Market Overview

Scotland has voted and the UK remains intact. Investors in UK can assets can breathe a big sigh of relief, with further rebound gains on Cable and a strong open on the FTSE 100. This also follows another strong day on Wall Street where the S&P 500 was around 0.5% higher. Asian markets were also boosted overnight by the news that Japanese Prime Minister Shinzo Abe would push through reform of the Government Pension Investment Fund. Across the board, European markets have opened strongly.

In forex trading, the dollar has continued to be strong against major currencies and is only trading weaker against sterling as the pound continues its relief rally. There is not too much on the radar for traders today, with Canadian CPI at 13:30BST and forecast to remains flat at 2.1%, whilst the US leading indicators are at 15:00BST and are expected to drop to 0.4 (from 0.9).

With the apparent doomsday scenario averted for UK assets that would have come with a “Yes” vote, trading can begin to get back to normal. It may take a few days for markets to settle and once again be properly priced especially on Cable and Euro/Sterling, but also UK equities too. Volatility levels will be high through today, but will therefore gradually reduce as traders’ focus begins to move elsewhere.

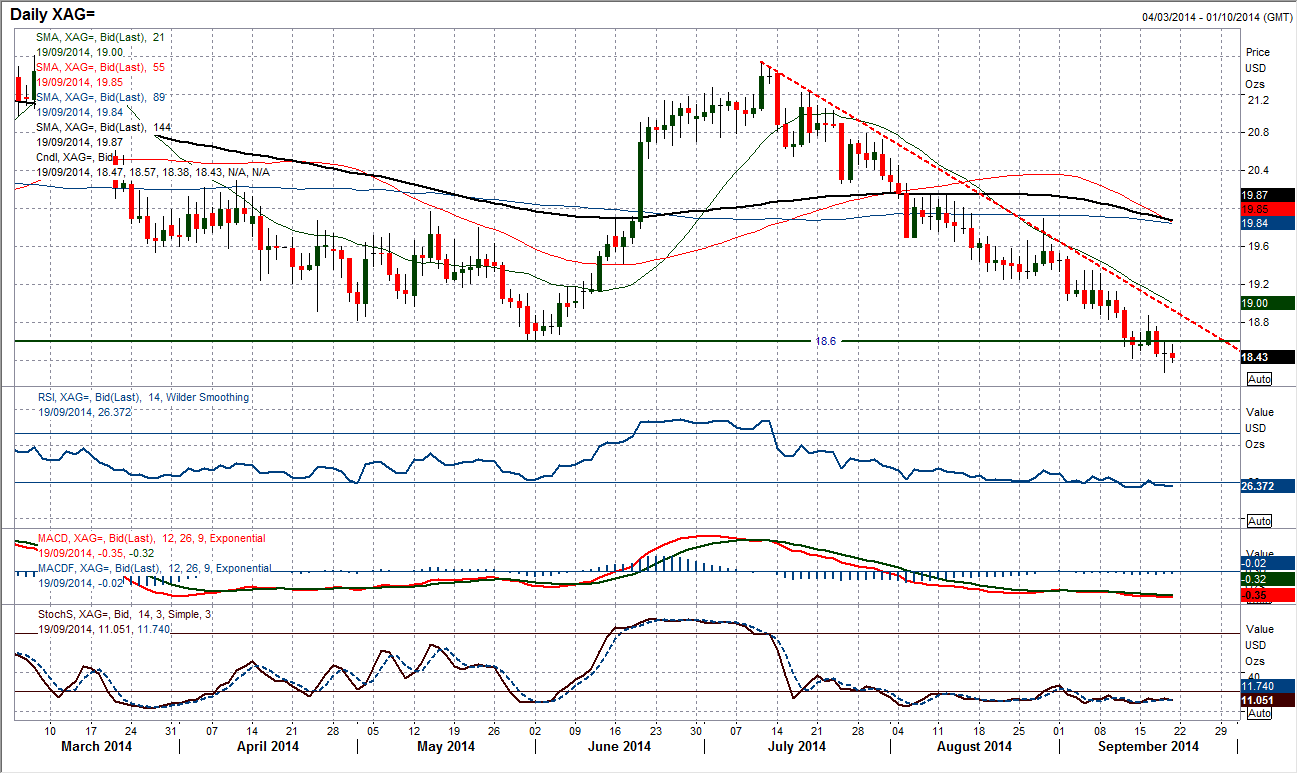

Chart of the Day – Silver

Silver continues to trade in a well-defined downtrend which is being flanked by the 21 day moving average which is currently falling at $19.00. Momentum indicators remain incredibly weak and suggest there is little other strategy other than using intraday bounces as a chance to sell. There have now been several closes below the key support of $18.60 and this suggests that silver should now continue to fall back towards a test of the key June 2013 low at $18.19. The initial resistance is being found at $18.60, but more important is Tuesday’s peak at $18.87. On a longer term note also, there has also been a death cross on the 55 and 144 day moving averages which suggests a bearish medium term outlook. There would need to now be a move above the $19.89 reaction high for the bulls to even consider being in the ascendency now.

EUR/USD

The rebound from the latest downside break has brought the euro back into the band of resistance between $1.2900/$1.2950 and at the moment simply looks like another chance to sell. The daily momentum indicators have picked up but are still suggesting that rallies acre a chance to sell, with the Stochastics flattening and the MACD lines still negative. There is arguably a slight bullish divergence on the RSI but the bearish outlook on the price suggests that there would need to be far more confirmation on other indicators before getting overly excited. The intraday chart shows a loss of recovery impetus into last evening which has been seen around a cluster of falling hourly moving averages. The outlook remains firmly one of selling into strength and this looks to be another opportunity. The outlook would change on a sustained break above $1.3000.

GBP/USD

Trading in Cable has been relatively orderly considering what might have been. It seems as though the Scottish independence vote has passed fairly comfortably with a “No” victory as a silent majority have come out in support of the Union. Cable has pushed higher in the past 24 hours, but the markets had already been preparing for the result, adding 125 pips yesterday in fairly steady fashion. With many European traders starting early the volumes have been much higher than normal for those hours, but as the morning has developed, the trades have taken on a less orderly pattern and volatility remains high. Much of the sell-off from $1.6600, from which Cable started to drop as the opinion polls tightened a couple of weeks ago, has now unwound. Today can be expected to remain rather volatile. Traders must now re-price sterling in a status quo but also factor in the strength of the dollar over the past couple of weeks. It may take Cable a day or two to settle back into normal trading conditions, at which point we can take a step back and assess the technical aspect. For now, the overnight peak has been at $1.6525 and there are support levels that have been left on the way up at $1.6400 and $1.6350.

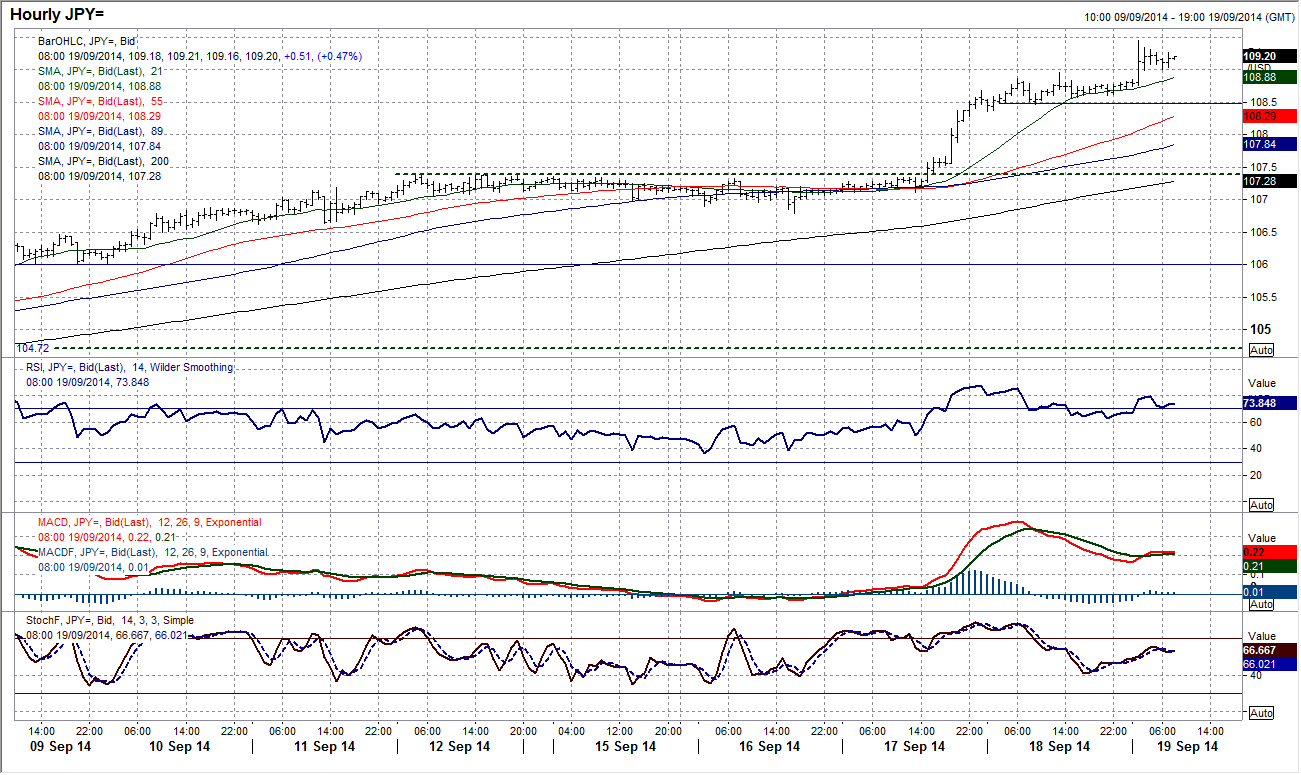

USD/JPY

The bulls just keep ploughing on as Dollar/Yen continues ever higher towards a test of 110.65 which is the August 2008 high. Momentum indicators remain strong and if anything seem to be getting stronger, with no apparent sign of slowing of momentum on the daily chart. The intraday chart shows a consolidation throughout yesterday between 108.50/109.00, but once more that was resolved to the upside with another upside break overnight. The only caveat of any note is a slight bearish divergence on the hourly momentum indicators with the overnight move. The support band is now 108.50/109.00 and with no real instance of a breakdown of a previous reaction low for several days and several hundred pips below, the support at 108.50 could become a near term indicator of strength.

Gold

A slight rebound in yesterday’s trading still seems to be little more than a consolidation within the bear run. The intraday hourly chart shows a resistance between $1225/$1231 that is the immediate overhead supply to contain the rally. Hourly moving averages are also acting as resistance, whilst the momentum indicators suggest that the move has unwound oversold momentum and is helping to renew downside potential. The daily chart shows that the breach of support around $1240 was key as this opened the crucial December low at $1184.50. With the daily RSI still below 30 there is always the prospect of a technical rally, but the serious resistance starts around $1240 and is a barrier towards $1260 and higher. I still view bounces as a chance to sell.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.