Market Overview

Although it seemed as though Janet Yellen played the latest FOMC press conference with a pretty straight bat, the market had not been anticipating a slight dovish change to the projections. A cut to the 2015 US growth forecast and a slightly dovish shift in the path of the dot plots especially for 2016/2017 has induced a significant turn in market sentiment. Treasury yields across the curve have fallen away as the path of rate hikes have been seen as slower, whilst the dollar has been hit hard against major currencies. There was also a rally on equities as Wall Street heralded the path of gradual rate hikes. The S&P 500 closed mildly higher at 0.2% having stopped the slide of early yesterday. The Asian markets have been mixed to weaker with the Nikkei off 1.1% as the yen has strengthened sharply against the dollar. European indices are lower in early trading as investors look towards a key Eurogroup meeting.

Today could be a very important day as the Eurogroup of Eurozone finance ministers meet, with Greece being front and central in their minds. Rhetoric from Greece Prime Minister Tsipras has been increasingly fractious in recent days and it appears that a deal is a long way off. Greece needs this deal to release the €7.2bn tranche of bailout money that would enable it to pay €1.6bn of debt due to the IMF at the end of the month. New surrounding this meeting will certainly drive sentiment today.

Forex markets are currently still reacting to the FOMC meeting from last night, although the dollar has managed to consolidate slightly. The Kiwi though is under significant pressure still after GDP missed estimates across the board last night. Gold and silver remain supported after the FOMC decision.

Traders will be looking out for monetary policy update from the Swiss National Bank at 0830BST, whilst the UK retail sales data at 0930BST (forecast to be little changed on last month at 4.5% year on year ex fuel) will impact sterling. There is then the US CPI at 1330BST which is forecast to sit at flat on the headline data and 1.8% on the core. Weekly jobless claims are forecast to improve slightly to 275k (from 279k last week).

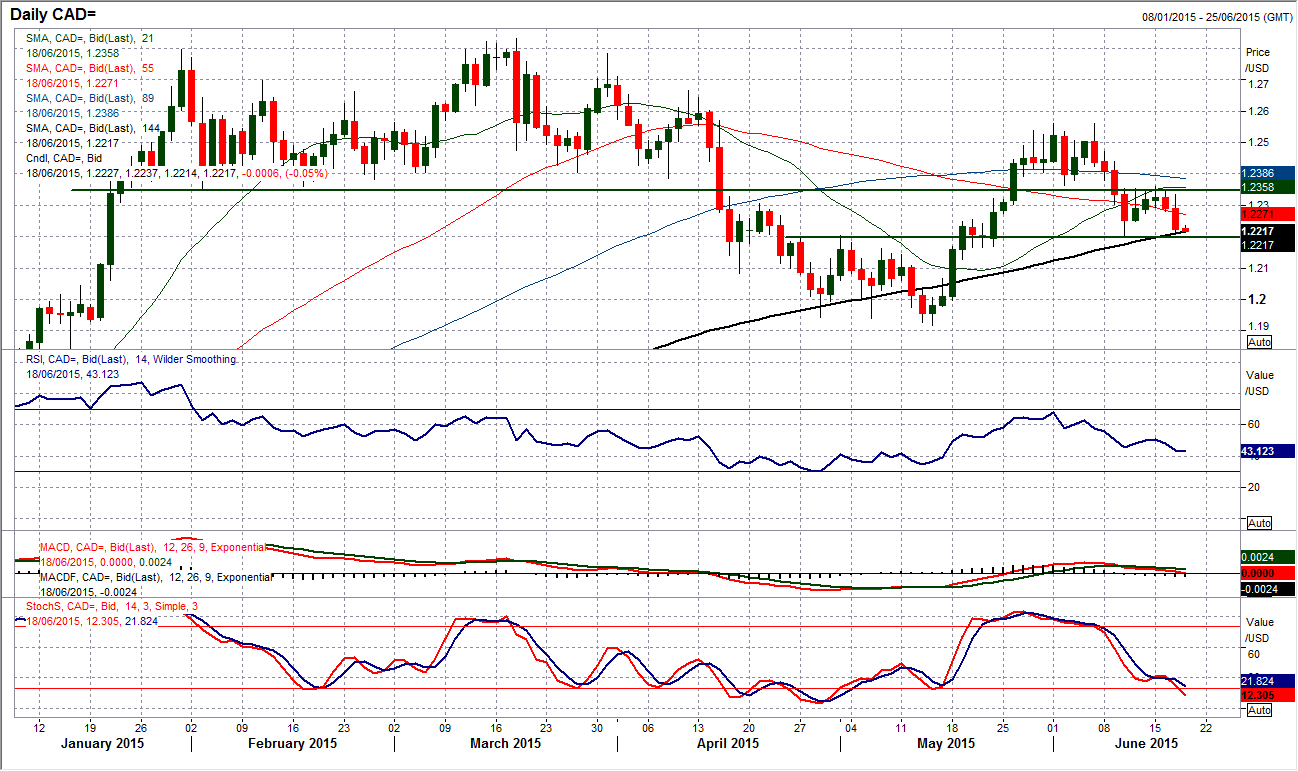

Chart of the Day – USD/CAD

I have been looking at the Loonie for a few days now as I am interested in the way that the old pivot levels play a continual role in the turning points. The two levels I am specifically interested in are 1.2350 (currently acting as resistance) and the support of an old breakout at 1.2200. This is the 150 pip range that the CAD has been trading in over the past week and despite the dovish Fed which pulled the rate lower the breakdown of the range is yet to be seen. The momentum indicators are all pointing towards a breach of the support with the RSI at a one month low and the Stochastics recently having completed a “bear kiss” before turning lower. The technicals on the hourly chart are also consistent with a strategy of selling into strength and further downside pressure. The initial resistance comes in at 1.2280. It looks like USD/CAD is building up for a test of the key near term support at 1.2200 and a breach would imply an initial 1.2050 (ie. 150 pips of the recent range projected downwards), with the next key support now until 1.1915 again.

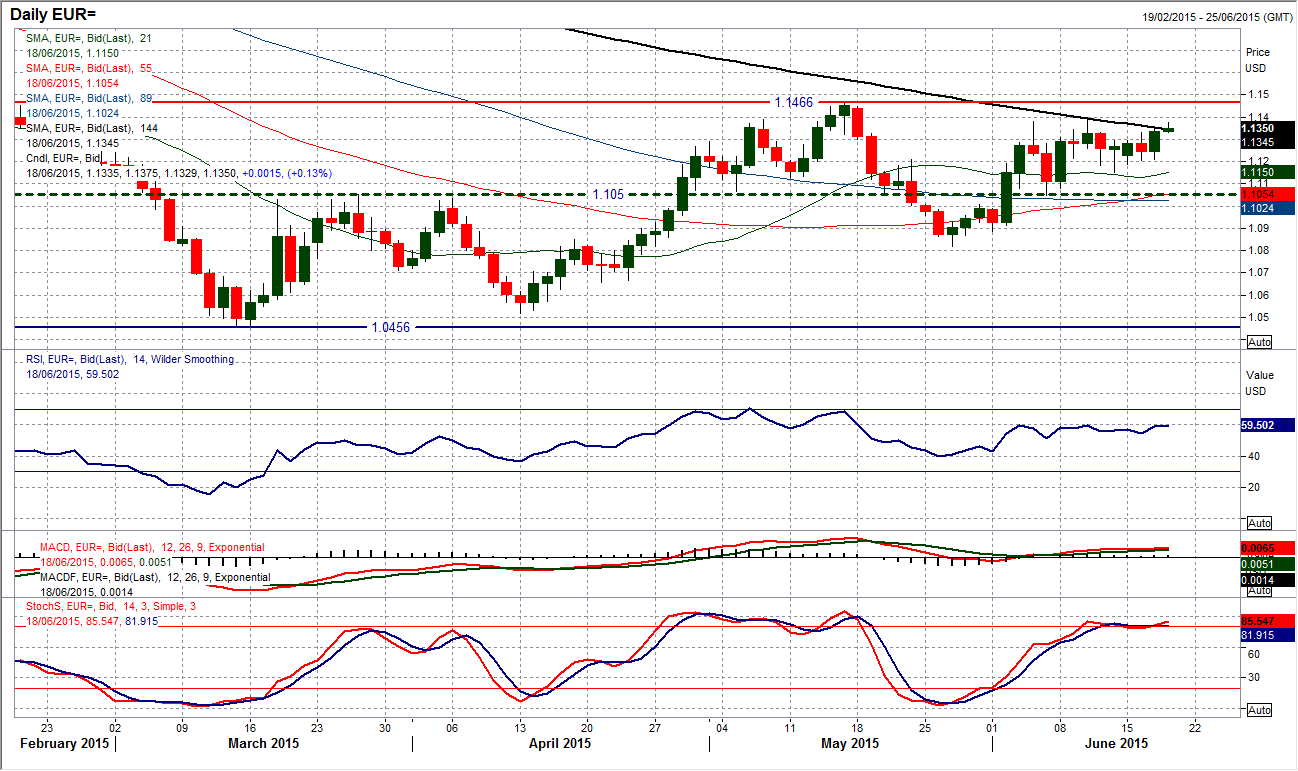

EUR/USD

Although the selling pressure on the dollar has not impacted across the EUR/USD pair as much as it may have done against some of the other major pairs, there has still been an appreciable reaction. This has pulled the euro higher which is once more testing the resistance of the recent consolidation high at $1.1384. This marks the June high and the last resistance holding the euro back from a test of the crucial resistance at $1.1466 (the key May high). Momentum indicators are now straining to move into a more positive configuration, with the RSI looking to push into the 60s , the Stochastics turning up again and the MACD lines positive. The strength of the candle yesterday suggests the bulls are growing in confidence now for the test of resistance. The intraday hourly chart shows a band of breakout support at $1.1290/$1.1330, whilst there seems to once more be a line of support that has formed around $1.1200 again.

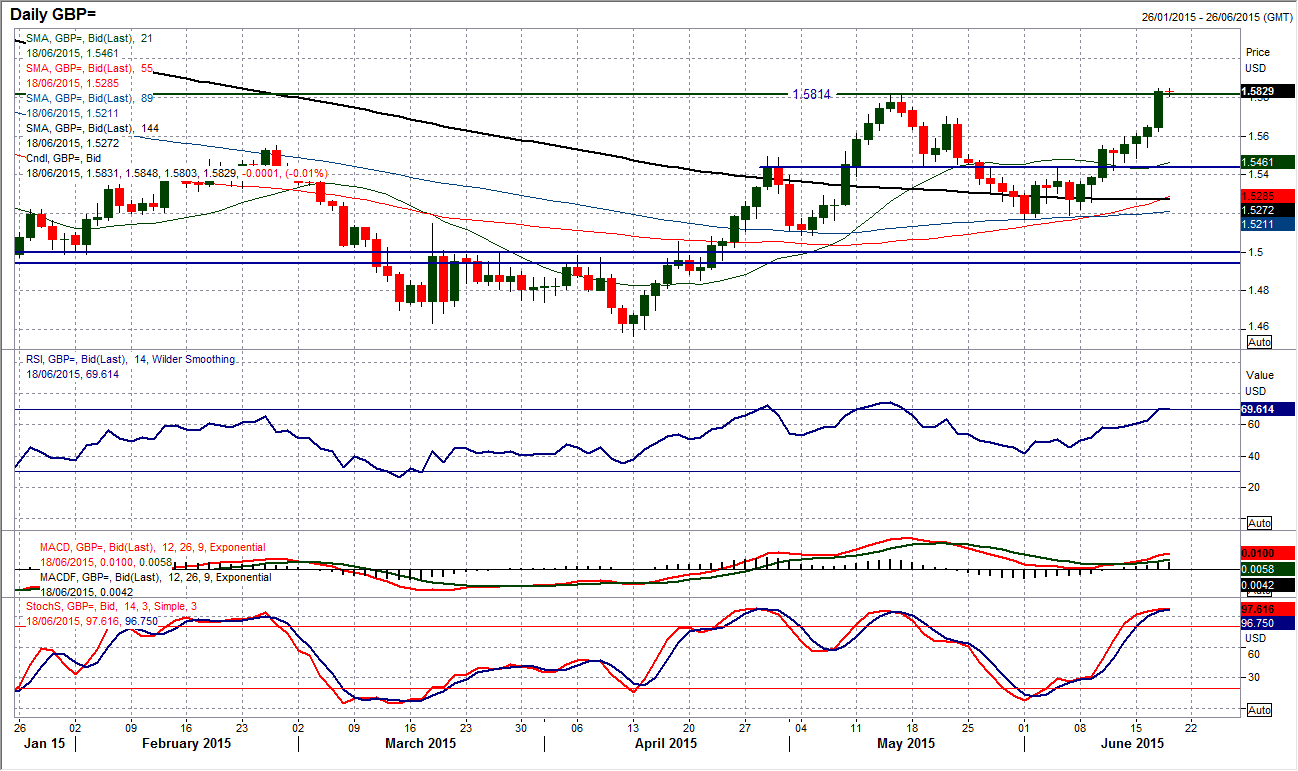

GBP/USD

I have been speaking about the gathering bullishness on Cable and yesterday the double whammy of strong UK wages growth and a slightly dovish Fed gave sterling the rocket fuel for a 200 pip burst higher. The move has resulted in a closing breakout above the key resistance at $1.5814 which was the May high and pushes Cable to its highest level since November. The momentum indicators all remain positive which also showing further upside potential with the RSI only just around 70 and MACD lines only recently turning higher. The hourly chart shows a strongly positive path higher where a sequence of higher lows is in place with the latest band of support being left at $1.5690/$1.5760. In an ideal world there would be a two day closing breakout above the $1.5814 resistance because there is also the caveat that this may be a blow out day. I remain bullish but cautious to see how the intraday momentum indicators react. The next reaction low will be key.

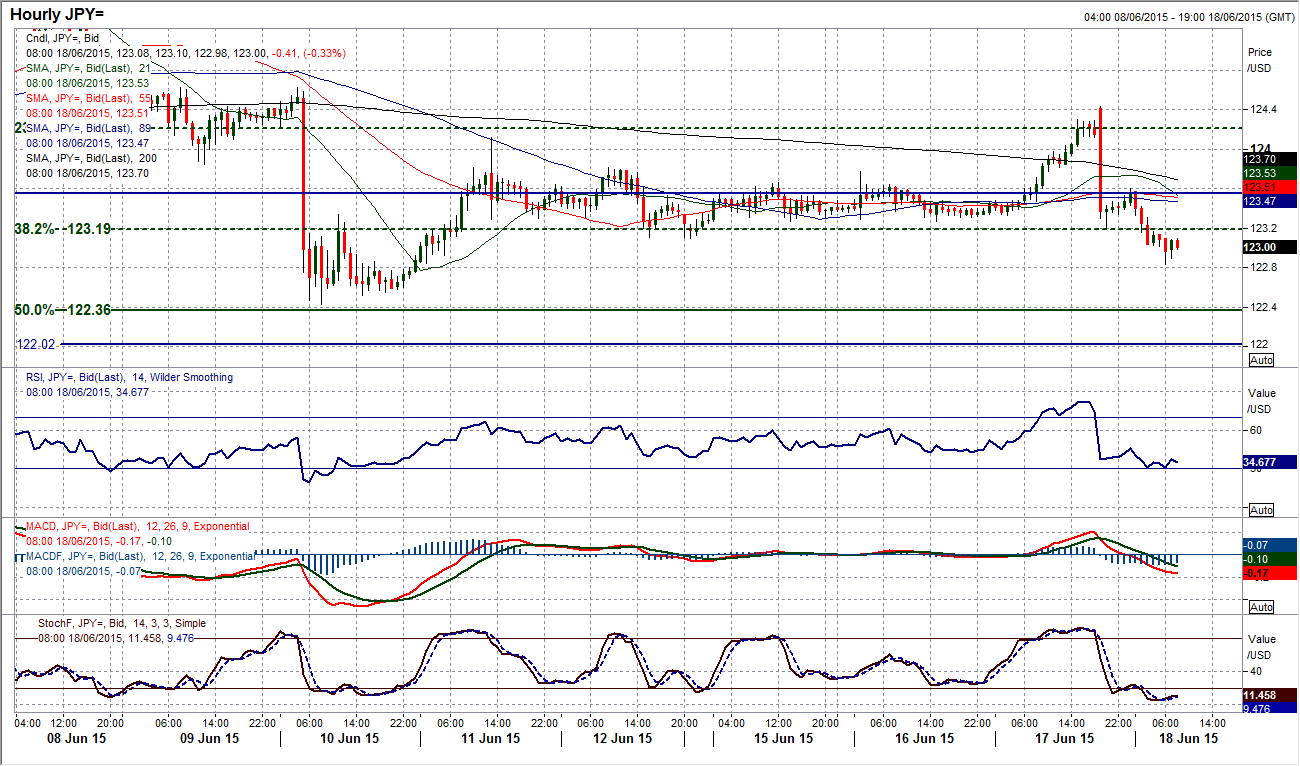

USD/JPY

There was a significant intraday turnaround on the announcement of the FOMC monetary policy. This has left a high posted at 124.43 and an arguable shooting star candlestick. This reversal has continued today with the pair continuing to fall away in early trading and is at a 5 day low, whilst also re-opening the support at 122.43 again. If the daily momentum indicators are anything to go by then the test of support will be seen, with the Stochastics continuing to fall away, the MACD lines declining and the RSI also turning lower again. The intraday chart shows the band of congestion that has been breached, but this congestion will once more turn into resistance, starting around 123.20 towards 123.60. There is little real support until 122.43 whilst I continue to expect a retracement back towards the original 122.02 breakout support.

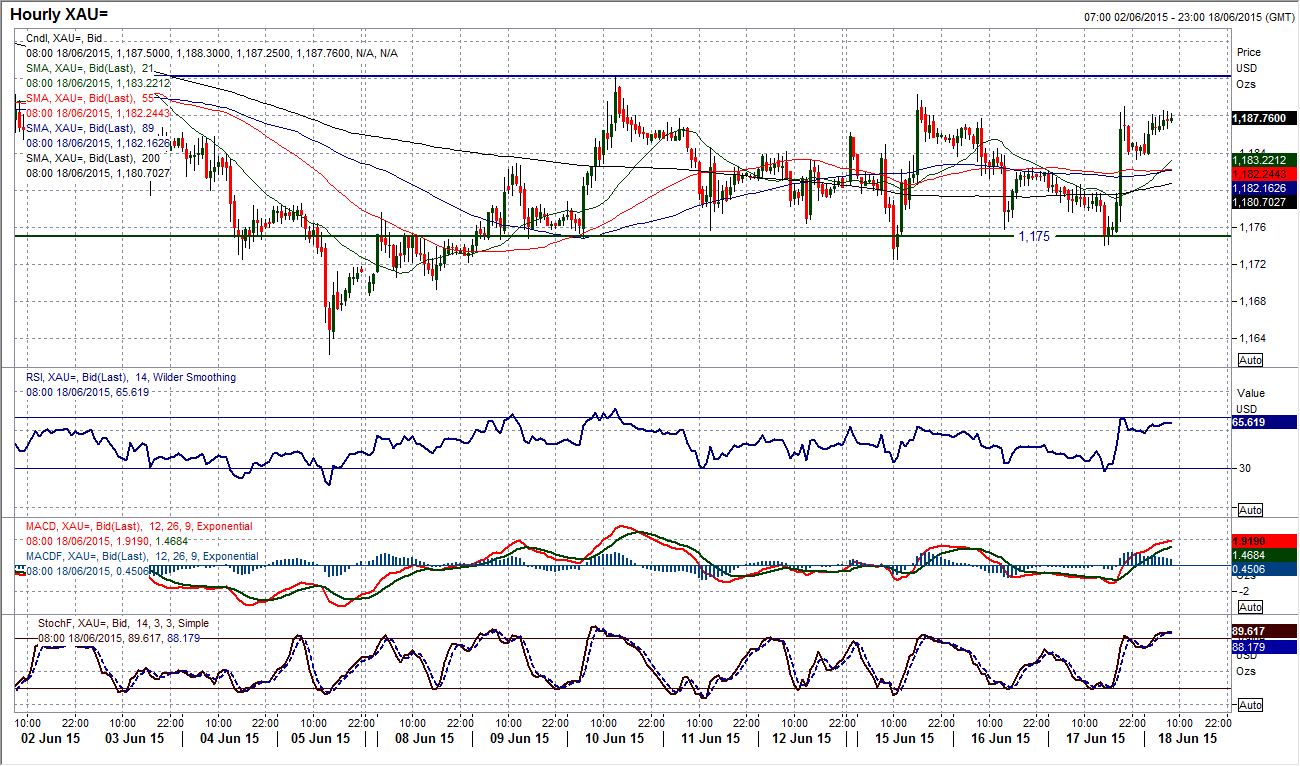

Gold

As gold has been consolidating again for the past 7 days, the corrective forces have always been suggesting that the next move would be to the downside. The reaction since the FOMC have gone to question that move as the gold bulls have supported once again around the intraday level at $1175. The reaction has also now taken gold back above the resistance of the 4 week downtrend. As yet this means little more than a slight improvement in the outlook, and nothing has really been achieved yet. The RSI has ticked higher but remains below 50, whilst the MACD lines remain flat as do the Stochastics. The hourly chart shows a range in formation over the past week above the support that comes in continually between $1172.50/$1175, however the resistance at $1192 is still the key near term ceiling. I am still siding with the bears on gold, however the arguments are not as strong as they once were. It would really need a decisive breach of $1200 to turn my outlook.

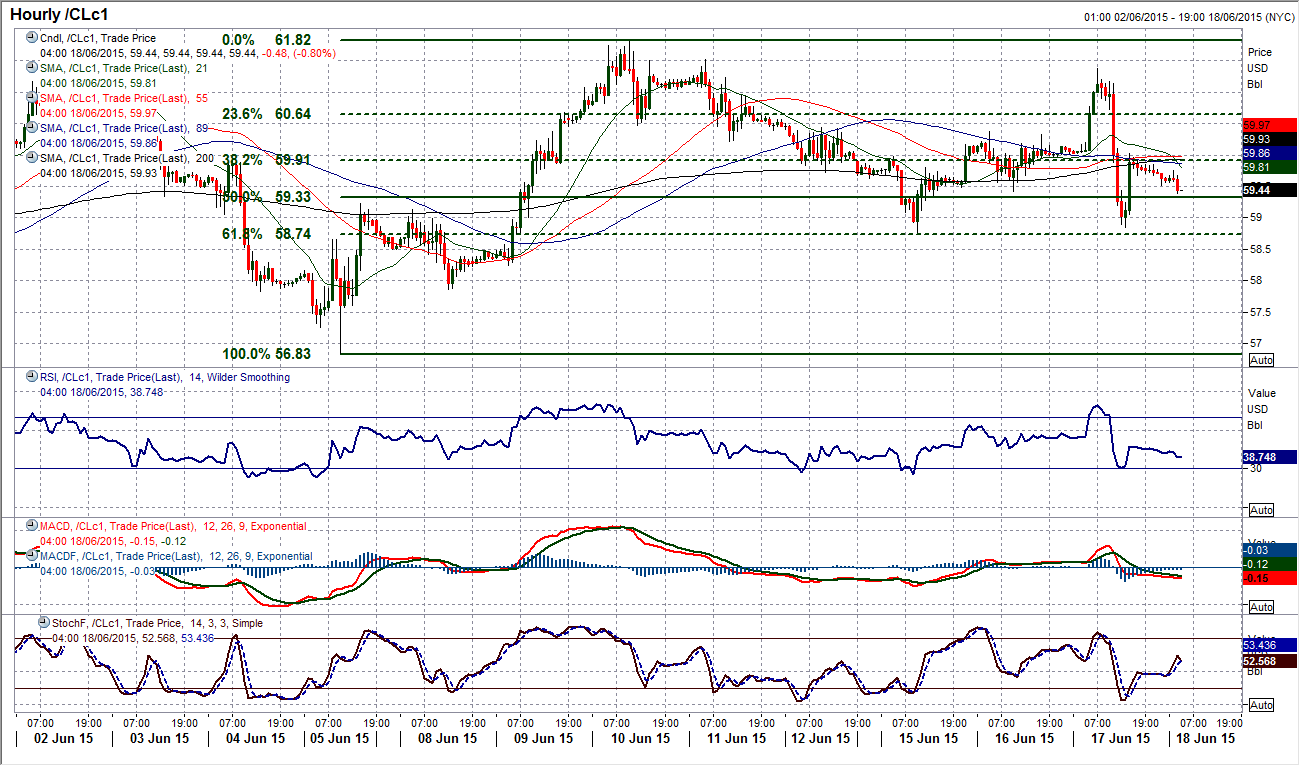

WTI Oil

The Fed has induced a reaction across WTI with a significant increase in volatility that has remarkably resulted in very little overall move. A candle that comprised of a high/low daily range of over 4% ended up with a near doji candle pattern which has meant that momentum indicators on the daily chart have barely changed. Looking at the hourly chart you will see the level of the volatility on the day, the initial sharp move came on the announcement of the weekly oil stocks, whilst the dovish lean from the Fed induced a rally once more. Overall though, the 61.8% Fibonacci retracement level has again helped to provide support and is growing in importance at $58.74. Continue to look at the Fib levels as potential turning points as the broad range remains in play.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.