Market Overview

A difficult start to the week has curbed the bulls on Wall Street, after indications from China are that monetary policy stimulus would not be knee jerk to disappointing data. This resulted in a decline on the S&P 500 by 0.8% as the index fell back below 2000 once again. The Asian markets reacted with support after the better than expected Chinese HSBC Flash Manufacturing PMI rose to 50.5 from 50.2 last month and ahead of the 50.0 forecast. European markets are mixed in early trading.

In forex trading, the dollar is seeing a second day of weakness and is losing ground against all major currency pairs with the exception of the euro. The commodity currencies such as the Aussie and Canadian dollars are especially positive following the improvement in the Chinese MI data. Traders have got much to keep them occupied in the European session, with flash PMIs out of France and Germany and also the broader Eurozone. The German data will be especially watched as it is expected to continue to deteriorate to 51.2 (from 52.0) at 08:30BST. The UK gives it public spending figures at 09:30BST. At 14:45BST there is also the flash manufacturing PMI for the US which is expected to stay flat at 58.0.

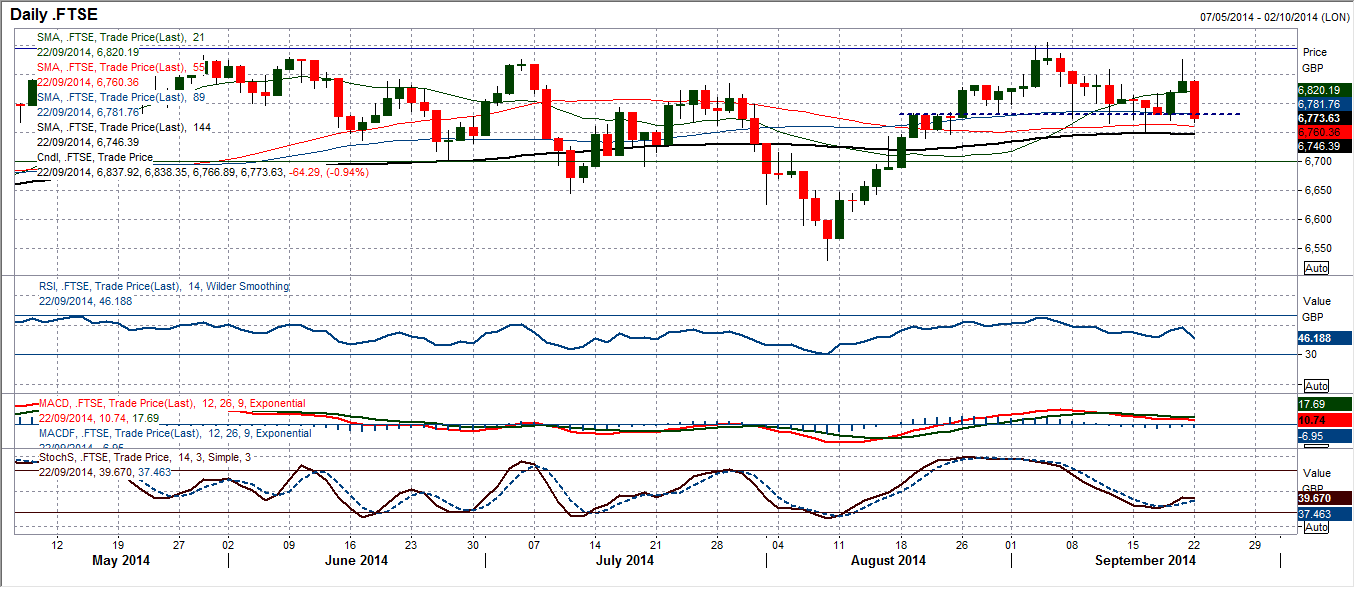

Chart of the Day – FTSE 100

Last week just prior to the relief rally with a “No” vote in the Scottish independence referendum, the FTSE 100 looked to be forming a top pattern. That relief rally has quickly been reversed and yesterday there was a close at 6773 which I had previously been looking at as a trigger for the completed top. This is now the FTSE 100 closing at a 1 month low and the bullish momentum from an August rally is dissipating. The completed top implies 6640 and the pressure to the downside is growing. The daily momentum indicators are deteriorating, with the RSI confirming the top and the near to medium term outlook is increasingly negative. There is now a band of resistance on the intraday chart between 6800/6820 which would now need to be overcome for the bulls to avert the immediate downside pressure.

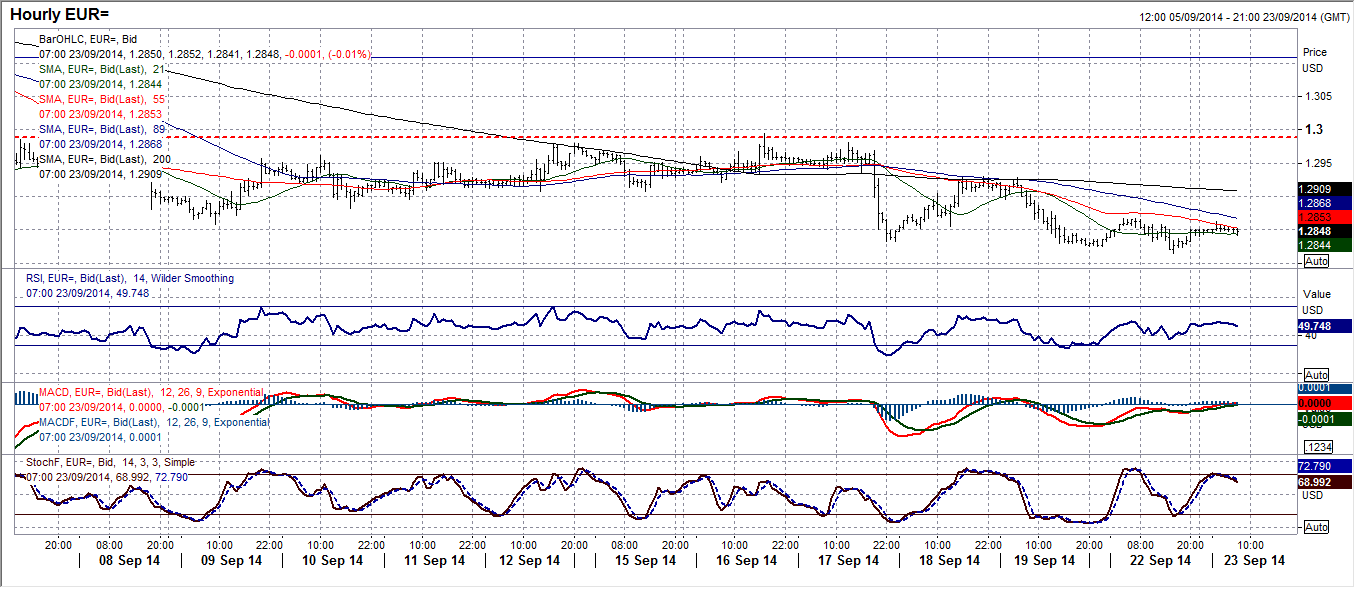

EUR/USD

The euro is still under pressure. The rallies just do not seem to be able to gain any traction before the selling pressure resumes again. In the past week there have been two separate days when the bulls look to be mounting a recovery, but the move is cut down by a sharp sell-off that just takes out a load of support and the stepped decline continues. Yesterday saw a slight rally off $1.2814, but looking at the daily momentum indicators the move just looks to be just another chance to sell. The very slight bullish divergence on the RSI is the only indicator that suggests there could be a chink of light for the bulls. However with all other indicators so bearish, the expectation is for further downside to the $1.2786 initial support of the 61.8% Fibonacci retracement of the $1.2040/$1.3991 bull run, in addition to the potential for a retest of the July 2013 low. The intraday chart shows an initial resistance at $1.2867, but $1.2930 is the main level the bulls will need to breach now near term.

GBP/USD

I spoke yesterday about some key support now beginning to form on Cable and that as the volatility settles down the outlook is beginning to improve. Not only has the gap at $1.6282 been bullishly closed, it also held again to the pip as support before pushing higher again. The strong positive candle from yesterday has gradually continued into today. The daily momentum indicators are all in recovery mode and suggest the rebound has some backing. The resistance of the big 10 week downtrend is the next test that is approaching for the recovery. The trend resistance comes in at $1.6389, and then above there is the 61.8% Fibonacci retracement of the $1.6644/$1.6050 sell-off at $1.6420. The intraday hourly chart now also reflects a fairly calm push higher over the past 36 hours and that if the move can get above $1.6400 the way is open towards a retest of the reaction high at $1.6525.

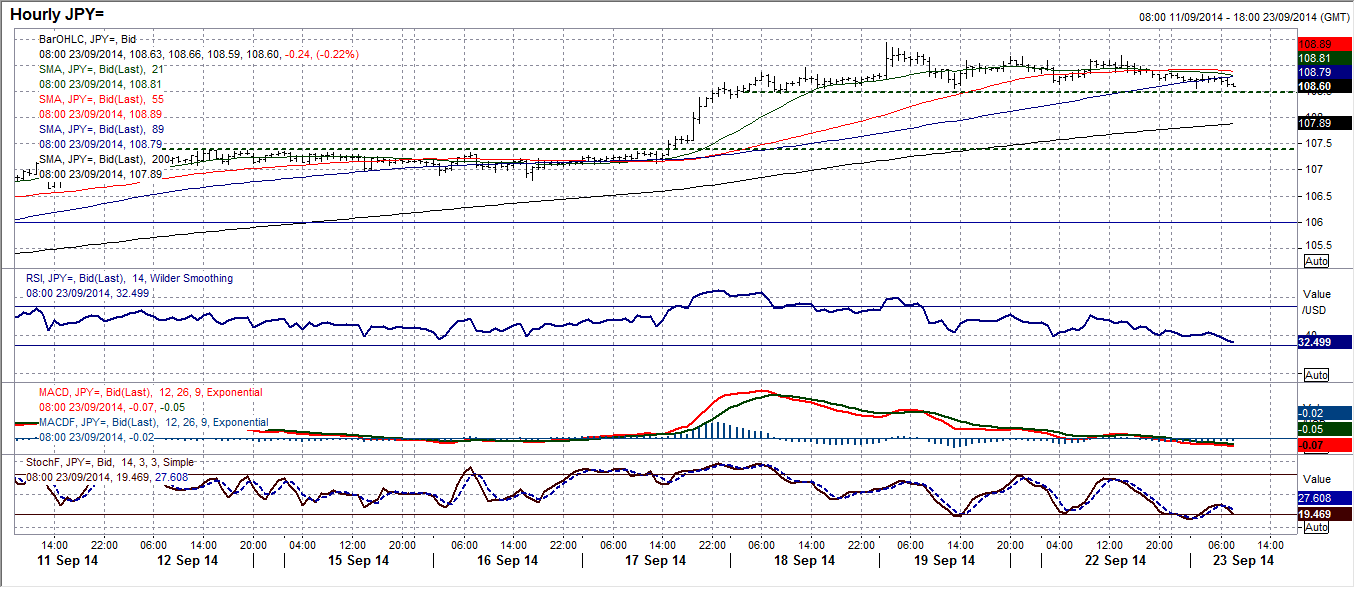

USD/JPY

Having be so strongly behind the dollar rally over the past few weeks, I am now in wait and see mode as the consolidation is threatening to form an intraday top pattern. The support at 108.48 is intact and guards against a near term top pattern completing that would imply a correction back towards 107.50, whilst the initial old breakout support comes at 107.40. the hourly momentum indicators have been falling away for the past couple of days now and this is a concern, certainly with the hourly MACD lines now turning negative. If the hourly RSI begins to fall below the 40 mark which has been a low over the past 48 hours then the prospects of a near term top will grow. A move above the 109.19 resistance of yesterday’s high would improve the outlook. Key resistance is now 109.45. I am still a buyer into a correction for the medium term move towards 110.65.

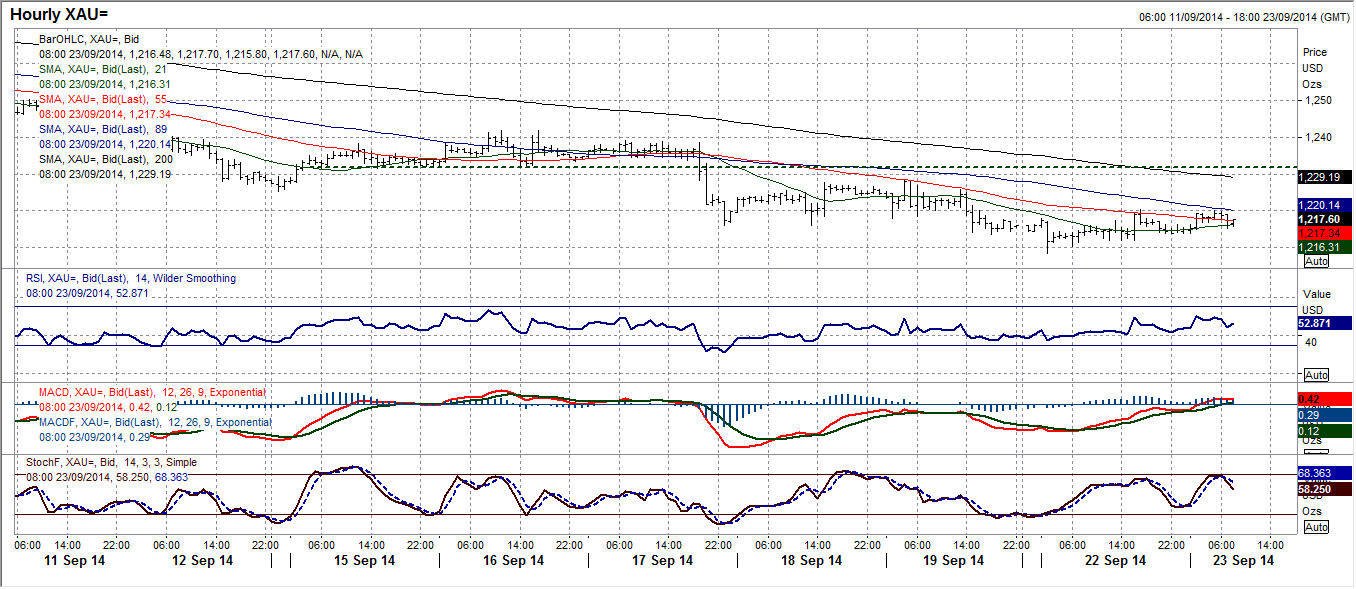

Gold

With rallies consistently being seen as a chance to sell, the slight rebound in the price yesterday has moved into today and once more traders will be on the lookout for another selling opportunity. With all the momentum indicators remaining incredibly weak the outlook continues to suggest further weakness towards at least the $1200 implied target from the breakdown of the downtrend channel and ultimately a test of the December 2013 low at $1184.50. The intraday chart shows that the hourly momentum indicators have already unwound, whilst the price is now back into the initial band of resistance around $1200 and recovery could already begin to struggle. Further overhead supply resistance comes at $1228.60 and $1231.60, whilst the key resistance comes in around the $1240.60 breakdown of the old key June 2014 low. A break under yesterday’s low at $1208.36 re-opens the downside once more.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.