Market Overview

Hawkish central bank meeting minutes from both the Bank of England and then the Federal Reserve suggest that there is serious debate amongst the two committees over potential rate tightening. However there is certainly not enough at this stage to suggest that there will be any imminent rise. Members of the Fed’s FOMC are looking for a “relatively prompt” rate hike due to the progress being made in the US economy. However, Janet Yellen remains dovish and is likely to use her Jackson Hole speech on Friday to continue to lay an outlook for leaving the loose monetary policy in place for as long as possible. The Fed minutes strengthened the dollar and just took a bit of steam out of equities on Wall Street.

The S&P 500 closed just slightly higher by 0.3% and remains just below the all-time high at 1991. Asia markets were mixed after contrasting data. The Japanese Nikkei 225 pushed strongly higher after a positive Manufacturing PMI and a significant weakening of the yen; whereas other markets in the region were dragged lower as the Chinese Flash HSBC manufacturing PMI fell to a three month low at 50.3 which was well below the 51.3 that had been forecast. European markets are trading higher at the open as the Eurozone awaits flash PMI data which is released throughout the morning.

In forex trading, the US dollar is still broadly positive against the major currency pairs as the legacy of the hawkish Fed minutes remains fresh in the minds. There may be a bit of consolidation though as the day goes one with Janet Yellen’s Jackson Hole speech looming on the horizon. The main focus for traders will come with this morning’s flash manufacturing PMI numbers for the Eurozone countries. How the latest set of numbers come out could have a significant bearing on the potential for ECB monetary easing. Sterling traders will be interested in the UK retail sales data at 09:30BST which is forecast to slide slightly to 3.5% from 4.0% last time out. The US weekly jobless claims at 13:30BST are forecast to drop slightly to 303,000 from last week’s 311,000.

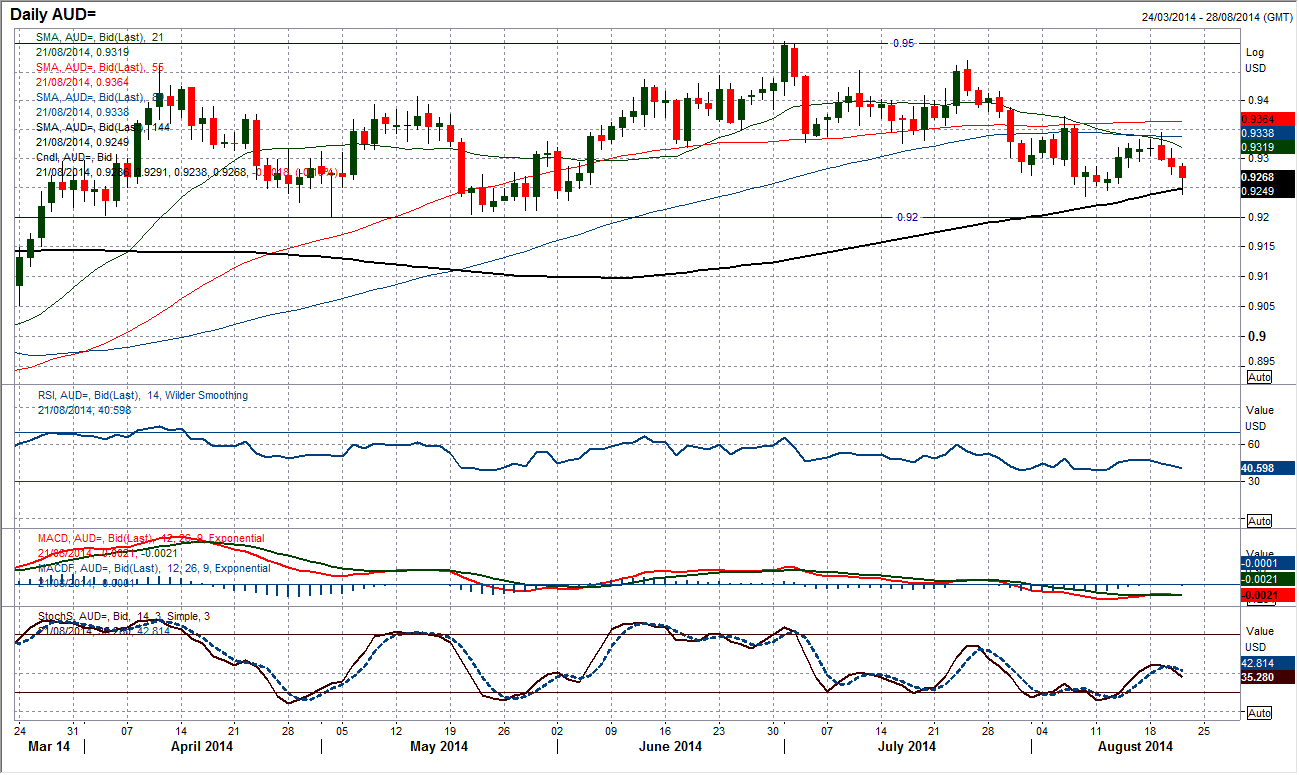

Chart of the Day – AUD/USD

The Aussie dollar is coming under increased pressure. Another key lower high appears to now have been left at 0.9345, but that lower high was also a bearish key one day reversal. The resistance of the high has also come once again at the barrier of the falling 21 day moving average (currently 0.9318). There now looks to be a test of the support of the 0.9236 reaction low under way. The configuration of the momentum indicators is negative, with the RSI again falling over under 50, it looks as though there will now be serious pressure on the key range support at 0.9200. The intraday chart shows there is resistance around 0.9280 which should be seen as an area to look for selling opportunities once again.

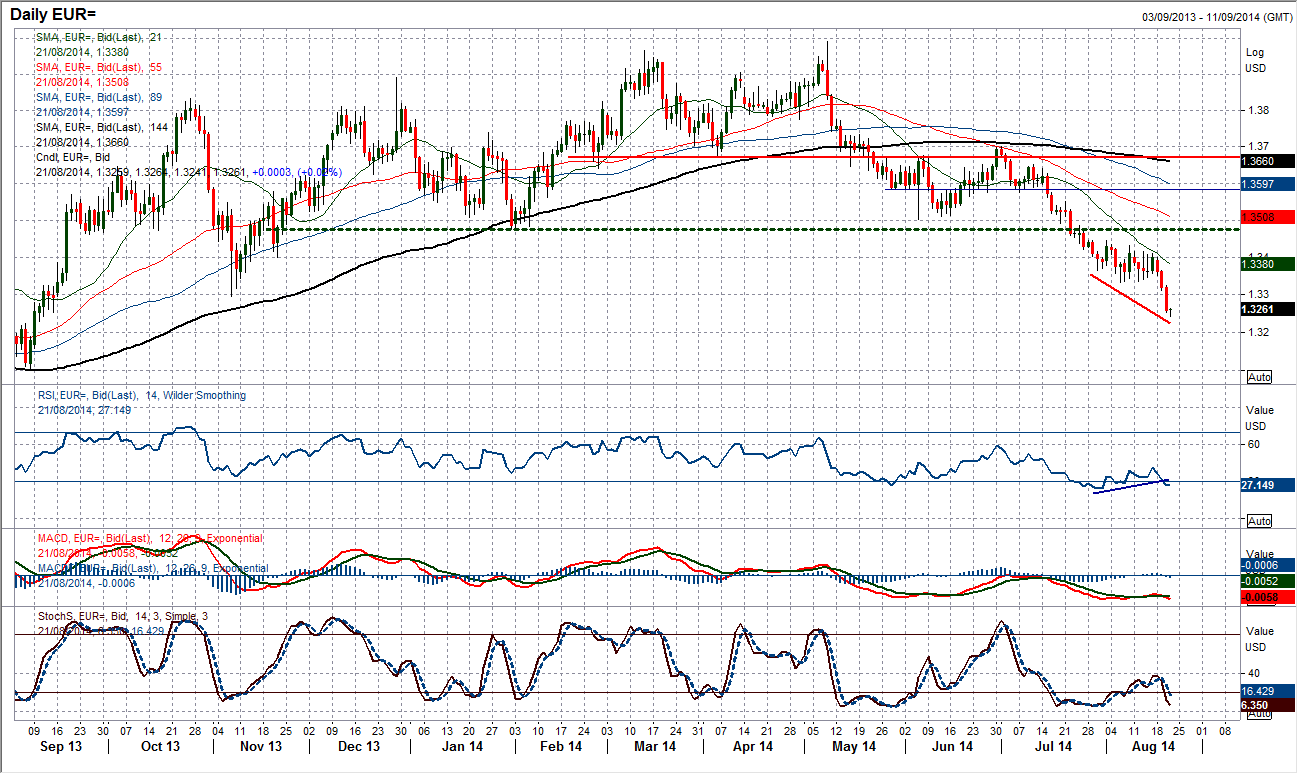

EUR/USD

A hawkish leaning in the Fed meeting minutes have added to dollar strength in the past few days and this is being seen on Euro/Dollar. Having breached the key near term support at $1.3330 a couple of days ago the euro is now really struggling again. The key November low at $1.3295 has been quickly blown away and there is now little reason not to believe the euro will not retest the September low at $1.3100. Momentum indicators are quickly turning negative once again as the bullish divergences which had been a feature of the consolidation are now being aborted. The only crumb of comfort for the bulls is that the RSI is again stretched to the downside. However the strength of the selling pressure does not suggest that it is going to be momentum that stops this sell-off. The intraday chart shows very minor resistance at $1.3273 and around $1.3300, with $1.3330 being the main near term resistance now. There may be a consolidation as we approach Janet Yellen’s Jackson Hole speech, but for now the strength is with the sellers.

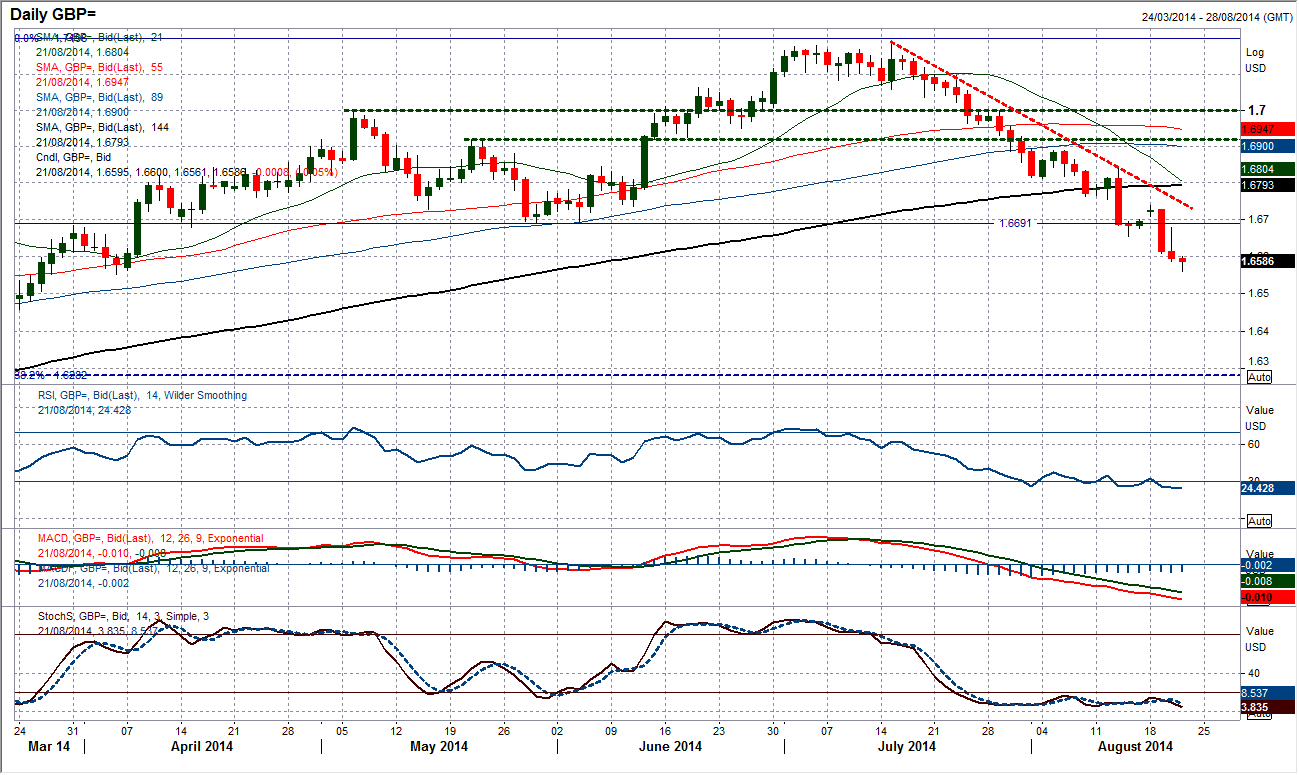

GBP/USD

Even hawkish Bank of England meeting minutes have done little to support Cable as an intraday bounce has quickly been swatted away by the bears. The selling pressure shows little sign of letting up now as the technical indicators remain very weak. The April low of $1.6552 is now under immediate threat, but it is unlikely to prove much of a match for the bears as Cable continues towards the March low at $1.6459. The momentum indicators are deeply negative with RSI, MACD and Stochastics all in bearish configuration. The RSI is now the lowest it has been since March 2013 and this may induce a very near term bounce. However the reaction highs are moving ever further away from the 5 week downtrend as the bulls lose faith ever sooner. There is minor resistance at $1.6600, but the main near term resistance is in the band $1.6654 to $1.6700.

USD/JPY

What a move on the dollar! The acceleration in Dollar/Yen higher towards the key April high at 104.12 has been remarkable. Now comes the tricky bit, what happens next. The problem is that the dollar has had a bout of strength three or four times in the past 6 months. Each time traders think that it will be the big breakout, only to be met by a sharp retracement. The latest move does have a different feel to it though. In the past, the RSI has struggled to really gain momentum, but this time it has pushed well above 70 to a level not seen since February 2013. This is not something that tends to be seen in sideways range markets and is more a feature of a strong trend. Whilst the indicator may be looking stretched and this could induce some consolidation, holding support above the breakout at 103 is now key. There is minor intraday support around 103.60 and 103.20. The test will now be how the rate reacts to Janet Yellen in her speech tomorrow as it is likely to retain a dovish tone and could induce some profit taking. Quite how much profit is taken out of the rate will determine whether the bulls remain in control this is just another spike higher that will be entirely retraced.

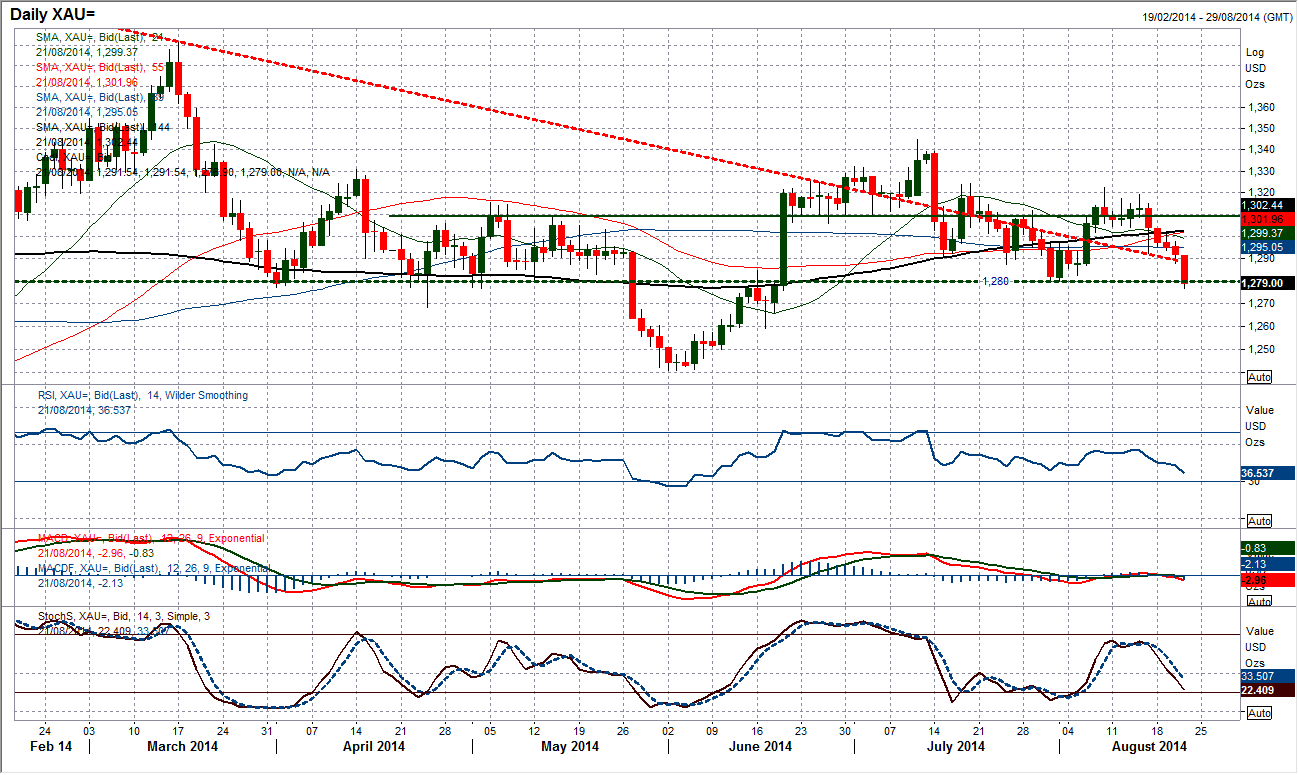

Gold

The bearish bias seen building on gold over the past few days continues to drag the price back below the key support at $1280. This comes as the geopolitical tensions ease and the “war premium” is squeezed out of the price and the weak technicals are leading traders again. Technical studies are deteriorating with the RSI now at a 2 month low and reflecting the bearish bias. The intraday chart retains its near term negative outlook with hourly momentum weak. All indicators therefore point towards a serious test of $1280 with a bearish breakdown confirmed on a close below. A breach would open $1258.85, but there is little real support until the key June low at $1240.60. The recovery bulls will be eyeing initial resistance levels at $1292.70 and around $1297.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.