Market Overview

If yesterday’s price action is anything to go by, traders certainly appear nervous about what this latest Fed meeting could contain. Comments by a respected journalist at the Wall Street Journal (Jon Hilsenrath), who is supposedly close to members of the FOMC suggest that the wording on the Fed statement will not be changed and the market took it that the Fed would remain dovish. Such is the impact of just a few words, equity markets jumped and the dollar was hit. Wall Street subsequently closed strongly with the S&P 500 up three quarters of a percent. Asian markets though did not follow the lead, finishing much in a mixed outlook. The stimulus announced by the People’s Bank of China amounting to around $82bn of liquidity to the 5 top Chinese banks failed to drive markets higher in the region European indices are though looking positive in early trading.

The US dollar is showing slight strength as the greenback regains some of its poise against the major currencies after yesterday’s wobble. However, sterling has been able to muster some support as a series of polls out yesterday evening suggested a trend towards a tight victory by the “No” campaign.

Traders will be looking out for the meeting minutes from the Bank of England today at 09:30BST. Last time out there were two members of the MPC voting for a 25 basis point rate hike, noting that wages were ready to start moving higher again. There is no expectation of any change to this 7:2 split today. There is also the US CPI inflation data at 13:30BST which is expected to show a very slight dip in the reading back to 1.9% (from 2.0% last month). However with the result of the FOMC meeting to be announced tonight at 19:00BST the market will be keeping one eye on the Fed throughout the day.

Chart of the Day – Brent Crude Oil

The sharp rebound in the oil price yesterday was the strongest move for the bulls in two weeks, however there is little to suggest this is anything more than a near term bounce. Brent has been in a downtrend channel for three months now and this looks to simply be another bear rebound within the channel which will give another chance to sell. The momentum indicators all remain in negative configuration. The RSI is just unwinding back towards neutral, whilst MACD and Stochastics suggest that once indicators have unwound the price is likely to fall away again. There is minor resistance at $100.17, whilst the top of the channel comes in at $101.00. Furthermore, the falling 21 day moving average has become an excellent basis of resistance, currently at $100.79. This all suggests that this rebound is unlikely to last too long and we should be looking once more for the sell signals. It would need in the least a move above $103.40 resistance for there to be any real substance in a recovery.

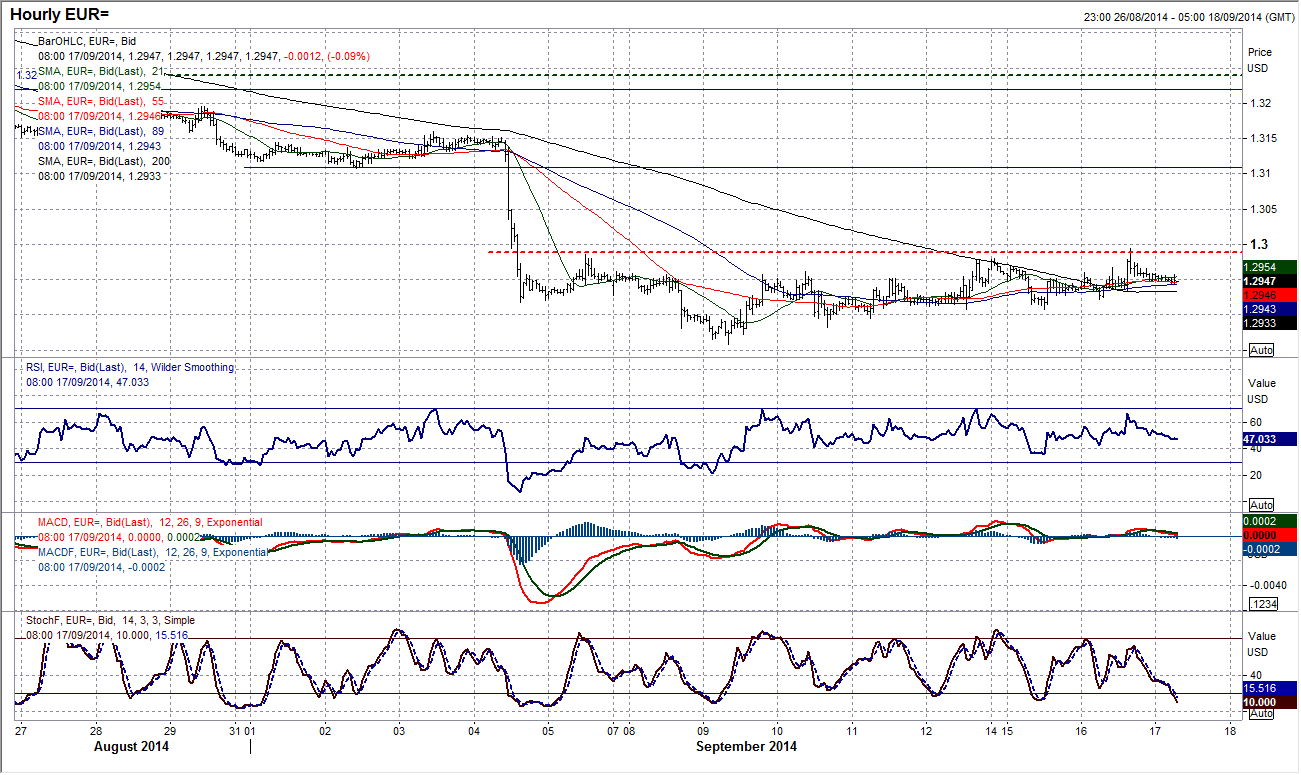

EUR/USD

Despite a small intraday spike higher yesterday, the consolidation continues on the daily chart. The intraday chart shows a very brief move above $1.2986 but the move failed under the psychological resistance at $1.3000 to maintain the recent band of sideways trading. The move came amid reports that the Fed were unlikely to hawkishly change the wording of its monetary policy statement tonight. So we are broadly back to where we were, trading around $1.2950 and traders waiting for the catalyst. There could be a shift today with the US inflation data, but the major focus is now the FOMC tonight. If there is no change and the Fed remains dovish, then expect a pop higher in the euro, a break above $1.3000 opens the upside with little resistance until just above $1.3100. Support within the consolidation comes at $1.2910, $1.2880 and the key low $1.2860.

GBP/USD

Yesterday’s volatile session, of a 150 pip daily range, has thrown up more questions than answers, however in front of the key Scottish independence referendum that is just par for the course. The gap down from $1.6282 has now been filled but has not yet been closed (ie. there needs to be a close above the resistance to suggest the bulls have fully recovered the downside break). This leaves the recovery in a state of limbo. The RSI is now back to where the minor rallies within the downtrend have all faltered, whilst the MACD lines are not suggesting any bullish momentum is building up. The minor gains this morning have taken Cable back to the resistance of the 38.2% Fibonacci retracement of $1.6644/$1.6050 at $1.6278. A couple of fundamental events today could impact on Cable, with the Bank of England meeting minutes and US inflation, and volatility could remain high in front of the Scottish vote.

USD/JPY

Consolidation has built ahead of the FOMC meeting tonight as the recent strong bull run is taking pause for breath. Yesterday’s session has now made it two in a row where there has been a lower daily high, whilst also posting a lower low. These are minor details but all add to the sense that the immediate upside impetus has just been lost slightly. However, the momentum indicators remain strong with the RSI remaining elevated above 80 whilst the MACD and Stochastics are not showing any corrective signals. That would suggest that a correction should still be seen as a chance to buy. The support between 106.50 and 106.00 is good near term as the bulls continue to build control. A break above 107.40 would re-open the upside towards 110.65.

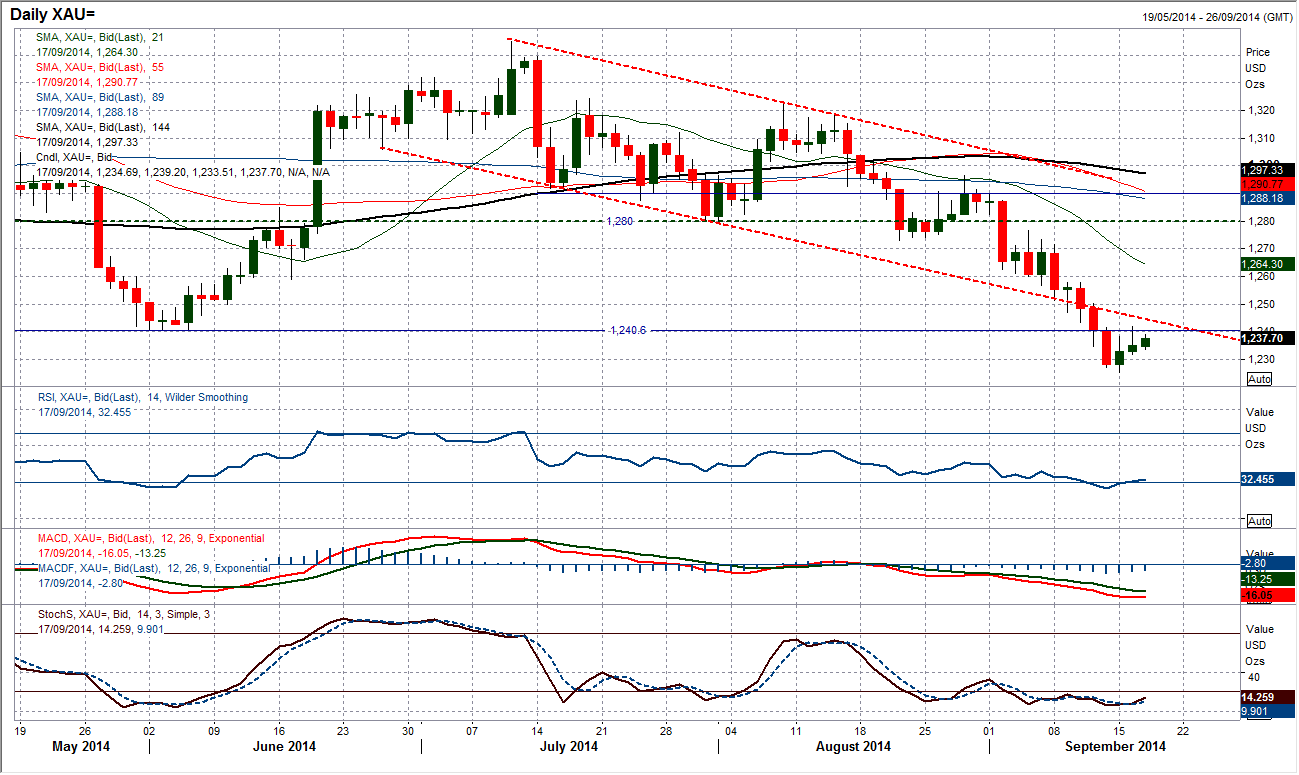

Gold

Recoveries in gold are still a chance to sell. The daily chart suggests that the latest bounce, off the $1225.30 low has been fairly tough (long upside tails on the candles suggest a lack of conviction). The drift higher is still struggling to overcome the initial resistance of the old key low from June at $1240.60, whilst the lower bound of the former downtrend channel is also a barrier around $1245. I still view the series of resistance levels between $1240 and $1260 as an area where the selling pressure will resume and am therefore on the lookout for sell signals. There is little conviction in the momentum indicators which continue to suggest downside momentum is strong and selling into rallies is the correct strategy.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AUD/USD pressures as Fed officials hold firm on rate policy

The Australian Dollar is on the defensive against the US Dollar, as Friday’s Asian session commences. On Thursday, the antipodean clocked losses of 0.21% against its counterpart, driven by Fed officials emphasizing they’re in no rush to ease policy. The AUD/USD trades around 0.6419.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday during the early Asian session. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Runes likely to have massive support after BRC-20 and Ordinals frenzy

With all eyes peeled on the halving, Bitcoin is the center of attention in the market. The pioneer cryptocurrency has had three narratives this year already, starting with the spot BTC exchange-traded funds, the recent all-time high of $73,777, and now the halving.

Billowing clouds of apprehension

Thursday marked the fifth consecutive session of decline for US stocks as optimism regarding multiple interest rate cuts by the Federal Reserve waned. The downturn in sentiment can be attributed to robust economic data releases, prompting traders to adjust their expectations for multiple rate cuts this year.