Market Overview

The first week of the month is always key. Jam-packed with crucial tier one forward looking data, the direction can be extremely important. China has kicked off proceedings with a hat-trick of arguably supportive releases. Firstly a 25 basis point rate cut by the People’s Bank of China to 5.35%. Furthermore, over the weekend we had official China Manufacturing still slightly in contraction at 49.9 (this will help to stoke the fires of further rate cuts by the PBOC) but beating expectations, whilst the HSBC manufacturing PMI was also better than expectations. Asian markets were mildly higher overnight and perhaps it is a little surprising then that the European markets are rather mixed in early trading.

The dollar has continued its positive end to the week with further gains today. The Dollar Index has already this morning pushed out to further multi-year highs and looks to be on the brink of the next bull leg. The dollar is trading higher against all major currencies today.

Traders will be looking out for a raft of data today. Throughout the morning there will be European manufacturing PMIs announced, with the UK at 0930GMT which is expected to continue to pick up at 53.5. There will also be flash Eurozone CPI to look out for at 1000GMT, with the headline number expected to improve slightly to -0.5% and the core data to stay as is at +0.6%. Then into the afternoon there is the US ISM Manufacturing PMI at 1500GMT which is forecast to dip just slightly to 53.4.

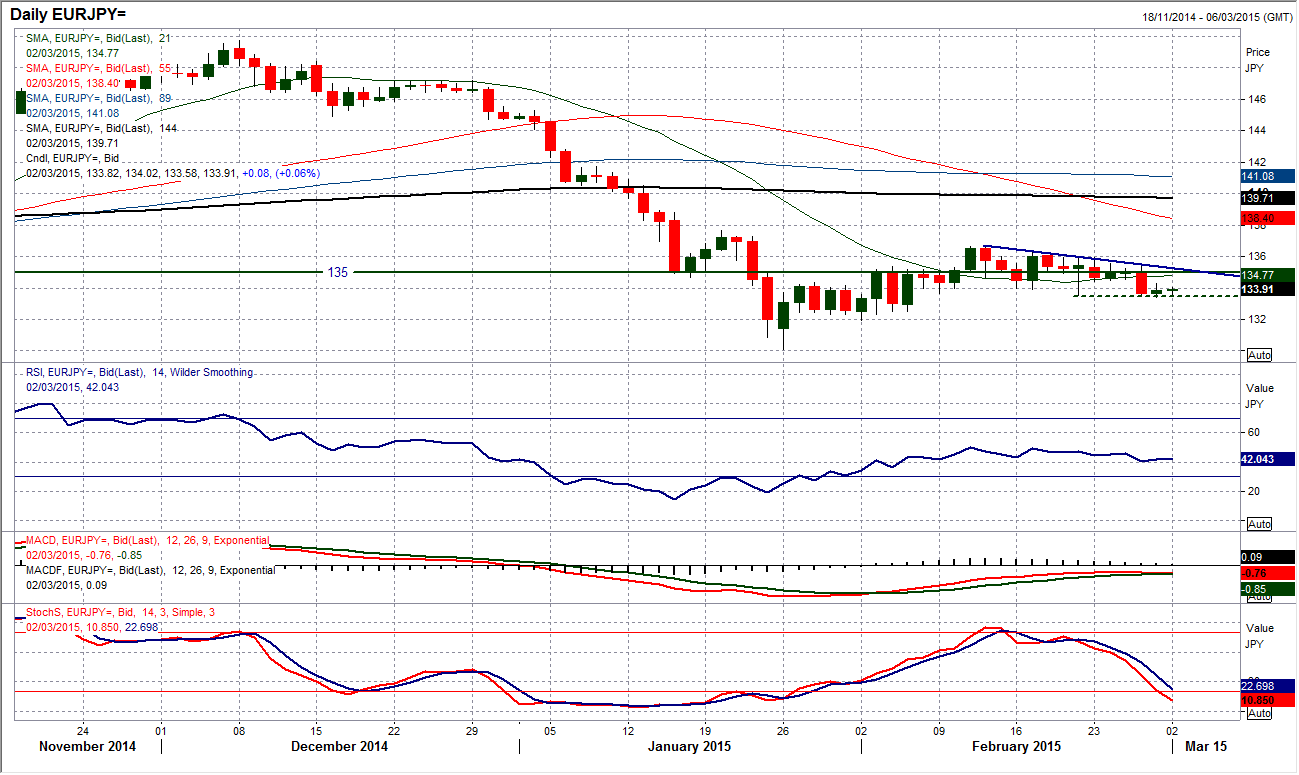

Chart of the Day – EUR/JPY

There has been a period where the pivot around 135 has been important for the outlook and with a decisive break below this level last week it looks as though the bears are once more in control. The move also continues a two and a half week downtrend that has left a series of lower highs in place and which looks set to test the support at 132/132.50. The momentum is turning against the bulls as well, with Stochastics in consistent reverse now, RSI in reverse and MACD lines topping out. The intraday chart shows a resistance now around 134.50, whilst there is growing pressure on the support at 133.50. Rallies are now being used as a chance to sell. It would need a confirmed breach of the reaction high at 136.36 to show the bulls are fighting back now.

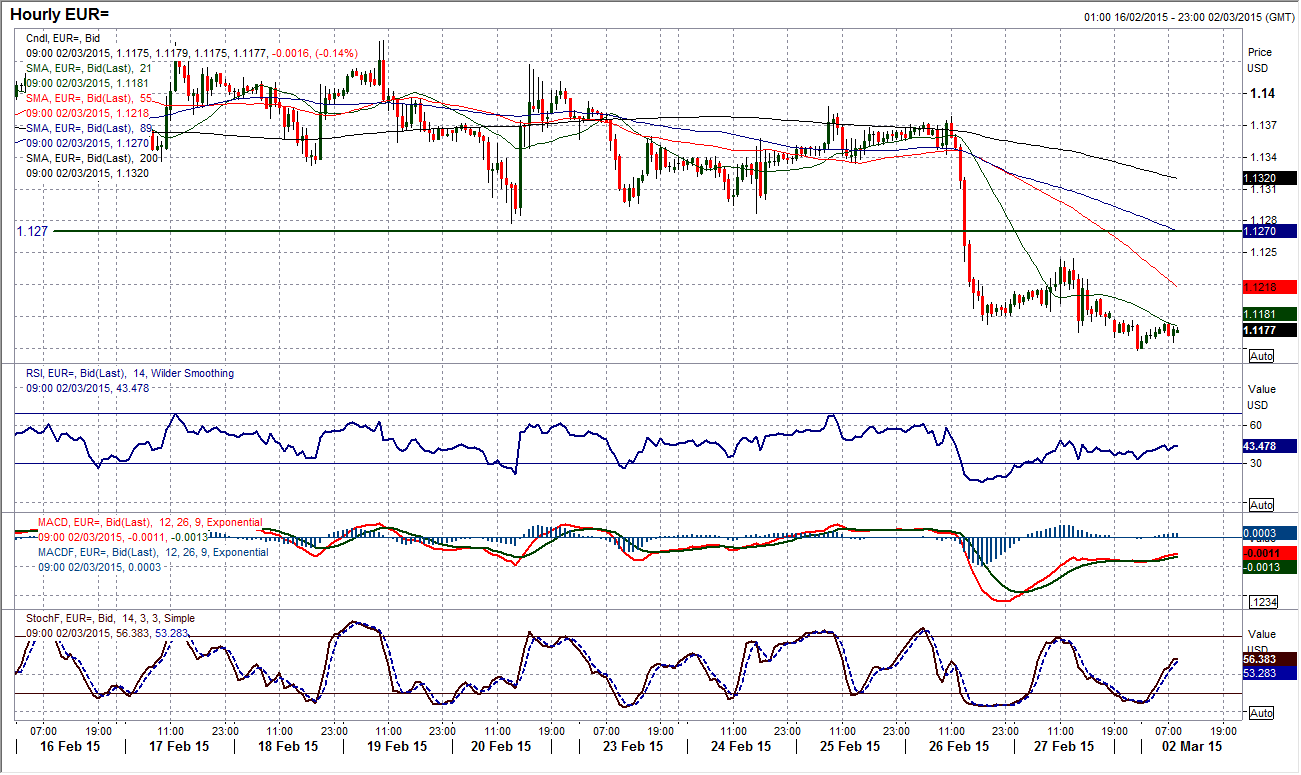

EUR/USD

The euro is increasingly positioning for a test of the key low at $1.1098. Thursday’s strongly bearish candle could not be reversed as an intraday sell-off again on Friday once more put the pressure on. Momentum has turned decidedly against the euro now with Stochastics falling sharply away and the MACD lines today forming a bearish crossover. At first glance, Friday’s almost “doji” candle looks fairly benign but the intraday hourly chart shows a sell-off into the close which is adding to the downside pressure and has left a lower high at $1.1245, which was just under the now key resistance at $1.1260 (old support becomes new resistance). The suggestion is that any intraday rebound should be seen as a chance to sell. There is a minor level of resistance at $1.1180/$1.1210 but any rebound would need to overcome $1.1260 to consistently be considered a recovery play.

GBP/USD

Despite the fact that Cable continues to trade nicely above the support at $1.5300, the warning signs are mounting for the bulls. The bearish key one day reversal at the $1.5552 high has now been followed by a confirmed sell signal on the Stochastics, and the MACD lines are now close to crossing over, whilst the RSI is also not as strong as it has been previously. Looking at the intraday hourly chart shows that the support at $1.5330 remains intact but the rate is now beginning to trade below the hourly moving averages and hourly momentum is also not as strong. However calling a correction before one is confirmed is not wise, seeing how strong the rebound has been, but the signals are becoming increasingly corrective. There is a reaction high from Friday at $1.5458 but the longer that $1.5552 remains intact the more the bulls will worry. A breach of $1.5300 would open the correction back towards the key support at $1.5200.

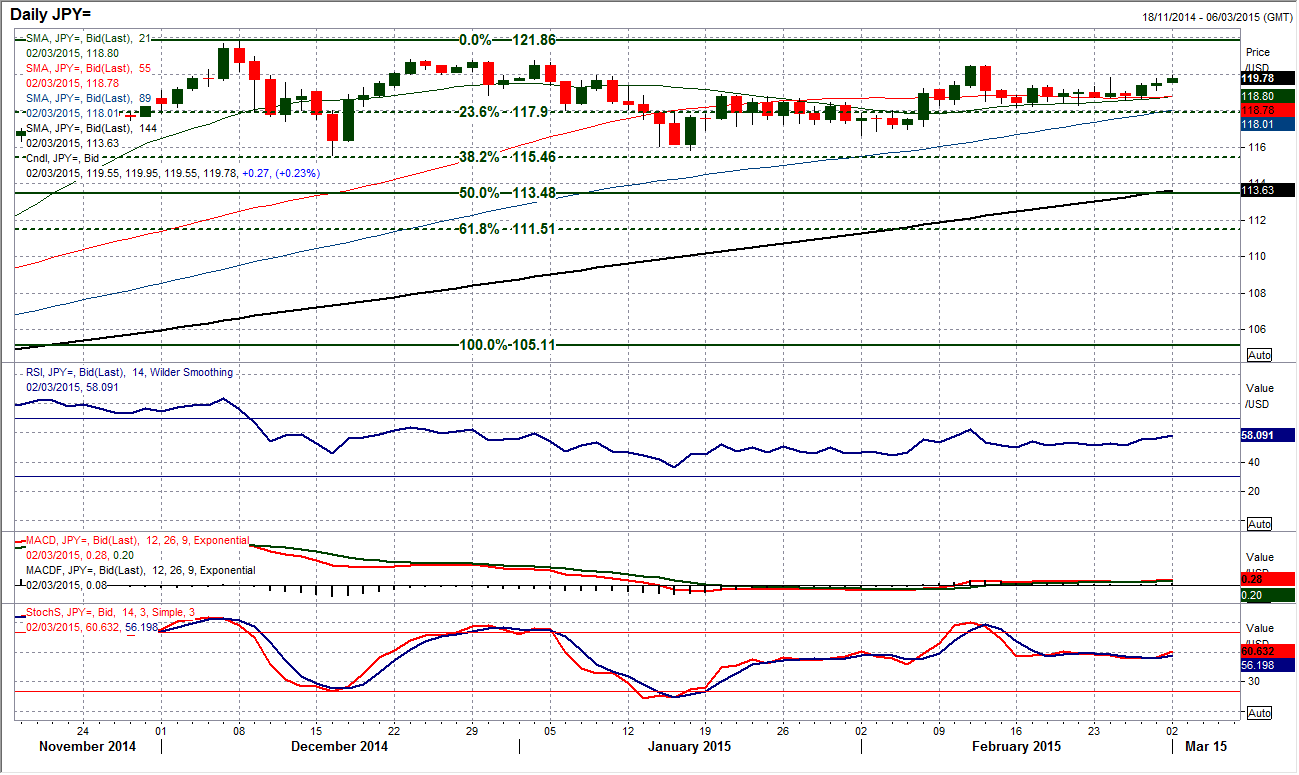

USD/JPY

The dollar is beginning to find some upside traction as the rate has moved to a 2 week high today and looks to be setting up for a test of the February high at 120.50. The daily RSI is confirming the move, whilst encouraging also is that the Stochastics have also begun to improve again. The intraday hourly chart shows that the rate is beginning to trade clear of 119.40 which had been a basis if resistance near term and could now become supportive. The last couple of trading days shows that there has been a series of higher lows and higher highs formed, with hourly momentum also improving. There is now a position where intraday dips are seen as chances to buy with a band of support now 119.10/119.40. A break above 120.50 would reopen the reaction high at 120.84.

Gold

We are currently seeing the gold bulls fighting back and they are close to breaking the strangle hold that has been a feature of the gold price in the past 5 weeks. Over the past 3 trading days we have seen consistent pressure on resistance around $1223 as a series of higher lows have been formed. Interestingly, there has been a confirmed buy signal on the Stochastics, whilst the MACD lines are close to crossing over. The intraday hourly chart shows that a breach of $1223 would be the first key lower high within the selling phase to be broken. It would also complete a small base pattern that would imply $1255. There is an argument that suggests that this is a near term improvement within a medium term bear phase, with the downtrend today coming in at $1234 still, and the $1236.50 resistance a key reaction high. Although there is still much to do to convince, the bulls are doing well. The rising 89 hour moving average has become supportive at $1209, whilst there is a key higher low at $1204.

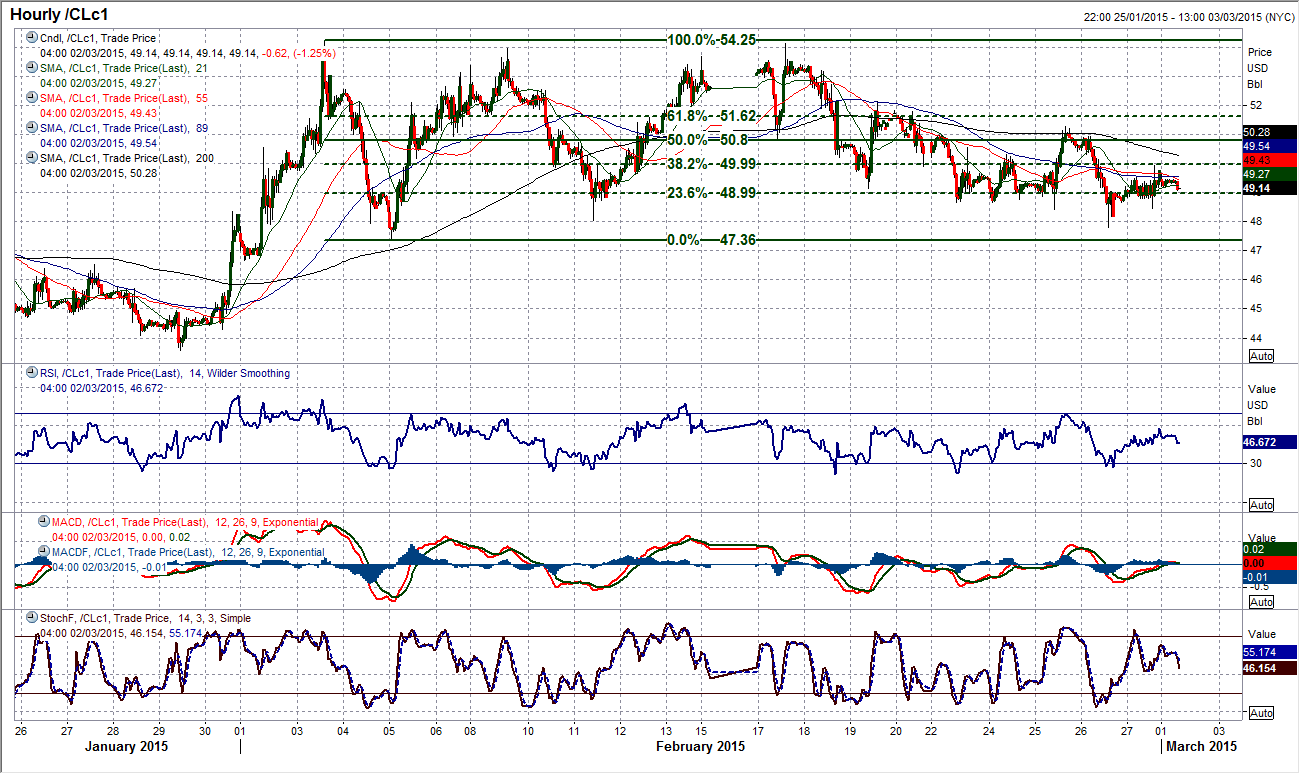

WTI Oil

A very indecisive day on Friday has taught us little about the direction of the oil price in the coming day. The tight inside day doji candle suggests a lack of willingness to take a view moving into the new week. The bulls are holding on to the support at $47.36 but there is little to suggest that this will not be tested again. The momentum indicators are now deteriorating, with the MACD lines forming a bear crossover underneath the neutral line. The intraday hourly chart tells us little from Friday’s price action, however the longer that the price trades below the psychological $50 level (which is also the 38.2% Fibonacci resistance level of the $54.24/$47.36 sell-off), the more the pressure will mount on support at $47.36. A breach of $47.36 re-opens the $43.58 critical low again.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD steadies above 1.0600, awaits German ZEW and Powell speech

EUR/USD is holding above 1.0600 in the European morning on Tuesday, having hit fresh five-month lows. The pair draws support from sluggish US Treasury bond yields but the rebound appears capped amid a stronger US Dollar and risk-aversion. Germany's ZEW survey and Powell awaited.

GBP/USD stays below 1.2450 after UK employment data

GBP/USD trades marginally lower on the day below 1.2450 in the early European session on Tuesday. The data from the UK showed that the ILO Unemployment Rate in February rose to 4.2% from 4%, weighing on Pound Sterling.

Will Gold reclaim $2,400 ahead of Powell speech?

Gold price consolidates the rebound below $2,400 amid risk-aversion. Dollar gains on strong US Retail Sales data despite easing Middle East tensions. Bullish potential for Gold price still intact on favorable four-hour technical setup.

SOL primed for a breakout as it completes a rounding bottom pattern

Solana price has conformed to the broader market crash, following in the steps of Bitcoin price that remains in the red below the $65,000 threshold. For SOL, however, the sensational altcoin could have a big move in store.

Key economic and earnings releases to watch

The market’s focus may be on geopolitical issues at the start of this week, but there is a large amount of economic data and more earnings releases to digest in the coming days.