Market Overview

On yet another strong day for the dollar, Wall Street posted record gains after a jump in the durable goods data and multi-year highs in consumer confidence suggested continued strength in the US economy. The S&P 500 has closed above 2000 for the first time as equity markets continue to push higher. There was little breakthrough in the talks between presidents Putin and Poroshenko over the diffusing the conflict in eastern Ukraine, but there is a desire to resolve the issue, publically at least. With a lack of economic data to help drive, the Asian markets were mixed to slightly lower overnight, whilst the European session has begun much in the same fashion.

In forex trading, the Dollar Index has now breached its September 2013 high at 82.6 as the euro and sterling weakened again. The European majors have rebounded slightly today, whilst it has been the commodity currencies, the Aussie, Kiwi and Loonie which have all started strongly.

There are no major economic releases due today, which could mean a continuation of the low volumes in the markets, and in the absence of any major newsflow, the potential for a day of consolidation.

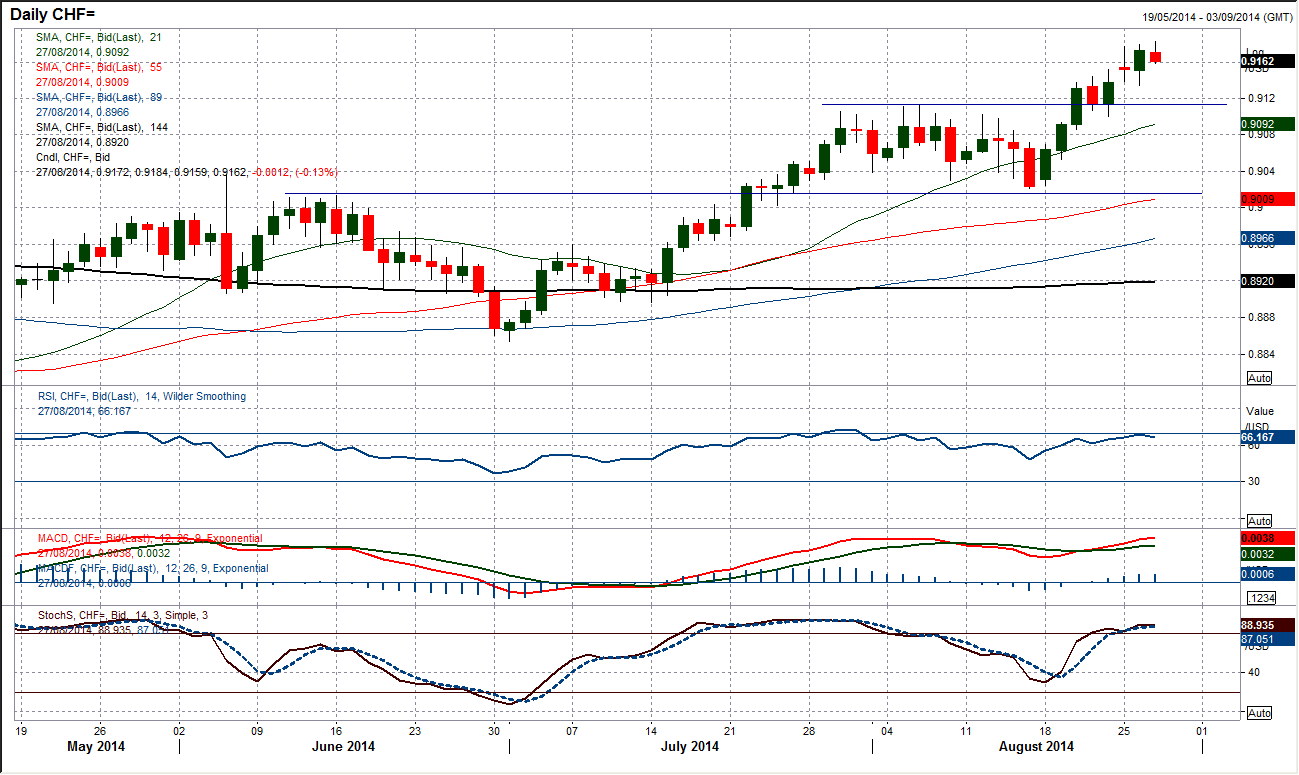

Chart of the Day – USD/CHF

Having broken out above 0.9115 the upside break gives an implied target of 0.9200. The technical outlook remains dollar bullish as the rate has pushed above the key January high at 0.9122 which has brought the November high at 0.9250 into range. Momentum indicators remain very strong, although the RSI is pushing towards overbought (above 70) there has already been left a higher reaction low at 0.9135 which is the first line of support. The momentum indicators on the intraday hourly chart show that there could be a near term dip today but this should be used as a chance to buy. The bulls would remain in control until a breach of the support at 0.9100.

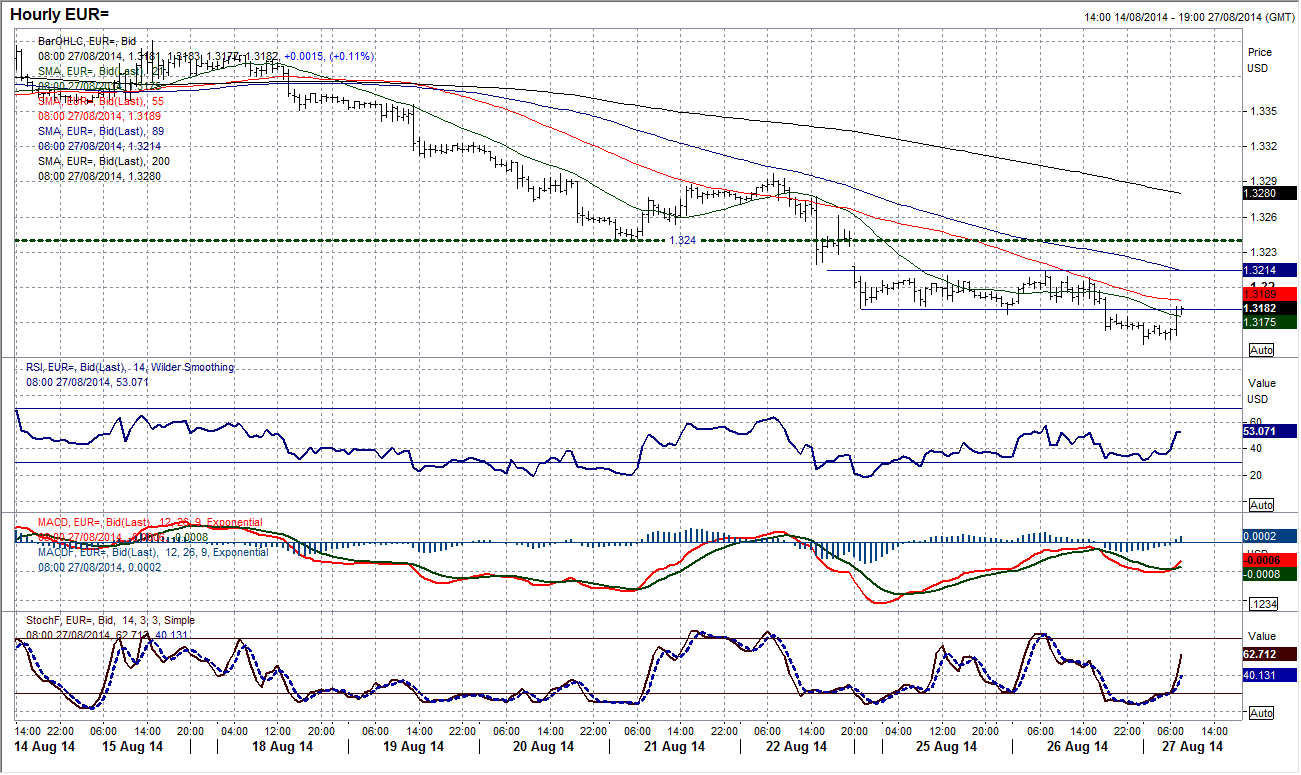

EUR/USD

It seems to be a slow and painful demise of the euro bulls at the moment, as the rate falls ever towards a test of the next key support at $1.3100 that was the September 2013 low. Momentum indicators are all extremely bearish now and even intraday rallies are barely being seen now, let alone a rally that lasts for two or three days. It would appear then that in the absence of any reversal signals, the only really viable strategy is to use intraday bounces as a chance to sell. The intraday chart now shows the first resistance band comes between $1.3180/$1.3220 and then the old support turned new resistance at $1.3240. A bounce early in the European session has resulted in the intraday RSI unwinding back towards neutral and should give a chance to sell. Sub $1.3100 opens the implied target from the head and shoulders top at $1.3000.

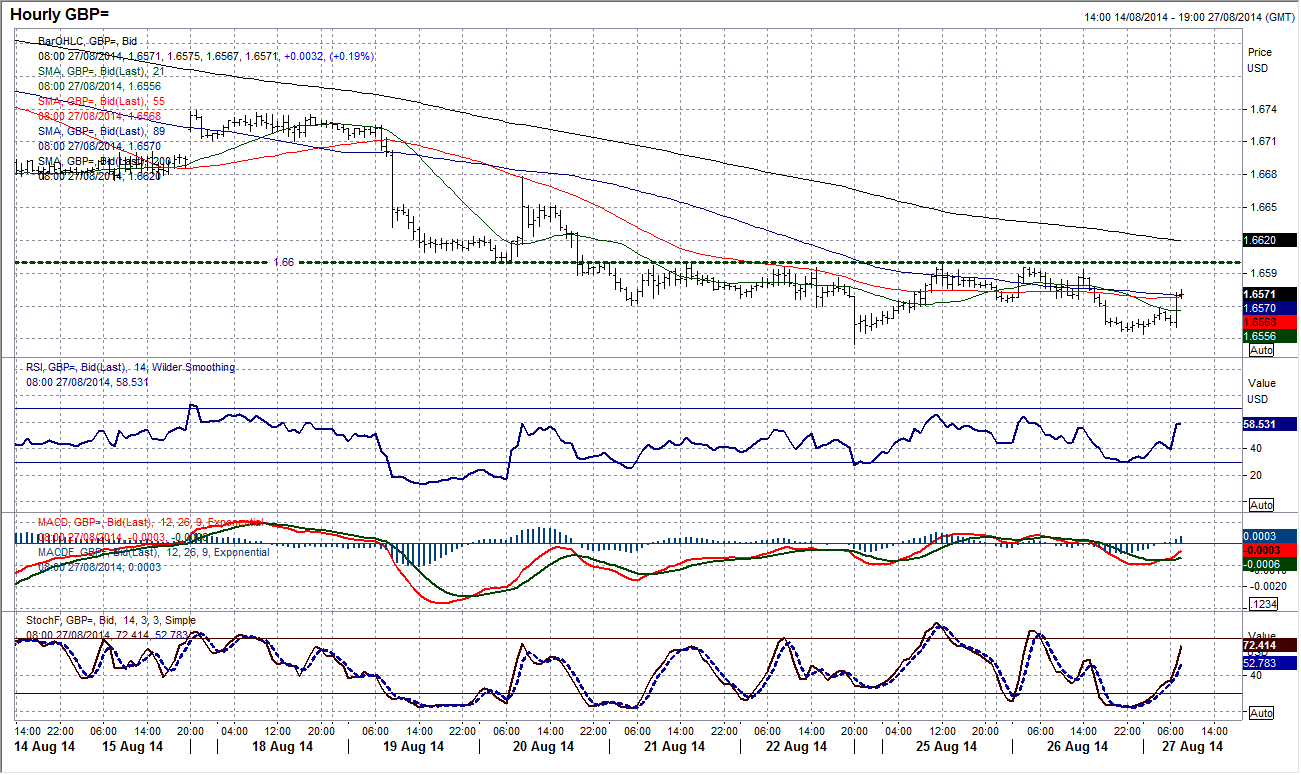

GBP/USD

Yesterday’s reaction to the resistance at $1.6600 just shows how weak the outlook for Cable is still. There had been a decent consolidation that had threatened a near term technical rally (within the downtrend) but the strength of the downside momentum and the resistance proved to be too much and once more we saw a negative trading day. Perhaps the bulls will be noting that the $1.6525 low from Monday remains intact, but this is the only positive that can be drawn from this chart. Even on the intraday hourly chart, momentum indicators remain negative, whilst any near term bounce needs to break through the strengthening resistance at $1.6600. Selling into any intraday rebound today looks to be the only real strategy as a test of $1.6525 can be expected, before Cable drifts back towards a test of the March low at $1.6460. Above $1.6600 may give some very near term respite, but there is plenty of further overhead supply to prevent any sustainable rally gaining traction.

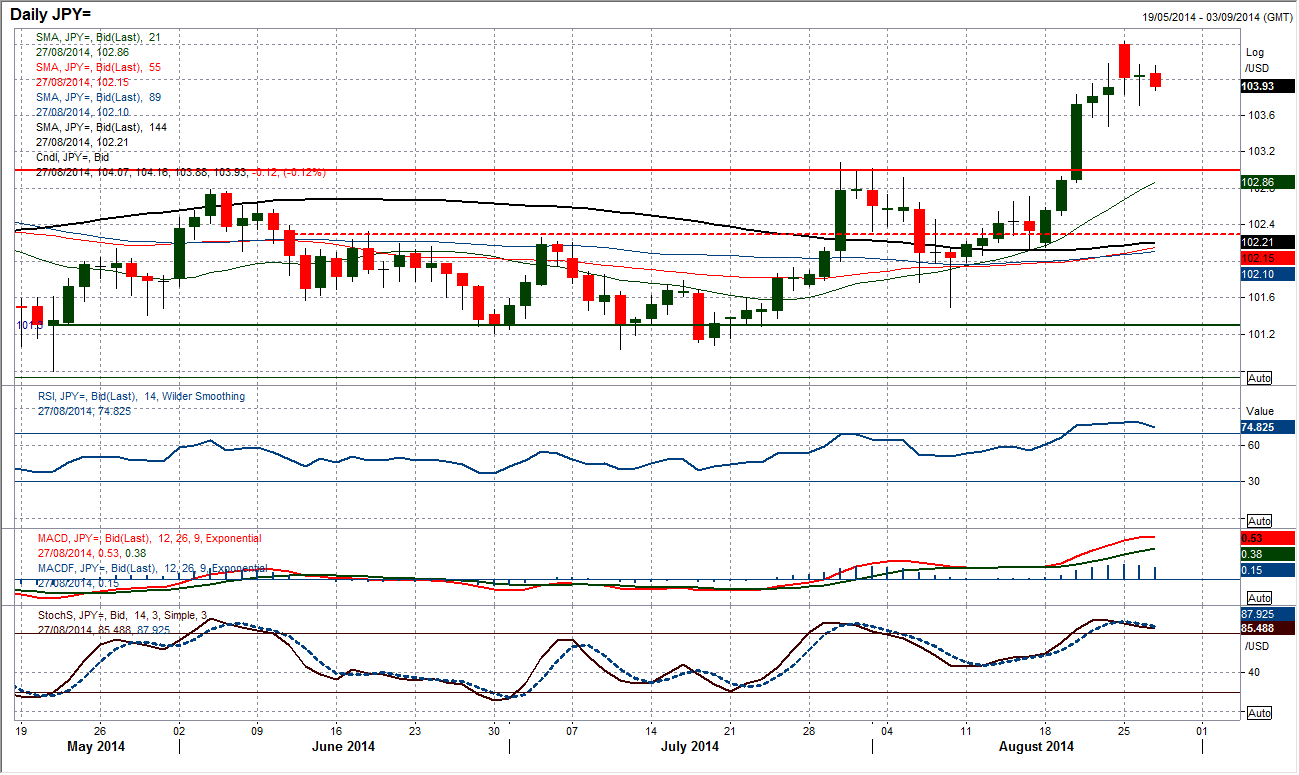

USD/JPY

Despite the corrective candlestick posted on Monday, the dollar bulls will be remaining fairly confident after some intraday support at 103.70 bolstered the reaction low around 103.50 from last week. Even though the RSI remains at extreme levels at 78, that fact that there has not been a rush of profit-taking (as there has on previous sharp rallies) suggests that there is some grounding to this move. The problem is what to do next. The ideal scenario would be to buy into a unwinding correction that forms support around 103.50 because with the RSI at such high levels it is difficult to see further upside potential in the current run. It may therefore be best to just stand aside for now to wait for the next development. Above 104.43 would re-open the way towards a test of the December/January highs above 105.00.

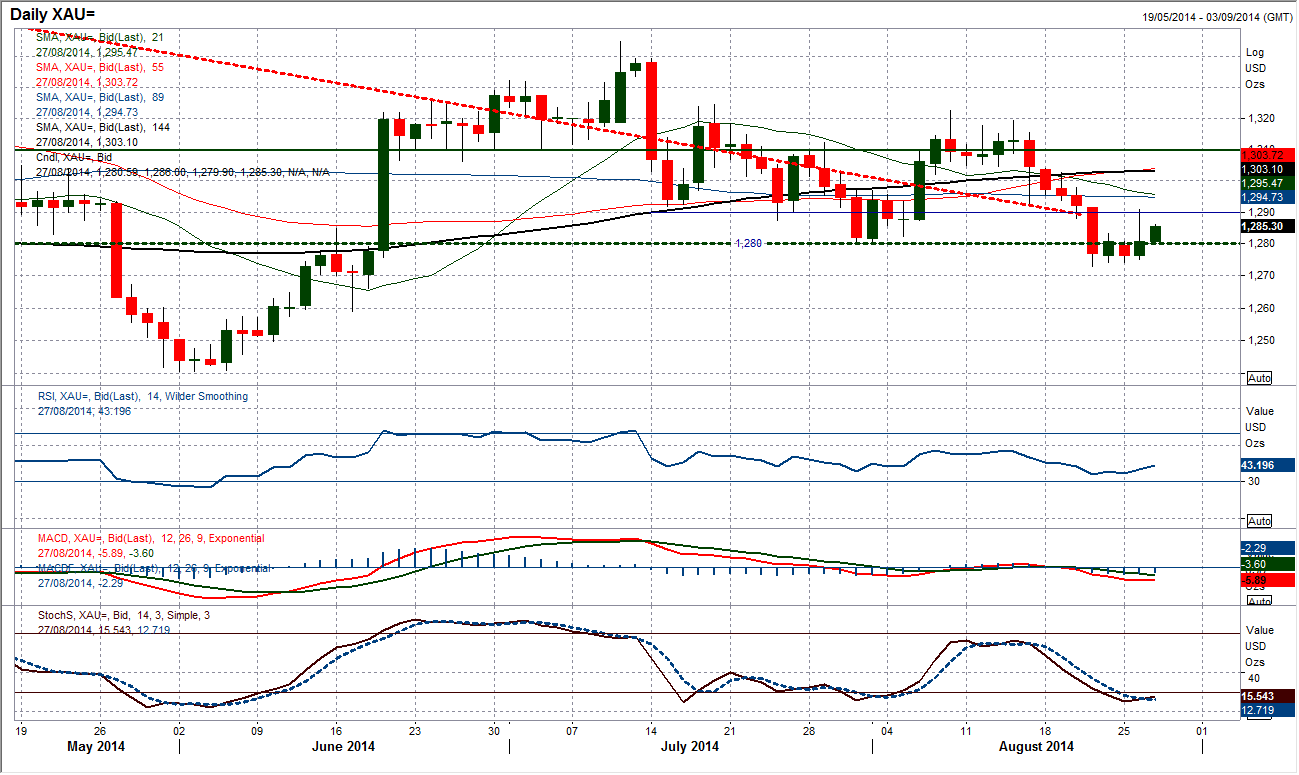

Gold

Once again as the yesterday progressed, the sellers gradually regained control. This control happened just above $1290 as an attempted rebound faltered and retreated back towards $1280. The weak technical indicators suggest that rallies such as these are likely to now be sold. On a very near term basis the price has picked up off $1280 again, but expect further downside pressure to pull the price lower to retest the $1273 low and likely further declines in due course. The big caveat to this position is an escalation of geopolitical tensions in eastern Ukraine which would result in a jump in the gold price. In the absence of this though, the technicals are still dragging the price lower.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD consolidates recovery below 1.0700 amid upbeat mood

EUR/USD is consolidating its recovery but remains below 1.0700 in early Europe on Thursday. The US Dollar holds its corrective decline amid a stabilizing market mood, despite looming Middle East geopolitical risks. Speeches from ECB and Fed officials remain on tap.

GBP/USD advances toward 1.2500 on weaker US Dollar

GBP/USD is extending recovery gains toward 1.2500 in the European morning on Thursday. The pair stays supported by a sustained US Dollar weakness alongside the US Treasury bond yields. Risk appetite also underpins the higher-yielding currency pair. ahead of mid-tier US data and Fedspeak.

Gold appears a ‘buy-the-dips’ trade on simmering Israel-Iran tensions

Gold price attempts another run to reclaim $2,400 amid looming geopolitical risks. US Dollar pulls back with Treasury yields despite hawkish Fedspeak, as risk appetite returns.

Manta Network price braces for volatility as $44 million worth of MANTA is due to flood markets

Manta Network price is defending support at $1.80 as multiple technical indicators flash bearish. 21.67 million MANTA tokens worth $44 million are due to flood markets in a cliff unlock on Thursday.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.