Market Overview

Equity markets have hit the buffers in recent days amid a lack of newsflow and as earnings season has all but ground to a halt. This has meant that the positivity which pushed Wall Street to record highs and the S&P 500 to 2000 for the first time has taken pause for reflection, as volumes remain incredibly light. The geopolitical tensions in eastern Ukraine have just jumped up a notch or two as it appears increasingly as though Russia are firing arms into Ukraine, whilst also apparently sending armoured vehicles and tanks over the border to support the separatists. If this proves to be the case then this could significantly complicate attempts to diffuse the tensions by Putin and Poroshenko. Wall Street was almost dead flat, with Asian markets also bemoaning a lack of direction overnight, although the Nikkei was slightly lower as the Japanese yen pulled some strength back. European markets have opened slightly lower once more.

In the past 24 hours, in forex trading the dollar has just begun to give back some of its strong gains that have built up over recent weeks as the Dollar Index corrects from its September peak of 82.6 back to currently 82.3. This has resulted in once again all of the forex majors clawing back some ground again this morning. At this stage these moves are merely short term but it will be interesting to see how far they go before the dollar bulls regain control.

There is a lot of data due today, so hopefully there will be more action on financial markets to speak of. Germany is the focus of the European session, with unemployment at 08:55BST where 6.7% is expected. However throughout the morning, the German CPI is released. With the regions giving their individual inflation readings and then the countrywide number at 13:00BST. This will lead to the market speculating on the impact of the Eurozone inflation figure due tomorrow. Germany is expected to see inflation steady at 0.8% but if there is a miss on expectations then the euro could come under some selling pressure . US preliminary GDP (the second reading) is announced at 13:30BST and is expected to just pull back slightly to 3.9% (from 4.0% at the first reading). The weekly jobless claims are expected to stay basically flat and steady with 300,000 at 13:30BST, whilst the pending home sales are expected to improve slightly by 0.5% at 15:00BST.

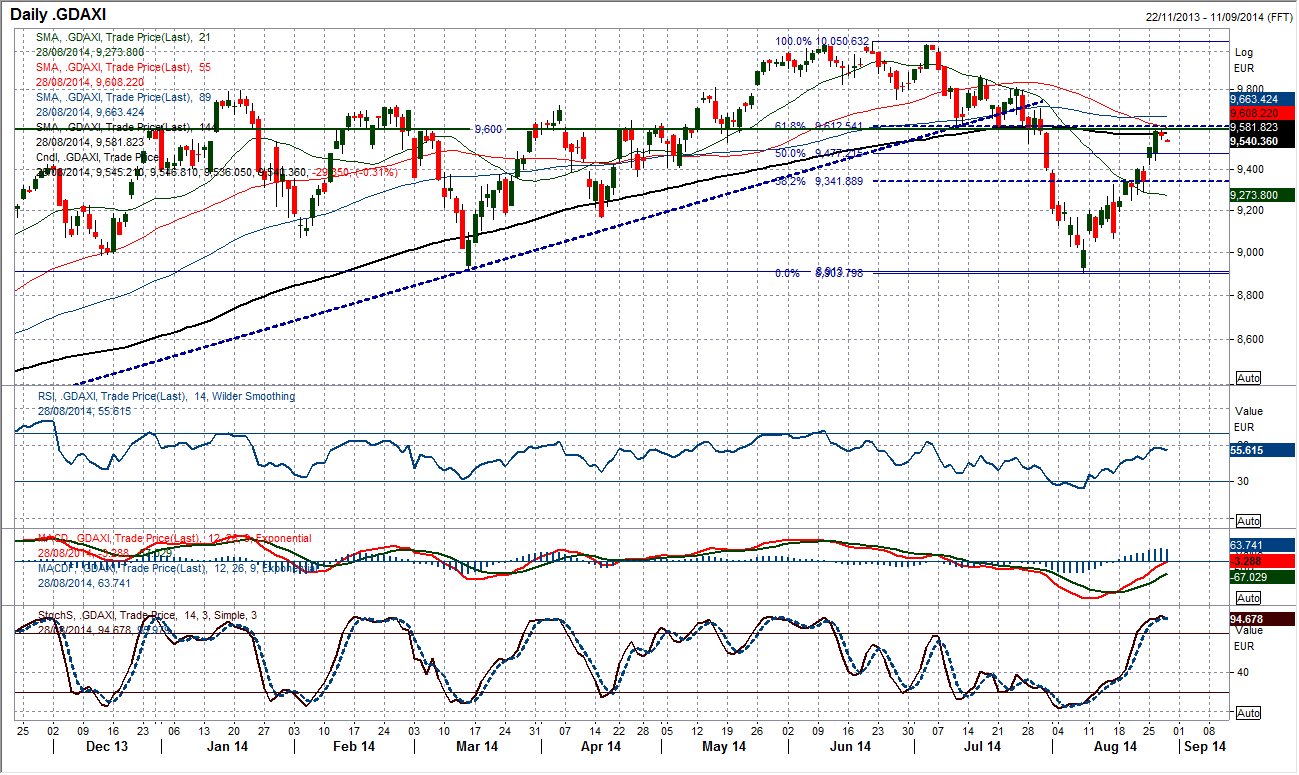

Chart of the Day – DAX Xetra

The number of times that the DAX has changed tack at the 9600 level in the past 8 months would suggest that it is a pivot level that should not be ignored. Having rallied strongly in the past couple of weeks, the DAX has spent the past two days hitting up against overhead resistance at 9600, but failing to break through. The early trading today suggests that once more this resistance remains a barrier to gains and the chances of a near term correction are growing. Interestingly also, the 61.8% Fibonacci retracement level of the big 10050 to 8903 sell-off comes in at 9612, furthermore the 144 day moving average which has been a reasonable basis of support during the uptrend, could now become the basis of resistance. The intraday hourly chart shows a good uptrend in place and this could just be a minor stalling. The initial support comes in at 9510 and then more importantly 9414. A move above 9600 would open the next resistance at 9704.

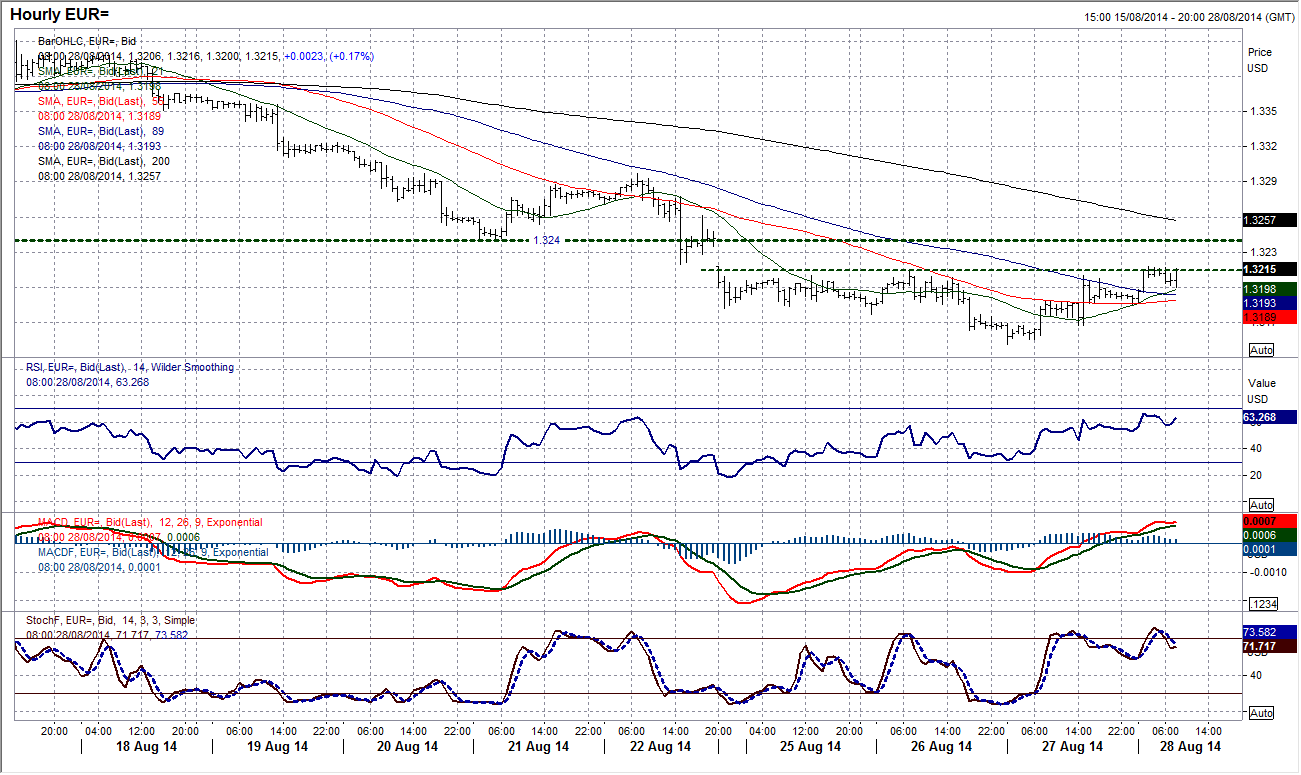

EUR/USD

Are the euro bulls ready for a fight back? The selling pressure of the past 8 days seems to have abated, at least near term anyway. The move which was triggered by a report that apparently the ECB will not be engaging further monetary easing measures at next week’s policy meeting has driven the euro up to test the reaction high resistance at $1.3215. This is a level which needs to be overcome for any sort of technical recovery to take hold. A breach would complete what would considered to be a small base pattern to give a target of $1.3280 which would not even get the rate back to the resistance of the falling 21 day moving average (currently $1.3325) which has been a basis of resistance recently. Buying into a rebound certainly is not without its risks and I would rather see it representing another chance to sell. However for now it looks like the bulls are fighting once again. It has been a while since we could say that.

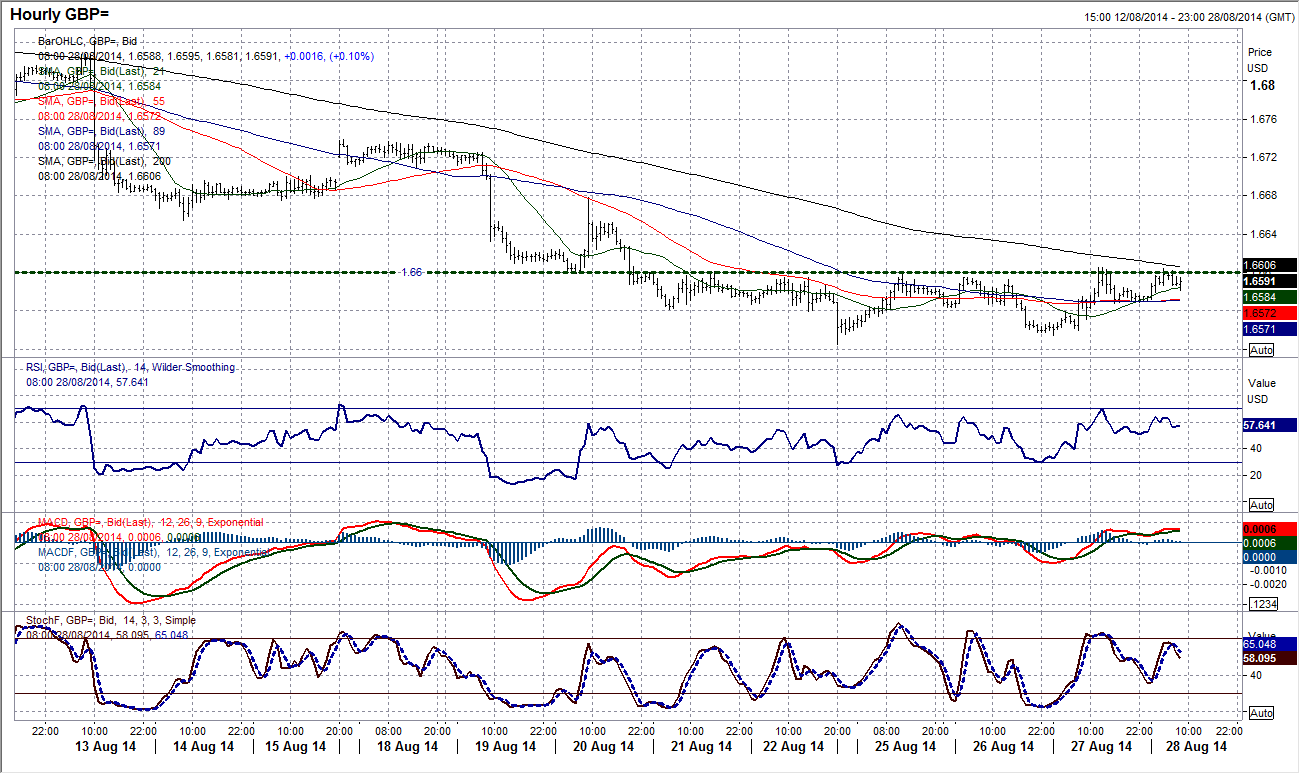

GBP/USD

The significance of the near term barrier of $1.6600 is growing. This level has been tested numerous times over the past 6 days as Cable has begun to form some support at $1.6525. A decisive breakout would complete a near term base pattern and imply a move to $1.6675. The consolidation is just beginning to show through on the momentum indicators which have shown initial signs of improvement. However any rebound would still likely be just a technical rally within the six week downtrend (which currently adds resistance around $1.6660). The overhead supply within the sell-off is also sizeable and would likely limit any recovery thus giving another chance to sell at $1.6650, $1.6700 and then $1.6740. However the chances of a near term rebound are growing. Cable just needs to break and hold above $1.6600 for the trigger.

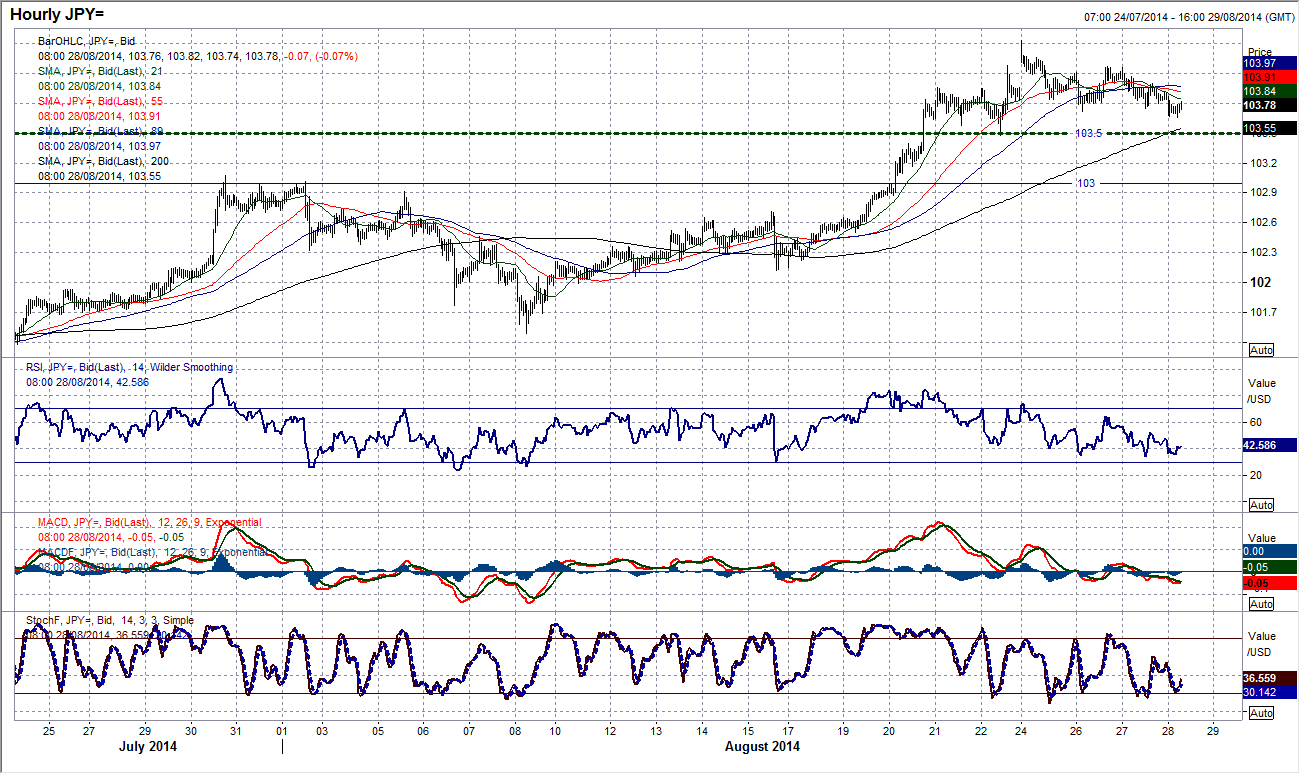

USD/JPY

The potential for a correction is growing as the Dollar/Yen just begins to slide back once more. A drift back towards a test of the support at 103.50 is being seen and this would be the first real test of the credential of the bulls. I still see this as a healthy near term move as the strong momentum begins to unwind to help renew upside potential. The RSI is on the brink of a crossover below 70 but I do not see this as a big sell-signal as I believe that the outlook has changed in the past week or so. I do not see this as the beginning of a big retracement, more that this is a move that the bulls will be looking to form support between the key breakout support around 103.00 and 103.50. There could be an opportunity for the brave to see a shorting opportunity, but I would prefer to trade with the new trend (which I believe is higher) and I will be looking for an opportunity to buy on support.

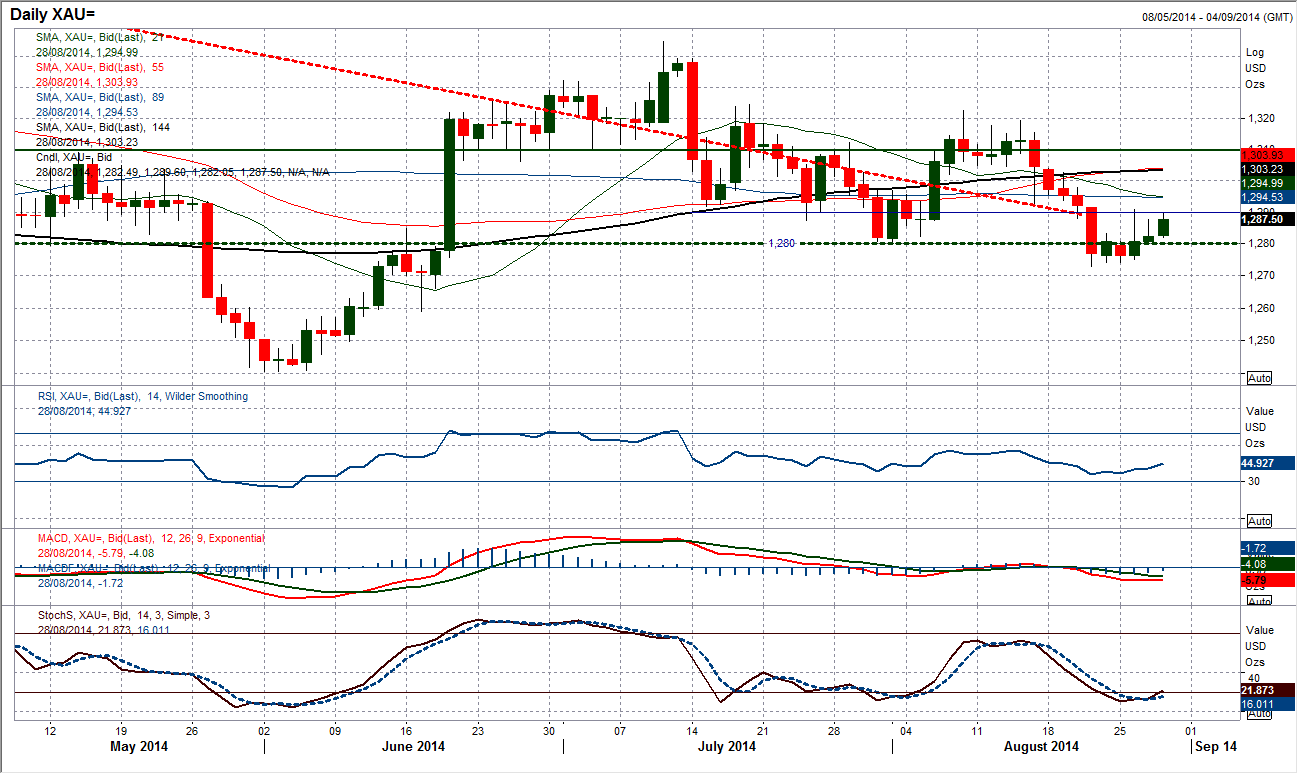

Gold

The gold price appears to have found a floor in the past few days and this could be the setting for another near term rebound. The decline seems to have been limited (at least for the near term) at $1273. The momentum is very weak still but there are initial signs that there might be a technical rally may be underway. The very near term resistance at $1280 which had held back a recovery has now been breached and is acting as a support level as the intraday hourly chart begins to show some minor higher lows. The resistance now at $1290.70 becomes key near term as a move above would suggest not only higher lows but higher highs forming on the intraday chart. However, I still believe that this would be just be a minor rebound before the selling pressure returns once more. The daily chart shows key lower highs and lower lows over the past 7 weeks, but there is certainly room for a near term rebound. The resistance band comes in between $1300/$1310. The caveat to this is the flaring up of geopolitical tensions in eastern Ukraine which would likely cause a spike higher in the gold price.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AUD/USD rises to two-day high ahead of Aussie CPI

The Aussie Dollar recorded back-to-back positive days against the US Dollar and climbed more than 0.59% on Tuesday, as the US April S&P PMIs were weaker than expected. That spurred speculations that the Federal Reserve could put rate cuts back on the table. The AUD/USD trades at 0.6488 as Wednesday’s Asian session begins.

EUR/USD holds above 1.0700 on weaker US Dollar, upbeat Eurozone PMI

EUR/USD holds above the 1.0700 psychological barrier during the early Asian session on Wednesday. The weaker-than-expected US PMI data for April drags the Greenback lower and creates a tailwind for the pair.

Gold price cautious despite weaker US Dollar and falling US yields

Gold retreats modestly after failing to sustain gains despite fall in US Treasury yields, weaker US Dollar. XAU/USD struggles to capitalize following release of weaker-than-expected S&P Global PMIs, fueling speculation about potential Fed rate cuts.

Ethereum ETF issuers not giving up fight, expert says as Grayscale files S3 prospectus

Ethereum exchange-traded funds theme gained steam after the landmark approval of multiple BTC ETFs in January. However, the campaign for approval of this investment alternative continues, with evidence of ongoing back and forth between prospective issuers and the US SEC.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Fed might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.