Market Overview

Risk appetite has made a welcome return in the past 12 hours and as per usual it has come as the oil price has managed to form a near term low. Exactly how long this respite lasts for remains to be seen, but for now there has been a shift in sentiment which should allow for some near term recovery in global markets. This has already allows the US 10 year Treasury yield to bounce from yesterday’s low of 1.7840 (the lowest level since May 2013) back 100 basis points higher. Furthermore, classic safe haven plays such as the yen have also come off.

This shift has allowed Wall Street indices to pick up off their lows, with the S&P 500 which had fallen below 2000, closing at 2011 down 0.6%. Asian markets rallied overnight with the improved sentiment, whilst European markets have opened in positive mood (after yesterday’s drubbing). Volatility remains elevated.

In forex trading, the dollar is mildly stronger although there is a feeling that the consolidation in the Dollar Index continues. The one big exception is the Aussie dollar which has bounce significantly today on the back of employment data which came in much better than expected, including a surprise dip in unemployment which bucked the recent trend.

Traders will be looking out for the German full year GDP release at 09.00GMT which is expected to come in at 1.5%. In the US there is also the weekly jobless claims at 13.30GMT (a slight improvement to 290k is expected), in addition to the Producer Prices Index also at 13.30GMT (-0.3% month on month expected). It might also be wise to watch out for the comments of Bundesbank President Jens Weidmann who is speaking today at 16.15GMT. Any comments on the potential for QE could impact the euro and indices such as the DAX.

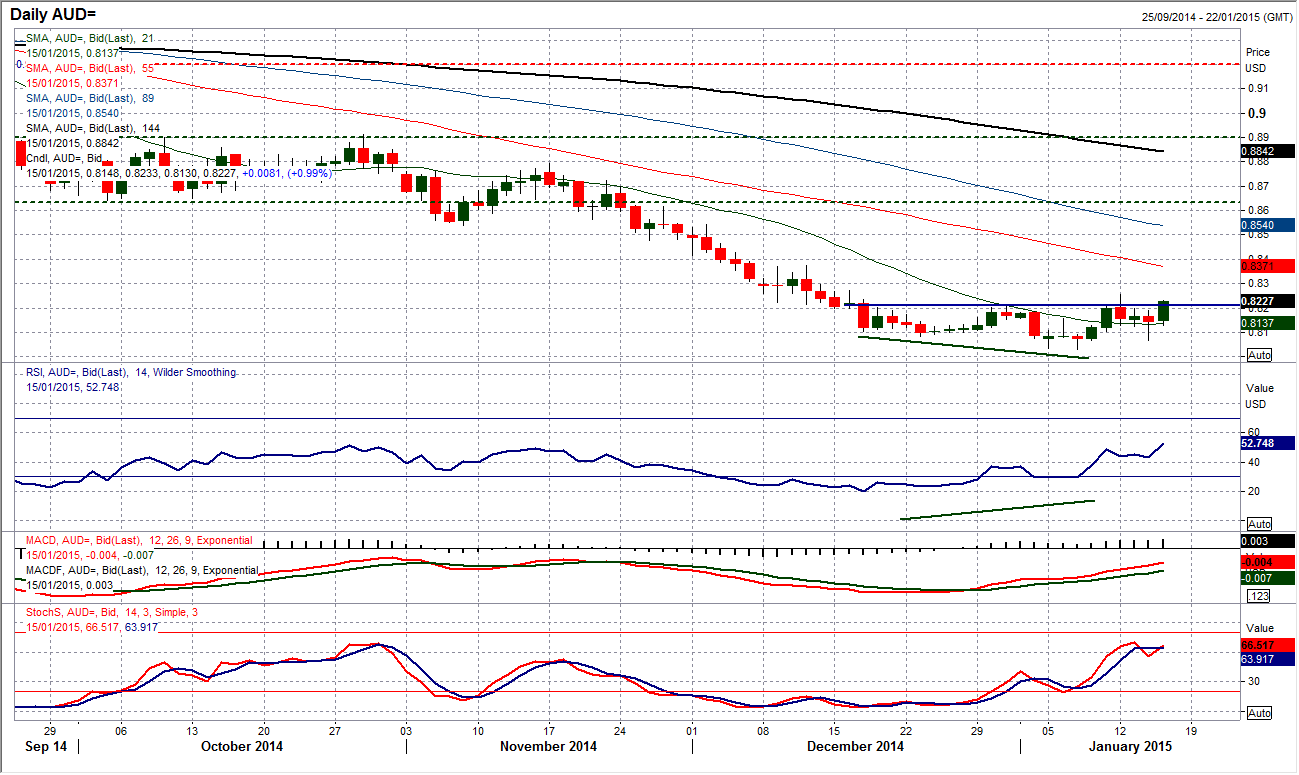

Chart of the Day –AUD/USD

The Aussie has had decent gains overnight (on the back of decent unemployment data) to leave it on the brink of what could be a fairly well-defined head and shoulders base pattern. The pair has been consolidating for the past month, during which there has been a bullish divergence on the RSI, MACD and Stochastics which suggested that downside momentum of the big sell-off has been waning. There had been an initial attempt to break through the neckline resistance around 0.8200 but which was rebuffed at 0.8254 on 12th Jan, however now the rally off yesterday’s low at 0.8066 has given the bulls a platform to go and complete the pattern. I will stress that although the Aussie has been able to break above 0.8200 overnight, until there is a confirmed move above 0.8254 then there is still an argument for caution. The implied target for the pattern is 0.8365 but for the first time in months the outlook is improving. The intraday hourly chart shows there is a decent band of support now between 0.8125/0.8200.

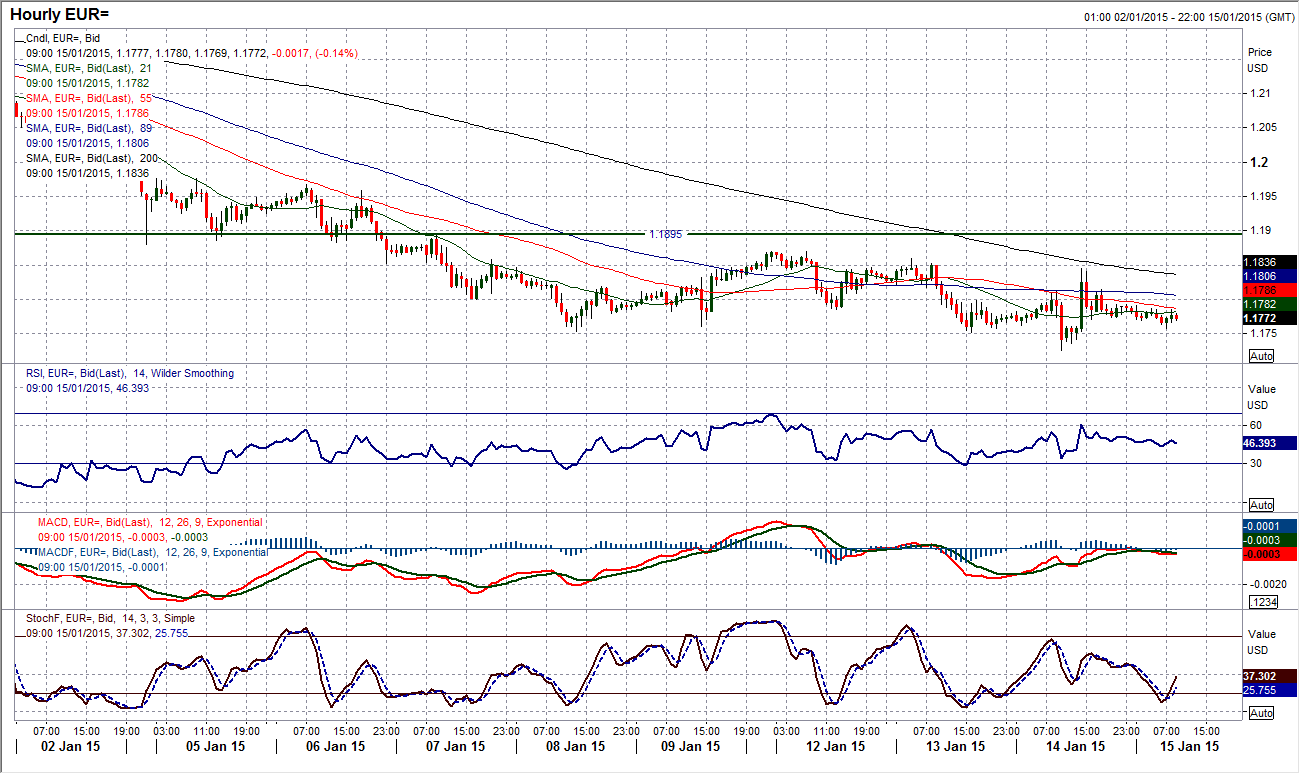

EUR/USD

The position of the euro remains rather precarious. Yesterday there was an initial break of the $1.1753 support which seemingly would open further downside towards $1.1640 which is the November 2005 low. However, an intraday rebound suggests there is some fight left in the bulls, although it is diminishing. The rebound (on the extremely disappointing US Retail Sales) peaked out at $1.1845 only for the bears to regain their poise and the drift lower resumed. I still see this as the norm, with rallies being sold into at lower levels to leave a series of lower highs. Yesterday’s low at $1.1726 is unlikely to remain intact for long as technically, both on a daily and hourly basis, the momentum signals are weak. Use any intraday rallies as a chance to sell, with $1.1845 now a near term barrier before the bigger resistance around $1.1900.

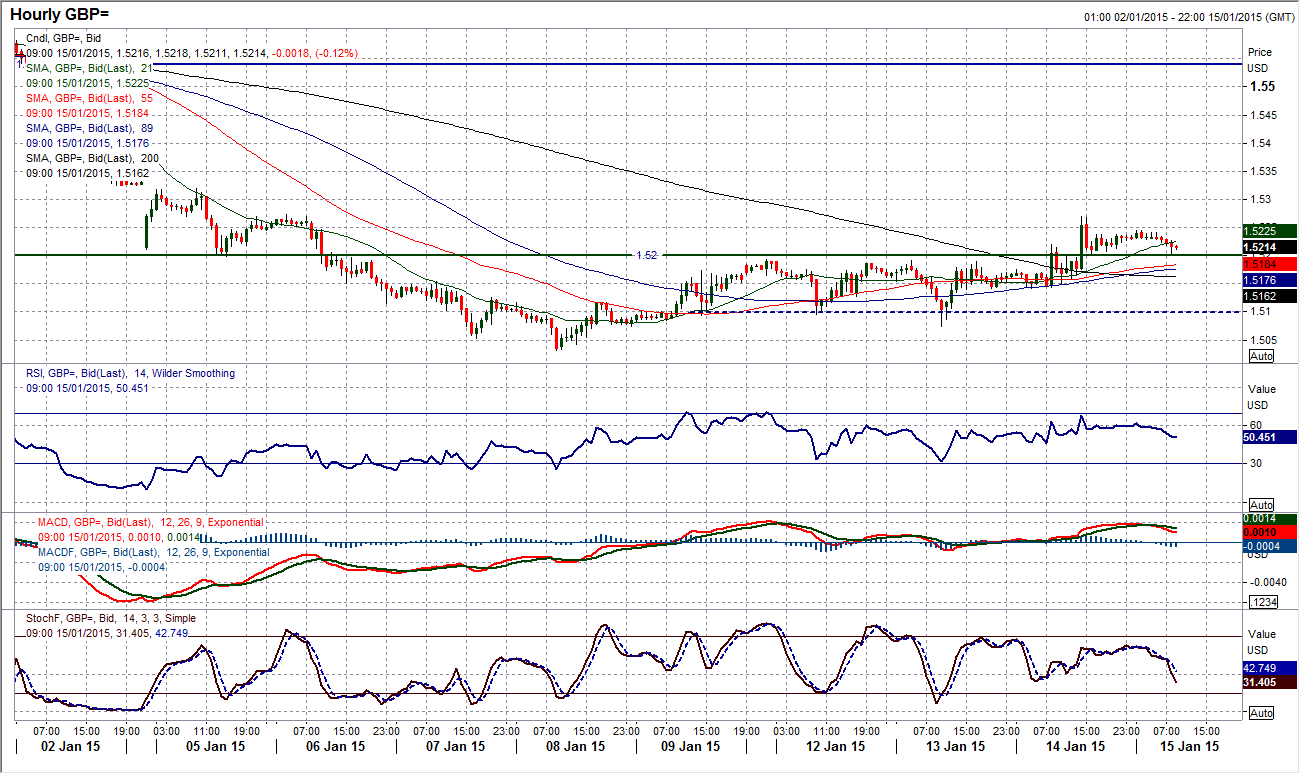

GBP/USD

There was a subtle change in the performance of Cable and Euro/Dollar yesterday. Whilst the euro has been unable to break the shackles and remains under bearish control, on Cable the bulls were able to make a key near term break. The barrier of $1.5200 had been holding back the recovery bulls for a few days but there has now been a break to the upside (again on the weak US Retail Sales data). The breakout has already come back to test $1.5200 as a new support and this has held to the pip. The subsequent price action has been fairly benign but the bulls will now be looking to hold on to the support band $1.5140/$1.5200 on a correction. The intraday outlook looks far more improved now with a decent set-up on hourly momentum indicators. Even on the daily chart there are signs of improvement, with the RSI unwinding along with the Stochastics. Interestingly, on the RSI when the rebounds tend to take hold the RSI will reach the mid-40s or even 50. Whilst I still see this as a near term technical rally, I am mindful of the medium term downtrend and that this is just a near term rally before the sellers are likely to regain control. For now though the rebound is progressing well. The big downtrend currently comes in at $1.5460, with the next intraday resistance at $1.5320.

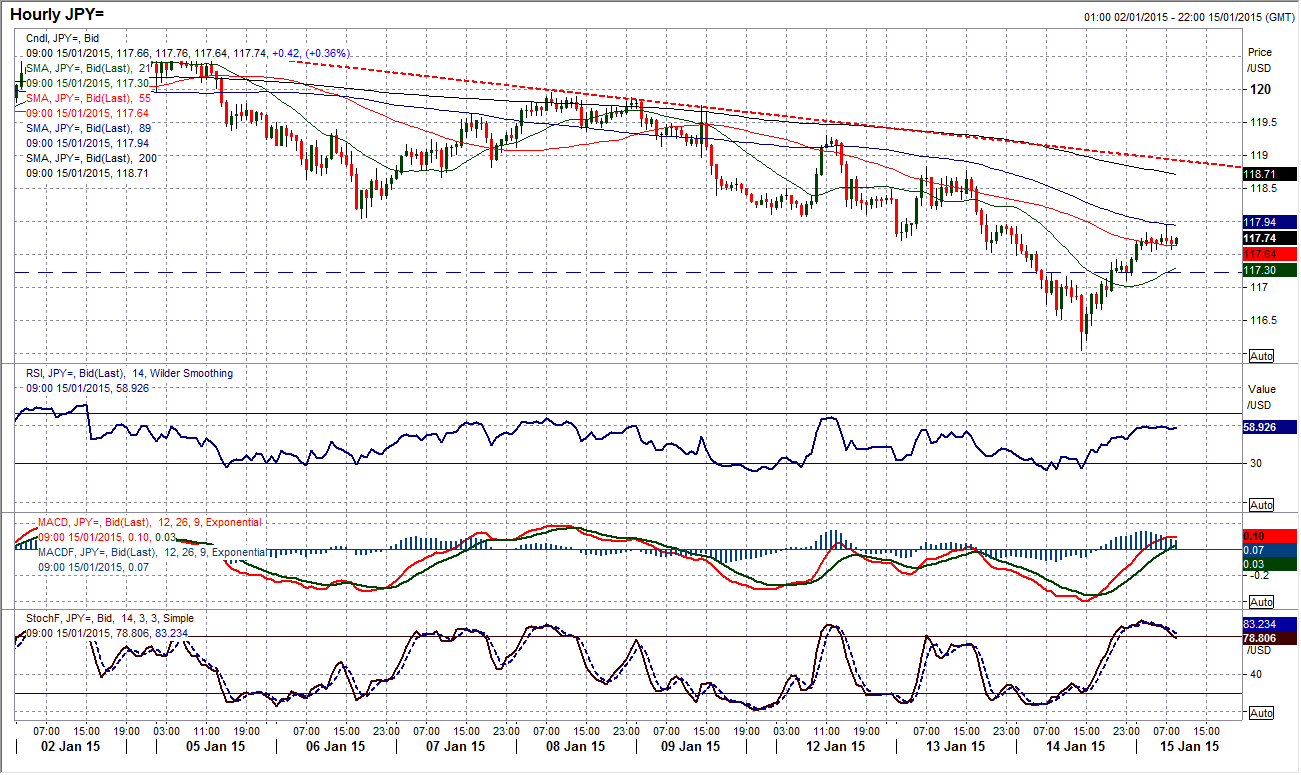

USD/JPY

I said yesterday that the key support of the December low at 115.56 had to hold for the bulls still to consider this to be just a bull market correction and for now it has. The low yesterday came in at 116.05 before a sharp rally has taken hold. On the daily chart this rally has left arguably an exhaustion candlestick, where the selling pressure of a large range day (of 190 pips high to low) has dissipated with a rebound closing well above the mid-point of the range. This suggests the sellers have lost impetus and looking at today’s reaction, this move has continued. The intraday chart shows an almost “V” shaped bottom as the buyers have returned (in keeping with a minor risk appetite recovery as oil has bounced). The first test is the old near term floor at 118.00. If the bulls can decisively push above here the outlook will continue to improve, with subsequent resistances at 119 and then 119.30. There is an old breakout level around 117.20 which is now supportive for a correction. The bulls are fighting back.

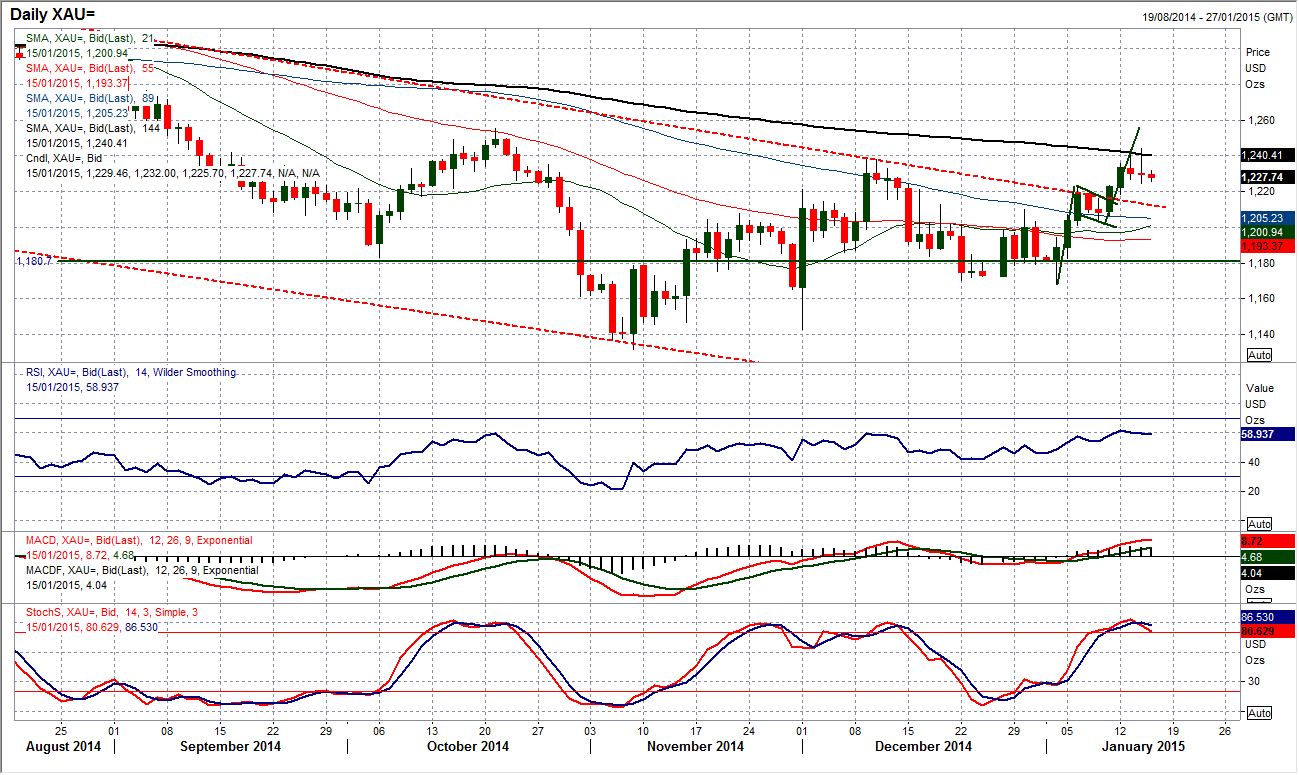

Gold

The gold price is just struggling to continue the good work that the bulls had put in at the beginning of the week having broken the long term downtrend and moved above the key near term resistance at $1238.20. On each of the past two days there have been times where it seemed as though the bulls had control but each time they have been reined to leave quite a disappointing candlestick. Resistance is now at yesterday’s high at $1244.00. This could turn out to be just another form of consolidation (see the 7th and 8th Jan), but the nagging doubt I have remains the RSI which cannot get traction above 60 and now the Stochastics have crossed lower (not yet confirmed). The intraday chart gives a little more confidence that it is just a consolidation with a decent band of support between $1218.20/$1224.55. For now the bulls must wait.

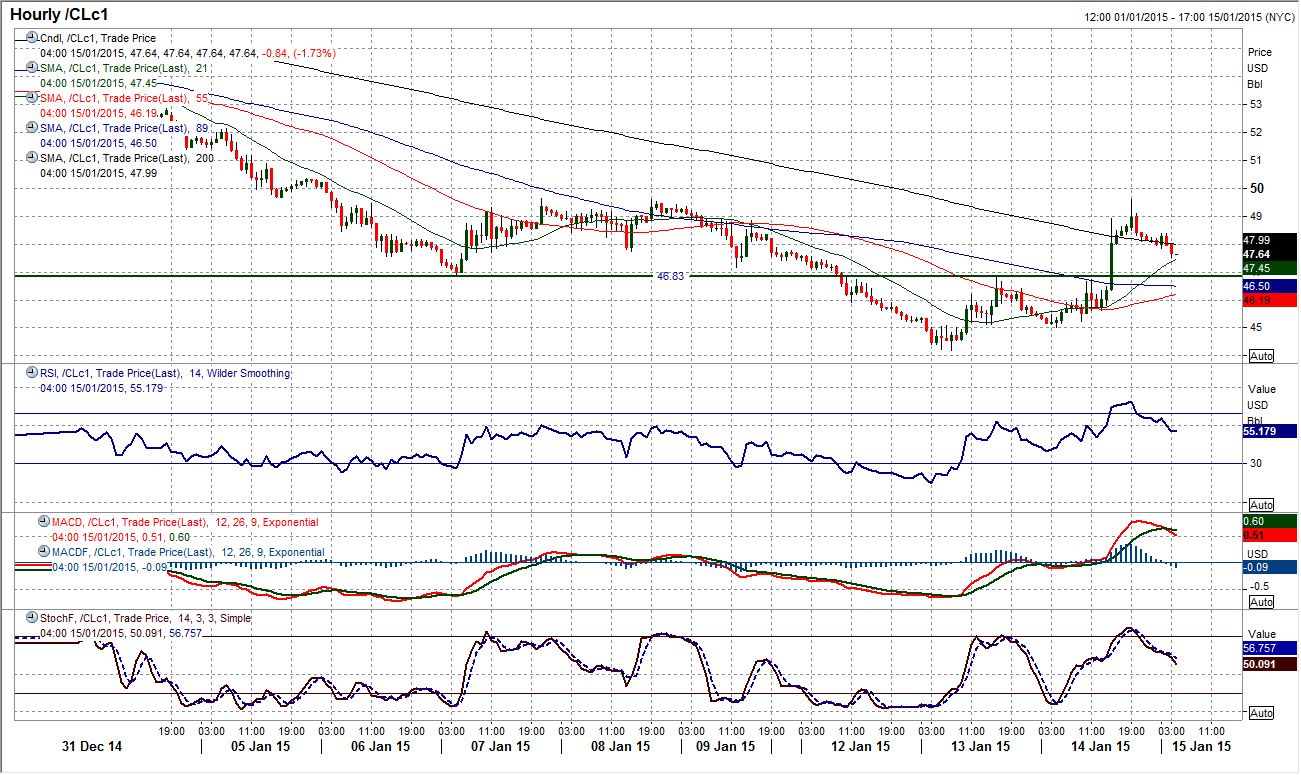

WTI Oil

Such is the level of bearishness surrounding WTI that even a single day of support will help to drive a risk rally. Exactly how long it lasts is another question. Interestingly, I have noticed that there might be something of note in the volume data in recent weeks. The spikes in volume with the 28th November, 16th December were both the precursors to a few days of consolidation. Volume on 13th January was the highest since August 2011 and subsequently yesterday’s price action showed some support from a low in place at $44.20. The RSI has quickly rebounded to 30 as a minor technical rally has set in. The resistance of the old downtrend channel (which has been a good gauge of resistance in the past month) comes in at $51.30 today. The intraday hourly chart shows that as it did last week, the resistance at $49.60 has once again capped the recovery before the price has subsequently drifted away. This barrier needs to be breached for the a recovery to be anything more than simply a very near term unwind. There is near term support at $46.80.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.