Market Overview

Calling the bottom is a risky game. The slightest signs of support and people jump in to suggest the lows have been seen and all is clear to buy once more. That is how it seemed with yesterday’s move on Wall Street which saw another sharp dip at the open, only to close broadly flat on the day (although well off the highs of the day in the end). There was strong data yesterday from the US, with weekly jobless claims at record lows and a good pick up in Industrial production. However it is clear that more good news is needed if the market is to allay concerns over a global economic slowdown. The volatility remains elevated in the market though with the VIX still at 25 despite dropping by 4% on the day. Asian markets have also been swinging around overnight, with the Nikkei well over a percent lower. The European markets are continuing to recover in the early exchanges.

In forex trading, there is an element of calm that has moved through the markets. Although there is just the slightest hint of a positive dollar bias, it is nothing of any real note. The Yen is though trading slightly stronger today. Maybe traders are settling in for what could be an interesting day of economic data. After a quiet morning and Canadian CPI at 13:30BST (2.1% expected) we are dealt a healthy dose of US housing data, with Building Permits at 13:30BST (+2.7% forecast) and Housing Starts (+5.1% forecast) both of which will be of interest after the disappointing Housing Market Index yesterday. There is also the University of Michigan consumer sentiment at 14:55BST which is expected to show a slight dip to 84.1 (from 84.6 last month).

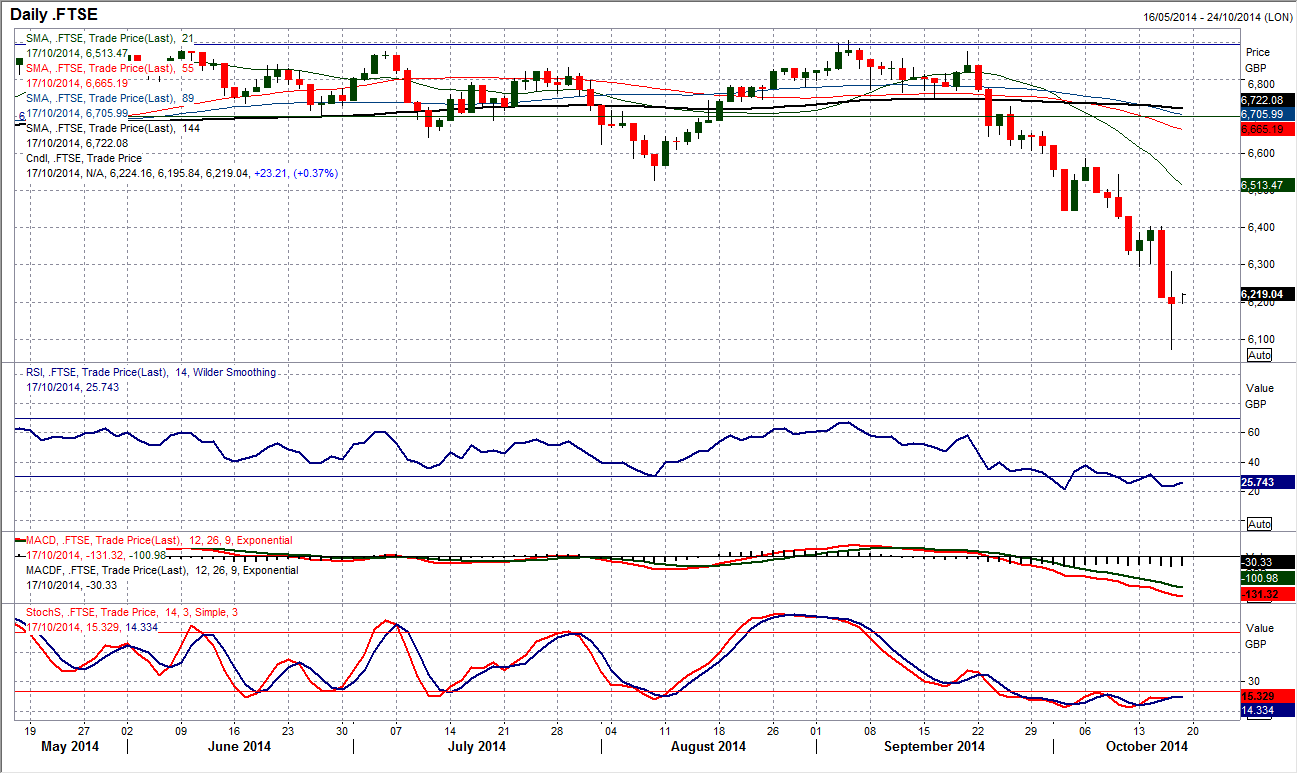

Chart of the Day – FTSE 100

The incredible volatility continued yesterday, with sharp swings first higher, then lower, only for the FTSE 100 to close with just minor gains. The result is the appearance of a very uncertain candlestick on the chart which could almost be classed as a “long legged doji”. This signifies a lack of conviction with the prevailing trend, but also depicts the volatility in the market. The momentum indicators are not really showing any real signs of an imminent recovery, but the daily studies are looking oversold with RSI at 23. The rebound has moved to test the initial resistance at 6210, with the more serious resistance coming in around 6300 and then up at 6400. However, these levels are quite wide due to the volatility and perhaps as the index begins to settle down, the index can build on yesterday’s low at 6075. However, I am still not sure that the wild ride is over quite yet.

EUR/USD

The incredible volatility continued yesterday with another trading daily range of well over 100 pips. I talked about the pivot level at $1.2700 (which was previously a neckline of a base pattern) and did not expect it to be hit yesterday, but a spike low during the day hit it almost to the pip at $1.2704 before a sharp rebound. Therefore despite the volatility, the euro continues on a slightly positive bias and whilst it continues to trade above $1.2700 near term this will remain the case. The daily technical continue to suggest an improvement in the near term outlook, however it is still difficult to know whether this is merely unwinding the medium term oversold outlook before another chance to sell. The RSI is now up at over 50, with the Stochastics over 60, so the euro will need to continue the near term bull bias and push above the spike high at $1.2885, with a move above re-opening $1.3000 again. A failure of $1.2700 would pile the pressure back on the euro.

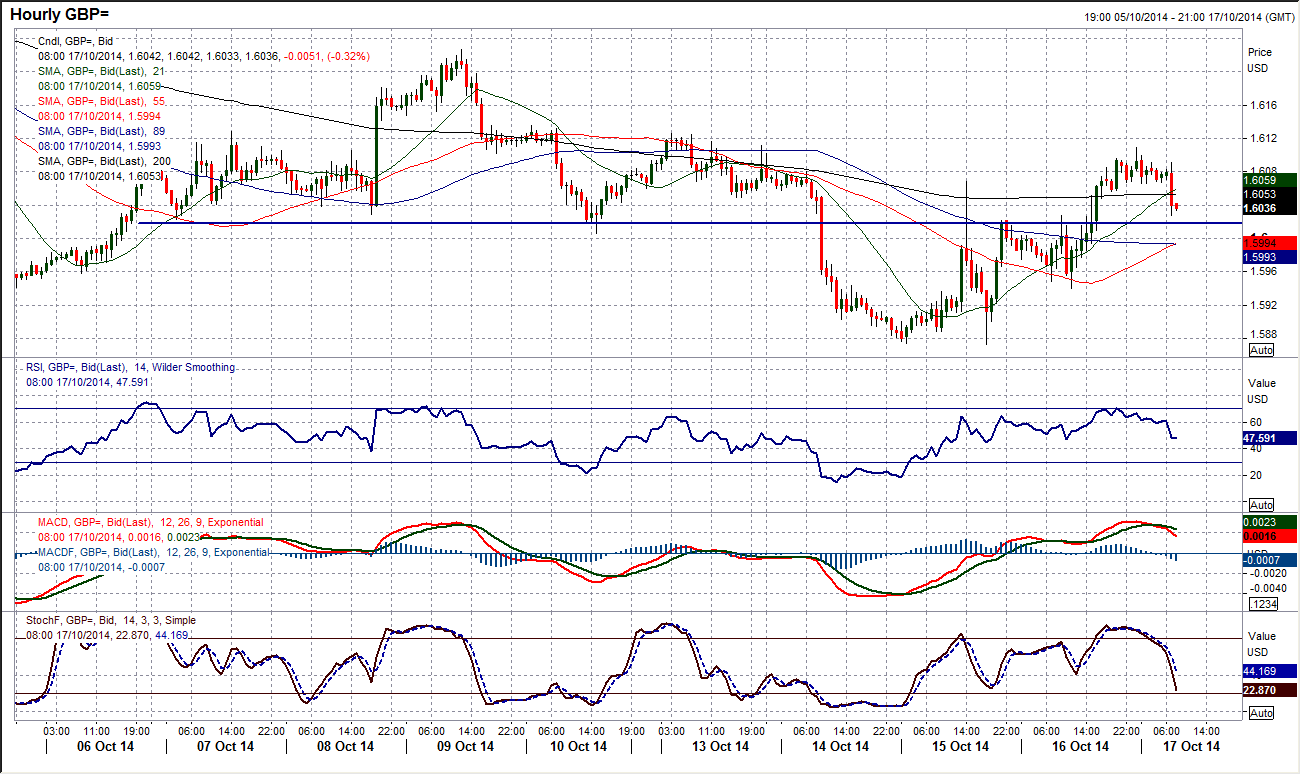

GBP/USD

Sterling was able to muster a second straight positive day yesterday. Despite this though there is still an expectation that the sellers will resume control at some stage soon and Cable will be dragged lower once more. The momentum indicators have marginally improved but are still in medium term bearish configuration. The rebound would certainly need to break above the initial resistance at $1.6126 to improve the near term outlook, but with the barrier of the 12 week downtrend and the key near term resistance both coming in around $1.6226 the upside may be limited. Although Cable has been volatile in recent sessions, I still expect a retest of the 1.5873 low in due course. The early European session has seen the pressure back to the downside and a break back below the near term pivot level at $1.6020 would be neagative once more. The initial support is then at yesterday’s low of $1.5940.

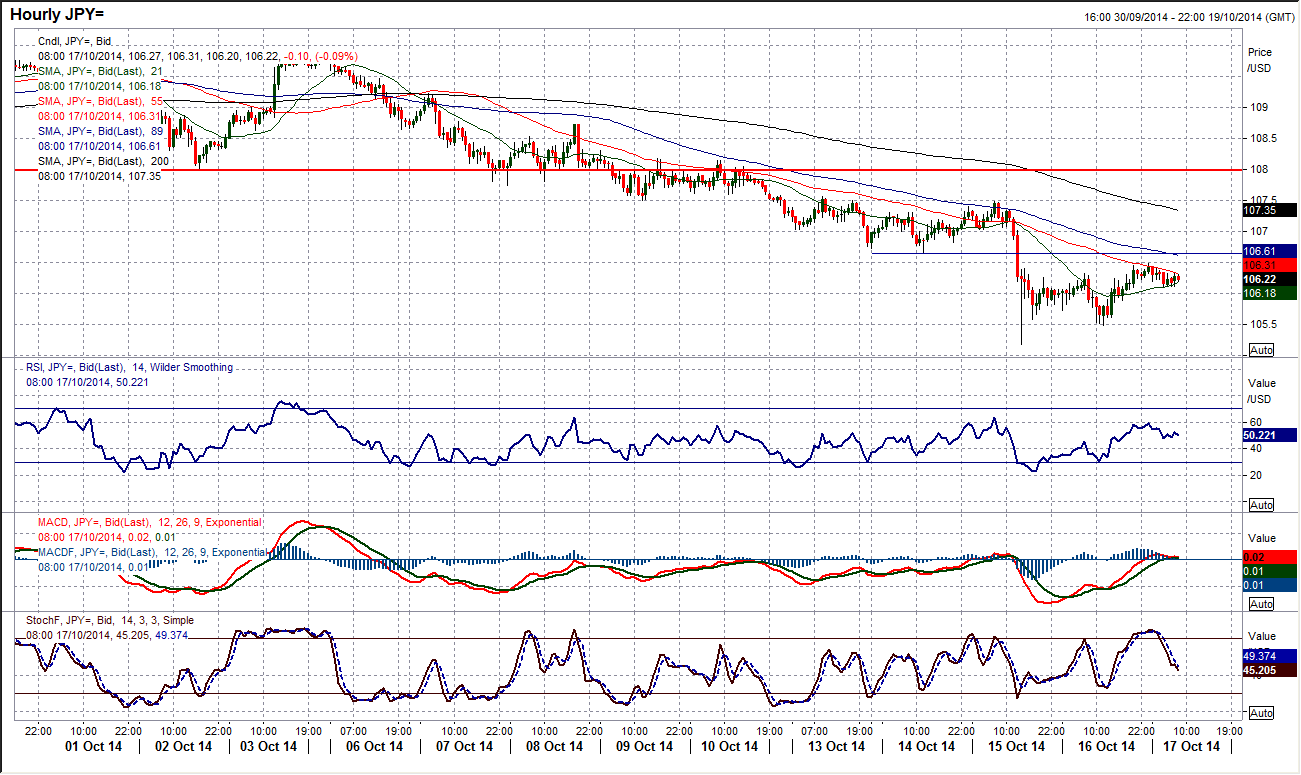

USD/JPY

The signs are that after the sharp spike lower of Wednesday, Dollar/Yen is beginning to settle down. Despite this though, there was a daily traded range just shy of 100 pips, However with support looking to build now at 105.50, above the spike low at 105.18, we can begin to assess the damage. The initial resistance at 106.50 is just holding back a rebound in the very near term, whilst the barrier of a falling 89 hour moving average comes in around 106.60. On the daily chart I have been interested in the bull cross on the Stochastics, but we are still waiting for the confirmation move back above 20. Furthermore, the MACD lines continue to decline, although the RSI is also beginning to show signs of medium term improvement. I am still waiting for the medium term buy signal therefore, but with the pair beginning to settle the signs of improvement are there.

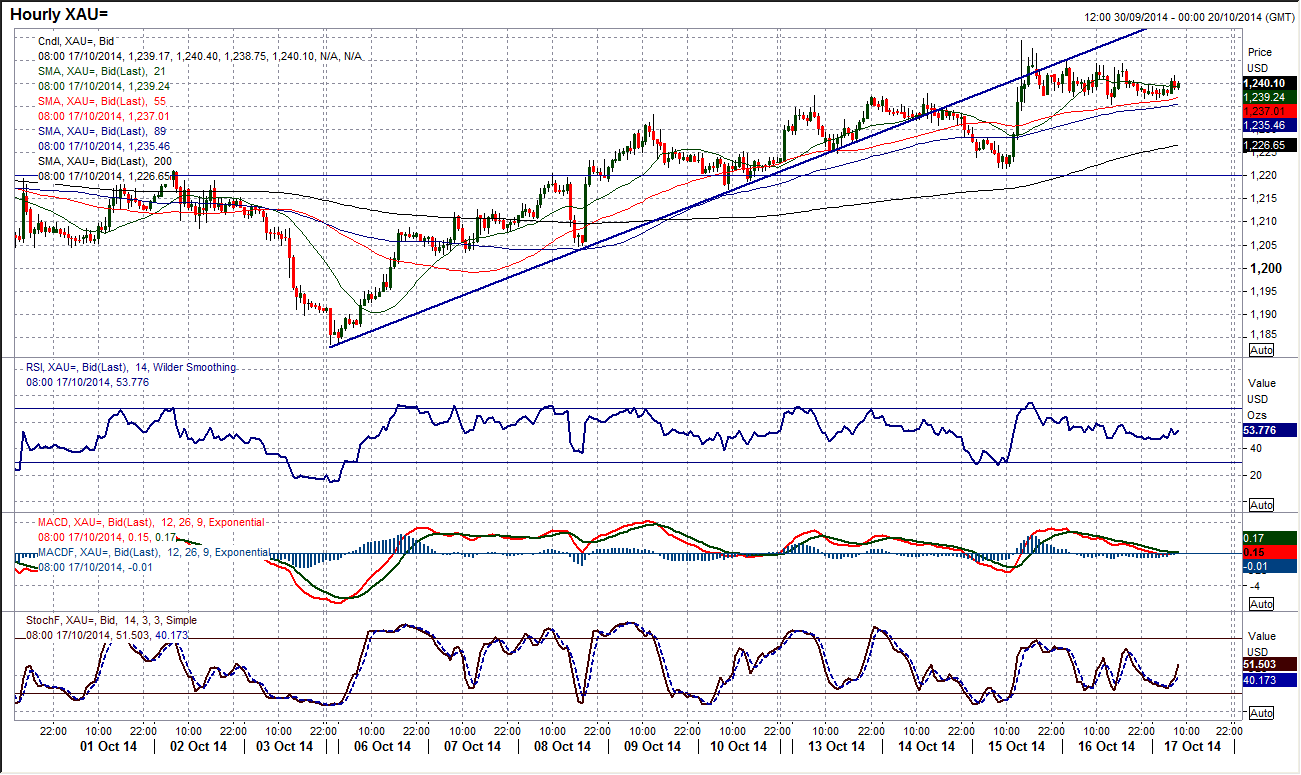

Gold

Despite the best efforts of gold, spending much time intraday trading above the key medium term resistance at $1240.60, I am still waiting for the close above the ceiling to suggest that the market is accepting a breakout. We have now had a second session with a failure to achieve that break. The big question is whether the bulls begin to get tired. A look on the intraday hourly chart shows that the price has actually settled into a sideways range between $1235.35 and broadly below $1245. With this consolidation that has built I am adding an extra element to my confirmation signal. I now believe that not only do we need the close above $1240.60 (arguably a two day close above would be safer), but also I believe there needs to be a push above the consolidation band, above $1245. If these conditions are met then I am happy to believe the bulls are backing a breakout and we can start looking towards $1260 and maybe $1280. It is clear that the bulls are having a good think about this range and in volatile markets I would not like to be premature with a false break.

WTI Oil

A rise in the oil price could be seen as a signal for a bottom in the recent sell-off. Yesterday, the price of WTI fell briefly below $80 but then managed to stage an intraday recovery that resulted in a bullish key one day reversal. This is the first properly bullish signal in weeks and with the strength of the buying pressure is something to sit up and take note of. Now this needs to be followed up by another positive day today. There is immediate resistance now from yesterday’s high at $84.83 and before we get carried away, there was a positive session on Monday before a resumed sell-off. However, if you look on the intraday hourly chart the move yesterday completed a small base pattern above $82.50 which now becomes a basis of support. It remains too early to call a bottom in oil, however as I said yesterday, there are some extreme signals beginning to come through. Breaching the $79.78 low once again re-opens the $77.28 June 2012 critical low.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.