Market Overview

Outside of the oil markets, most of the other financial markets were fairly steady yesterday, with the US off for Thanksgiving. Forex markets took on a slightly dollar positive outlook as the euro, sterling and yen gave up some of the gains of the past few days. However, equity markets have been broadly strong (with the notable exception of a consistently lagging and disappointing FTSE 100). The big news in the past 24 hours has been the decision of OPEC not to cut production which resulted in huge declines in the oil price. This has impacted Asian trading today, with equity markets of oil importing countries such as China and Japan performing positively (Nikkei up 1.2%) in contrast with the Australian ASX which was lower and dragged down by the oil producing stocks. With Wall Street futures currently around flat for the open, European markets have started off the day with slight weakness.

In forex trading the dollar has retained its slight element of strength gained yesterday afternoon and is positive against most major currencies, whilst the gold price has also slid back too. The yen is notably weaker after Japanese CPI dipped slightly to 2.9% (from 3.0%) which was broadly in line with expectations. However when the impact of the April sales tax hike is factored in the inflation number is actually just 0.9% and this suggests that the Bank of Japan still has some work to do.

The major focus for traders today will be the Eurozone flash HICP inflation data. The release is due at 10:00GMT and the expectation is for a dip back to 0.3% from 0.4%. With German inflation dipping to 0.5% from 0.7% last month and countries such as Spain coming in lower than expected, the chances of a forecast beating euro rally look fairly slim today.

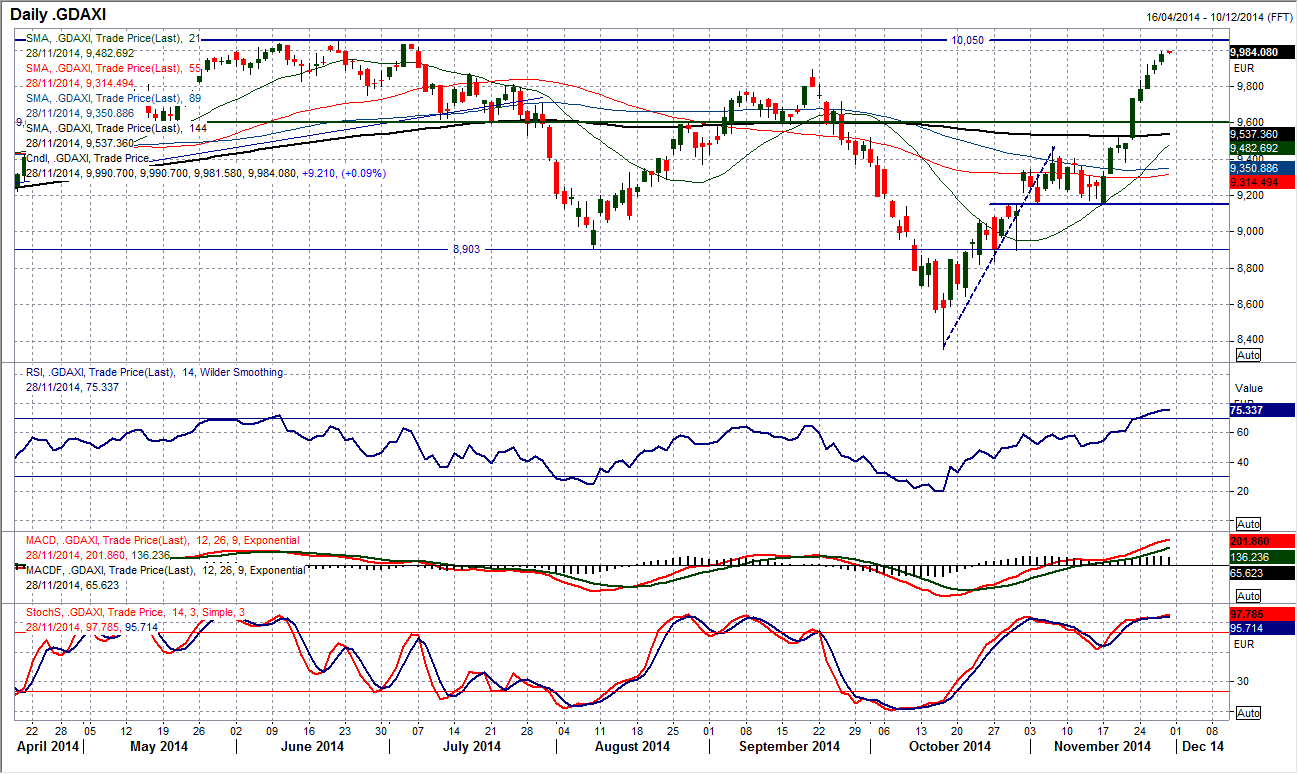

Chart of the Day – DAX Xetra

The DAX has now had a positive close on an incredible 11 consecutive sessions and is within 75 points (or 0.8%) of its all-time high at 10,050. With the RSI now at 75 and the highest in almost 12 months (it reached 80 in early December 2013) upside potential is becoming limited. The bulls will point to the fact that the key resistance of the September high at 9891 caused the DAX to barely flinch, whilst optimists would say that momentum is very strong, which it is (MACD line and Stochastics both still rising). I am just a cautious trader at heart and I would like the DAX to be approaching the all-time high with momentum looking less frothy. This leaves it open to a near term bout of profit-taking. The early moves on the DAX show the index is basically flat around the open. Immediate support comes at 9891 and around 9800. The ideal entry point for a new near to medium term long position would be the pivot level around 9600.

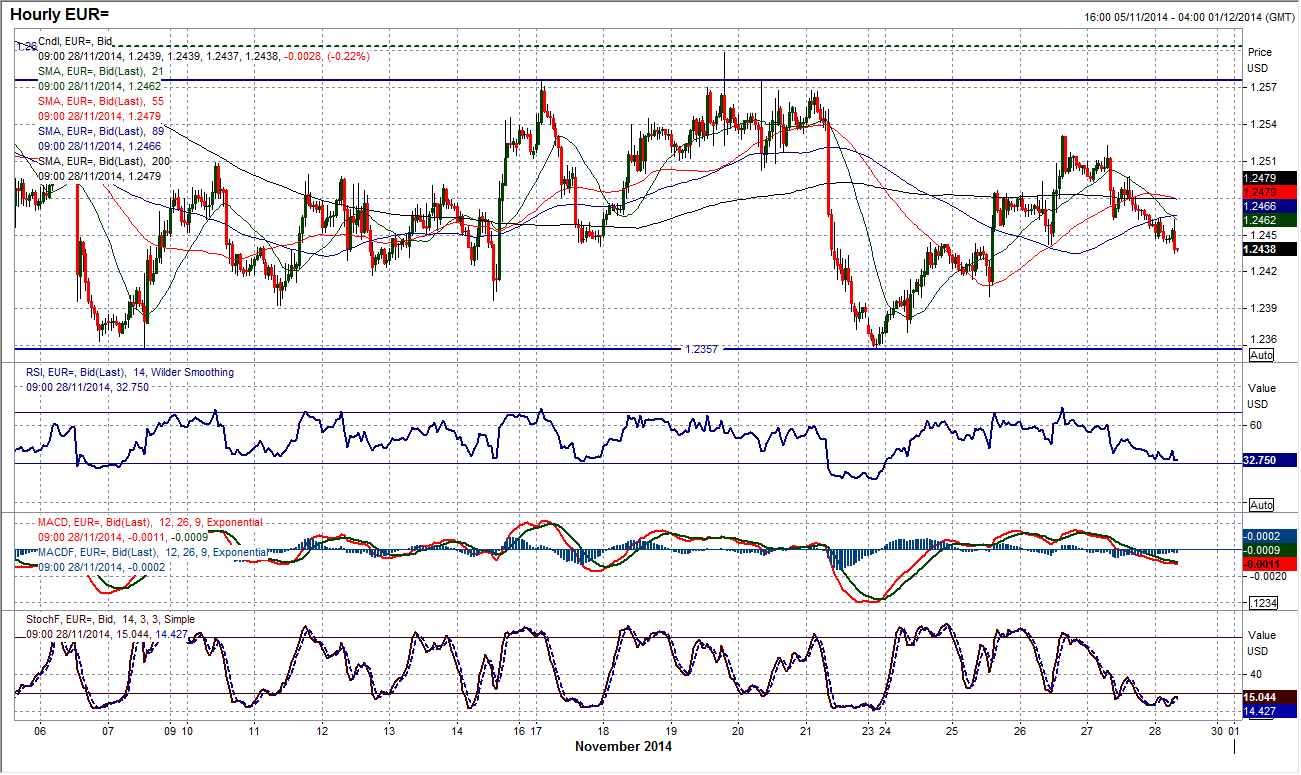

EUR/USD

The euro continues to trade in this 3 week range between $1.2357/$1.2600 and within that range, selling the rallies has continued to be the best strategy. The outlook on the daily chart remains under medium to long term downside pressure with the 3 month downtrend once more recently proving to be the resistance which has capped the gains. The downtrend today comes in at $1.2513. The intraday hourly chart shows the recent rebound looks to be running out of steam once more. The recent peak at $1.2530 seems to have marked a near term high with the initial higher low at $1.2440 under serious threat. The hourly momentum indicators are suggesting the impetus in the latest rebound has been lost with the configuration on the hourly RSI, Stochastics and MACD lines all turning negative. Yesterday’s lower high came once more around the $1.2500 pivot level within the band which also adds to the growing bearish outlook within the band. Any rallies remain a chance to sell and a confirmed breakdown of $1.2440 would confirm further weakness for a test of first $1.2400 and then $1.2357 once more.

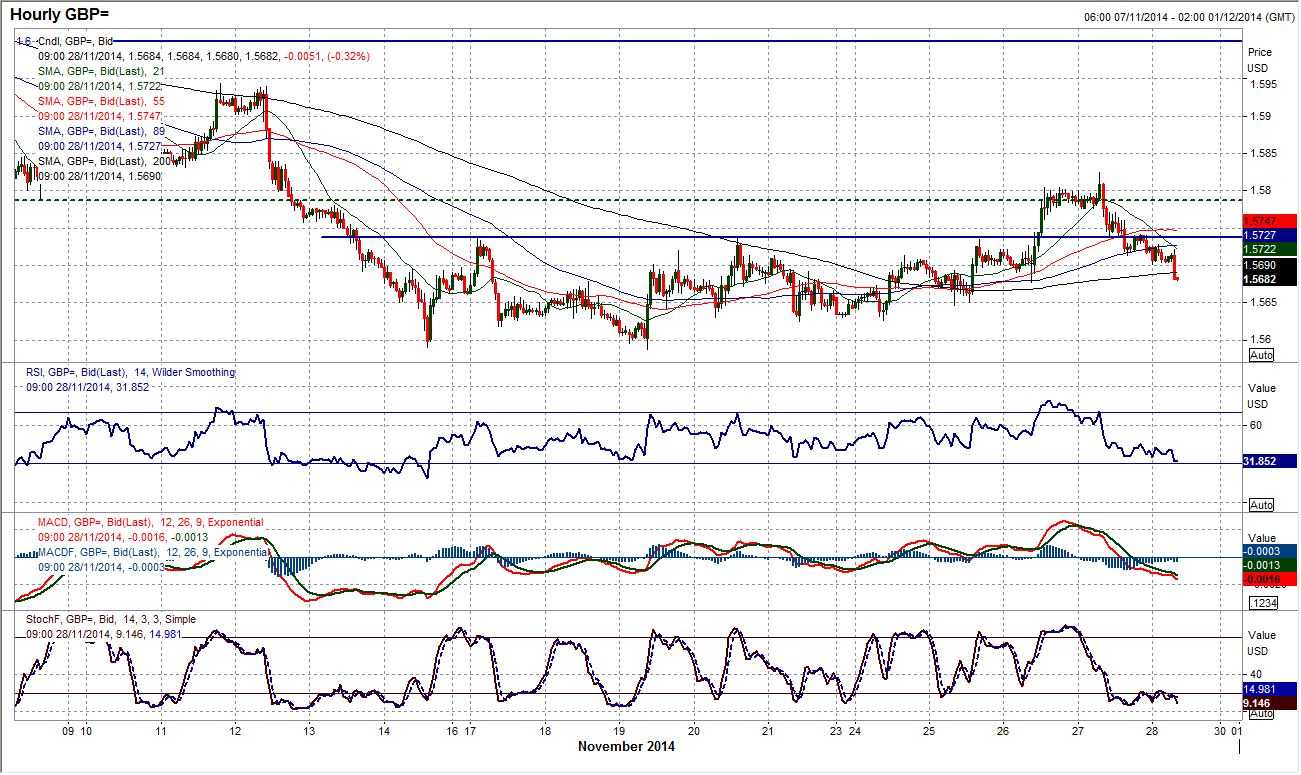

GBP/USD

I spoke a couple of days ago about the base pattern completed above $1.5736 which implied a rebound towards $1.5880, which would coincide with a move once more back to the resistance of the 4 month downtrend. However, this move is counter trend, whilst in bear market rallies the upside targets are often not met before the sellers return once more and the slide in the price once more has me questioning whether $1.5825 is the peak in this rebound. The subsequent drift lower has taken Cable below the $1.5736 neckline which is an initial concern and I think that now if the support at $1.5677 were to be breached then the bulls would once more be under pressure. Looking at the bigger picture, rallies on the daily chart are certainly chances to sell as the outlook remains decidedly bearish. I fear that once more the sellers have returned strongly and the opportunity has been all too fleeting. Today’s trading is key now near term, with the $1.5677 support important for the near term outlook. Subsequent supports at $1.5625 and $1.5588.

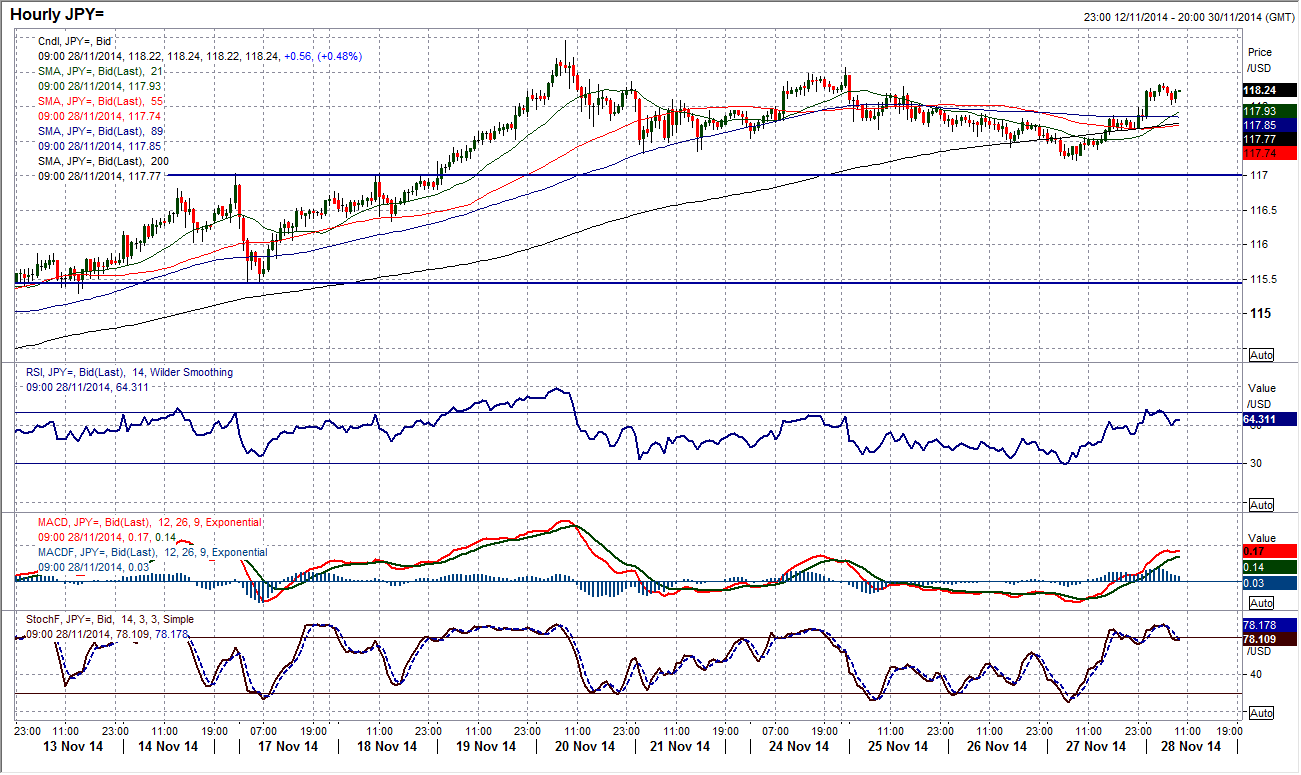

USD/JPY

Whilst it is necessary to talk about potential breakdowns during consolidation phases, it is important not to call a correction until one has actually been triggered. This is the situation we have found with Dollar/Yen, as the dollar bulls have returned once more above the support at 117.00 to leave a near term low at 117.22. The MACD lines have given a bearish crossover which is a concern for the immediate prospects of the bull run, however, the RSI closed yesterday above 70 and Stochastics are yet to give a similar crossover confirmation (for now). This leaves me with a cautious outlook and the consolidation continues. Whilst the resistance at 118.57 remains intact on the intraday hourly chart the immediate chart outlook is difficult to call and perhaps we can just play the range for now whilst the battle of the bulls and the bears continues.

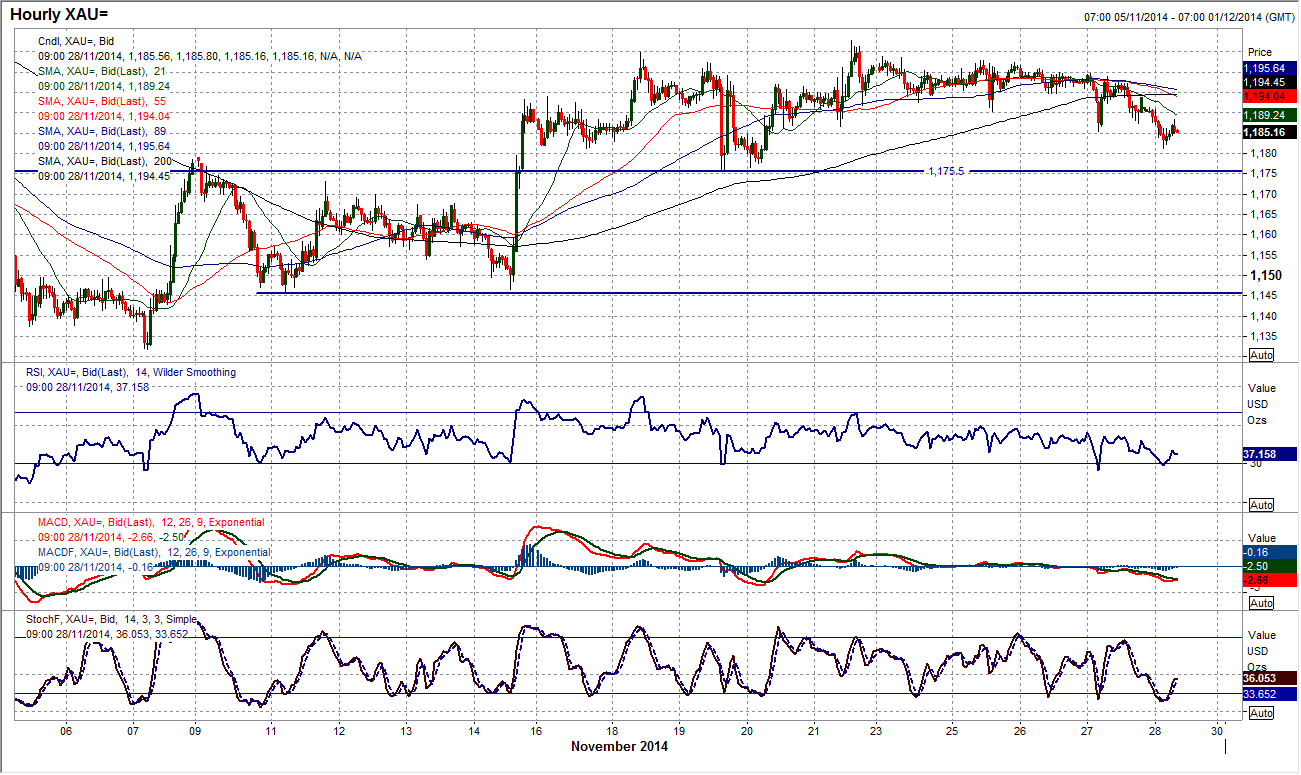

Gold

As the dollar has gradually pulled back some lost ground in the past 24 hours, the gold price has begun to drift lower. The consolidation that has built over the past few days is showing signs of breaking down. However, for now the higher reaction lows remain intact, with support at $1175.50 still a strong marker near term, whilst interestingly the overnight low has come just above the key pivot level of $1180.70 (at $1181.30). There is a danger of gold losing its bullish bias today, however to be honest it is unlikely that unless there is any fundamentally driven newsflow regarding the Swiss Gold referendum (anything that suggests Sunday’s poll will return a negative result would drive gold lower) then we could be in for another rather sedate day with traders reluctant to commit themselves. Technically the gold price remains in the range $1175.50/$1207.70.

WTI Oil

So OPEC chose not to cut production levels. This is a decision that had been touted for a number of days due to the off the cuff comments from fringe meetings. However, the only surprise for me was that the oil price fell so sharply on news that had largely already been viewed as likely by the consensus. Despite this though, the WTI price has fallen sharply through the bottom of the downtrend channel. The channel is around $6 deep, so this means you could derive an immediate downside target at $64.60 (measured from the $70.60 breakdown level). However volatility is likely to remain high over the coming days as traders look to find a fair price (furthermore we could be in for more fun when the US returns from Thanksgiving holiday in the US). Interestingly, the next key low comes in from the $64.25 May 2010 low, just under the implied downside target from the breach of the downtrend channel. There is at least one caveat though, with the RSI down at 22 it is incredible stretched, however the ferocity of the sell-off suggests that downside momentum simply remains extremely strong currently.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.