chart confirm that view with both RSI and Stochastics in decline. The rallies should therefore be seen as a chance to sell. The hourly chart shows a slight slowing of the selling pressure in the near term, however all the momentum indicators remain in a bearish configuration with the hourly RSI continually now failing in the low 50s. From yesterday’s peak there is now resistance in the band $118.90/$1121.00 but there is further resistance at $1126.80 within the downtrend and the bears would still remain in control until the reaction high at $1134.50 is breached. I continue to expect a retest of the $1098.30 low in due course.

WTI Oil

Yesterday was another example of why it is much better to trade WTI with a near term or even intraday outlook. What looked to be initially a strong bullish day completely turned on its head later in the session with oil closing towards the lows of the day. This has left a sharply bearish candle on the daily chart where the failed break maintains the range. Although this looks like a shooting star candle the fact that it comes in a range does not mean it is a big sell signal. I would not be taking too much direction from this candle on anything more than a near term basis and I expect the range to continue. The daily chart shows that the 38.2% Fibonacci retracement of the $61.50/$37.75 bear run coming in at $46.80 should still be considered to be a barrier. So a tighter range is forming between the 23.6% Fib at $43.35 and the 38.2% level. The intraday hourly chart shows bolstered resistance at $47.15and the late correction could now test initial support at $44.30. Continue to play the range with the extreme signals on the hourly RSI still giving chances to trade.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

How will US Dollar react to Q1 GDP data? – LIVE

The US' GDP is forecast to grow at an annual rate of 2.5% in the first quarter of the year. The US Dollar struggles to find demand as investors stay on the sidelines, while waiting to assess the impact of the US economic performance on the Fed rate outlook.

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.