Market Overview

It is Non-farm Payrolls Friday and the markets are taking a pause for breath. However this pause may be just as much related to a rather volatile afternoon yesterday with Mario Draghi’s ECB press conference. Despite upward revisions on Eurozone growth the inflation projections suggested that perhaps ECB QE could be continued beyond the current 18 month programme. Cue sharp euro weakness and sharp gains on equities. With the DAX storming into new high ground, even the FTSE 100 managed an all-time closing high as the London market was dragged up by the bootstraps in a further day of underperformance.

However, the usual action in the European morning of Non-farm Payrolls is that markets become rather subdued with traders unwilling to take too much of a view ahead of such crucial data. The US markets were only slightly higher yesterday with the S&P 500 closing up 0.1%, although Asian markets were showing gains with the Nikkei closing just over a percent higher on a weaker yen. The European session is consolidating in early trade. The expectation is that Non-farm Payrolls will fall slightly to 240,000 from last month’s 257,000. This is set to drag the unemployment lower to 5.6%, whilst keen eyes will also be trained on the average hourly earnings growth which is forecast at +0.2% on the month. There are risks of surprises either way, but February was a month of adverse weather conditions in the US and with some of the data still disappointing to the downside, this could put pressure on payrolls.

In forex trading, market appear to be consolidating some of the sharp moves we saw yesterday following Mario Draghi’s press conference. The euro is again trading lower but only slightly, whilst there is little real direction in any of the other major pairs. I do not expect too much movement in front of another key Non-farm Payrolls report that could hold the key to whether the word “patient” is removed from the FOMC statement in two weeks time.

Chart of the Day – AUD/USD

The Aussie has become somewhat rangebound in the past few weeks, but once more it is approaching a key near term crossroads. Last week we saw an attempted rally fail at the resistance of a 6 month downtrend. This downtrend is currently falling at 0.7843 and continues to act as the basis of resistance. The momentum indicators are fairly consistent with the outlook that this is a bear market rally though. The RSI is below 50, the MACD lines are beginning to plateau again and he Stochstics are now in consistent decline. The interesting factor is now that the resistance around 0.7850 which has been key on numerous occasions in the past 6 weeks is now above the downtrend. The intraday hourly chart shows that downside pressure s mounting on the lower support at 0.7740. An overnight rally seems to be failing around a minor resistance at 0.7800 and this could be a chance to sell for the test of 0.7740, whilst a decisive breach would open the key low at 0.7640.

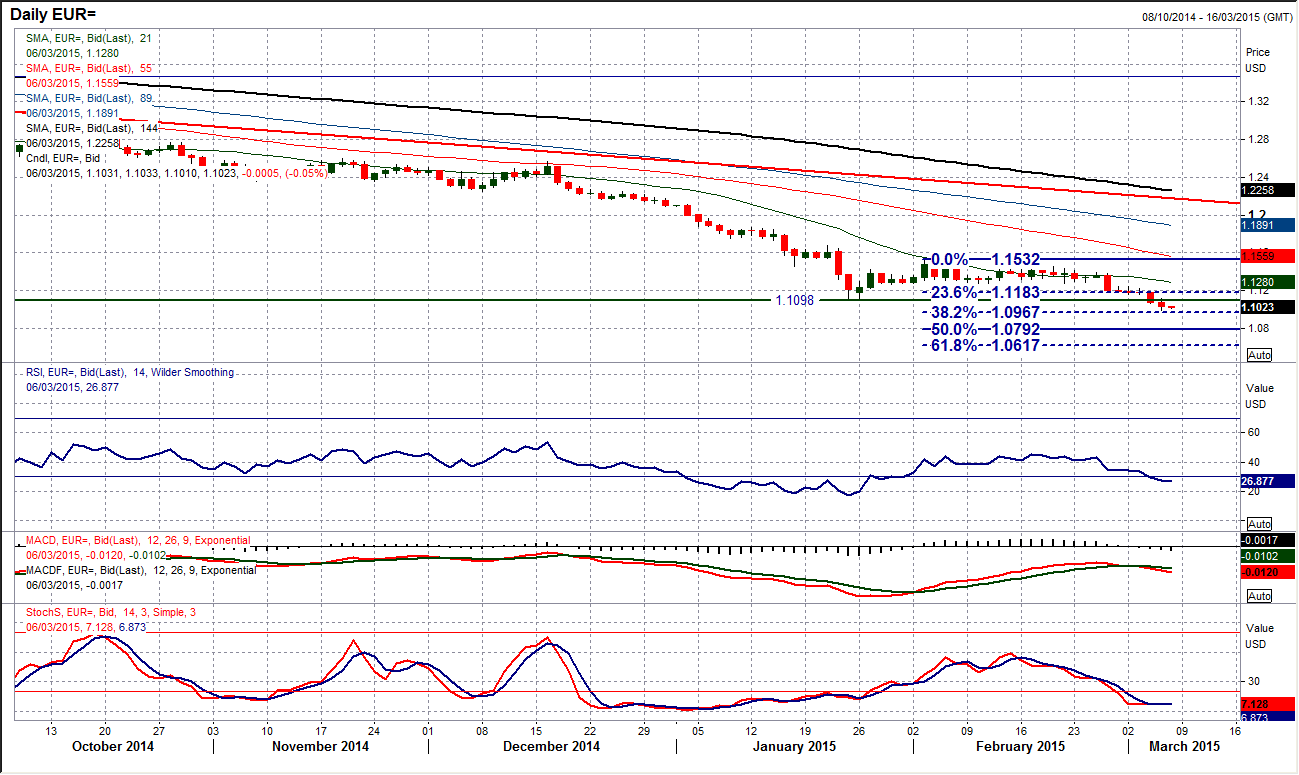

EUR/USD

A second successive solid day of losses has seen the euro confirm the downside break of the $1.1098 support. The psychological support at $1.1000 was also breached and this has opened the next Fibonacci projection target (ie 38.2%) at $1.0967. Momentum indicators are all in negative configuration and the daily chart seems pretty well set for further weakness. However, that is not to say the bears had it all their own way though yesterday’s session. The ECB press conference was a fairly volatile one with first a strong jump to leave resistance at $1.1113 (due to the ECB’s upgrade of its growth projections) however then talk of lower inflation and purchase of negative yielding debt sent the euro into decline once more to a low at $1.0986. The rate may well now settle down in front of the payrolls data which could provide another sharp move in the direction of any surprise. The bears do now look to be in control but once Non-farm Payrolls are out of the way we can get a proper gauge of where we are at.

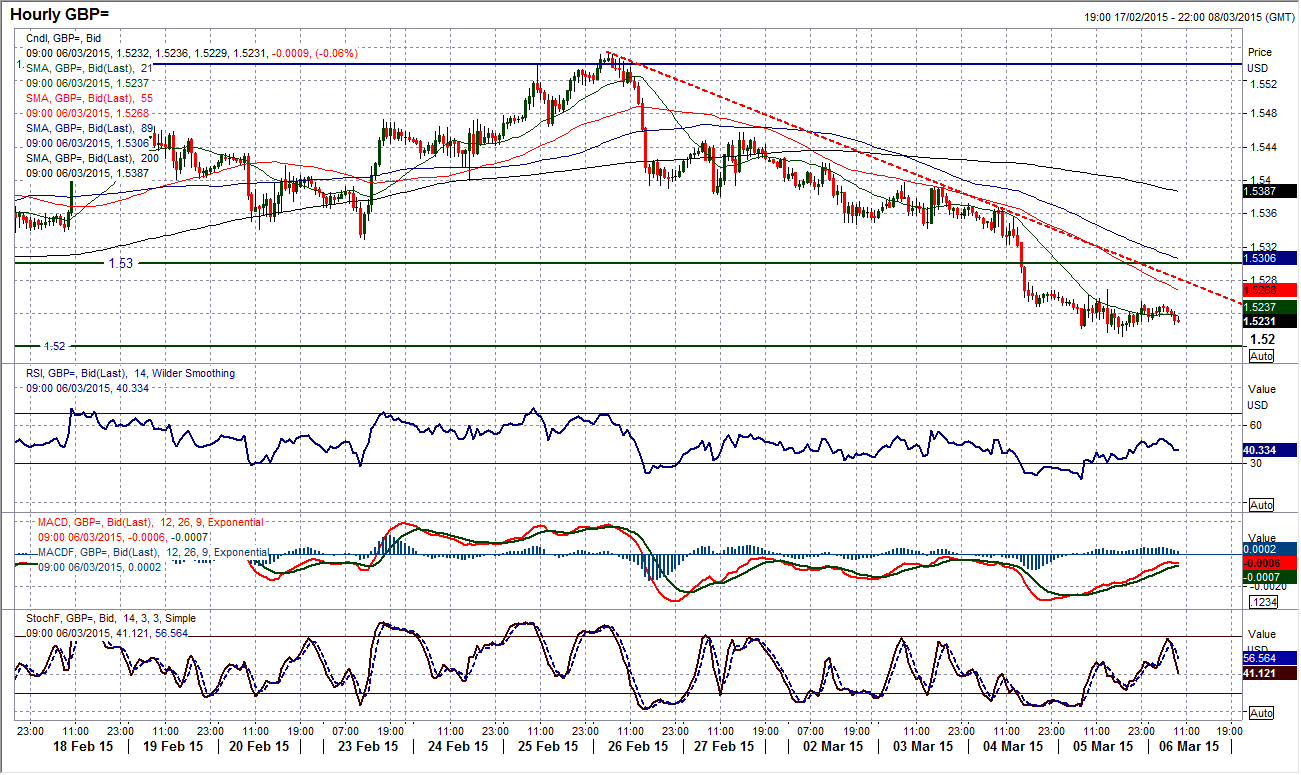

GBP/USD

Although it was not an incredibly bearish day, yesterday’s trading did confirm that the bulls have now certainly lost control of Cable. The momentum indicators back up this assertion with the RSI now back below 50, MACD lines having bearishly crossed and Stochastics continuing to fall away. The one aspect now outstanding that is preventing me from turning outright near to medium term bearish is the key support at $1.5200 is intact. I am of the belief that this support will be seriously tested in the coming days but I also know that during the rally it was tested on numerous times and held firm. I therefore see any rebounds on Cable now as a chance to sell for a retreat towards $1.5200 and likely further weakness. A breach opens $1.5135, whilst there is little real support until the $1.5000 area. The intraday hourly chart shows that yesterday’s price action was fairly muted and this is likely to continue ahead of Non-farm Payrolls now. However I see intraday resistance overhead between $1.5300/$1.5350 which should be seen as an area to think about short positions again if there were to be a bounce. A sustained rally above $1.5400 is needed to turn positive again.

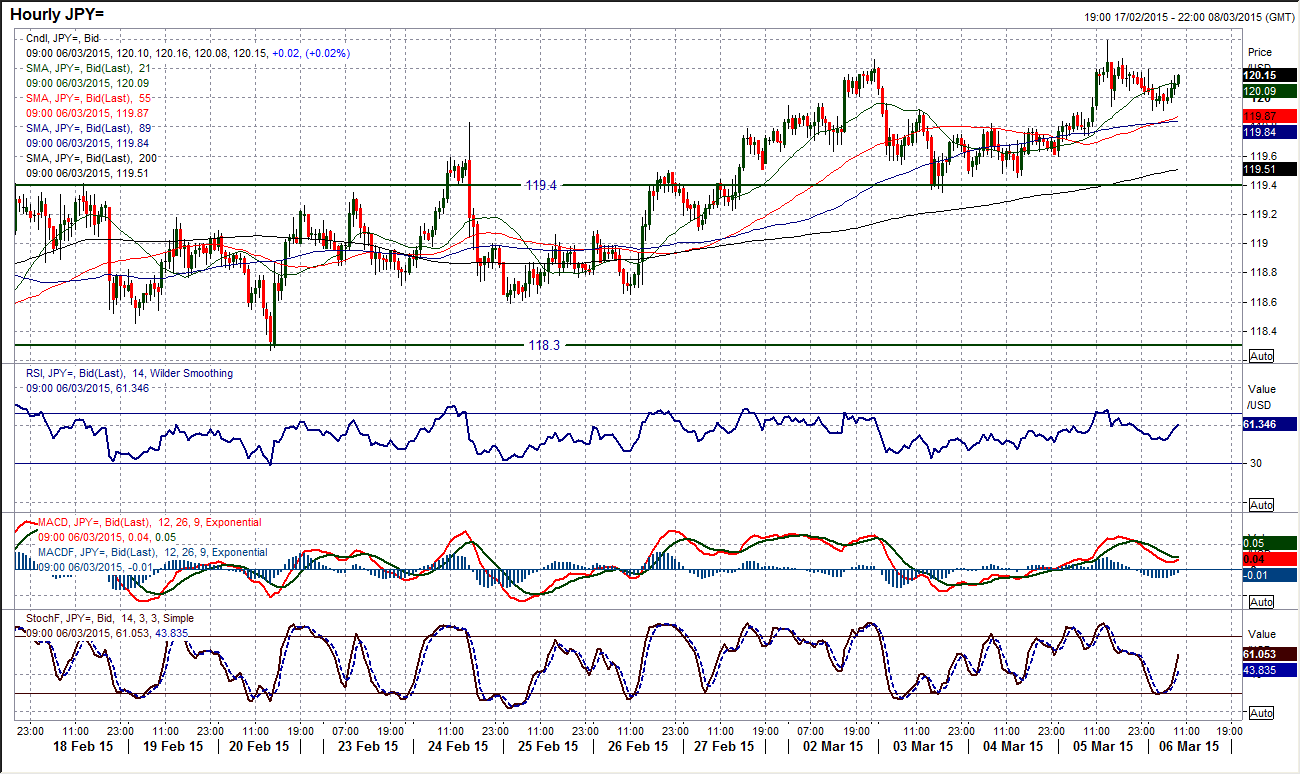

USD/JPY

The dollar bulls regained the element of control yesterday as there was a move above the resistance at 120.24, however there is still work to be done for them to be confident in the outlook. The daily chart suggests that whilst it is a fairly slow grind to the upside there is certainly reason to be positive that there will finally be a move towards 120.50 resistance and subsequently back towards the 121.84 key December high. On the intraday hourly chart, I would be looking upon the overnight correction to a previous minor resistance which is now supportive at 119.90 as a chance to buy. The rate has now seemingly left behind the key reaction low support at 119.35, whilst the hourly momentum indicators show a positive configuration that has just used the overnight slide as a chance to unwind overbought momentum and to use it as a chance to buy. Although the approach to Non-farm Payrolls may be quiet the technical outlook is increasingly suggesting that we should be backing the bulls now.

Gold

I have gradually been changing my view over the past few days on gold. As the price movement has become increasingly less akin to that of a bear market in the near term I have been suggesting that the gold price is trading within a range, and has done for over 2 weeks. This range is pivoted largely around $1210 and the price is holding on to the lows around $1191 up to the highs around $1223. There is a very slight bearish bias within the range of late but nothing that yet is screaming out for a downside break. However there is still the overriding medium term bear trend that is a negative guiding force, falling today at the $1223 resistance, whilst the daily momentum would still suggest a downside break of this range is far more likely. Perhaps the gold price is waiting for a catalyst from Non—farm Payrolls. Last month shows a sharp bearish move on gold on a strong payrolls report, so pressure on $1191 would be seen. The near term resistance is around $1210.

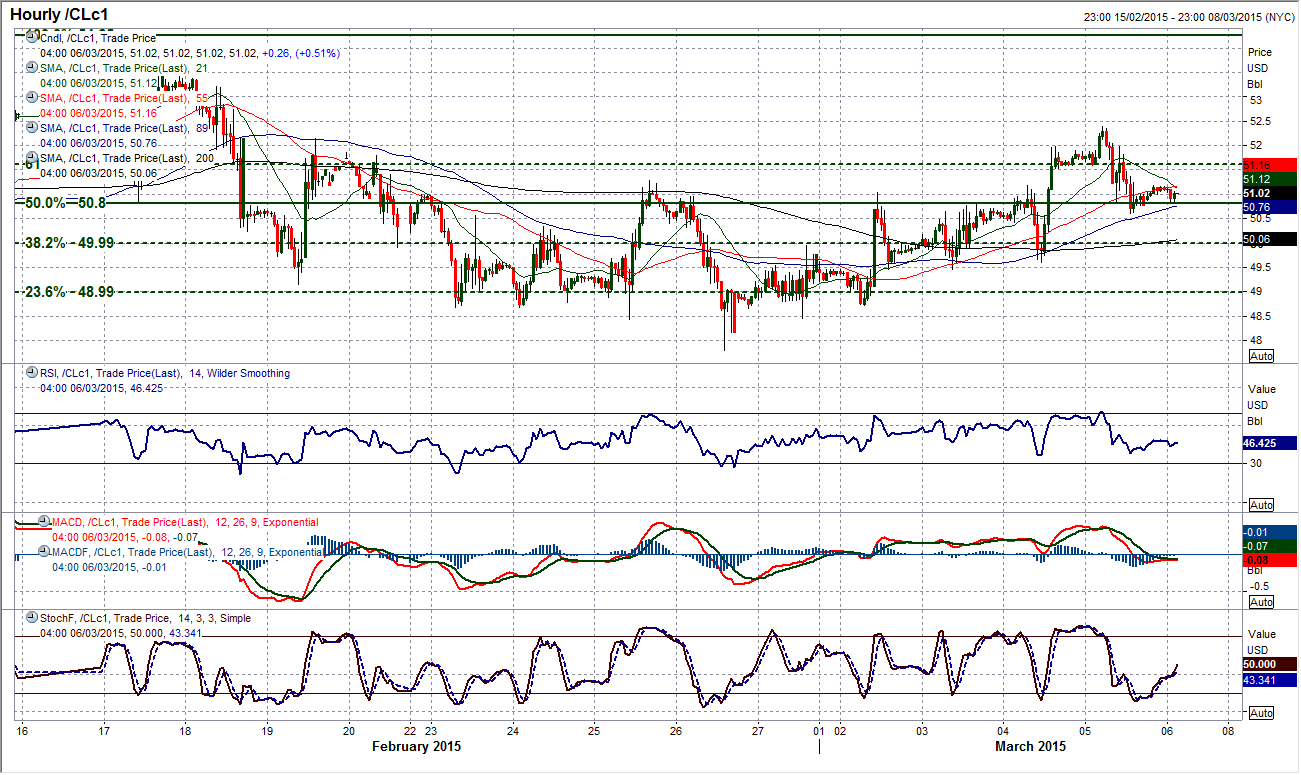

WTI Oil

With five consecutive higher daily lows on WTI the outlook continues to improve. Although momentum indicators remain largely neutral (reflective of the rangebound position) the Stochastics are advancing positively and the bulls are regaining confidence. The intraday hourly chart shows the $51.28 resistance being decisively broken and the fact that a correction has used the 50% Fibonacci retracement at $50.80 of the range $47.36/$54.24 is also a positive development, as are the rising hourly moving averages and positive configuration on the hourly momentum. The bulls would argue that the move above $51.28 completed a base pattern that implies a return towards the resistance around $54.00. For near term trades it looks good to buy into weakness, but the time horizon of trades needs to be monitored as the volatility within the range suggests that the sharp fluctuations are set to continue for the time being. The near term bulls would remain in control whilst the support at $49.45 remains intact.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.