Market Overview

In the past 24 hours there has been a real sense of a shift in sentiment away from the US dollar. This has resulted in key moves being seen on forex pairs such as Cable and Dollar/Yen, whilst the gold price has also managed to break some near term shackles that had been holding back the recovery.

Wall Street managed to post another day of gains in the rebound which is lightening the mood in Europe today, whilst the technology and consumer sectors should be buoyed by the positive results from Apple. Furthermore, overnight, the release of Chinese GDP should also be supportive. China continues to slow down but the pace of the decline seems to be under control. GDP was 7.3% for Q3 which was above the consensus forecast of 7.2%.Asian markets have been mixed on the news with the Nikkei 225 losing 2% amid a strengthening of the yen. However, European indices are more positive and are performing well early in the session.

In forex trading, the dollar is suffering across the board. The main impact is being seen on the yen which is around 0.5% stronger against the dollar and the commodity currencies (Aussie and Kiwi) which are also around 0.5% to the good. Traders will be looking out for the UK’s public sector borrowing requirement at 09:30BST which is expected to come in at -£9.4bn. In the US the focus is on Existing Home Sales at 15:00BST and is expected to show a 1.0% improvement to 5.10m homes (up from 5.05m last month).

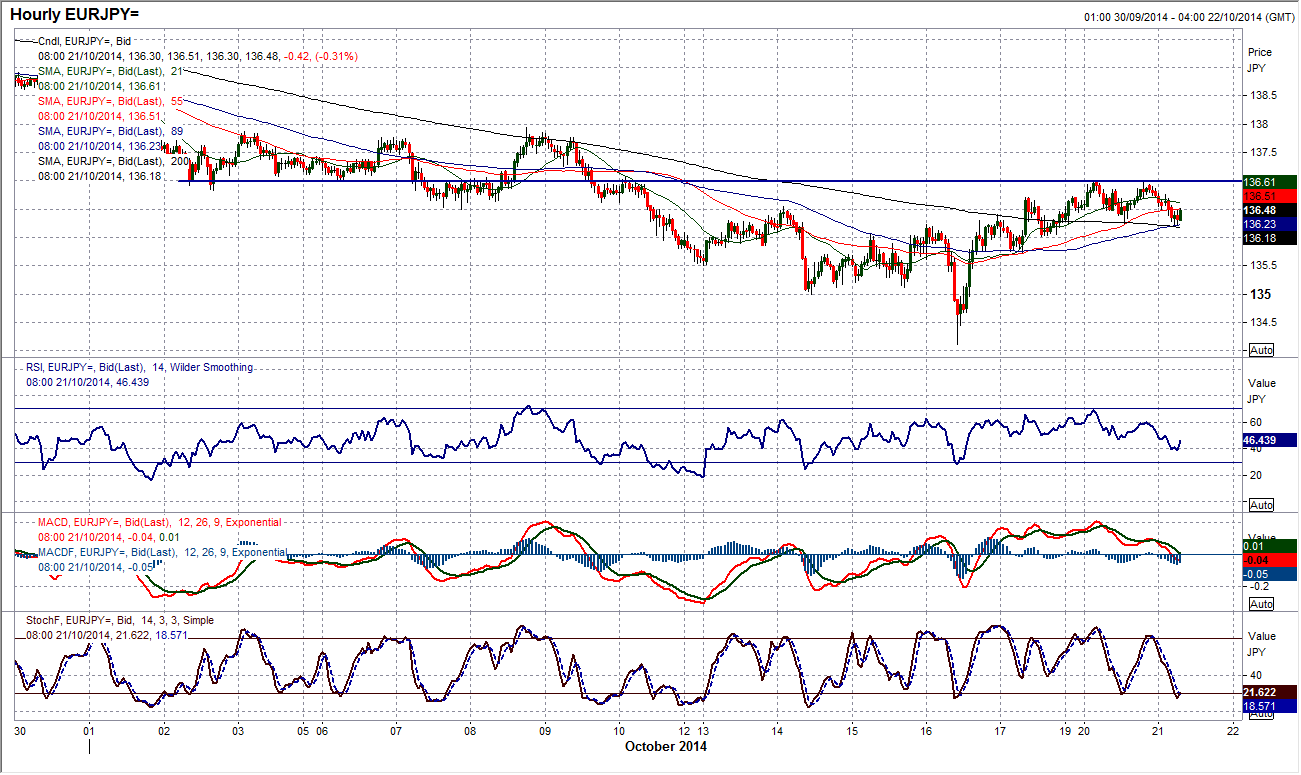

Chart of the Day – EUR/JPY

After 4 straight days of gains, is the rebound for the euro running out of steam already? The bullish key one day reversal last Thursday is a powerful signal and points towards a continuation of what has broadly been a sideways range for the past 5 months. The momentum indicators suggest the continuation of the range and the likelihood of a rebound back towards 138.00 which is the key pivot level within the range. However the intraday hourly chart shows a disappointing slide overnight. The support at 136.00 is now key near term to keep the recovery of the past few days on track. For now this is just a minor consolidation within the rebound which is just unwinding hourly momentum indicators. However the bulls will need to react above 136.00 support to prevent the impetus in the recovery from being lost. There is resistance at 137.00 near term.

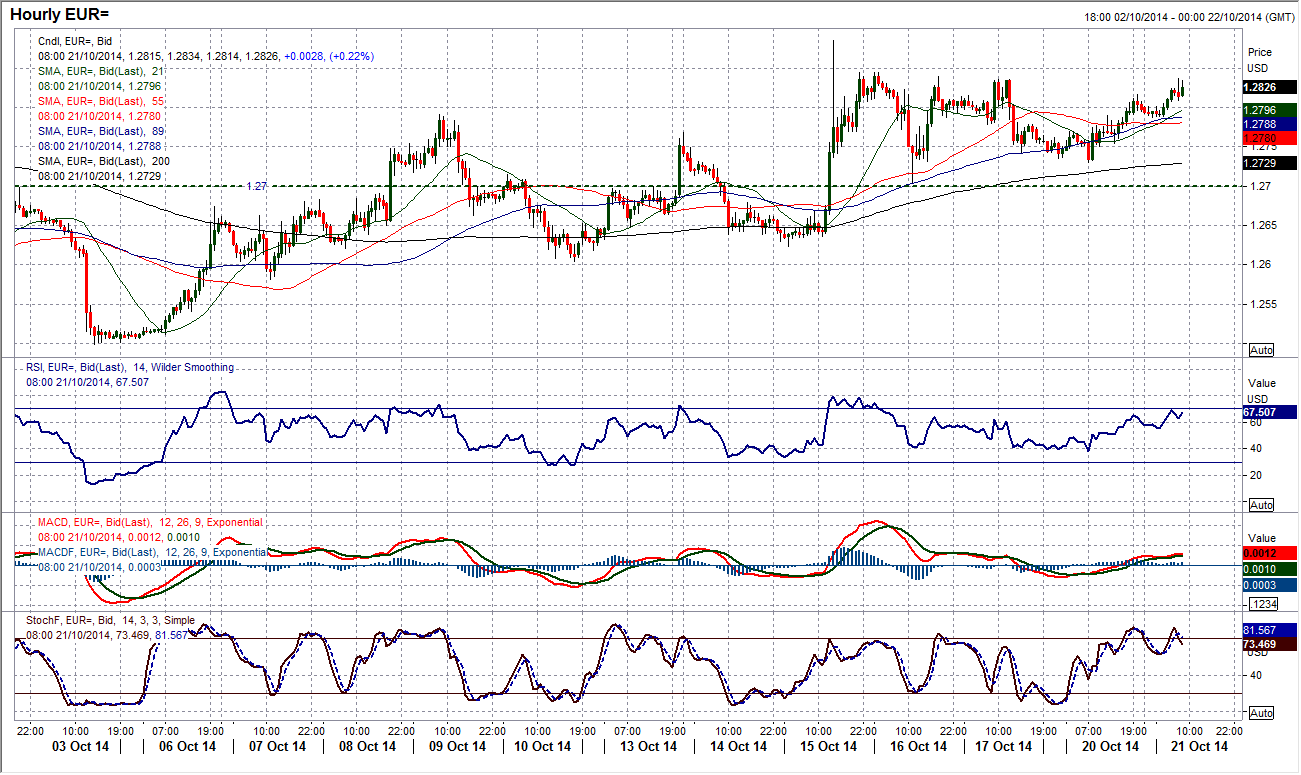

EUR/USD

The euro chart has been a good gauge for the performance of the dollar over the past few days and the bullish bias that has been seen suggests that the dollar is under increasing pressure. After a couple of days where the euro just drifted slightly, the bulls are regaining the initiative once more. The rate seems to be settled now above the $1.2700 level which had previously been a neckline for a bullish break and is now acting as near term support. The first key test will be at $1.2840 which has capped the upside on several occasions in the past week. With intraday momentum building nicely once more the bulls will certainly be looking for a breakout. A breach opens the spike high at $1.2885, whilst above that the way is open for a return to $1.3000.

GBP/USD

Cable is another chart that is showing the impact of a weakening dollar. Sterling has now rallied for a 5th consecutive day to breach the resistance of the 13 week downtrend. The momentum indicators are picking up and although there is still much to be done for the configuration to be considered as positive, the RSI is at a 3 month high and reflects the improvement. The key move would come with a break above $1.6226 which is the key reaction high on 9th October. Until that lower high is breached then a recovery cannot be confirmed. The intraday hourly chart shows a consistent rebound in the past few days and having moved through the resistance at $1.6135 the outlook continues to improve. The old resistance at $1.6135 now becomes the new near term support, with the key near term support at $1.6020. A break above $1.6226 opens the next resistance at $1.6415.

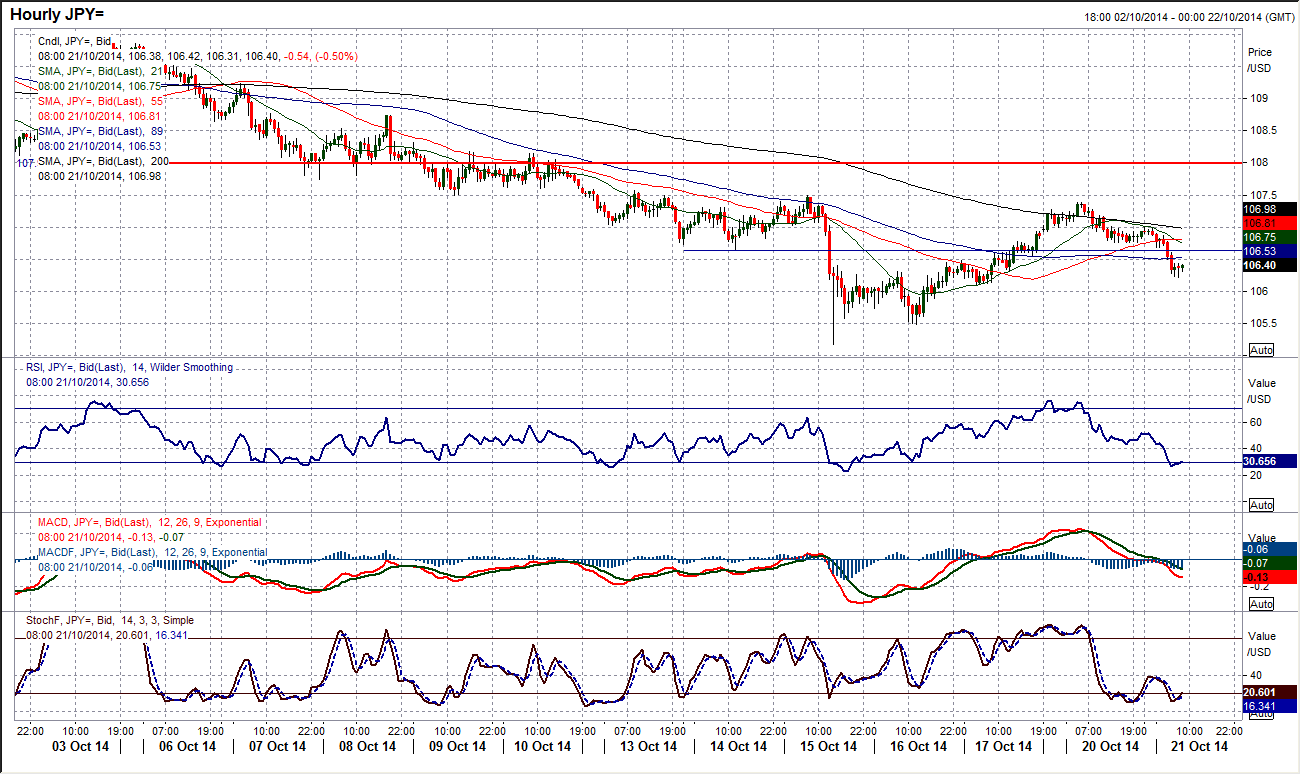

USD/JPY

Just in the price action overnight I am becoming concerned for the medium term strength of the dollar. The fact that Dollar/Yen has dipped to question what had been up until recently an orderly rebound means that the next couple of days could be key for the medium term prospects of the dollar. The daily chart shows yesterday’s weak candle being followed up by a bearish reaction today. For now the daily momentum indicators remain on track but the rebound is being questioned. The intraday hourly momentum indicators have unwound once more which is fine for now, but if this continues then the outlook will deteriorate once again. Having peaked early Monday at 107.40 a lower high has now been left at 107.00 and is resistance that needs to be overcome. The support between 106/106.50 needs to hold to prevent a retest of the recent lows at 105.50 and the spike low at 105.18.

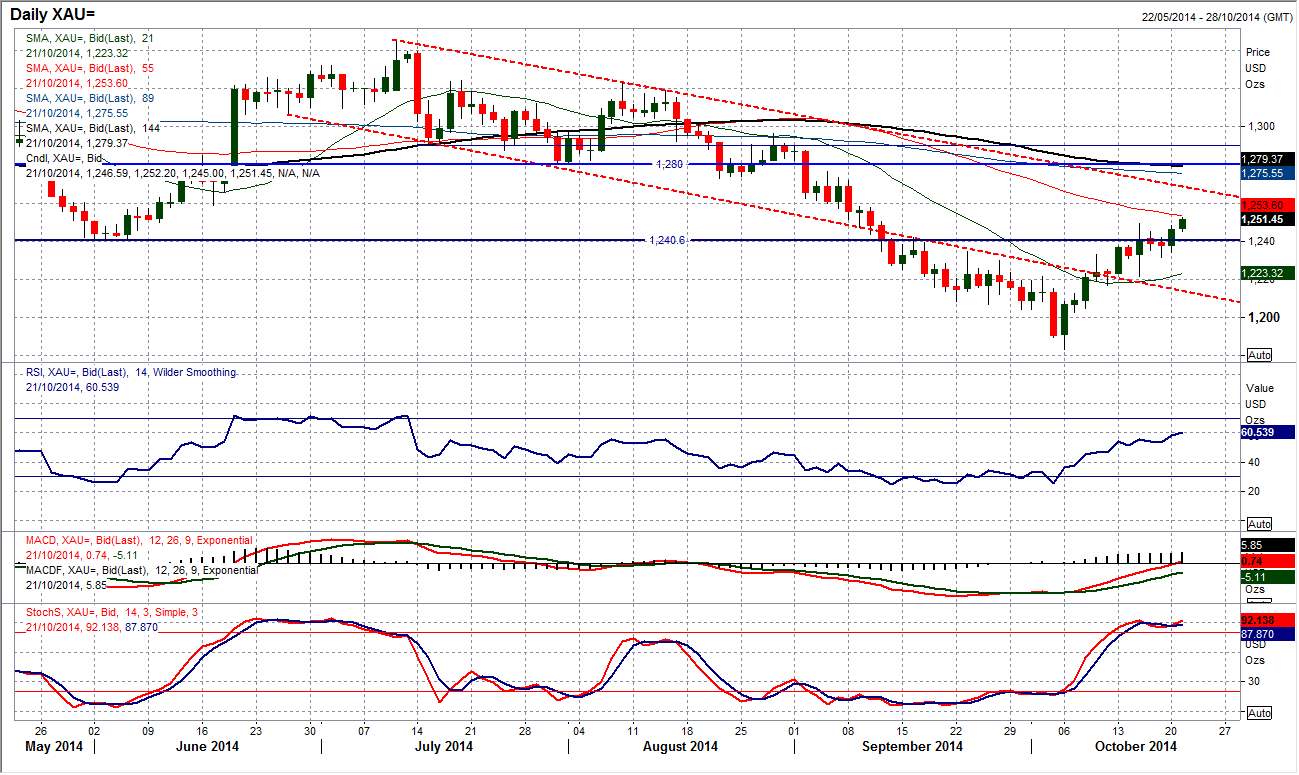

Gold

After the consolidation of the past few days which saw successive failures to close above the key medium term resistance at $1240.60 there seemed to be a change of sentiment yesterday. After an early morning move through the resistance the new level seemed to be accepted by the bulls and this resulted in a close above $1240.60, which confirms that the recent recovery is on track. The positive sentiment has continued today with the price looking to now build on the new found positive outlook and push above the spike high at $1249.90. The next resistance is at $1260, whilst the next key medium term barrier is the resistance of the old lows around $1280. The daily momentum indicators continue to improve and the suggestion is that the move is gathering impetus once more. There is plenty of support now starting at $1245 and all the way down to the low in the consolidation range at $1231.50.

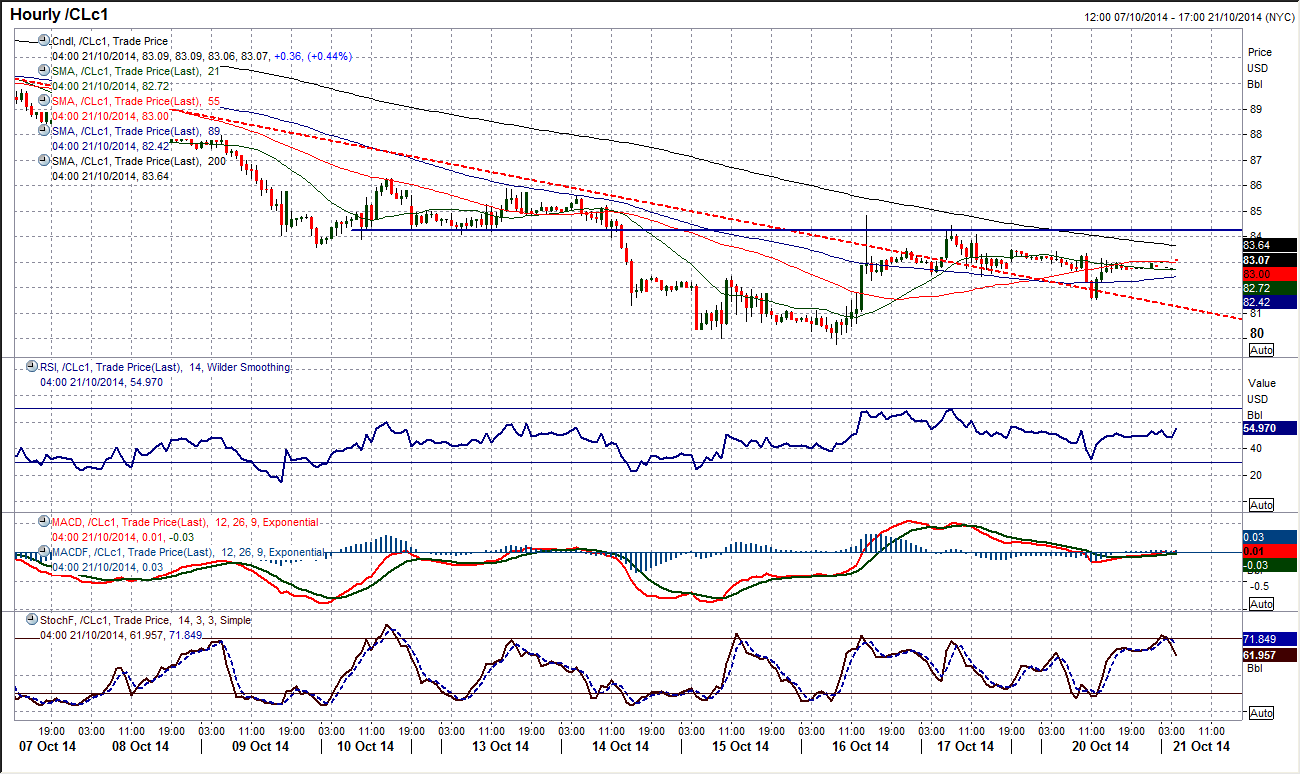

WTI Oil

Having posted two days of recovery gains, the oil price has lost a bit of recovery impetus and is resorting to consolidation mode. The bullish key one day reversal that left a low at $79.80 remains the key support, but the intraday hourly chart shows the price broadly consolidating between $82.50/$83. However, the old downtrend which had pulled the oil price lower since 30th September, is now being used as a basis of support and is currently around $81.20. Also if the price can build upon yesterday’s low at $81.56 then the prospect of a higher low could be seen. This all suggests that the near term outlook is increasingly mixed, which is a far better prospect for the WTI price than we had during the precipitous selling over the past few weeks. Despite this, until the spike high at $84.83 is taken out then there will still be a feeling that the bulls have not fully backed a recovery.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD holds gains near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.