Market Overview

The mid-term elections in the US have delivered both houses of Congress to the Republicans which will now mean that President Obama (Democrat) has a rather tricky final two years in the White House. However, despite the negative implication, the dollar seems to be reacting positively and the US futures are up. Asian markets have been mixed in their response, although they have also had to contend with the release of the China HSBC Non-manufacturing PMI data which fell to a three month low at 52.9 (53.5 last month). European markets are taking a positive reaction from the US mid-terms and are trading higher in early moves.

In an almost complete reversal from forex trading yesterday, the US dollar is stronger against all the major currencies today. The yen is especially weaker, as is the Aussie dollar which is unwinding the rebound seen yesterday. This dollar strength is also having a sharply negative impact on precious metals such as gold and silver.

Traders will be watching out for the Eurozone services PMI throughout the early morning, whilst the US services PMI at 09:30GMT is expected to fall only slightly to 58.5 (from 58.7). The US data kicks off with the ADP employment report at 13:15GMT which is expected to show a gain of 220,000 jobs (up from 213,000 jobs last month). The ISM Non-manufacturing at 15:00GMT is expected to dip slightly to 58.0 (from 58.6).

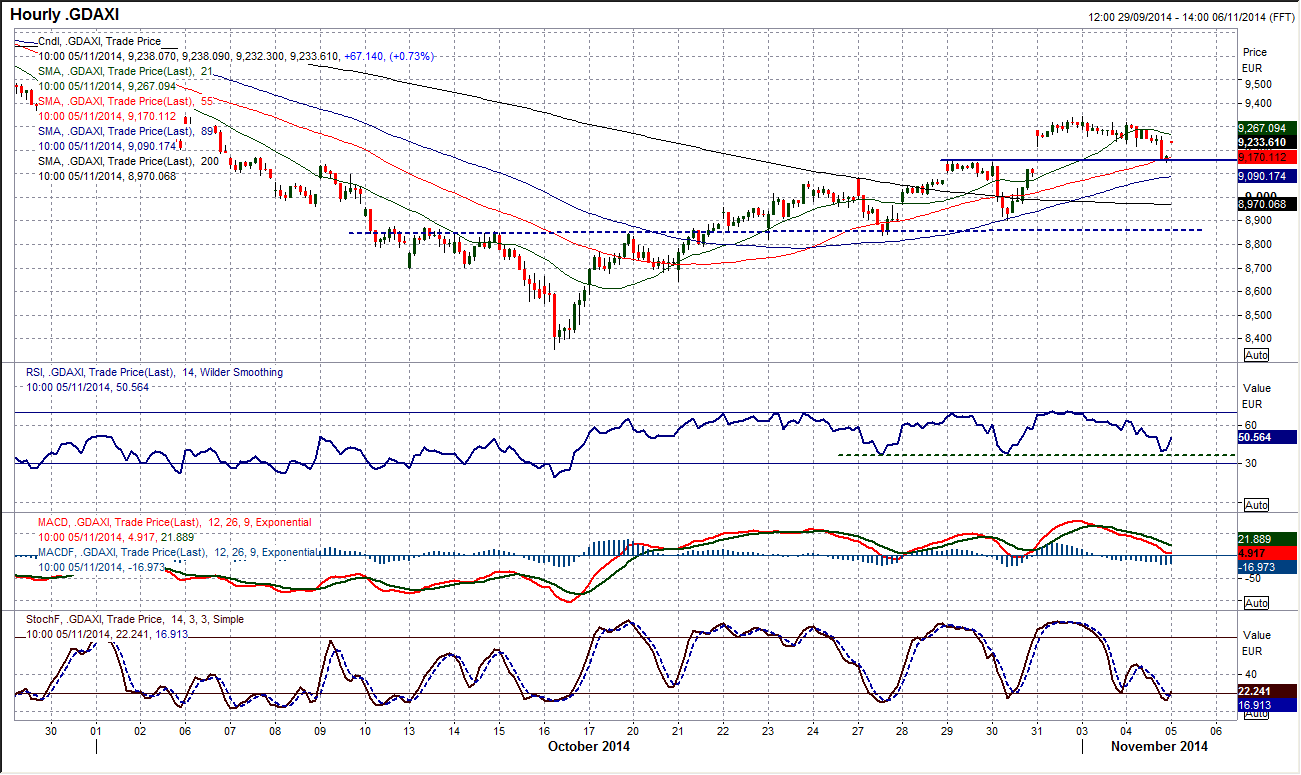

Chart of the Day – DAX Xetra

The DAX has dropped 1.7% in the past two sessions, but might now be ready to settle and resume its uptrend that has pulled the index 10% higher from the selling nadir on 16th October. The intraday hourly chart shows that yesterday’s correction has now come back to fill the gap that had been left open by Friday’s jump higher at the open. Furthermore the hourly momentum indicators are all back to levels that suggest that if the outlook is going to remain bullish this will be considered to be a chance to buy. The hourly RSI is back towards 40 again, the MACD has unwound to neutral again and the Stochastics are also at a level where the buying pressure has tending to resume in this bull run. That all suggests that today’s trading is important for the near to medium term technical outlook. If a basis of support can be formed in the band 9068/9158 then the bulls can look to use this as a chance to buy. Early signs are good with a degree of support already coming through.

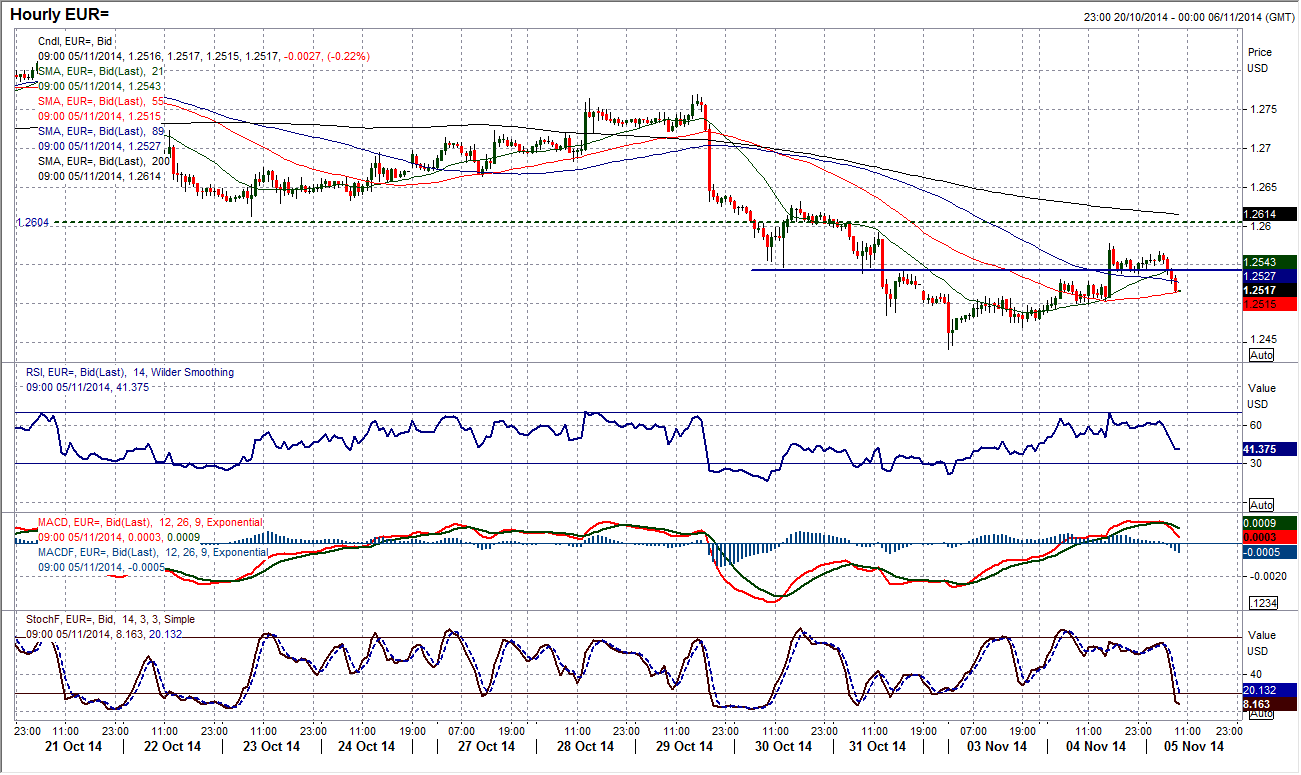

EUR/USD

The rebound in the euro yesterday afternoon has not yet been able to inflict too much damage on the bearish outlook. The move came after the Reuters report over divisions within the ECB cast doubt over the viability of further easing measures, resulting in a relief rally on the euro. This adds an extra dimension to the ECB meeting this week and may mean that the euro has increased volatility. However in isolation, the technicals still remain weak and this move looks to be a jump towards the resistance around the neckline at t $1.2600 that would constitute another chance to sell. Momentum indicators remain weak and the likelihood is that if this Reuters report is of little consequence then the sellers should quickly gain control. The intraday hourly chart already suggests that as the European session gets going the pressure is mounting to the downside again. A breach of $1.2500 would see the selling pressure mount again. The bearish outlook would remain until the reaction high at $1.2770 has been breached.

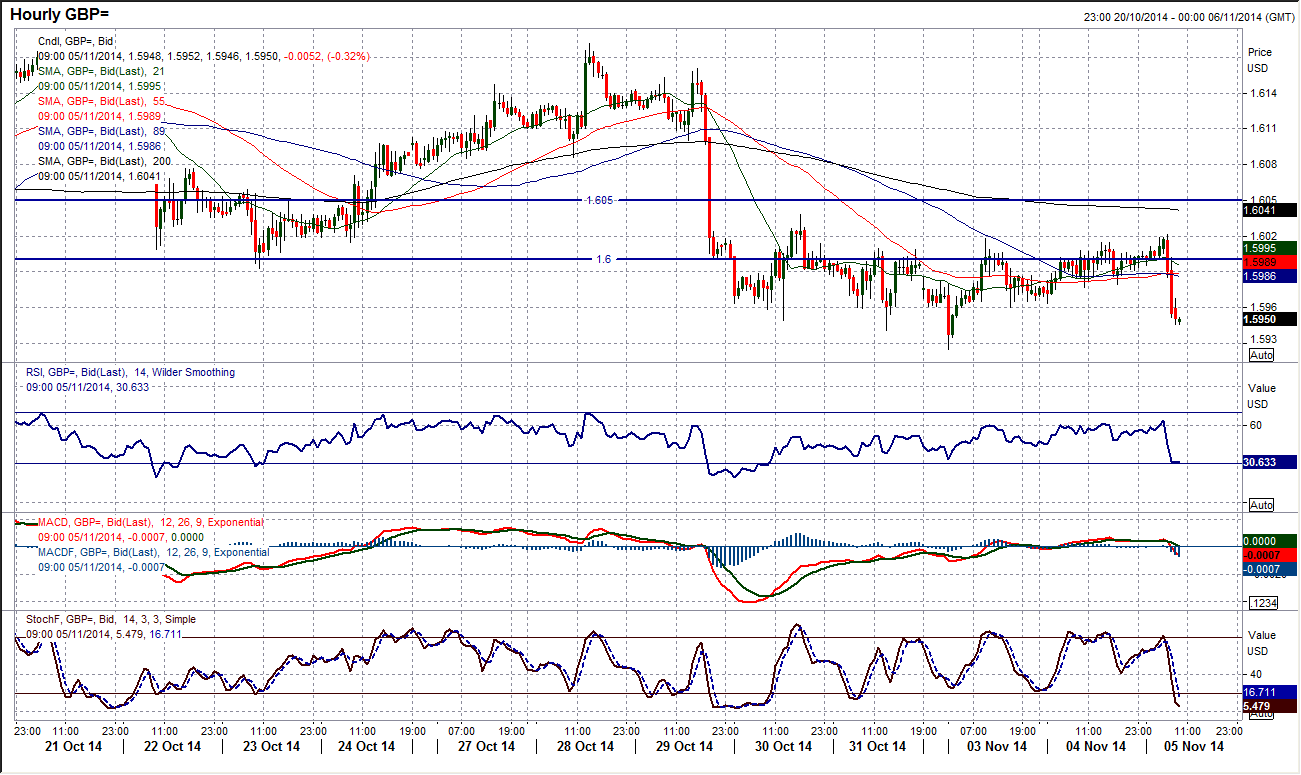

GBP/USD

I could have almost written exactly the same comment for Cable for the past three days as the rate once more continued to consolidate around the $1.6000 mark. The period of sideways trading has come as momentum indicators become increasingly benign, although there is still a bearish bias to the outlook with the small double top still in place. In the last three days there has never really been any attempt by the bulls to engage a run higher and move through the top of the resistance band at $1.6050. This consolidation may have been due to the US mid-term election uncertainty, but the early European trading suggests an appetite to buy the dollar once more and this could put pressure on the $1.5925 low again. This is the low that has protected the key cycle low at $1.5873.

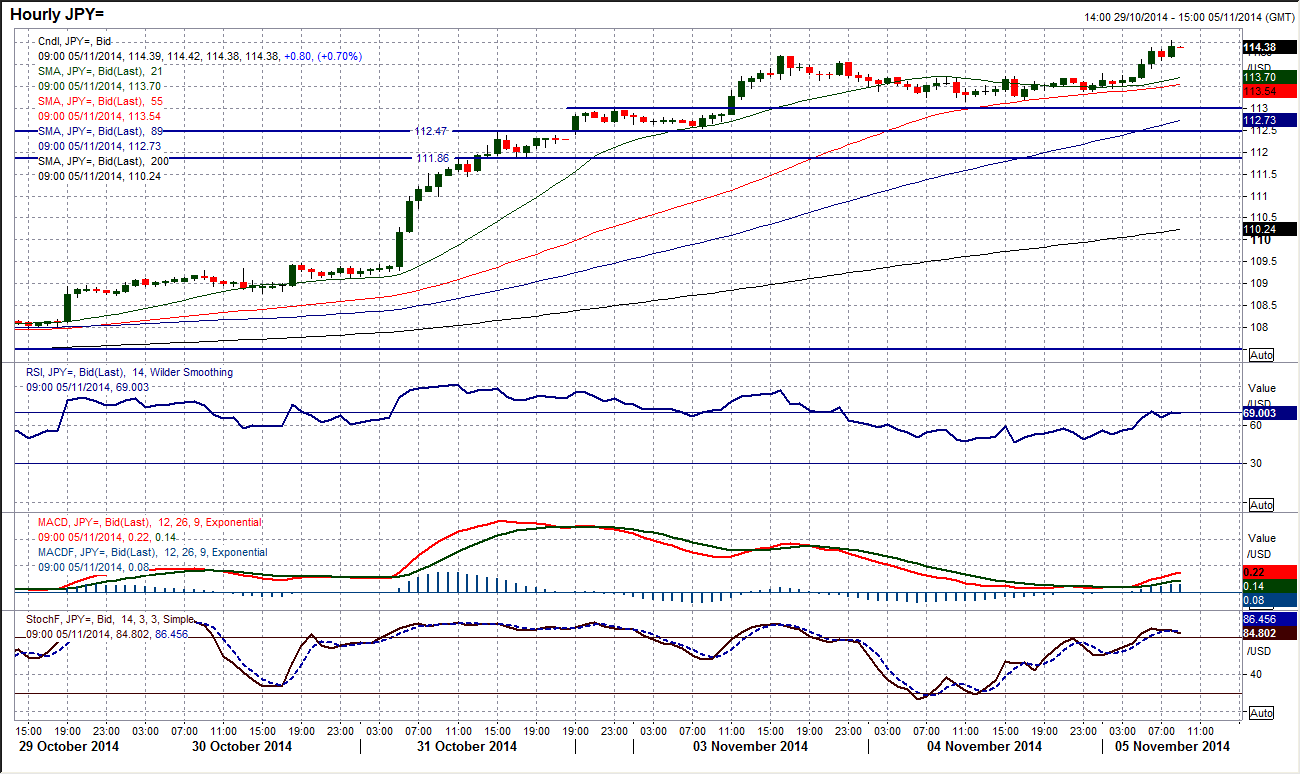

USD/JPY

The consolidation around the 100% Fibonacci projection at 113.77 continued throughout yesterday, but may prove to be just near term as the Asian trading session today suggests that the bulls could be ready to push the rate higher again. Momentum remains strong and if the breach of the reaction high at 114.20 can be sustained, Dollar/Yen will quickly move to test the next resistance at 114.65 which dates back to 2007. The intraday chart shows a good use of the support at 113.00 and this is becoming increasingly strong now near term. The hourly momentum indicators also suggest that the consolidation from yesterday was used to unwind momentum and help to renew upside potential. The outlook for Dollar/Yen remains very strong.

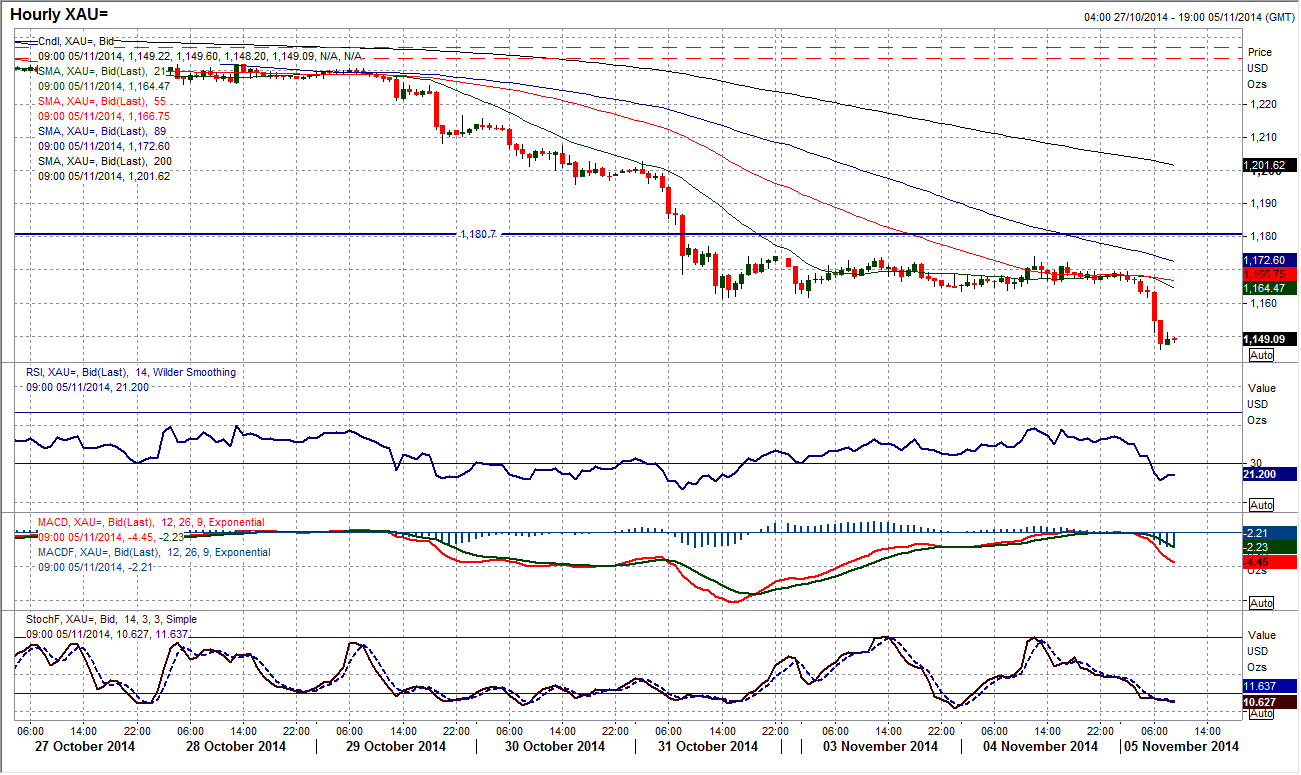

Gold

The period of consolidation seen over the past couple of days has ended. As the dollar has started to strengthen, the European traders have taken the opportunity to put pressure on the gold price once more. The move has resulted in a couple of supports already being breached as the question of how much further the gold price could go now the crucial floor at $1180 has been taken out. The $1157 from July 2010 has been breached to open the reaction low at $1123.15 from April 2010. However the more significant support comes from March 2010 and $1084.85. The concern is that, technically, the momentum indicators are extremely weak and with a lack of any real support now the bears could drag the price sharply lower. The key near term resistance remains the old crucial floor at $1180.70.

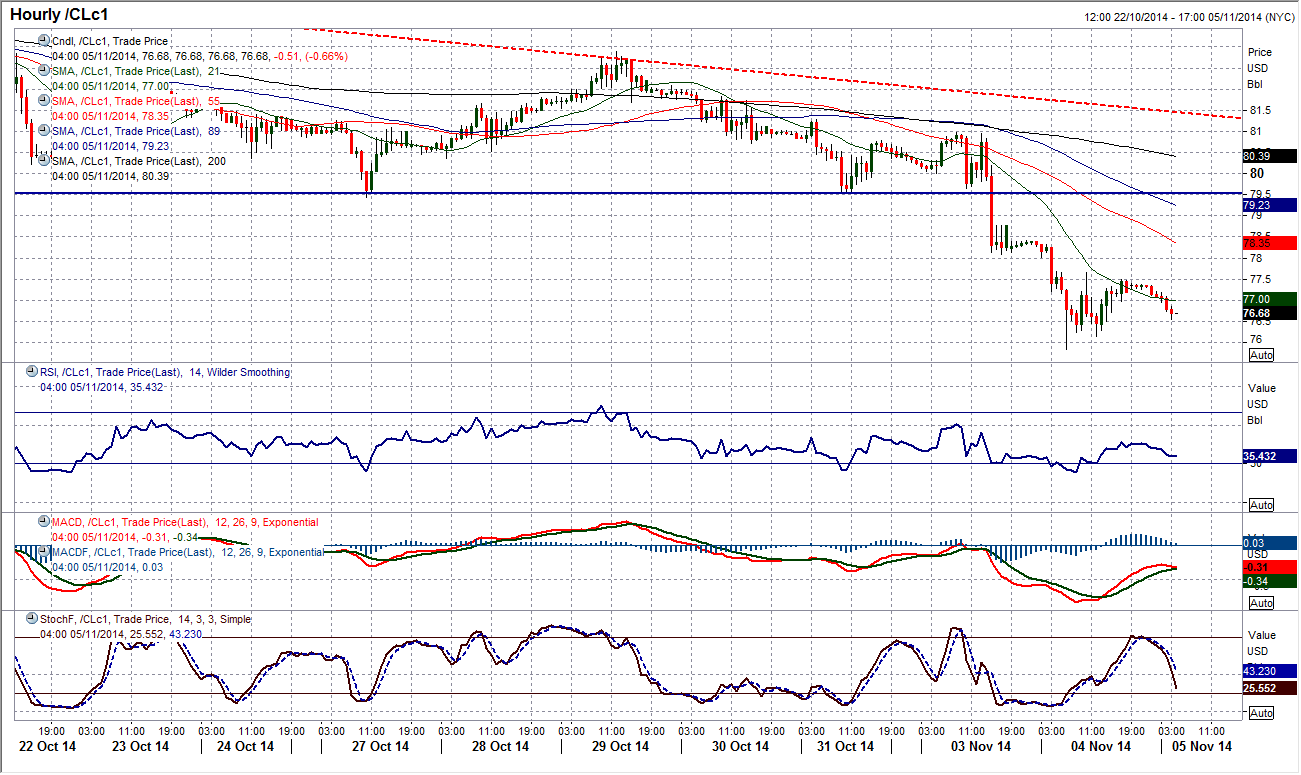

WTI Oil

How low can WTI go? The downside break from the descending triangle implies a target of $75 on WTI and the price is well on the way towards achieving that target. The initial support at $77.28 has already been breached and the next key low of any note is the $74.95 from October 2011 low which coincides nicely with the implied target from the triangle break. Underneath there, comes the key low from August 2010 at $70.76. Technically, daily momentum indicators are incredibly weak, although the RSI is now down at levels where it got a few weeks ago when a snap intraday rally was seen. This would suggest caution should be taken when running short positions. The intraday hourly chart shows an initial resistance band $77.65/$78.10.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.