Market Overview

There was an interesting move against the dollar yesterday afternoon in the wake of a rather concerning number from the Chicago PMI. The regional survey data came in well below expectations and contracted to 48.7 (54.0 exp). Now this will not derail the expectations of a Fed rate hike in December, but it certainly does not bode well for further growth (US 10 year yield fell back) but also the speed of potential Fed rate hikes. There has been a subsequent dollar correction with dips against major currencies and also commodities such as gold and silver have rallied. It is too early to see whether the dollar is going to correct, but it is posing a few questions. This means that all eyes will be on today’s ISM Manufacturing data for the US could be very interesting as the dollar bulls have begun to waver. The expectation is for very slight growth of 50.5 and the dollar is likely to react to the announcement.

Wall Street closed lower by around half a percent yesterday but despite a mixed set of China PMI data, the Asian markets have pushed higher today. This is helping the European indices to early gains, however again the outlook will be guided by the release of the PMIs which are throughout the morning. Forex markets still have the legacy of yesterday’s dollar correction filtering through and it will be very interesting to see how long this can continue before the sellers which have been consistent in their presence return once more. The Reserve Bank of Australia meeting resulted in no change to the monetary policy and also a similar statement to last month, with a minor addition of talk of a slight improvement in credit growth. The Aussie has pushed higher as a result, dragging the Kiwi with it.

Traders will be looking out for the UK Manufacturing PMI which is at 0930GMT and is expected to dip back to 53.60 from a strong 55.5 last month. The US ISM Manufacturing is at 1500GMT and is expected to pick up slightly to 50.5 from 50.1 last month.

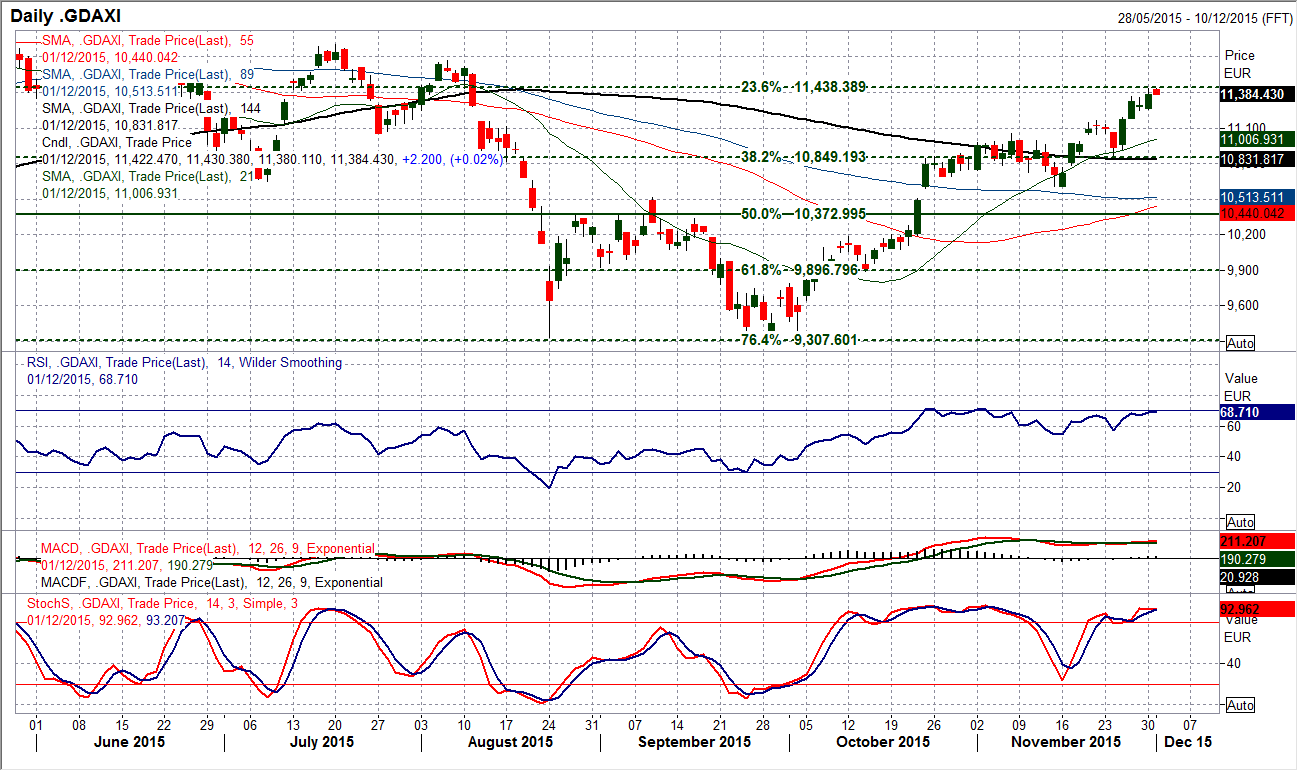

Chart of the Day – DAX Xetra

The technical outlook for the DAX remains strong as the market continues to push higher. Another strong bullish day has pushed the DAX to within touching distance of the next key technical level. The 23.6% Fibonacci retracement of 8355/12,390 is sitting at 11,438 and could be the next area of consolidation. The Fibonacci levels have worked extremely well on the DAX throughout 2015 and this is likely to continue. With the DAX having rebounded over 22% in two months there is always the prospect of a technical correction looking round the corner. If Mario Draghi underwhelms in his easing measures on Thursday could this be the cue to take profits? Momentum indicators are strong without looking excessively stretched. The hourly chart is also positive although there is a very slight hint of a bearish divergence on the momentum indicators. Initial support comes in around 11,250. The bulls will be eying a test of the peaks at the August high 11,670, July high 11,802.

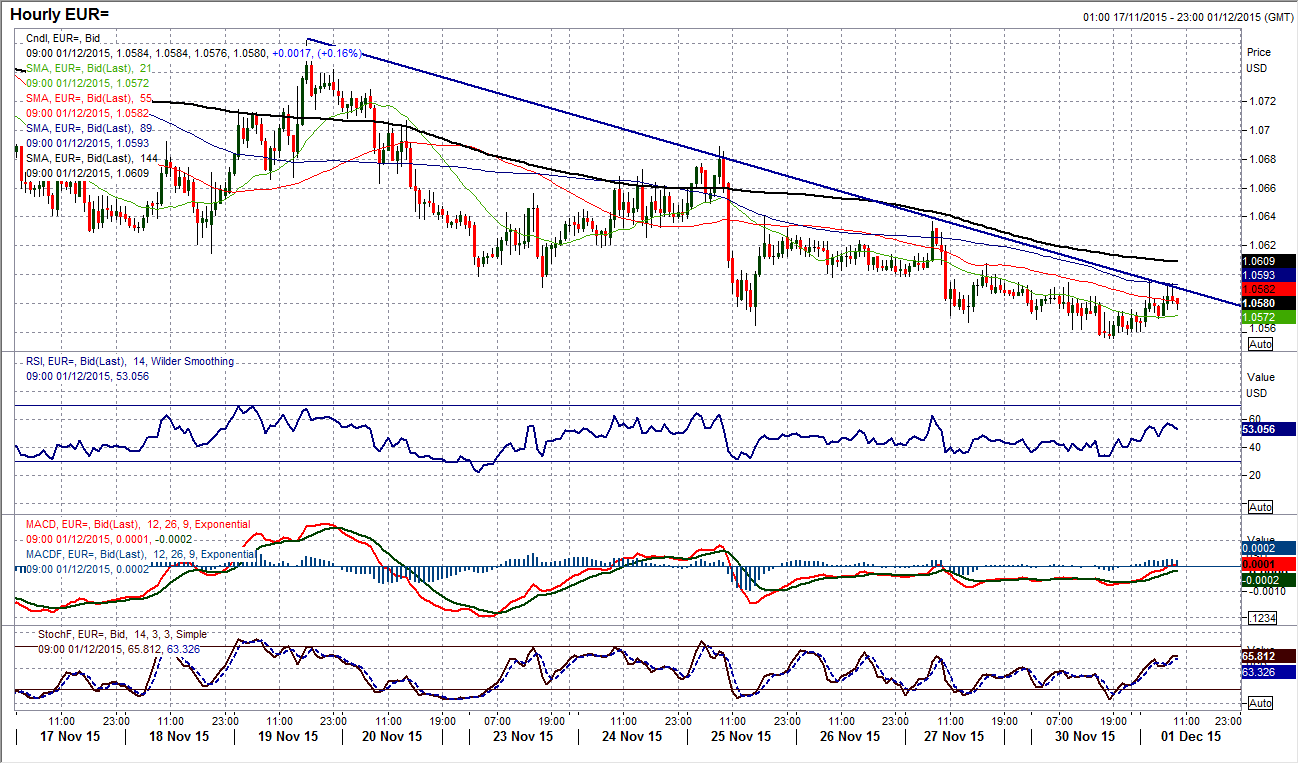

EUR/USD

The euro continues to drift lower within the 4 week downtrend and despite a tight daily range of 40 pips the bears remain in control. These gradual sell-offs always leave me a bit cautious of a potential technical rebound, but for now there is still little technical reason to suggest that the bulls are ready to bounce back with any sustainability. Until the ECB meeting on Thursday it is likely that this drift sell-off will continue and that any intraday rallies will be sold into ahead of the week’s big risk event. Resistance remains in at $1.0640 initially with last Wednesday’s reaction high at $1.0690 adding to the overhead supply. The main caveat will be that the vast majority of the market looks to now be short of the euro now and this could still set us up for a sizeable short squeeze if Mario Draghi does not meet somewhat high expectations of further easing on Thursday.

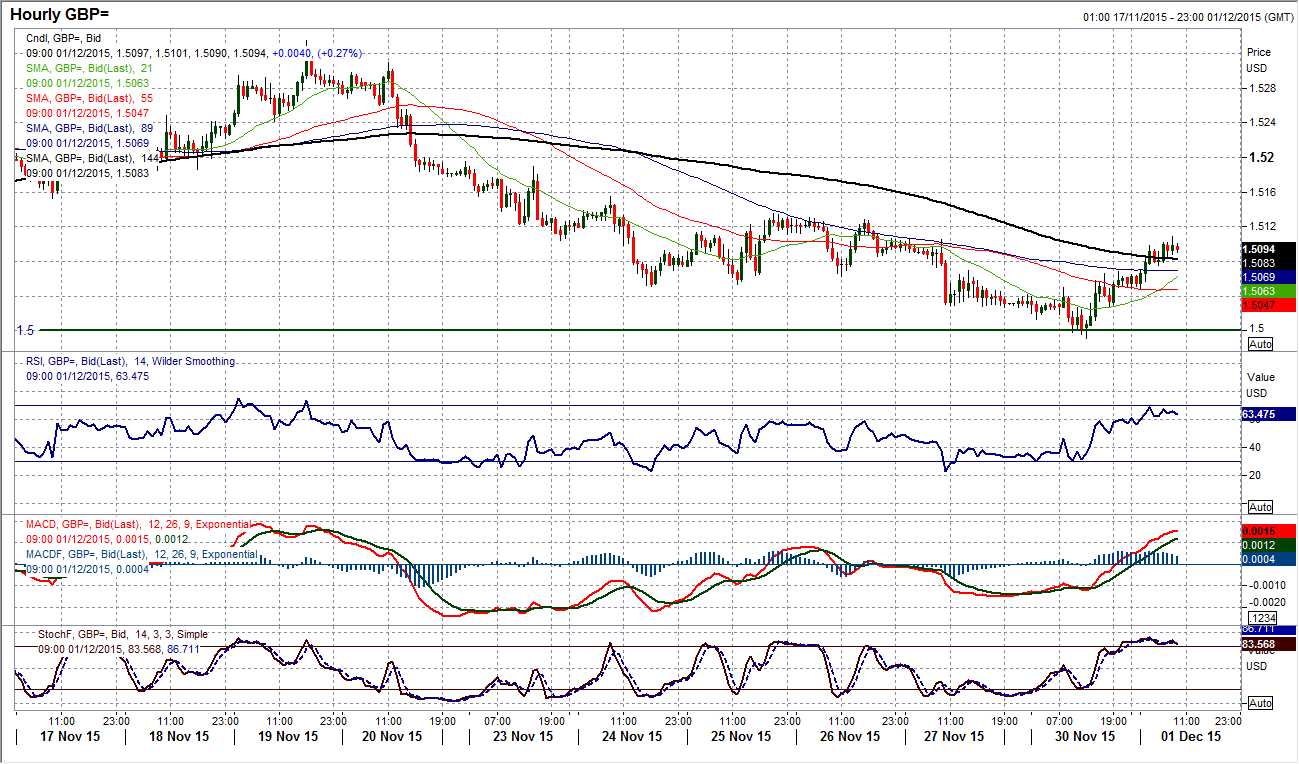

GBP/USD

Cable has engaged a slight rally since yesterday afternoon, however as yet nothing has been achieved technically that would suggest there is any significant recovery that is about to be seen. The rebound has formed a positive candle on the daily chart (not far off being a bull hammer) which is being back up by further rebound today. However I would continue to view this as a near term reaction against the bear trend and is unlikely to last too long before the sellers take hold once more. The near term reaction high at $1.5135 remains intact and is the start of a 20 pip band of resistance up towards $1.5155 that will provide overhead supply for the bears. Another technical rally may come with the breach of this resistance but whilst it is intact I am favouring using this rally as a chance to sell. We are now into the beginning of the tier one data with all the PMIs today and this could impact on Cable. However I favour a return to test yesterday’s low at $1.4990 in due course.

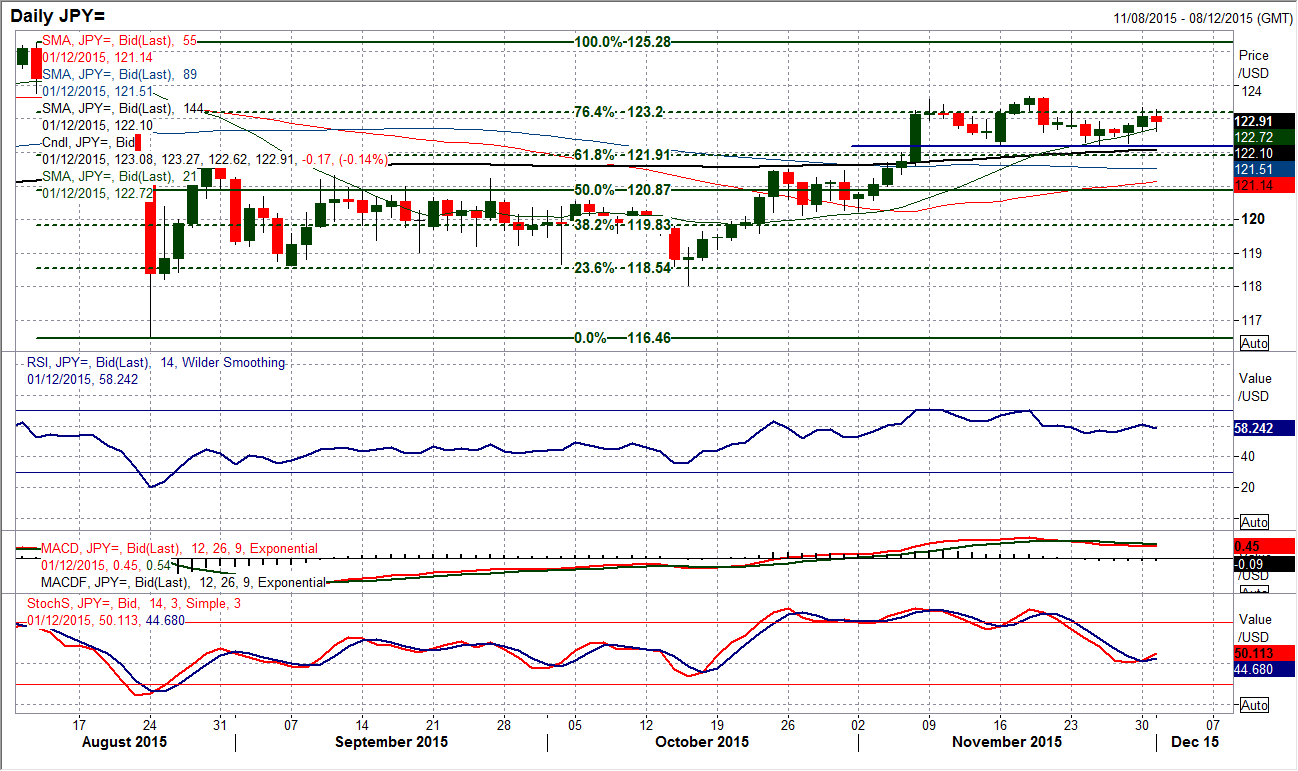

USD/JPY

The move higher away from the 122.20 support has improved the outlook, with the Stochastics crossing positively once more, however I am now expecting this pair to consolidate in the range 122.20/123.67 which it has been in for over three weeks, that is at least until Friday’s Non-farm Payrolls. There may be a bullish bias to the technical indicators, however an upside break does not look imminent. Yesterday’s move above resistance at 123.25 could not be sustained and this failure suggests the bulls are not entirely in control. The intraday hourly chart shows positive hourly momentum however the overnight bearish reaction would suggest there is still a demand that is driving safe haven flows. Initial support now comes in today at 122.60, whilst the resistance is at 123.35. The outlook remains neutral.

Gold

With the dollar correction since yesterday afternoon, the gold price has begun to engage a minor recovery. This has now left a low in place at $1152.50 and interestingly the near term downtrend channel is breaking to the upside. If this recovery can be sustained today, it also comes with a small positive divergence on the RSI and an improvement in the Stochastics. I tend to be cautious about recoveries such as these as I feel that it can be easy to be drawn into hanging tack and expecting a rally whilst the overriding trend remains firmly bearish. For now I am still playing for a rebound being used as a chance to sell, at least until some more important resistance is overcome. The key near term band of resistance start with $1077/$1184.50. The intraday hourly chart shows that the gold price has rallied from $1163.00.

WTI Oil

An intraday improvement in the oil price saved the bulls yesterday but exactly how sustainable the move is remains to be seen. The strong bearish downside candle on Friday is still prominent as a near term impact and with the momentum indicators still bearishly configured whilst the key overhead supply of the old support band between $42.60/$43.70 is still present, the bulls will struggle to gain traction. Technical resistance is strengthened around $43.35 which is also the 23.6% Fibonacci retracement of the big July/August sell-off to $37.75, whilst the falling moving averages also reflect the fact that selling into strength is the most viable strategy. I would be looking upon yesterday’s rebound as a chance to sell once more as I expect further pressure on the near term support band $41.50/$41.85. It would still need a move above $44.00 to suggest the bulls are gaining control.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

GBP/USD stays weak near 1.2400 after UK Retail Sales data

GBP/USD stays vulnerable near 1.2400 early Friday, sitting at five-month troughs. The UK Retail Sales data came in mixed and added to the weakness in the pair. Risk-aversion on the Middle East escalation keeps the pair on the back foot.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Israel vs. Iran: Fear of escalation grips risk markets

Recent reports of an Israeli aerial bombardment targeting a key nuclear facility in central Isfahan have sparked a significant shift out of risk assets and into safe-haven investments.