Market Overview

The mixed signals regarding the prospects of a deal for Greece in the past few days have been difficult to fathom. Greece have been insisting that a deal could done by Sunday, whilst the European Commission have denied these claims, whilst IMF chief Christine Lagarde has suggested that a Greek exit from the Eurozone is a possibility still. This uncertainty weighed on equity markets yesterday, which I feel will be moving increasingly on the toing and froing of this story in the coming days. However, interestingly the positive correlation between the German 10 year Bund and the euro has slightly broken down in the last couple of days as the euro has looked to rally. Today is growth day for many countries, but focus will be on the US which according to some models could have a downward revision on its annualised Q1 GDP from +0.2% to potentially -1.0%.

Wall Street limped to close 0.1% lower last night, whilst the Asian markets were mixed to slightly higher. The Nikkei was up 0.2% as the weaker yen helped exporters, whilst the 6.5% one day sell-off in Shanghai looks to have stabilized for now. European markets remain in cautious mode as traders await any further news on Greece.

In forex trading, there is little significant movement, although there have been slight signs that the recent recovery in the dollar may be wavering. A notable mover is the Kiwi which has continued to sell-off overnight following its crucial break down below $0.7200 yesterday. Japanese core CPI can in slightly above estimates and this has helped to stabilise the weaker yen. Gold and silver continue to consolidate.

Traders will be looking towards the GDP data for the US at 1330BST with the preliminary reading of Q1 GDP expected to be revised sharply downwards to -1.0%. Canadian GDP is also at 1330BST and is expected to come in at 0.3%. The final Michigan Sentiment is at 1500BST and is expected to be revised slightly higher from the first reading of 88.6 to 89.9.

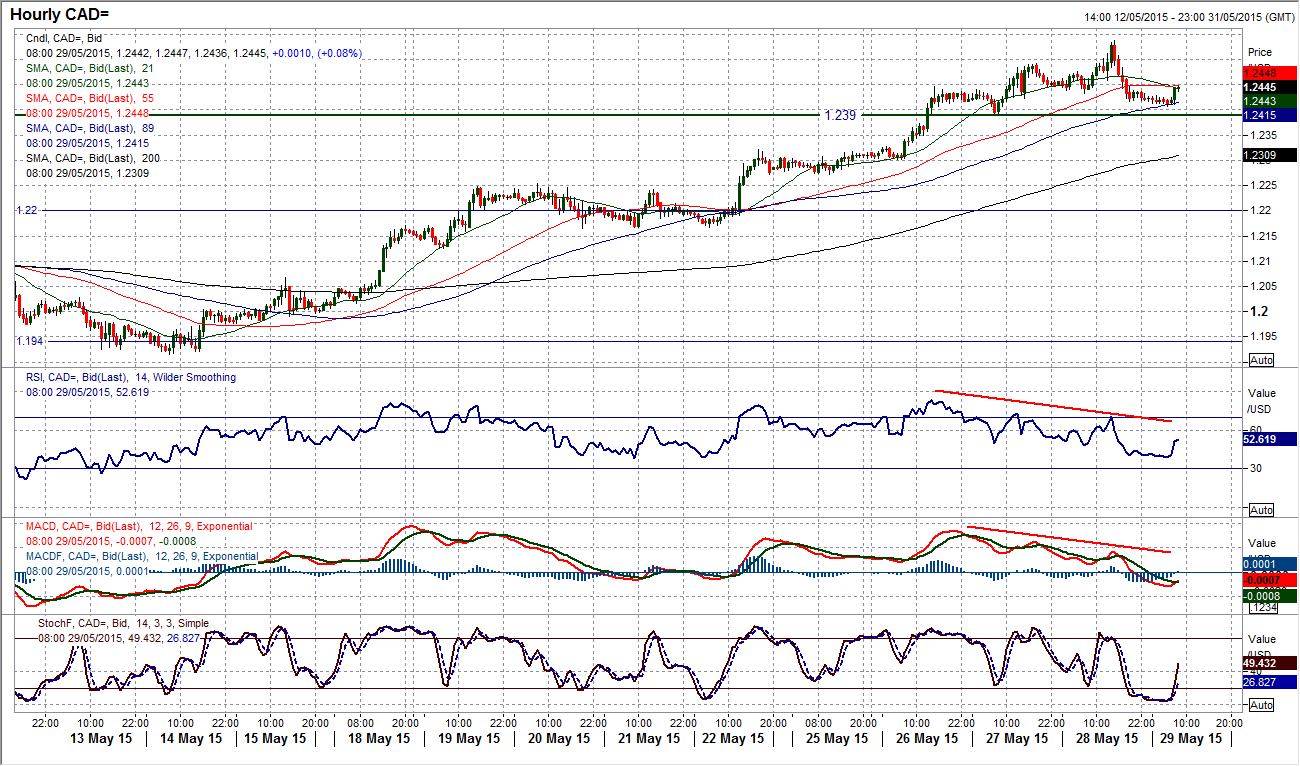

Chart of the Day – USD/CAD

The rebound on the US dollar has been strong in the past couple of weeks, but a shooting star candlestick pattern was posted yesterday and could now be set to engage some sort of retracement. This bearish candle comes after a slightly weak candle on Wednesday, whilst the reaction so far today has been to continue the rolling over of the bull run. The momentum indicator are not too bad yet, although the Stochastics have crossed lower but it may be best to wait for a confirmed sell signal (lines crossing back below 80) to suggest the sellers are gaining momentum. The intraday hourly chart shows the price has fallen away since yesterday afternoon, however, interestingly there are also bearish divergences with both the hourly RSI and hourly MACD lines with the recent run to 1.2537. There is also a “death cross” on the 21 hour and 55 hour moving averages. So it would suggest that some sort of near term correction is building. There is a minor higher reaction low at 1.2393 from Wednesday which can be seen as a further signal of a deterioration is it is breached. Support then comes in around 1.2317 and 1.2255.

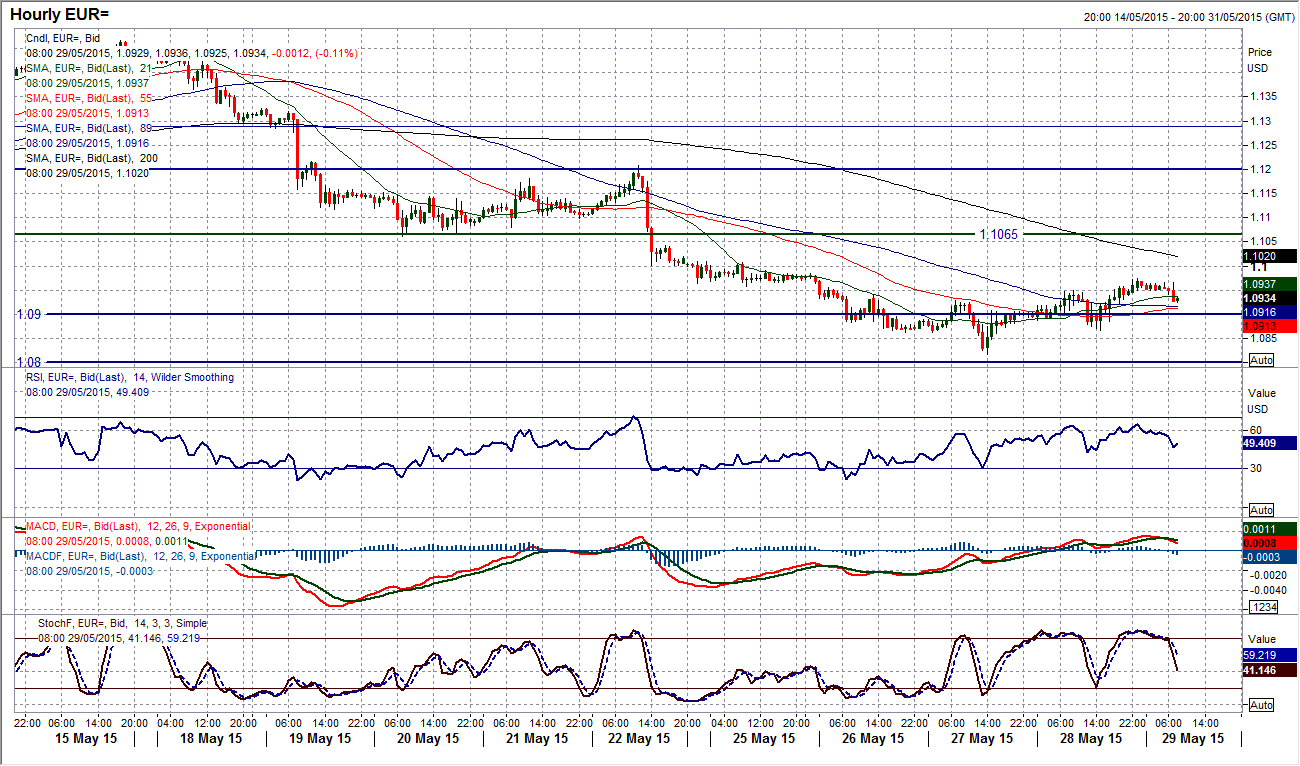

EUR/USD

A second positive candlestick in a row has continued the minor recovery in the euro. This is also coming as the momentum indicators begin to tick higher too, with the Stochastics beginning to improve. The near term outlook is no longer suggesting imminent downside pressure. However, I still see this recovery as a short term move. The intraday hourly chart shows a band of resistance overhead between $1.0960/$1.1065, the upper portion of which I see as a key level of resistance in the near/medium term outlook. There is a higher low which has been left at $1.0867 that is now a near term marker post for the bulls, and with the configuration of hourly momentum indicators looking more positive there is still the prospect of further to run in this rebound. The early weakness today needs to form support above the old $1.0900 pivot level to continue a sequence of higher lows in the past couple of days. However, I remain cautious for too much further upside in the near term rebound. A breach of $1.0867 would open a retest of the $1.0818 low.

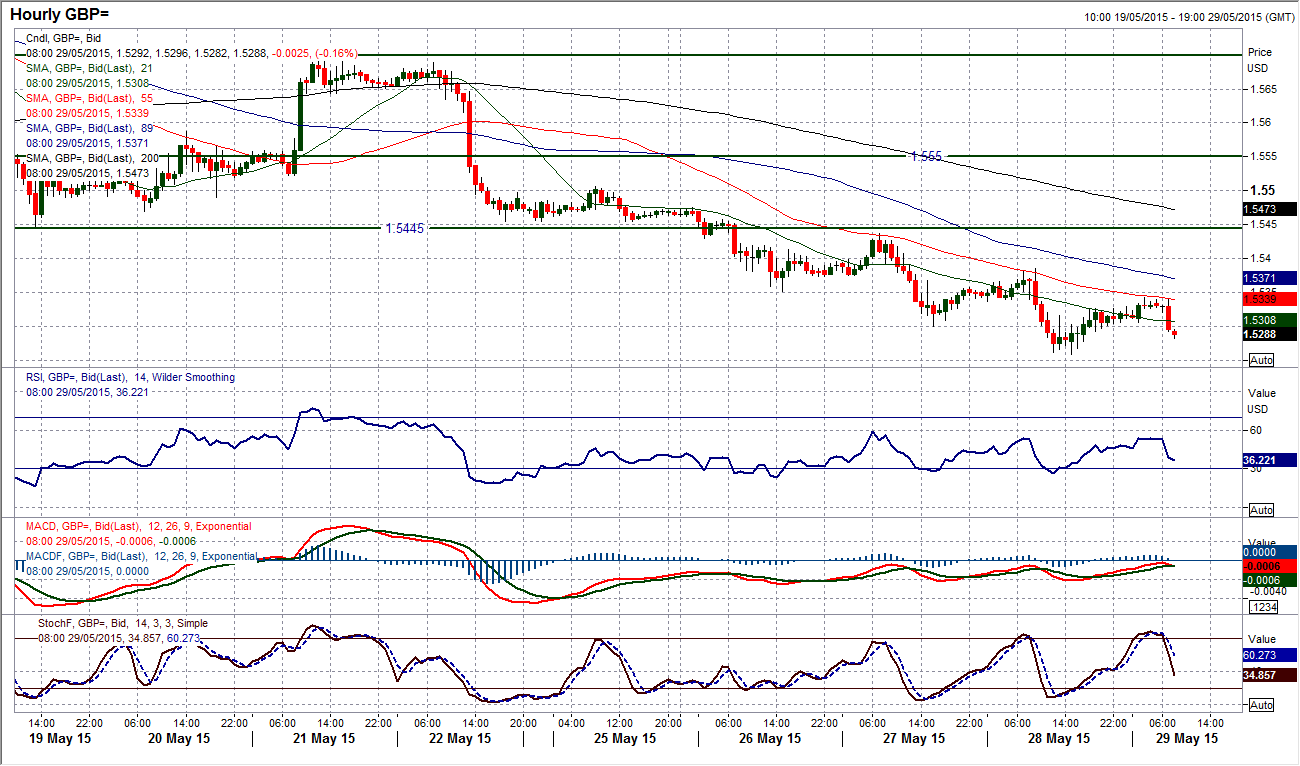

GBP/USD

Intraday rallies on Cable continue to be sold into as the new bear trend has been building. The break below $1.5445 has created a sequence of lower highs and lower lows now and with all momentum indicators in a corrective configuration, a further negative drift is possible. A test of the support at the key May low at $1.5088 is an increasing possibility. The hourly chart shows that momentum has been bearish throughout this week, with the hourly RSI consistently falling over around the mid-50s, the hourly MACD lines negative and also the Stochastics. This is another chance to sell today as there has been a rebound of around 80 pips from $1.5260 yesterday and both hourly RSI and Stochasticss are again rolling over around the point at which the sellers have been returning in recent days. The key one hour reversal resistance at $1.5385 is the resistance near term. The key resistance comes in around $1.5445, but there would need to be a push above $1.5700 to suggest that any rebound was anything more than a continuation of the sequence of lower highs in a bear phase.

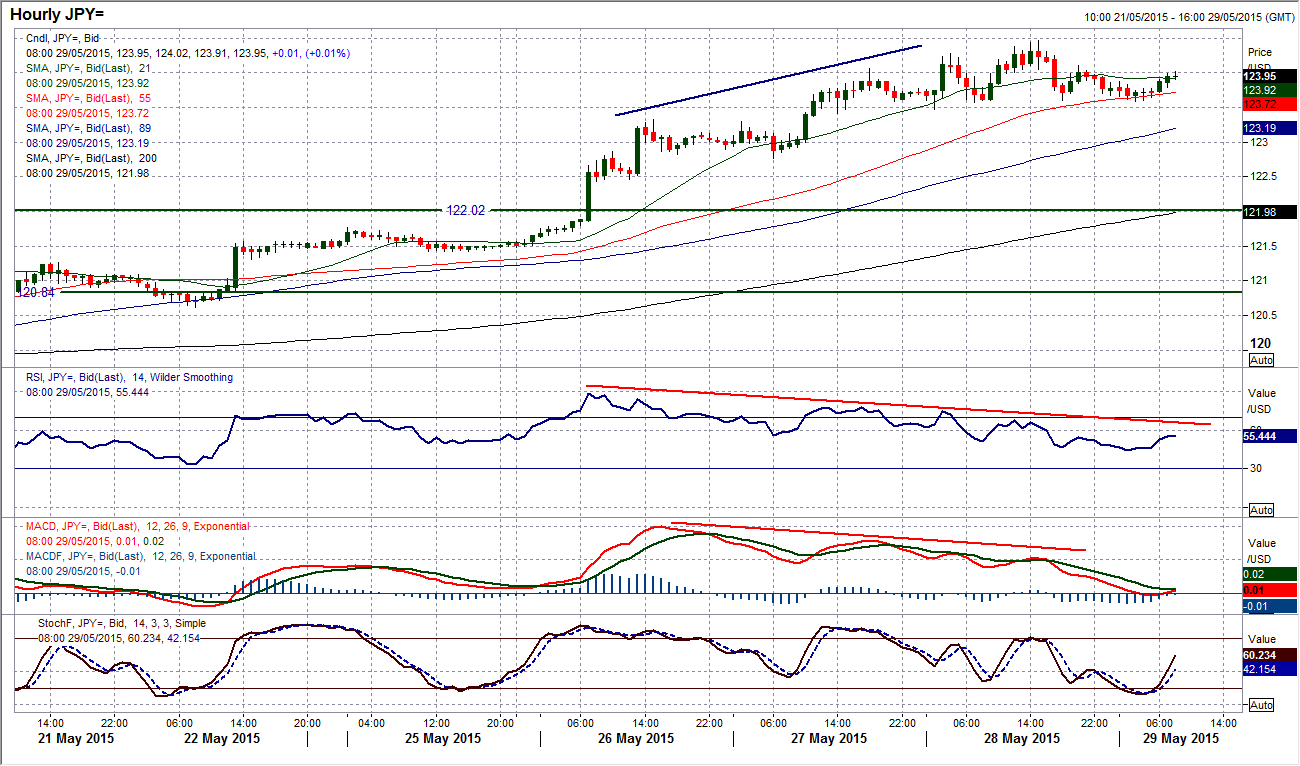

USD/JPY

The bullish breakout above 122.02 implies a breakout target of 125.70. However is the bull run just losing impetus now? Yesterday’s candle seems to suggest that the bulls have failed to control proceedings, with the closing price below the marabuzu line (mid-point of the session). However, more importantly, I am becoming increasingly interested in the bearish divergences across the hourly RSI and MACD indicators. I wrote about these divergences yesterday and despite Dollar/Yen subsequently running a further new high to 124.46, once again the hourly RSI and MACD lines continued to bearishly diverge. Overnight there is a hint of a consolidation, but whilst the support at 123.42 remains intact there is no real breakdown in price and higher lows. If a correction does set in near term, the support starts to come in around 122.50, whilst a retreat back towards the key breakout level at 122 would be likely. Above 124.46 would continue the run higher, but whilst the bearish divergences continue I will remain cautious now.

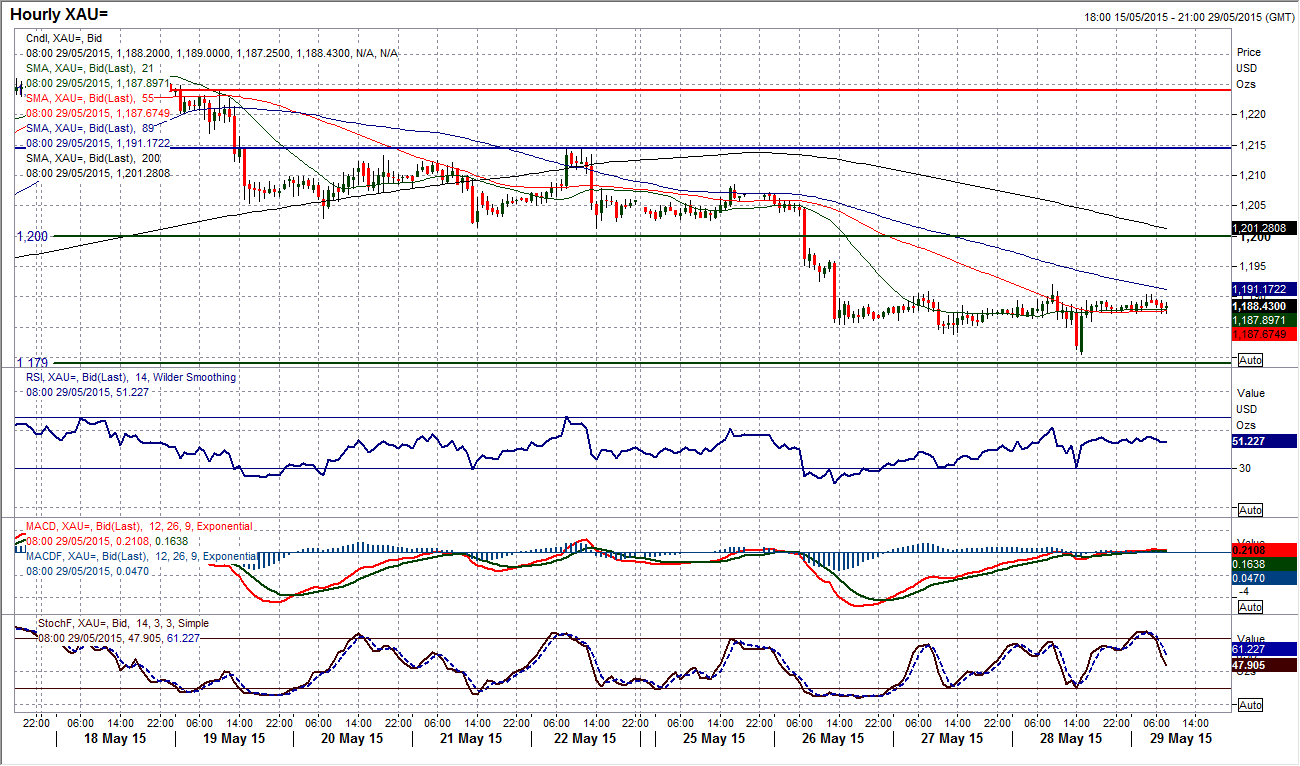

Gold

I argued yesterday that the candle on Wednesday was a “doji”. If there was any doubt about Wednesday, then yesterday certainly can be considered t be a “doji” (both open and close around $1187). It is interesting because a doji is an uncertain candle and this is the second in a row, whilst I said yesterday that I thought a test of the range low support at $1179, I also do not see this as a breaking of the range. The doji candle suggest a lack of conviction and with the support forming above $1179 now the sellers are unable to gain control. I see this as a continuation of the range, with support bolstered at yesterday’s low of $1180.50, whilst the support continues to build today. However, there is still much to do, with hourly momentum indicators showing little real improvement yet. A move above the near term resistance at $1192 would improve the outlook and open a test of $1196 and then the pivot around $1200 which is around the mid-point of the range.

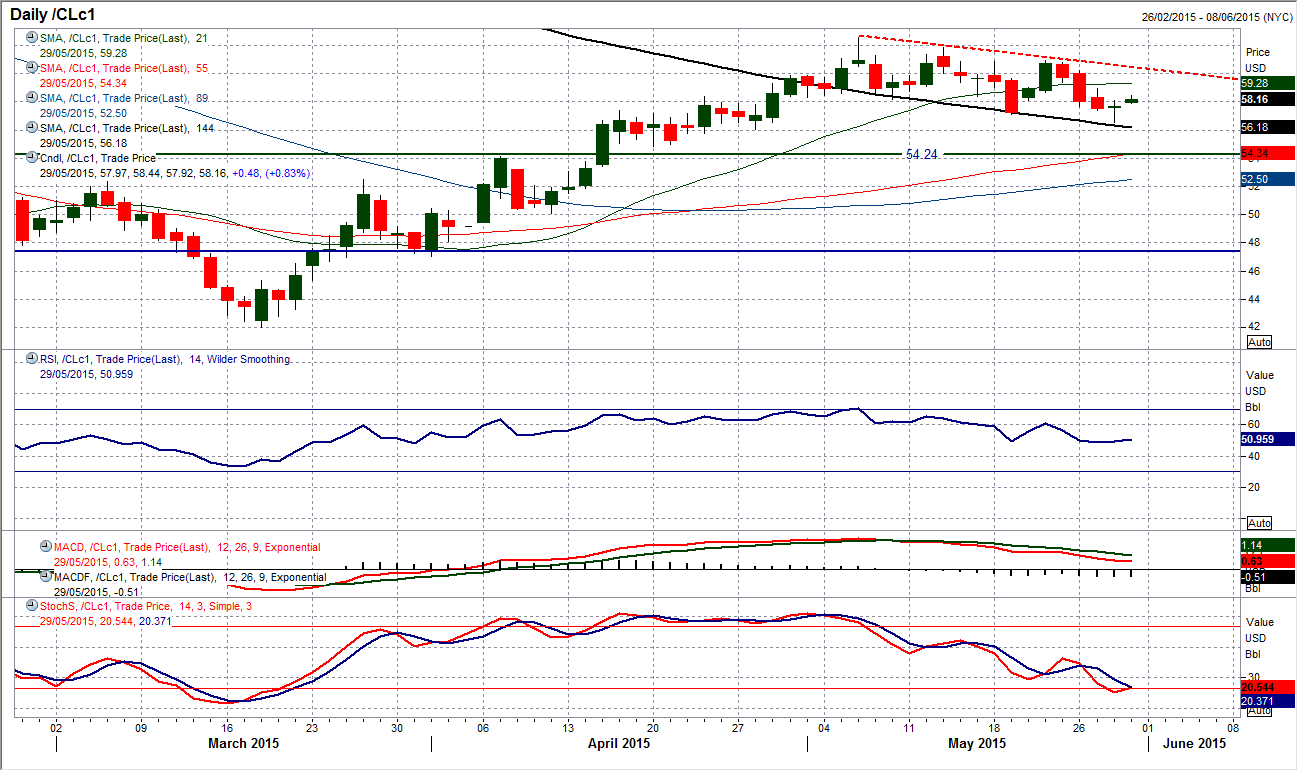

WTI Oil

The outlook for WTI has been deteriorating over the past few weeks with a series of lower highs and a continued breach of support levels. The latest breach of support (at the previous reaction low of $57.09) has been accompanied by a “doji” candle (denoting near term uncertainty). This could now open for the latest rebound within the recent downtrend (which today comes in around $60.20.. However, with the daily momentum indicators, such as RSI at a 9 week low whilst MACD and Stochastics also continuing to deteriorate, any intraday rallies should be seen as a chance to sell with the likelihood of continued correction back towards the old key neckline which is now supportive at $54.24. The hourly chart shows a series of lower highs in place over the past few days, which have left resistance around $59.00. The key resistance to change the corrective outlook is at $60.88.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD stays weak near 1.0650 ahead of Eurozone PMI data

EUR/USD remains on the back foot near 1.0650 in European trading on Tuesday. Resurgent US Dollar demand amid a cautious risk tone weighs on the pair. Investors stay wary ahead of the preliminary Eurozone and US business PMI data.

GBP/USD eases below 1.2350, UK PMIs eyed

GBP/USD is dropping below 1.2350 in the European session, as the US Dollar sees fresh buying interest on tepid risk sentiment. The further downside in the pair could remain capped, as traders await the UK PMI reports for fresh trading impetus.

Gold could see a rebound before resuming the correction

Gold price sees a fresh leg down in Asia on Tuesday even as risk flows dissipate. Receding fears over Middle East escalation offset subdued US Dollar and Treasury bond yields. Gold remains heavily oversold on the 4H chart, rebound appears in the offing.

PENDLE price soars 10% after Arthur Hayes’ optimism on Pendle derivative exchange

Pendle is among the top performers in the cryptocurrency market today, posting double-digit gains. Its peers in the altcoin space are not as forthcoming even as the market enjoys bullish sentiment inspired by Bitcoin price.

Focus on April PMIs today

In the euro area, focus today will be on the euro area PMIs for April. The previous months' PMIs have shown a return of the two-speed economy with the service sector in expansionary territory and manufacturing sector stuck in contraction.