Market Overview

As the recovery in equities has taken off, the outlook for forex has become somewhat more muddied in the past day. I have spoken at length about the tendency for key market bottoms to coincide with the decline in VIX Index of volatility in S&P 500 options, and the VIX fell another 13% yesterday as Wall Street posted its strongest gains for the year. With the S&P 500 up another 2% overnight the index is now over 6% off its nadir on Wednesday last week. This time around the Asian markets have taken part in the rally, with gains across the region’s major markets and the Nikkei 225 2.5% higher helped again by a weaker yen over the past 24 hours. European markets which posted strong gains themselves yesterday have opened in positive mood once more today. The sentiment has been helped by reports that the ECB could be getting ready to purchase corporate debt as part of its easing programme.

In forex trading, there was a comeback for the dollar as yesterday’s session went on (helped by these ECB reports). This move has stunted the progress of some of the major pairs which looked to be engaging in bullish moves against the dollar. The forex markets are broadly flat today, with little real movement yet. After a weak day yesterday the Japanese yen has just gathered itself following some positive trade data announced overnight. Furthermore, the Aussie dollar is also holding up after Australian CPI came in line at 2.3%.

Traders will be looking out for the Bank of England meeting minutes today at 09:30BST, although there is no expectation that there would be any further dissenters on top of Martin Weale and Ian McCafferty. The main event will be US CPI inflation today at 09:30BST which is expected to show a fall from 1.7% last month to 1.6%. This could mean that Cable has a choppy day today. There is also the Bank of Canada giving monetary policy but there is no change expected on rates at 1.0%, whilst in the evening there is also New Zealand CPI which is expected to fall sharply to 1.2% (from 1.6%).

Chart of the Day – DAX Xetra

What a rebound for the DAX in the past few days, however there is still further work that needs to be done. The daily chart shows significant volatility in the past 5 sessions but now the DAX is in direct challenge of the resistance at 8903 today. The encouragement comes in the fact that the momentum indicators are now showing positive recovery signs. The RSI is advancing, whilst the Stochastics have given a confirmed crossover buy signal. Furthermore, whilst the daily chart does not show it so well, the intraday hourly chart shows a well-defined head and shoulders reversal has been completed above 8847. The potential implied rebound for this move is around 500 ticks (which would equate to around 9350) so if the bulls can continue their run, there is plenty to recover. The breakout neckline at 8847 becomes the initial support, whilst the pattern would remain intact until 8645 is breached. After 8903 the next key near term resistance is not until 9140.

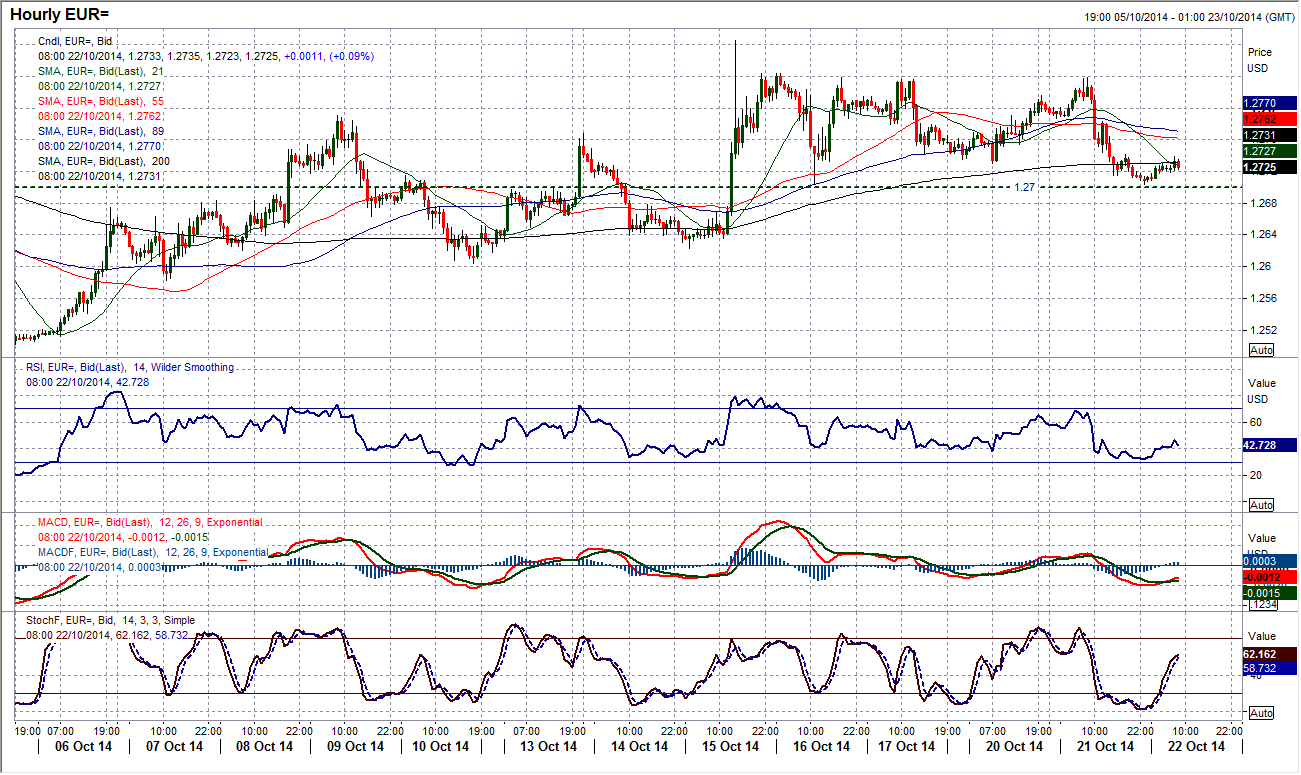

EUR/USD

The outlook for the recovery in the euro is being threatened. Tuesday’s decline resulted in a bearish outside day (a move above the previous high only to close below the previous low). This suggests there is a turn in sentiment and the momentum indicators confirm the deterioration with RSI and Stochastics falling away. I have been talking for the past few days about the key initial support being at $1.2700 and that a move back below the support would see the bulls on the back foot again. Overnight we have seen $1.2700 tested but not yet broken, however the rebound has not been enough to prevent the pressure remaining. A breach of $1.2700 opens the higher reaction low at $1.2600 a break of which would be confirmation of the end of the recovery. There would now need to be a move back above yesterday’s high at $1.2840 to avert the change in sentiment.

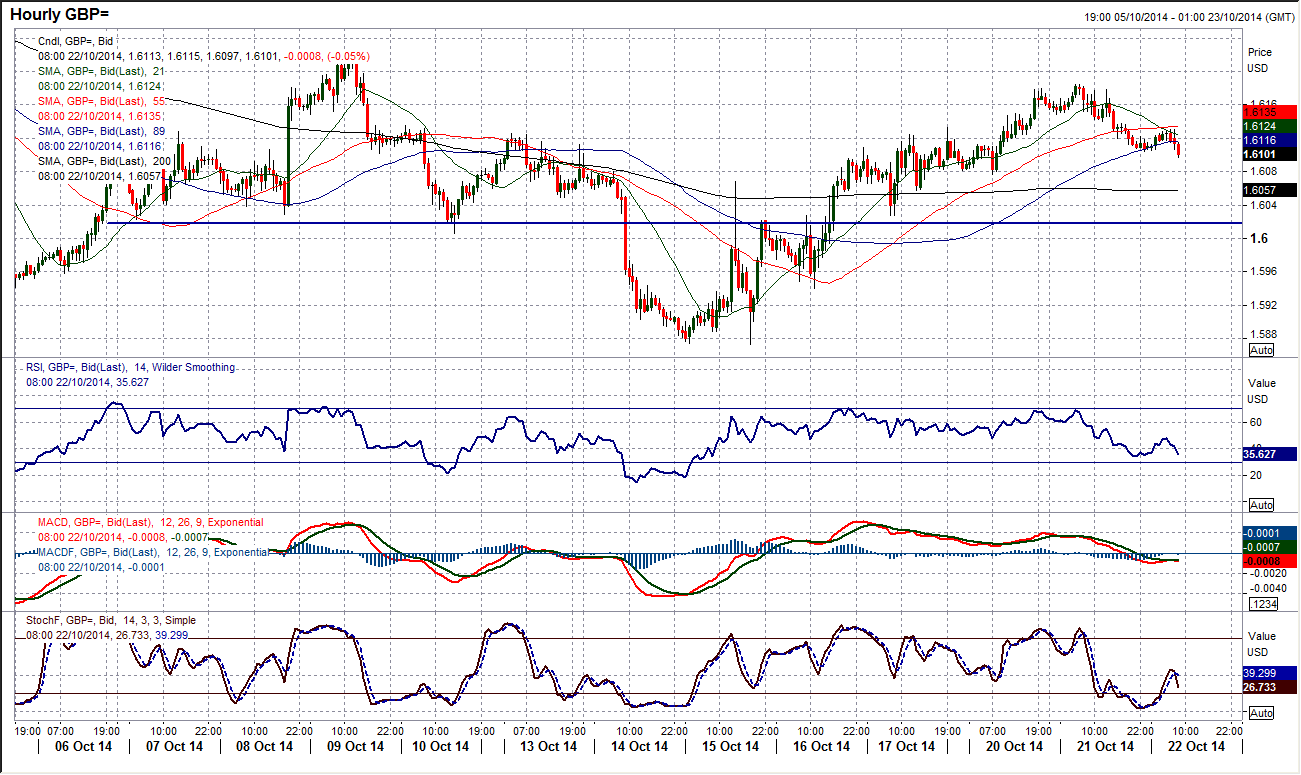

GBP/USD

Yesterday’s strong bearish candle which saw Cable close at the low of the day has brought into question the rebound for the first time. I have said that the recovery needs to breach the lower reaction high at $1.6226 for the bulls to be in control. This remains the case, however it seems as though this current move needs to sustain momentum otherwise it will be viewed as yet another rebound within the downtrend and seen as another chance to sell. The momentum indicators are still improving but once again there is much more that needs to be seen to become positive. However, all is not yet lost for the bulls. The intraday hourly chart shows the support in at $1.6080, whilst the key near term support at $1.6020 is also present. Whilst these two levels are intact the prospect of a recovery remain. The price action of yesterday has muddied the outlook somewhat near term, but once the European trading gets underway it will be interesting to see how strong the recovery bulls are.

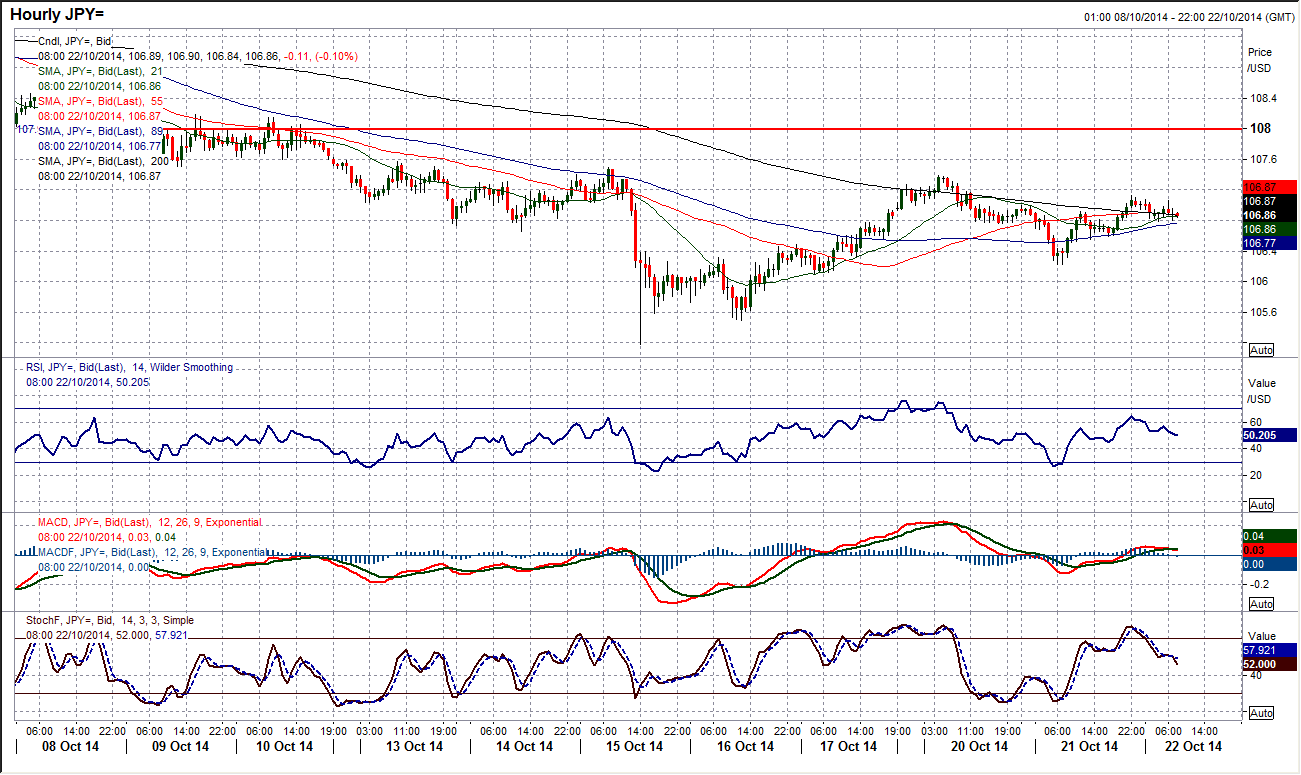

USD/JPY

There is clearly a battle going on for overall control on this chart. The last two days have shown doji candles both closing around the same level, but one bearish and one bullish. The uncertainty does not help the outlook for the chart but the rebound from yesterday’s low of 106.22 will make the bulls the happier going into today. It increasingly looks as though trading will be choppy in the near term with momentum indicators largely in neutral configuration on both the daily and intraday charts. Taking a step back, the key resistance near term remains the 107.50 reaction high, whilst yesterday’s low of 106.22 also seemed to have an air of importance too. So it would appear another dollar chart that has taken on more of a neutral outlook then over the past 24 hours.

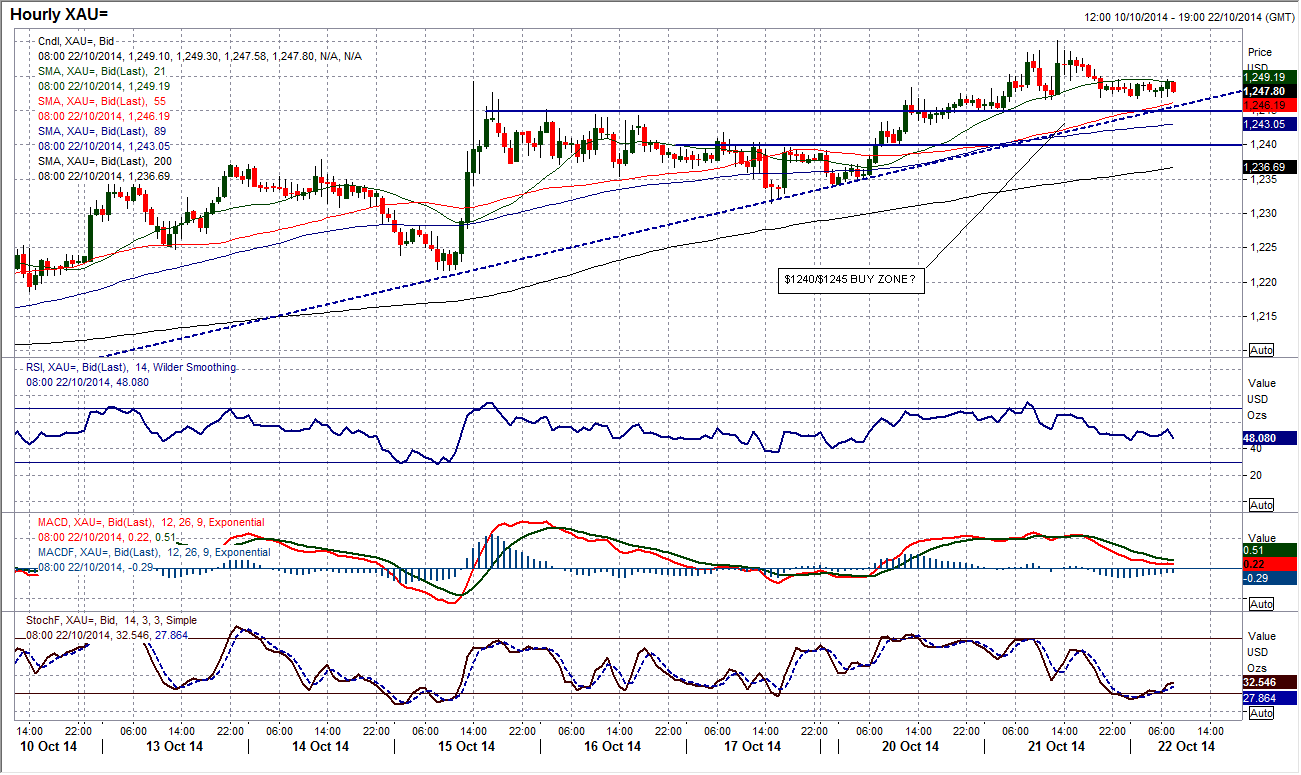

Gold

Having looked for confirmation of the medium term strength of gold, there was another sign of it yesterday, with the first entire trading session clear of the $1240.60 old resistance. This has continued the rebound over the past 13 days and has opened the subsequent upside resistance levels of $1260 and more importantly at $1280. The daily momentum indicators continue to improve with the MACD lines now up at neutral and interestingly the Stochastics having spent the past week and a half above 80 (a sign of strong momentum). The intraday chart shows a consolidation overnight, but there is good near term support now between $1240 and $1245 to use as a potential buying opportunity. The reaction low at $1231.50 is the key near term support that protects a breakdown.

WTI Oil

The oil price is now consolidating. However, as I said yesterday, after the huge sell-off and bearish pressure, the bulls will be happy for the respite. The building blocks for recovery are there though, even if there are several barriers to be overcome first. The bullish key one day reversal from last week is still intact following the support and key low at $79.80. The three week downtrend on the intraday chart has also been broken and has been used as a basis of support (which confirms the break). WTI is now trading in a sideways range $81.55/$84.25 and hourly momentum indicators are increasingly neutral as we await the breakout from this near term range. It is difficult to tell the direction of the breakout, however, with volume having dropped dramatically since the key low it suggests that the sellers have sold, at least for now. A move above the spike high at $84.83 would open the next key resistance within the sell-off at $86.30.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

GBP/USD remains on the defensive below 1.2450 ahead of UK Retail Sales data

GBP/USD remains on the defensive near 1.2430 during the early Asian session on Friday. The downtick of the major pair is backed by the stronger US Dollar as the strong US economic data and hawkish remarks from the Fed officials have triggered the speculation that the US central bank will delay interest rate cuts to September.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Israel vs. Iran: Fear of escalation grips risk markets

Recent reports of an Israeli aerial bombardment targeting a key nuclear facility in central Isfahan have sparked a significant shift out of risk assets and into safe-haven investments.