Market Overview

Investor sentiment has shown signs of improvement in the past 24 hours. The flows into safe haven assets are beginning to reverse with the gold price and the yen weakening and Treasury yields also up off their recent lows. The move is also coinciding with an element of support that the oil price has formed. Even if the oil price cannot form a sustainable recovery, the curbing of the downside is the most important aspect as it may help to assuage fears that a lack of demand is a key factor behind the recent slide. The release of a reassuring set of meeting minutes from the Federal Reserve has also helped to calm markets, resulting in a big rally on Wall Street and a sharp correction in the VIX Index of volatility, seen as the market’s so called “fear gauge”. The S&P 500 closed up 1.2% which has helped Asian markets to push strongly higher overnight and also means that European trading has begun on positive ground.

In forex trading the dollar is positive once more against the yen, sterling and the euro. However, the commodity currencies, the Aussie and Kiwi, are performing much better against the greenback, although some could be down to a strong set of Building Approvals data out of Australia.

The main focus this morning will be on the Bank of England which releases its latest monetary policy at 12:00GMT. With UK inflation in decline and recent PMI data also deteriorating the prospects of a rate hike are still fairly slim, whilst as per usual it will be the meeting minutes in a couple of weeks which will be the move interesting aspect. Thoughts in the afternoon will once more turn to US employment with the Weekly Jobless Claims at 13:30GMT which are expected to improve slightly to 291,000.

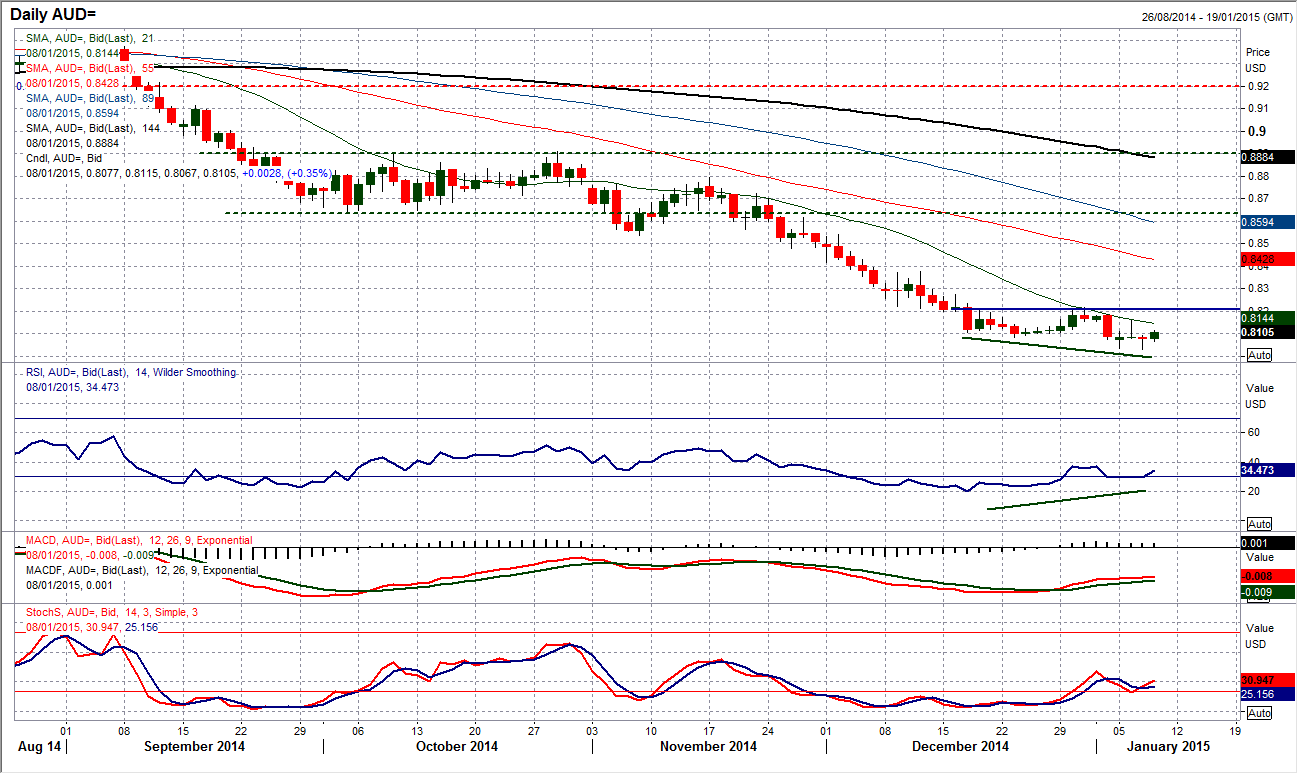

Chart of the Day – AUD/USD

The Aussie dollar has spent the past three days with closing levels all within 7 pips of each other. This has resulted in the formation of three “doji” candle sticks (which denote uncertainty with the prevailing negative trend). This could be an initial signs of support in the sell-off and potentially a rally. The momentum indicators have certainly picked up in the past week, with slight bullish divergences on the RSI and Stochastics, whilst the MACD lines are advancing (albeit gradually). The overnight reaction has been fairly positive but there needs to be a move above 0.8157 to suggest a consolidation is underway, whilst a move above 0.8215 is needed to suggest the consolidation is turning into a near term recovery. Holding on to the support at 0.8031 is a must to prevent further downside into multi year lows towards the next support at 0.7700.

EUR/USD

The trading days since the New Year have seen solid declines in the euro which has now taken it to level not seen since 2005. There is little sign yet of support coming in as the bears remain in full control. The technical outlook remains extremely negative and further losses seem likely. The question is though whether it is wise to be chasing the euro lower at these levels. The RSI is down at 22 and whilst the sell-offs in September and October saw the RSI at lower levels, momentum is becoming historically stretched. The intraday chart continues to show the sellers eying rallies of between 50 to 100 pips as opportunities to get short once more. The latest resistance is at $1.1858 and then$1.1896, with the key near term resistance at $1.1976. The chances of a technical rally are growing but there is very little appetite for the euro from a long perspective for the time being.

GBP/USD

I remain bearish on Cable, however there is just a slight feeling that after 500 pips to the downside in just 4 days perhaps the appetite to sell could be beginning to run out of steam in the very near term. My preferred strategy is to look for selling opportunities at higher levels and to not chase the rate lower at these levels. The RSI is under 24 which is extremely stretched on a historic basis and also there just seems to be a reduction in the severity of the negative daily candles as yesterday’s candle closed in the upper half of the daily range. This suggests perhaps waning selling pressure and makes today’s daily candle important for the near term outlook. Looking on the intraday hourly chart shows the momentum indicators still in negative configuration but not anywhere near as severe as a few days ago. I am not ruling out further downside below yesterday’s $1.5053 low but the time for a technical rally might be close. A move above yesterday’s high at $1.5153 could be the trigger.

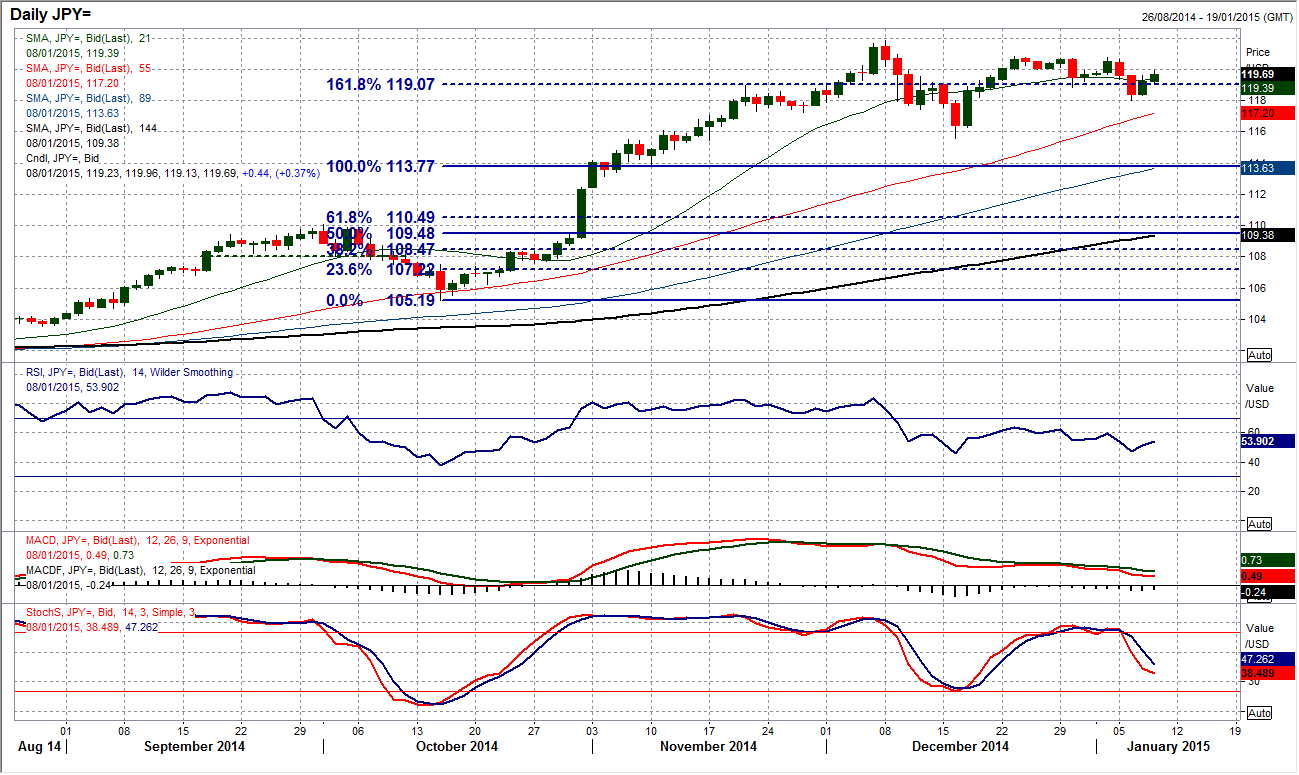

USD/JPY

Yesterday I spoke of the prospect of a corrective move should there be a sustained bout of trading below the pivot level at 119. The dollar rally pulled the rate higher and now Dollar/Yen is consistently trading above 119 once more. The reality is that the pair has taken on rather an uncertain outlook of late (as the financial markets have started the year in a volatile mood). The intraday hourly chart shows that the pivot around 119 remains a level to be used as a basis and with the dollar pushing strongly higher overnight the bulls will gain in confidence now to use 119 as a floor again around which to work off. On the upside the next level to breach is around 120 which looked to be used as a floor on 2nd January before the flight to safety kicked in last week. This would therefore be a key near term level for the bulls to breach above which re-opens 120.82. On more accurate terms the key support now lies at 118.80.

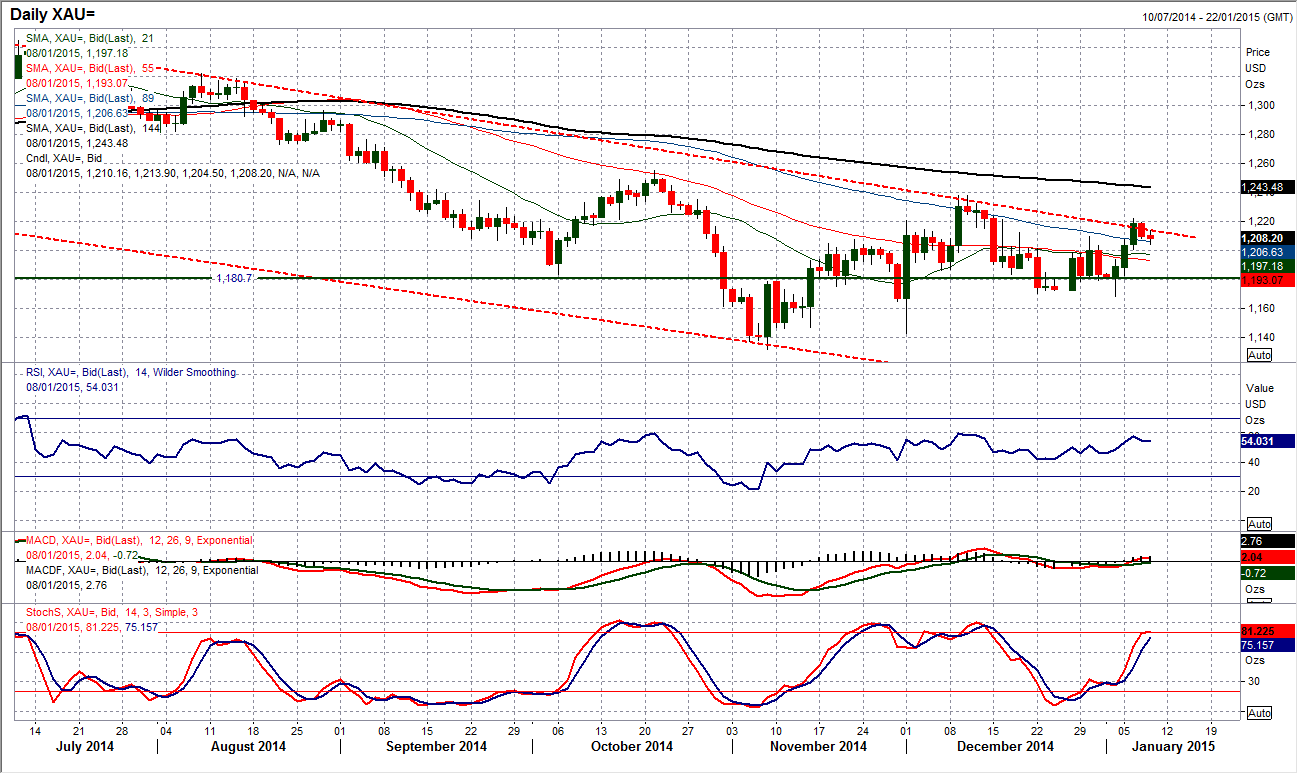

Gold

Just as we have had slight support in oil and the yen weakening, so continuing the improvement in trading sentiment we see the gold price rally petering out. The fact that this is coming around the resistance of the key long term downtrend will add to the perception that the bulls cannot get a grip on this gold price. The move needs to break through the resistance at $1238.20 to suggest the bulls have something sustainable to hang on to but as yet this has not been seen. Taking a step back then the moving averages remain flat to negative, the RSI continues to fail under 60 (a classic bear market rally trait) and MACD lines are showing little sign of life. Tuesday’s high at $1222.40 is clearly now the near term resistance and for now we should just view gold as a continuation of the consolidation trading seen over the past few weeks. $1200 remains the near term pivot level to suggest sentiment is either positive (above $1200) or negative (below) in the range between $1168.25/$1238.20.

WTI Oil

The first positive trading session in 5 days has finally seen some support come in for oil. With the daily RSI reaching a low of 20 on Tuesday which is a level where the technical rallies have generally been seen over the past few months, this rebound is understandable. The trouble is that rebounds continue to be used as a chance to sell and it is unlikely that this one will be treated any differently this time around. The initial resistance is at $50, however the intraday hourly chart shows that $52/$54 is a more prominent band of resistance. The hourly RSI however suggests that the oversold momentum has already unwound and if this near term bearish outlook is set to continue then the sellers are likely to already be eying their next move. It might be best to allow the rally to play out, looking for the next sell signal before playing the short side once more. The low from yesterday at $46.83 is the near term support.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD rebounds to 1.0650 on renewed USD weakness

EUR/USD gained traction and rose to the 1.0650 area in the early American session on Tuesday. Disappointing housing data from the US seem to be weighing on the US Dollar, helping the pair stretch higher.

GBP/USD climbs above 1.2450 after US data

GBP/USD extended its recovery from the multi-month low it touched near 1.2400 and turned positive on the day above 1.2450. The modest selling pressure surrounding the US Dollar after dismal housing data supports the pair's rebound.

Gold retreats to $2,370 as US yields push higher

Gold stages a correction on Tuesday and fluctuates in negative territory near $2,370 following Monday's upsurge. The benchmark 10-year US Treasury bond yield continues to push higher above 4.6% and makes it difficult for XAU/USD to gain traction.

XRP struggles below $0.50 resistance as SEC vs. Ripple lawsuit likely to enter final pretrial conference

XRP is struggling with resistance at $0.50 as Ripple and the US Securities and Exchange Commission (SEC) are gearing up for the final pretrial conference on Tuesday at a New York court.

US outperformance continues

The economic divergence between the US and the rest of the world has become increasingly pronounced. The latest US inflation prints highlight that underlying inflation pressures seemingly remain stickier than in most other parts of the world supported by a strong US labour market.