Market Overview

Markets are starting off an incredibly important week in a reflective mood, coming on the back of a strong end to the week on Wall Street. Asian markets were mixed overnight with the Nikkei 225 continuing to benefit from the weakness of the yen, whilst investors are also keeping an eye on events in Hong Kong where democracy protests continue. European markets are slightly higher in the early moves today, although it could be a case of the calm before the storm that is to come this week.

In forex trading, the US dollar is showing slight gains, dragging on the Aussie dollar and the yen especially. Traders will be looking towards the flash German CPI inflation data which is released at 13:00BST, with euro traders especially interested to see if the reading drops from last month’s 0.8% (the forecast is to remain flat at 0.8%). The US pending home sales will also be of interest at 15:00BST. Coming after the New Home Sales smashed expectations, expectations are for a fall of 1.4%.

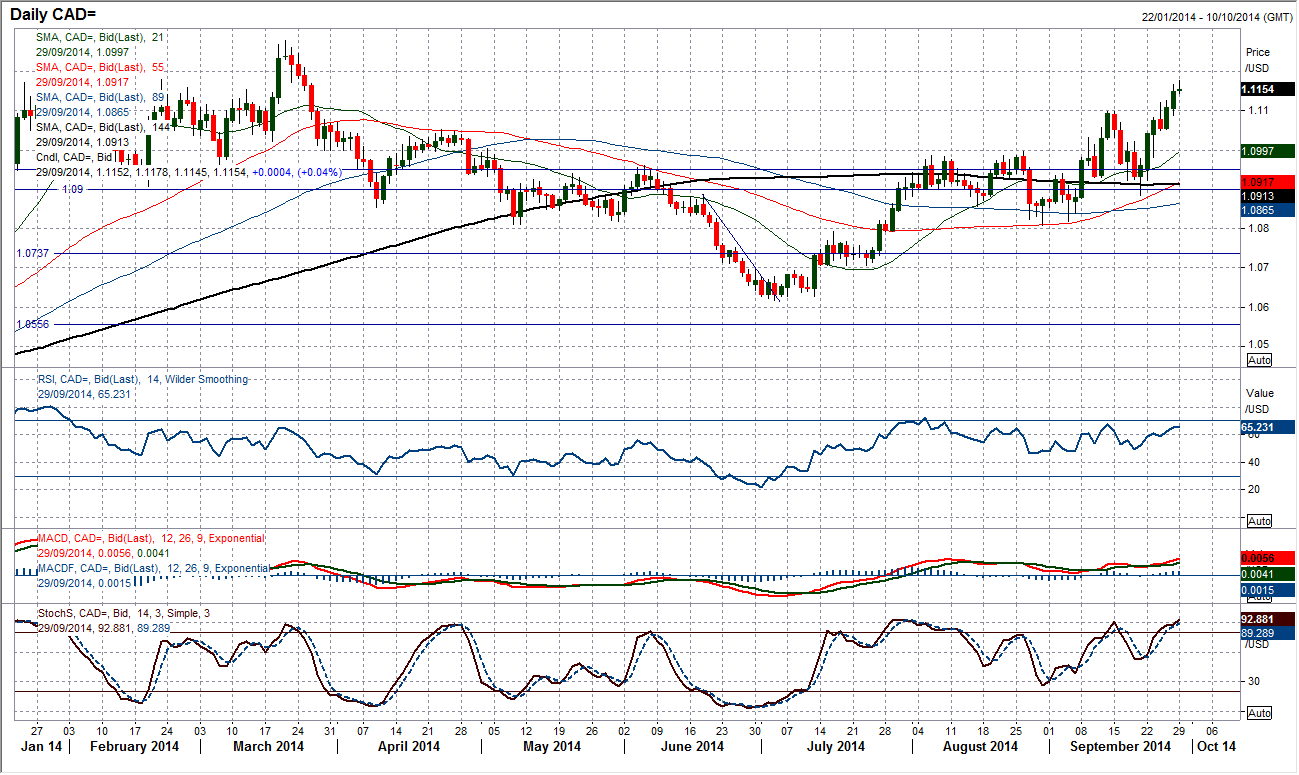

Chart of the Day – USD/CAD

The mid-September move above $1.1000 was the key breakout and since the move, USD/CAD has been building for the bulls to break higher once more. Having left a minor reaction high at $1.1100, last week this resistance was taken out as the bulls once more pushed on. There is little resistance now until the key March 2014 high at $1.1278. In the very near term, chasing the price higher may not be the best plan, as there tends to be a week or so of gains prior to a consolidation/minor retracement, that helps to unwind momentum. In the last couple of months of US dollar strength, the RSI has tended to become stretched around 70 and it is currently around 66. This suggests that there is still some upside momentum, but that there could be a better entry point. The hourly intraday chart shows a band of support is now between $1.1080/$1.1120 which could be seen as a buy zone, whilst there is also a key higher low near term at $1.1050.

EUR/USD

Even the intraday consolidations are now being sold into. On Friday, an intraday rebound of over 50 pips formed resistance around $1.2760 before the sellers once more moved in. Use rallies to sell. This sounds like a very obvious strategy, but there is little more that can be done. Through the course of September there has been a rally of over 100 pips just once. Most rallies last for between 50 to 80 pips before running out of steam and being sold off in the next leg lower. All technical indicators on the daily chart are in bearish configuration and there is little reason to suggest this outlook will not continue. There is a support at $1.2660 which is the November 2012 low, but once that is cleared then the next support is not until $1.2500.

GBP/USD

After pressurising support around $1.6280 on several occasions throughout the week, Friday afternoon saw the support breached which changes the whole outlook of the chart once more. The recovery within the downtrend has now rolled over and the bears seem to be back in control. The concern is that the RSI now suggests renewed downside potential and the MACD lines along with the Stochastics are in bearish configuration. A test of the higher low at $1.6160 appears to be on the cards now. The intraday hourly chart shows a whole range of disappointments for the bulls, with a broken uptrend, a series of lower highs now in place (the latest at $1.6340) and now the old support at $1.6280 which is now a new basis of resistance. Hourly momentum has also taken on a bearish configuration and suggests that rallies are now a chance to sell.

USD/JPY

The bulls just could not wait any longer as the consolidation has once more burst to the upside. This continues the well-defined uptrend over the past four weeks and once more takes Dollar/Yen into a new multi-year high. The move towards the next resistance at 110.65 (from August 2008) is back on, which coincidentally is almost to the pip the 120 point upside target from the consolidation breakout. All momentum indicators are in bullish configuration and show little reason to suspect the upside target will not be achieved. There is now a minor band of support 109.20/109.45 that may be seen as a chance to buy if there is a pullback near term. The key support is now at 108.24.

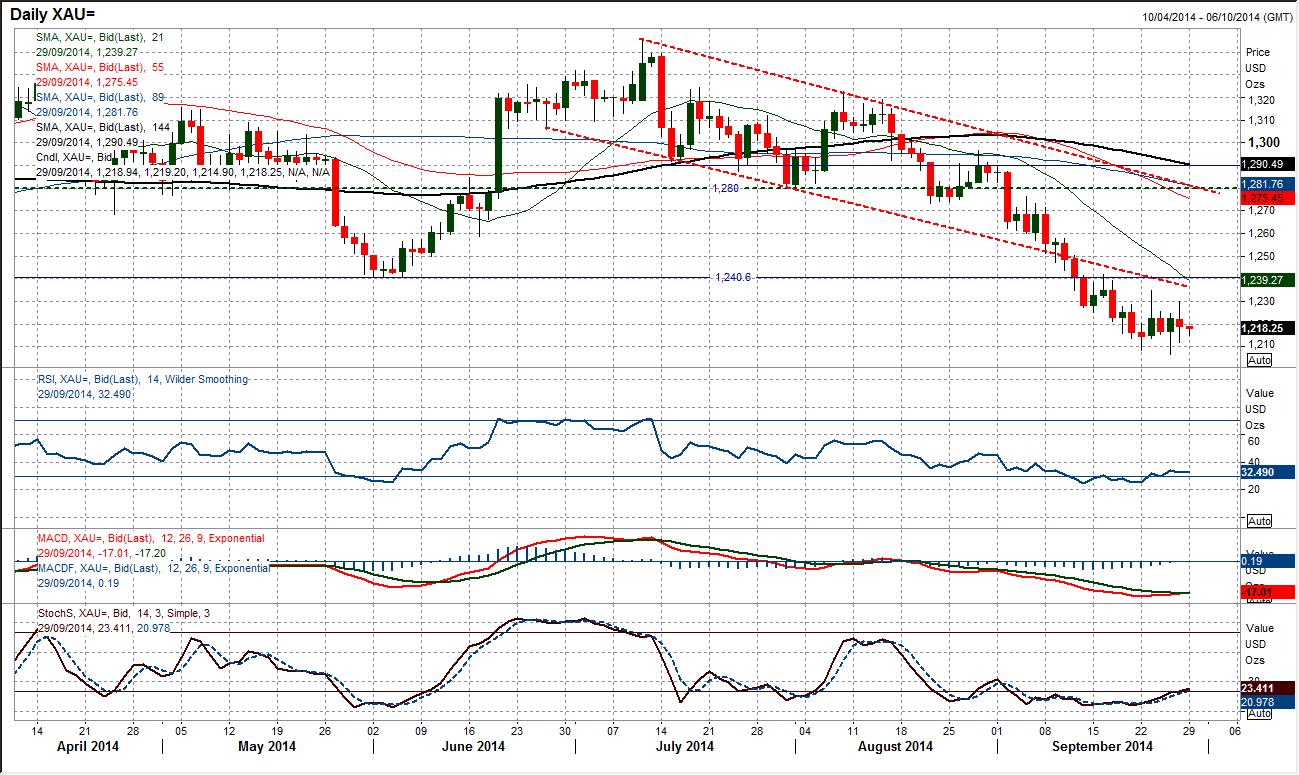

Gold

Although there is an over-riding bearish control to the chart, gold has been consolidating for the past week. However consolidation does not mean to say that the price has been flat. In that time there has been a $26 range and fluctuating price conditions. However there are a couple of lower highs (the latest at $1230.00 and $1234.80) within that consolidation, whilst the price continues to flounder under the resistance of the old downtrend channel. The MACD and Stochastics may be gradually picking up but I am still of the opinion that with the strongly bearish outlook, this should just be taken as a warning for short positions, rather than a signal for potential longs (which I see as being very risky). I am still happy to be selling into strength for the move to $1200, before likely move to $1184.50.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0650 after US data

EUR/USD retreats from session highs but manages to hold above 1.0650 in the early American session. Upbeat macroeconomic data releases from the US helps the US Dollar find a foothold and limits the pair's upside.

GBP/USD retreats toward 1.2450 on modest USD rebound

GBP/USD edges lower in the second half of the day and trades at around 1.2450. Better-than-expected Jobless Claims and Philadelphia Fed Manufacturing Index data from the US provides a support to the USD and forces the pair to stay on the back foot.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.