Market Overview

So we come to what could be one of the most crucial days for the euro in years. This is expected the day that Mario Draghi announces a package of QE that will significantly increase the size of the ECB balance sheet possibly by around €1 trillion within the next two years. We have had leaked reports that a €50bn per month programme of sovereign debt (and possibly a combination of corporate debt) purchases will be engaged today and could last for between 12 months and two years. Consensus estimates suggest somewhere in the region of €500/€600 billion in total will be announced. With sharp falls on the euro and sharp gains on Eurozone equity markets already been seen it is difficult to know what the reaction will be, however there is certainly the potential for a “sell on rumour, buy on fact” rally.

Equity markets have been volatile, but have broadly been consolidating in recent days. The S&P 500 was again between highs and lows only to close around 0.5% higher. Asian markets were also choppy but showed slight gains, whilst the European markets are broadly flat with traders unlikely to take much of a view in front of the ECB.

Forex trading this morning has been rather muted with no real moves amongst the majors, although the euro is under a little bit of pressure ahead of the ECB. Traders are likely to pay merely a cursory glance to UK public sector costs at 0930GMT with £9.2bn expected. The main event is clearly the ECB. Do not expect anything around 1245GMT with rates the main focus of that announcement. The real action will come with Mario Draghi’s press conference at 1330GMT, and it could be a volatile one.

Chart of the Day – NZD/USD

After months of trading sideways there has been a decisive downside break on the kiwi. This has come about as a negative reaction that all the commodity currencies felt after the Bank of Canada unexpectedly cut interest rates yesterday. The move below 0.7606 now means a consolidation downside break has been formed and gives an implied decline towards 0.7200. The break would be confirmed by a second close below 0.7606 tonight. Momentum and moving averages have all turned bearish again and the break looks to be sound. The interesting move could be seen today if the US dollar strengthens significantly on the back of ECB action, which could then have a knock-on impact on the Kiwi. The 0.7606 level now becomes initial resistance and any relief rally is now likely to be sold into.

EUR/USD

The euro has continued its sideways trading, although yesterday’s session was a little more volatile than for much of the past week. News of the ECB QE plan were leaked yesterday and the euro spiked around 100 pips higher and lower before settling in much as it was during the morning. This has left us with more consolidation on the daily chart, however I would expect this consolidation above $1.1460 and now below $1.1675, to come to an end this afternoon, possibly just after 1330GMT (when Draghi begins his press conference). This is likely to then blow all technicals out of the water (at least for the near term). What to expect? With the market anticipating something in the region of €500bn of QE, any indication of a programme bigger than that could send the euro tumbling. The reports of €50bn per month until the end of 2016 would mean around €1 trillion, which may not have been entirely priced in yet. The volatility could come with an announcement of QE which the market may see does not go far enough (maybe more than €50bn per month could have been injected) and then we move into the realms of a disappointment rally for the euro. Even then there could be a “sell on rumour, buy on fact” reaction. Whatever the outcome it is sure to be a volatile reaction as traders try to work out the implications.

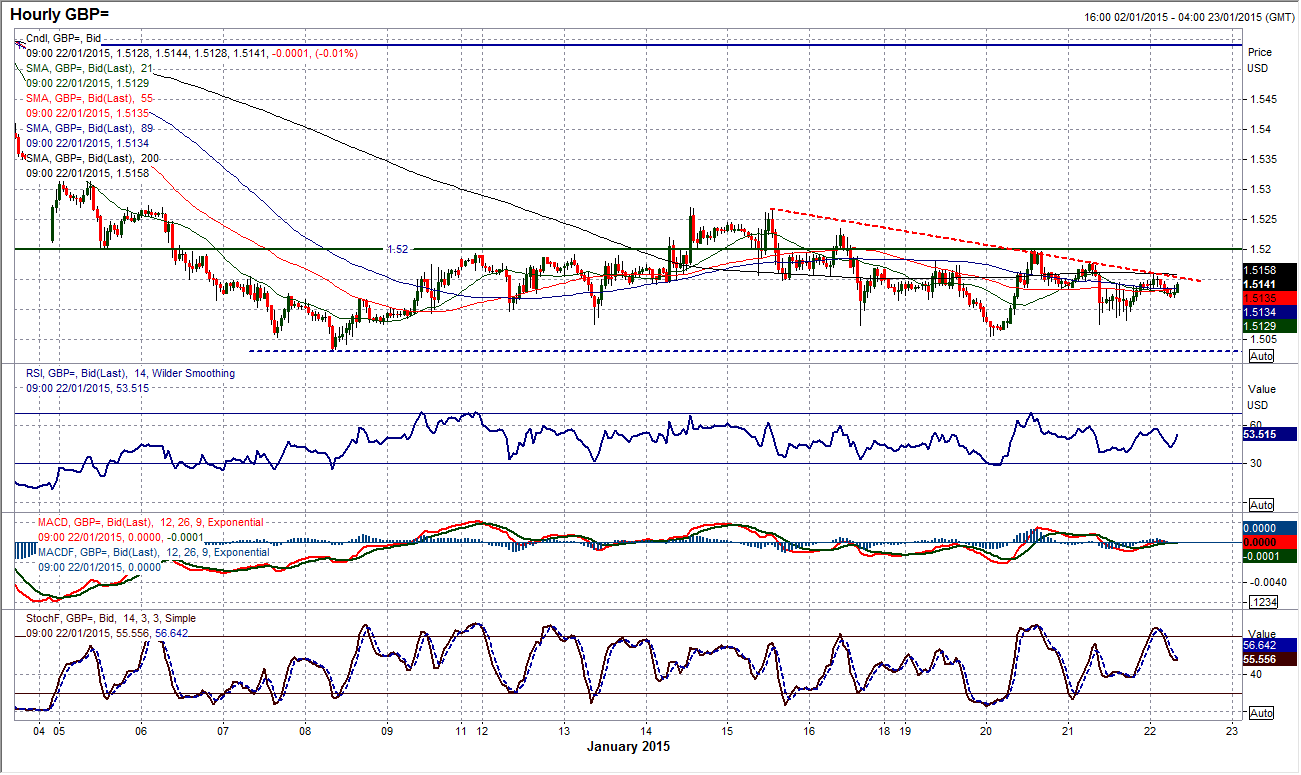

GBP/USD

Sterling is another pair that has been consolidating this week, but it is likely that there will be an impact on Cable following any move by the ECB. This is due to the impact on general dollar strength. Technically Cable has been consolidating for a couple of weeks, however the intraday hourly chart shows a series of lower highs, which have reaffirmed the resistance at $1.5200 and yesterday’s peak at $1.5180. The hourly RSI suggests continuing to play the RSI range trade (buying at 30 and selling at 70), however there does seem to be a bearish drift which could add to pressure on the lows around $1.5032/$1.5050. The key factor to watch out for is the reaction to the ECB this afternoon, as Cable could follow the lead of the euro but in a less dramatic fashion.

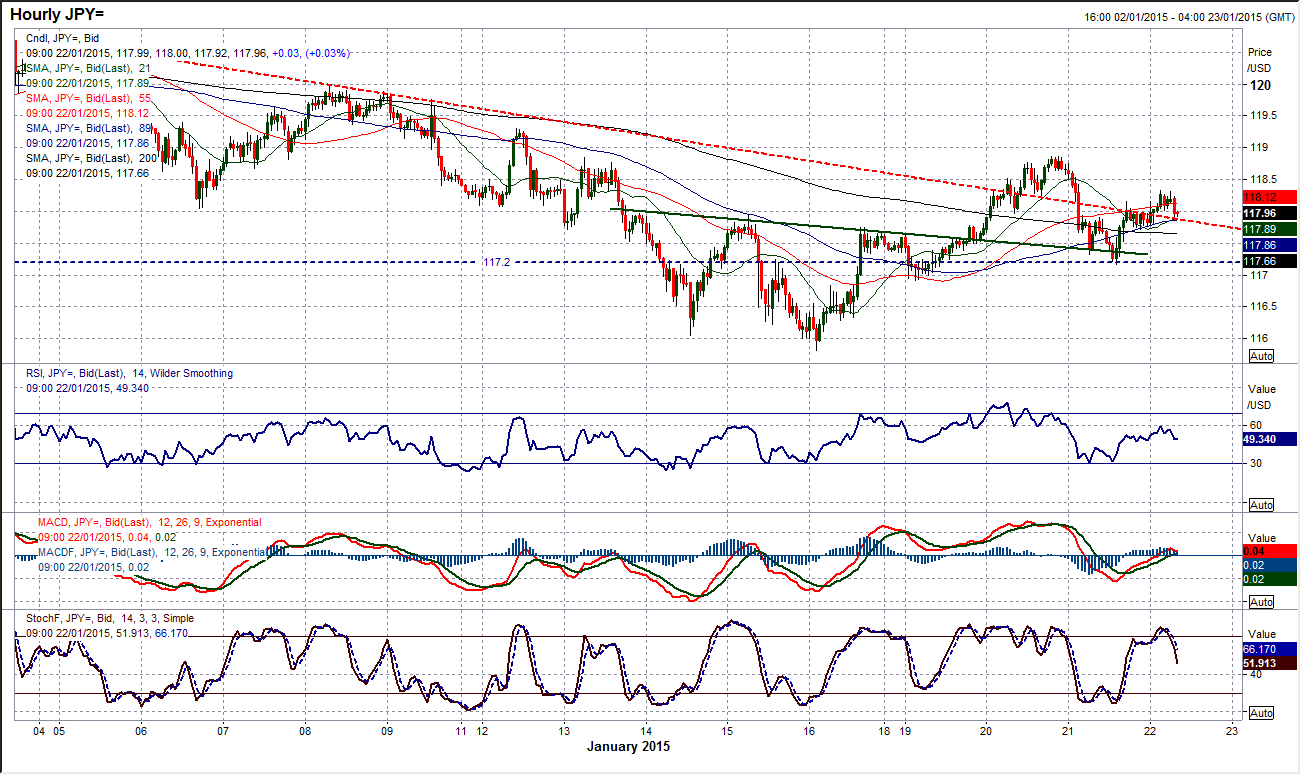

USD/JPY

The daily chart continues to reflect the on-going consolidation of technical indicators as the Dollar/Yen has developed a sideways range over the past couple of months. This is reflective in the shorter moving averages (21,55 days) beginning to flatten off and momentum indicators becoming increasingly neutral. However it is intraday where the interest lies, as there has been a base pattern which was completed on a move above 118.00. The pattern can be derived in a couple of different ways, but I am taking the conservative method of a base measured from the slanting neckline breakout c. 117.50 which implies an upside move towards 119.40. Yesterday’s correction found support around the slanting neckline and the bulls have since regained the initiative. The move overnight has also taken the dollar back above the old downtrend resistance. The key breakout would now come above the reaction high at 118.87 and this would confirm the bulls being back in control. The reaction low at 117.15 is now key near term support.

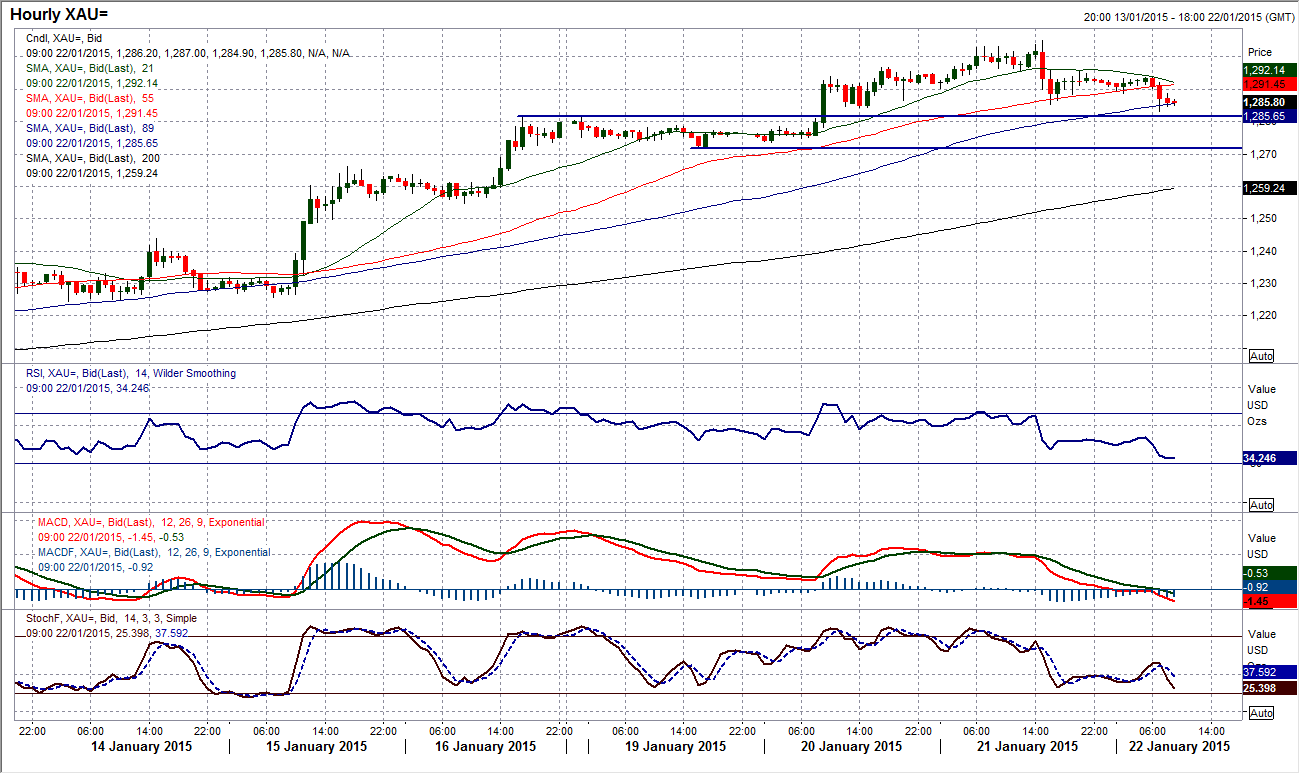

Gold

I wrote yesterday about the strength of the bull run but there is just a near term pause underway which suggests the bulls are taking a slight breather. This comes with momentum indicators slightly stretched and is not out of the ordinary after such a big move which hit $1305 yesterday. The question is whether this is something more than a near term pause. The intraday hourly chart is interesting as it shows a stepped advance with sideways consolidation giving way to further gains in due course. This outlook is under threat though. The hourly RSI has tended to find support at the lows around 35/40, which is now being strained. Also the 89 hour moving average (now $1285) which has been a good basis of support is also under pressure now. I still see the near term band $1271.85/$1281.50 as supportive ad until this is breached then I see the bulls as remaining in control. This is a consolidation, for now, but if gold lost $1271.85 support then the outlook near term would be under question once more.

WTI Oil

Despite a 3% rally on WTI yesterday, there has been little discernible impact on the daily chart which continues to reflect the consolidation over the past two weeks. In fact, as the day to day volatile moves have continued there has been a series of strongly bullish and then bearish candles that have been left. This consolidation is all allowing the RSI to unwind but the fact that it remains below 40 then the outlook remains weak. The price continues to trade below the resistance of the bottom of the previous downtrend channel and there is still a concern for the bulls being unable to achieve any really positive milestones within this consolidation. The intraday hourly chart continues to show initial resistance at $48.87, under the key near term resistance at $51.27. Near term support is now at $45.90 with the key low still at $44.21.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.