Market Overview

There has been a significant change in market tack in the past 24 hours. A whole string of factors have contrived to turn the market back towards the dollar with the euro under significant pressure. The dovish comments from the ECB’s Benoit Coeure, the dip into deflation in the UK and the stronger than expected Housing Starts in the US. A triple-whammy of good news and traders have really ran with it. Today is equally as important though for the near term market outlook as we need to see a series of confirmations on these markets to suggest that it was not just a flash in the pan. All too often in recent weeks the dollar has had negated bullish moves as the correction has continued. There is as yet no sign that Treasury yields have reversing their recent gains, whilst I remain concerned that Wall Street is still moving on a “bad news is good” track (extremely strong housing starts caused stocks to consolidate yesterday).

The S&P 500 closed slightly lower by 0.1% although it did make another intraday all-time high. Asian markets have been boosted by the stronger dollar, but also the news that Japanese GDP grew an annualised 2.4% in Q1 which was way above the 1.5% that had been predicted. European markets are mixed at the open.

Forex markets show that the euro is under further pressure today as the European session has got going. This certainly looks to be the end of the recent rally. The dollar looks to be stronger across most of the majors once more today. The stronger dollar is also impacting across precious metals with both gold and silver weaker.

Markets are looking out for the meeting minutes of the Federal Reserve today at 1900BST. The FOMC statement gave a rather uncertain outlook for the prospect of a rate hike and more information over how “transitory” the recent weak economic data is would be of interest. Before that, the Bank of England gives its own minutes with a unanimous call for holding rates expected.

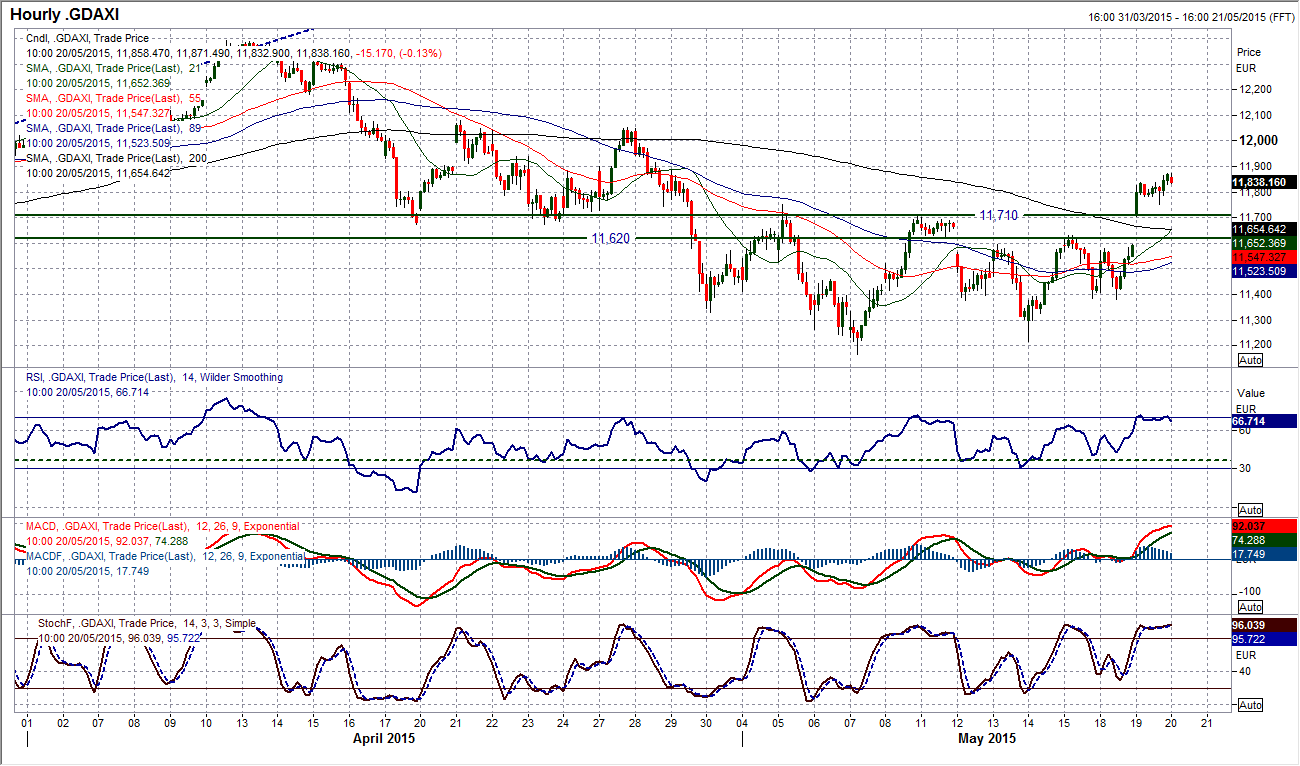

Chart of the Day – DAX Xetra

The high volatility on the DAX has been a significant feature of trading in the past weeks or so. Once more, yesterday we saw a severe reaction on the DAX to news flow, with the reaction again being strongly negatively correlated to the movement on the euro. However, having spent the past couple of weeks trading around of below the neckline resistance of a top pattern at 11,620, a break above resistance at 11,710 yesterday suggested the bulls were fighting back. The momentum indicators have reacted with the RSI at a 4 week high and the DAX trading above all the daily moving averages. Looking at the hourly chart it becomes clear that there is breakout support around the old 11,710 resistance which needs to hold today. If this is the case then the bulls can look higher towards the 12,079 net key resistance. The near term outlook has certainly improved with momentum indicators looking far more positive. Today’s candle needs to confirm the strong move from yesterday to suggest that the bulls are truly regaining control.

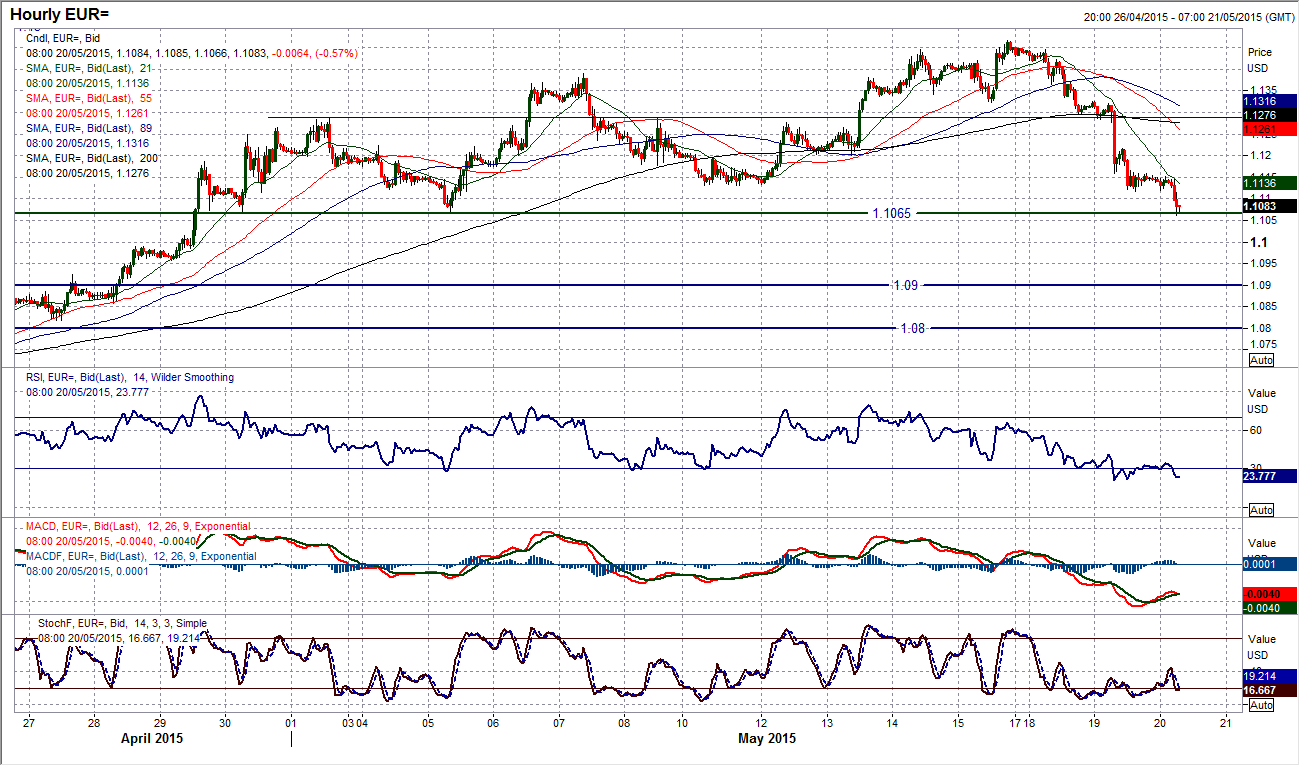

EUR/USD

The euro was absolutely smashed yesterday as the ECB jawboned it lower through the dovish comments from ECB member Benoit Coeure. This now means that the bull recovery that had been building over the past few weeks now looks to be over (in that way I suppose the ECB has again done its job). If (and seemingly now when if this morning’s price action is anything to go by) the first key support in the recovery at $1.1130 is broken on a closing basis then the euro rally will be confirmed as being over. The $1.1130 support level was breached slightly (by around 13 pips) yesterday but not broken on a closing basis. This support is the key near term trigger and as the European session has begun the sellers are again in control. A close below will confirm my change of outlook as it is a key reaction low. Momentum indicators are already now deteriorating sharply with Stochastics falling strongly and MACD crossing lower. The intraday hourly chart shows no sign of recovery from yesterday’s sell-off with momentum now very bearish. The initial resistance comes in at $1.1160 for a potential turnaround of the near term sentiment. Next support under threat are the $1.1035/$1.1065 old key breakout levels.

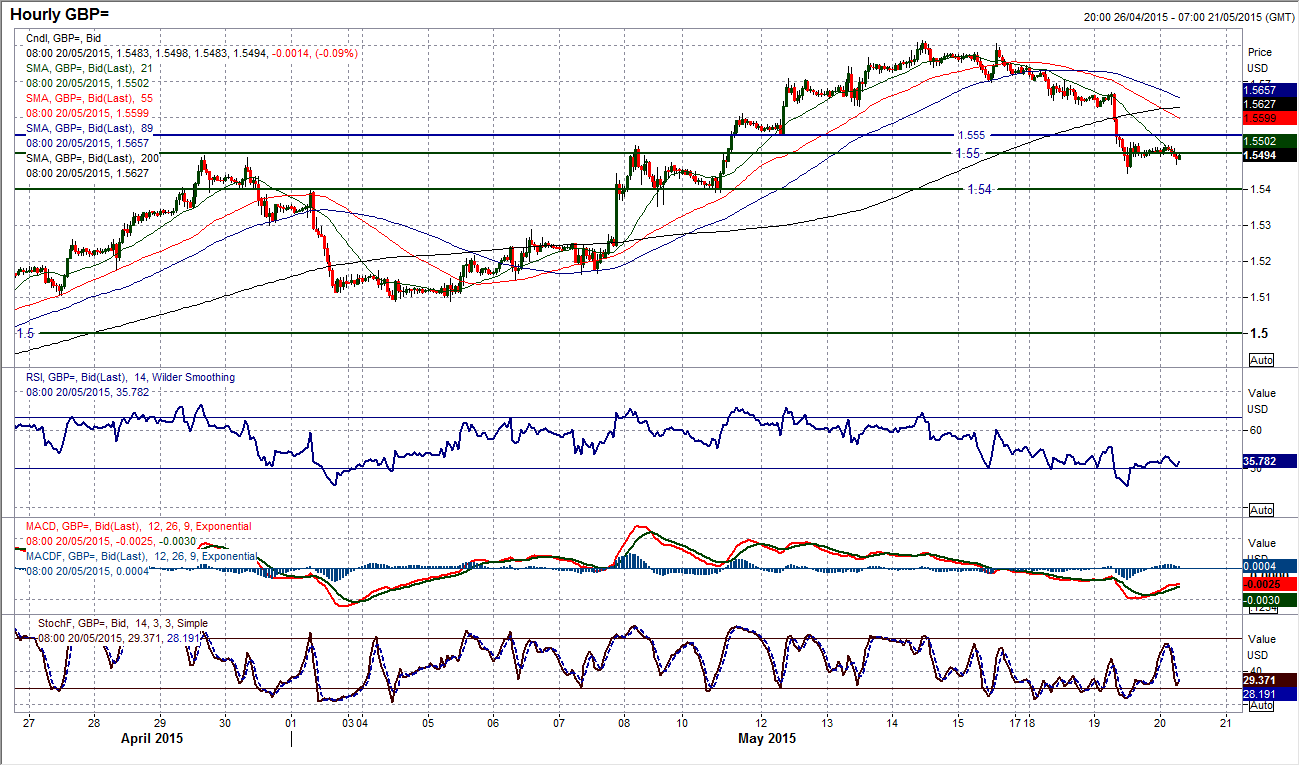

GBP/USD

Wit three days of selling pressure culminating in a huge sell-off yesterday the price of sterling has deteriorated near term. However, now Cable is back into the support around $1.5500 (there was a spike low to $1.5445 yesterday but interestingly the price bounced quickly back to now consolidate around $1.5500) this makes today’s trading very important. As a closing level of support $1.5500 remains intact, whilst the momentum indicators do not look to have been too badly impacted by this correction yet. Taking a step back, this could still just be part of the bull run higher, sill trading above the rising 21 day moving average. On an intraday basis the $1.5445 support becomes important today but also the closing support around $1.5500. The second day after a big candle move is seen as a move to either confirm or deny. Resistance comes in at $1.5550 and $1.5630.

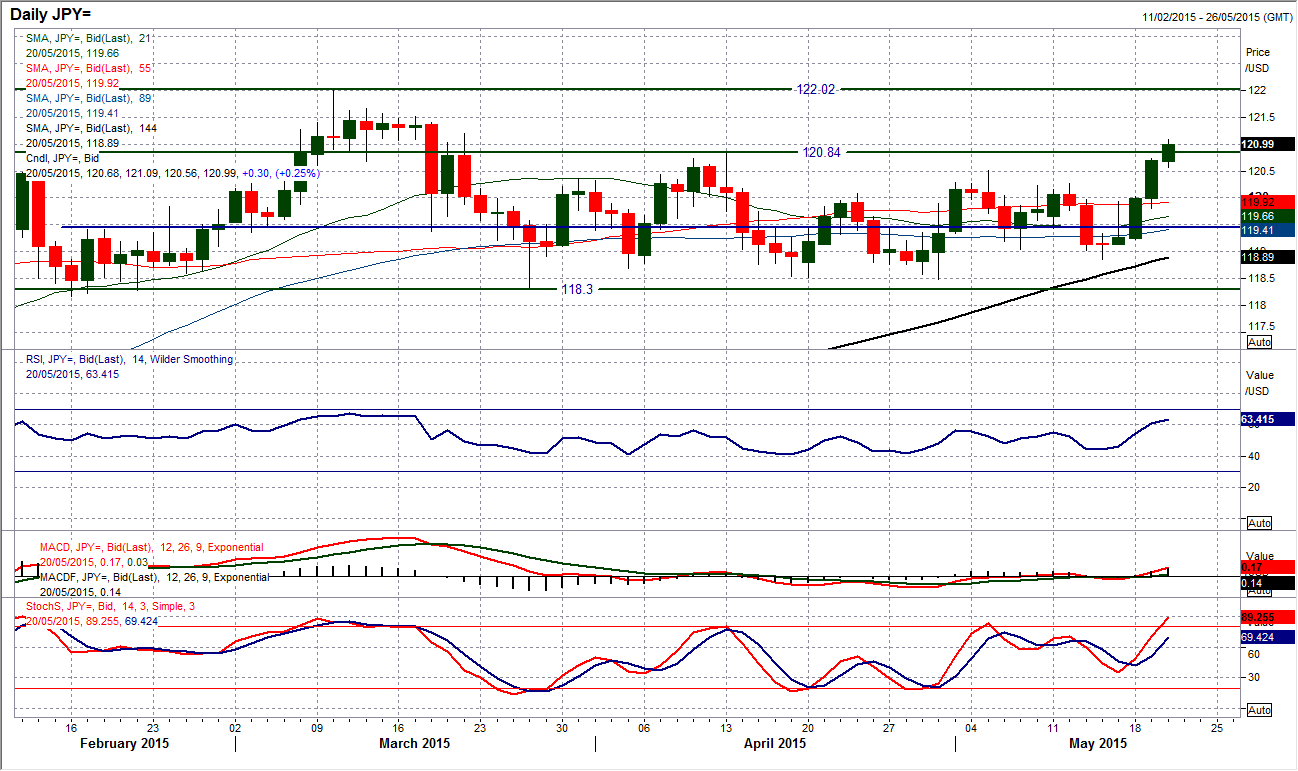

USD/JPY

After weeks of saying “just play the range” there finally seems to be signs of life in the dollar bulls. Two consecutive strong bullish candles (something that has not been seen for at least a month) has taken Dollar/Yen through the range resistance levels at 120.50 and now today the 120.85 key April high is in the process of being broken. Ideally there would be a close above the resistance to act as a confirmation. Interestingly, the RSI is already at a two month high with Stochastics rising strongly. The hourly chart shows a strong run higher in the past few days with a series of higher lows and flanked by the 21 hour moving average (currently 120.60). Momentum is now much stronger too and although we may have to wait for a confirmation of a breakout today, the outlook is increasingly strong. A close above 120.85 would then open the old highs once more at 122.02 from March. Near term support today is between 120.50/120.60.

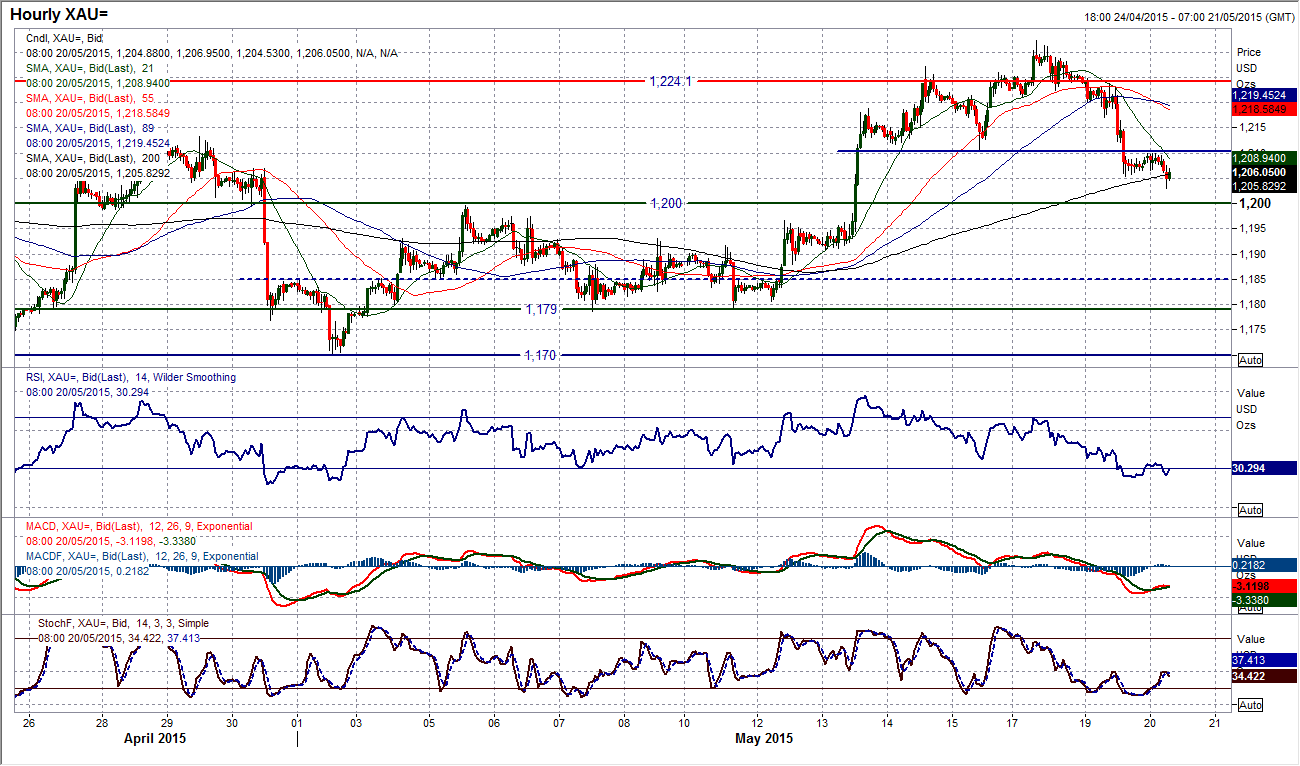

Gold

I had been concerned by the lack of conviction in the attempted breakout on Monday and the huge negative candle yesterday showed that there was never really an appetite to push gold for an upside break. The breakdown of the initial support around $1211 was the key move that suggests that the sellers have neutralised the bull threat for now. This has turned the outlook on its head and is at the very least make gold a neutral play once more, if not more corrective within the range again. I always believe that the subsequent candle after a strong move is equally as important as it shows the market’s level of acceptance on a different day’s trading. So look for today’s reaction, which is so far negative. The hourly chart shows the key break of $1210.80 support and deteriorating momentum. A failure to move back above the minor resistance band $1210/$1215 would now add to the level of expectation for gold’s new trading level. There is an old pivot support at $1200.

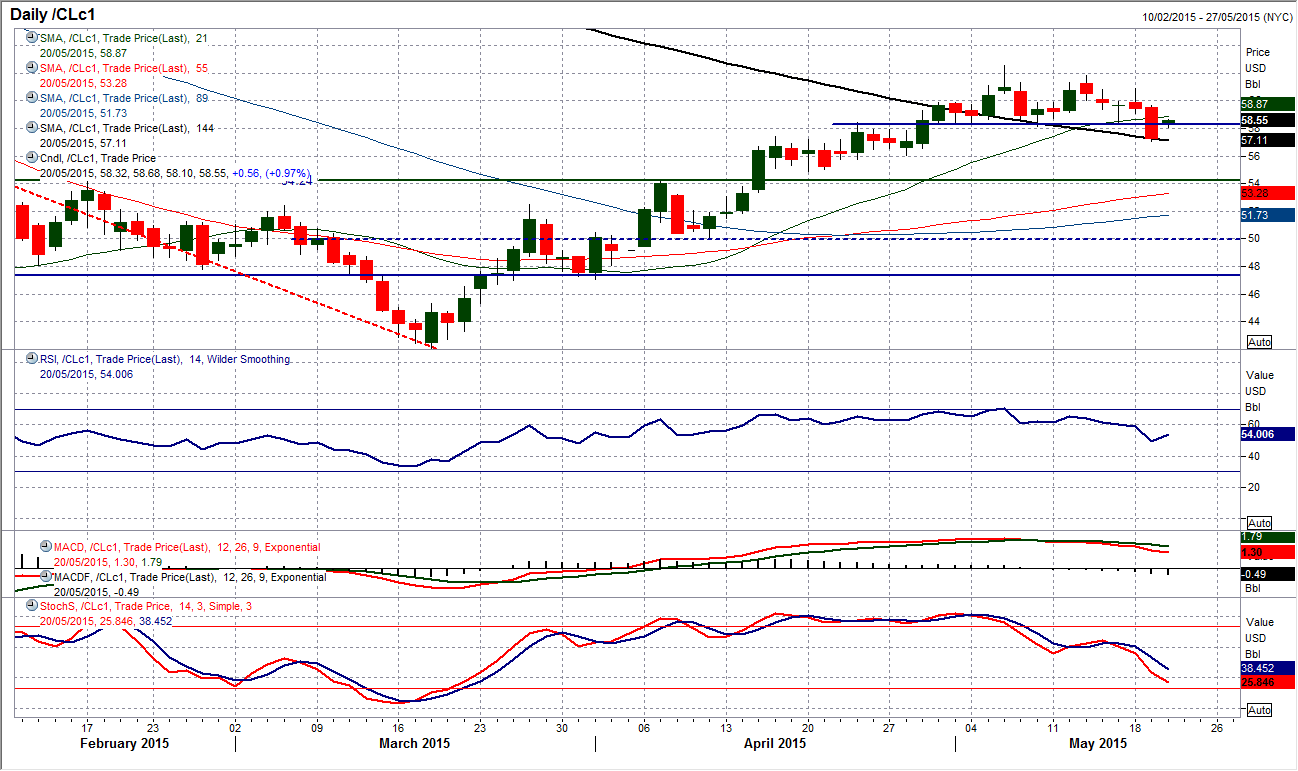

WTI Oil

After several days threatening the key near term support at $58.30, yesterday we finally had the breakdown. This move is certainly corrective as it comes with confirmation breakdowns on the momentum indicators such as the daily RSI, Stochastics and with a MACD crossover. The downside break implies a target of $54.00 near term. The intraday hourly chart also confirms the breakdown, with hourly moving averages all falling in bearish sequence and the momentum indicators in negative configuration. The sharp downside yesterday with the hourly RSI oversold has induced a technical rally which has helped to renew downside potential and this provides an intraday opportunity to sell again today. With resistance in the band $58.30/$59.00 this pullback towards the neckline resistance (old support is new resistance) is a chance to sell. Above $60.88 to properly abort the bearish control.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.