Market Overview

It seems as though traders and investors are beginning to take provision for the key FOMC meeting tomorrow. Equity markets and forex trading have moves into consolidation mode in front of what could be a meeting where the Fed begins to prepare the market for its path towards tightening monetary policy. Wall Street was mixed into the close, held back by weakness in the tech stocks. Asian markets also failed to make any headway, whilst the European session has started mildly weaker.

The dollar is broadly positive again the major currencies, with the notable move once more being the slide in sterling amid the uncertainty as we move ever closer towards the referendum on Scottish independence. Both the Aussie and Kiwi dollars are still under pressure as the fallout from yesterday’s weak Chinese industrial output weighs on sentiment.

Traders will be looking towards the UK CPI data that is released at 09:30BST. Sterling is unlikely to gain too much support if the expected slide to 1.5% (from 1.6%) is seen. The euro traders will also be watching for the German ZEW economic sentiment which is expected to fall to 4.8 from 8.6 at 10:00BST. This would be a ninth consecutive decline and the lowest since November 2012.

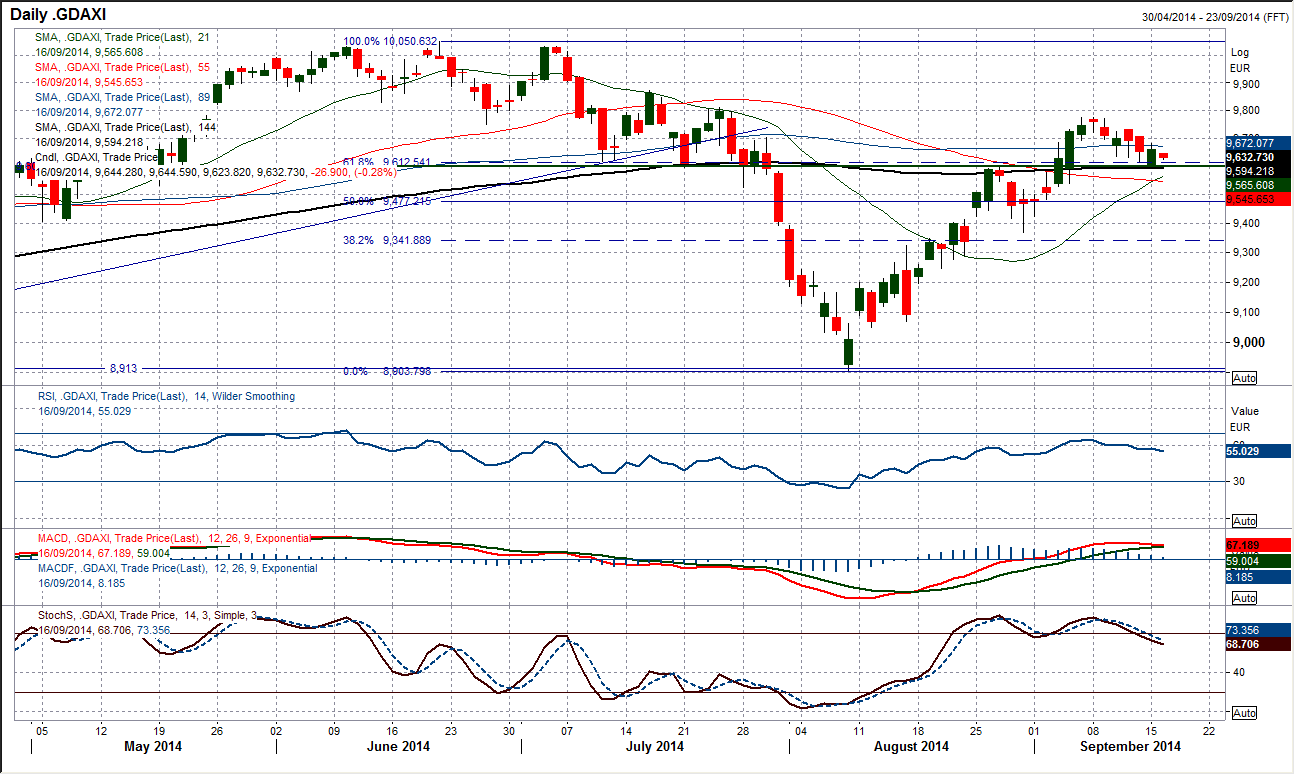

Chart of the Day – DAX Xetra

Having found that 9600 was a barrier to gains on the way up in the recent recovery, the 9600 level is once more pivotal on the way back down again. The support was hit almost to the pip yesterday as a five day corrective drift backwards formed support. In fact the bulls fought back fairly strongly yesterday and it could be important today. If the DAX can move above the lower high at 9733 this would suggest that the bulls are regaining control again. However, there is a medium term concern that is building up now. The DAX has made little headway in the past 10 months with longer term indicators turning neutral. This suggests it is set up for range play momentum sell signals. The MACD crossover sell signals have consistently come before a corrective phase in 2014 and the MACD lines are once more threatening a cross, whilst the Stochastics are also looking increasingly corrective. It would be worth keeping an eye on the momentum indicators for early signals.

EUR/USD

The potential basing process has turned into a sideways consolidation for the euro and it seems for now as though there is a lack of direction. This mood is likely to continue possibly until tomorrow evening when the Fed announces its latest monetary policy update. The positive aspect of EUR/USD is that the selling pressure has abated in the past few days and that the prospects of a base pattern are still reasonably high. The resistance at $1.2986 remains a barrier and the psychological $1.3000 will need to be breached to suggest that a recovery might have some legs in it, whilst intraday momentum indicators are completely neutral. However there is still the feeling that as so often in the past couple of months that consolidations will resolve to the downside. Daily momentum indicators just suggest this is helping to unwind an oversold position, ready to renew downside potential. I still remain a seller into strength and I expect further downside in due course.

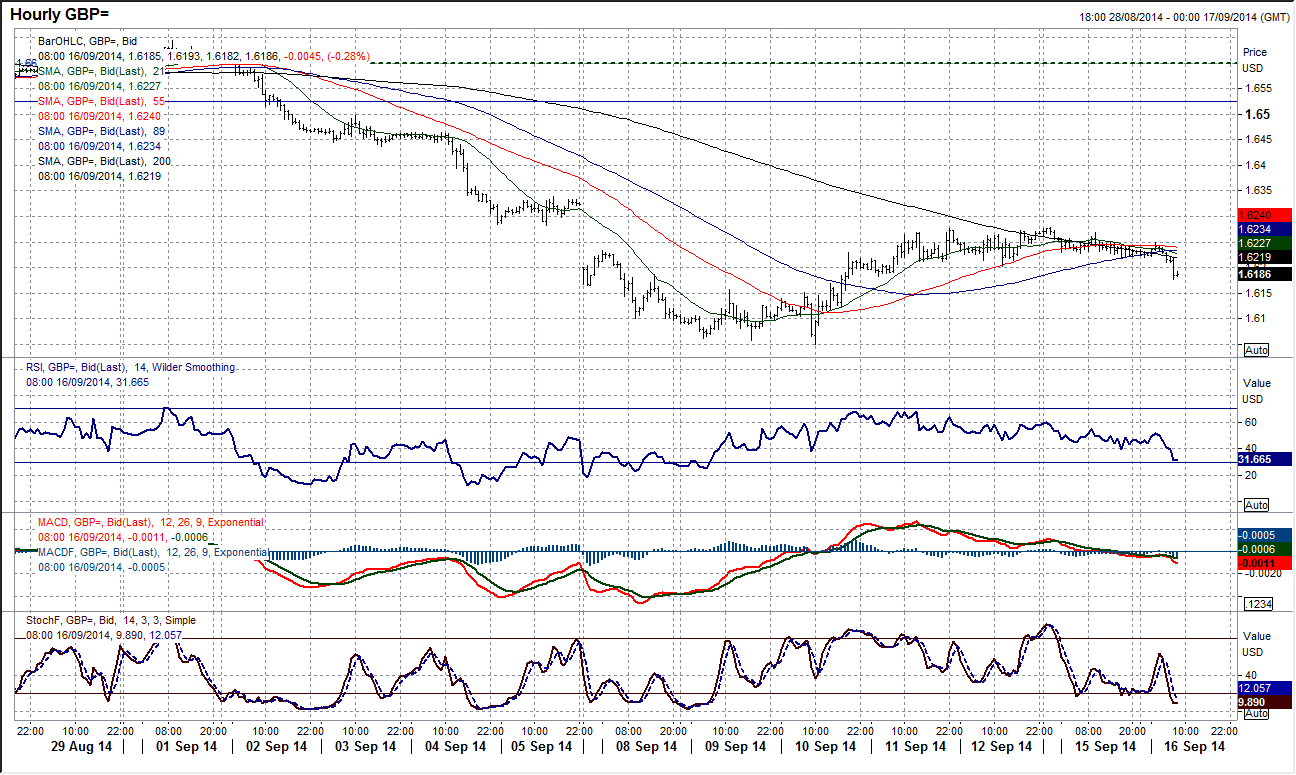

GBP/USD

There is now considerable concern that the recovery has already been seen. The 38.2% Fibonacci retracement of $1.6644/$1.6050 provided the barrier to the rebound at $1.6278, whilst the big gap was all but filled before Cable worryingly fell away again. The fact that the RSI has once more simply unwound back to 30, whilst the MACD lines remain in bearish configuration just adds to the feeling that downside potential is growing again. The intraday chart shows more of a consolidation, but there is a line of key support at $1.6200 which needs to remain intact. A consistent breach of $1.6200 would suggest the recovery bulls had lost the impetus and the likelihood would be for the selling pressure to drag Cable possibly back towards a test of the $1.6050 low again. The reversal of this weak outlook would still be a close above the $1.6282 gap resistance.

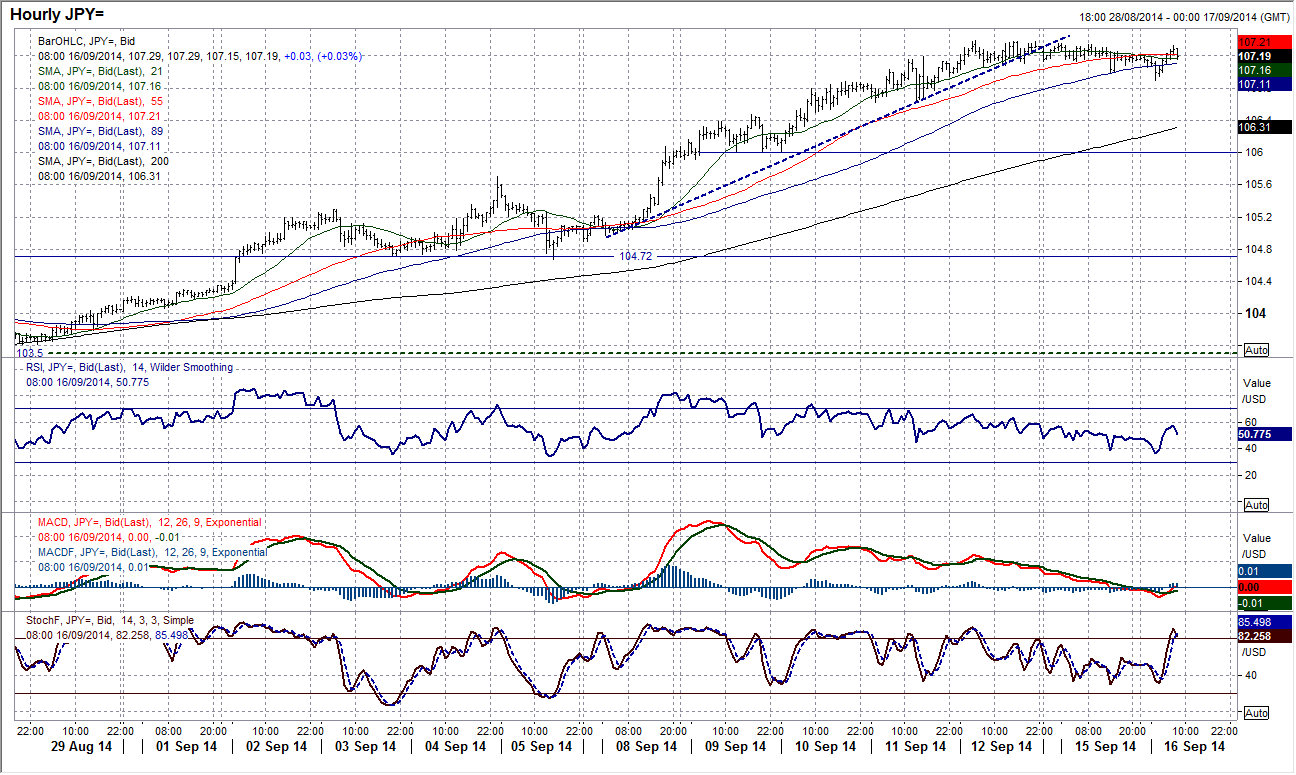

USD/JPY

A consolidation is setting in as traders weigh up the considerable gains of the past couple of weeks in front of the key meeting of the Federal Reserve. The stretched RSI would suggest there would be consolidation seen at some stage, but so far there has been a lack of profit taking of any serious degree. The big question is whether this will turn into a correction of any substance, but the initial indication is that traders are accepting the new breakout. I still believe that buying into weakness is the best strategy, with support in at 106.50 and then 106.00. The likelihood is that we will know more after Wednesday’s FOMC meeting, but the outlook remains very strong and any downside should be quickly supported.

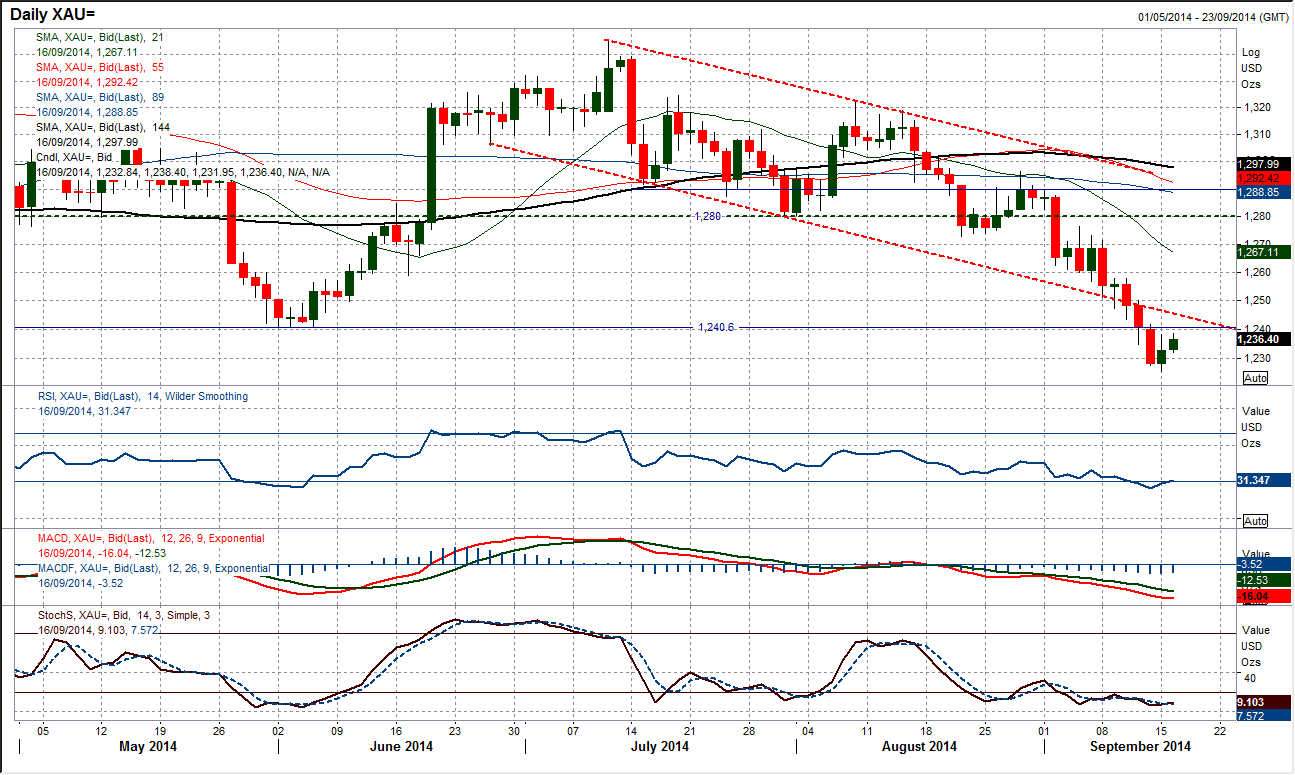

Gold

The gold price is trying to rally, but I would not expect too much upside before the selling pressure resumes once more. The rebound from $1225.30 simply looks to be unwinding overstretched momentum and should give another chance to sell. The intraday hourly chart does suggest a minor recovery as the 5 day downtrend has been broken however could be struggling at the $1240 resistance. The old support of $1240 has become the new resistance and already this morning this seems to be the case. Furthermore, the bottom of the downtrend channel is also a basis of resistance now and comes in around $1245, whilst there is near term resistance up towards $1260. The medium term outlook suggests weakness towards the $1184.50 low and I expect rallies to be sold into before this ultimately is seen.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AUD/USD pressures as Fed officials hold firm on rate policy

The Australian Dollar is on the defensive against the US Dollar, as Friday’s Asian session commences. On Thursday, the antipodean clocked losses of 0.21% against its counterpart, driven by Fed officials emphasizing they’re in no rush to ease policy. The AUD/USD trades around 0.6419.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday during the early Asian session. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Runes likely to have massive support after BRC-20 and Ordinals frenzy

With all eyes peeled on the halving, Bitcoin is the center of attention in the market. The pioneer cryptocurrency has had three narratives this year already, starting with the spot BTC exchange-traded funds, the recent all-time high of $73,777, and now the halving.

Billowing clouds of apprehension

Thursday marked the fifth consecutive session of decline for US stocks as optimism regarding multiple interest rate cuts by the Federal Reserve waned. The downturn in sentiment can be attributed to robust economic data releases, prompting traders to adjust their expectations for multiple rate cuts this year.