Market Overview

Are we about to fall into the trap once more of believing that geopolitical tensions are easing once more? With talks in Berlin between Russian and Ukrainian officials over the humanitarian aid convoy having been resolved, the very fact that there is dialogue between the sides is giving markets cause for optimism. Safe haven assets such as gold and the yen have both suffered as risk sentiment has improved once more. Wall Street again bounced strongly, adding another 1%, with Asia also responding positively. After the strong gains seen in yesterday’s session, European markets are mildly higher in early trading.

There is a very small amount of dollar positive bias in forex trading today, although in truth there is little real move yet. The only exception to this has been with the Kiwi dollar which is 0.4% lower after inflation data overnight showed a drop in the New Zealand 2 year inflation expectations to 2.23% (from 2.36%).

Traders will have much to occupy themselves today. The inflation data for both UK and US means that Cable could be especially volatile. The UK CPI is announced at 09:30BST with expectation of a drop to 1.8% which would not help to argument of the hawks. The US CPI is released at 13:30BST with a forecast 2.0% just slightly lower than the previous month. Traders also have some US housing data to digest at 13:30BST. US building permits are expected to improve by 2.8% to 1.00m (from 0.973m) and Housing Starts which are epected to improve considerably to 0.970m from 0.893m).

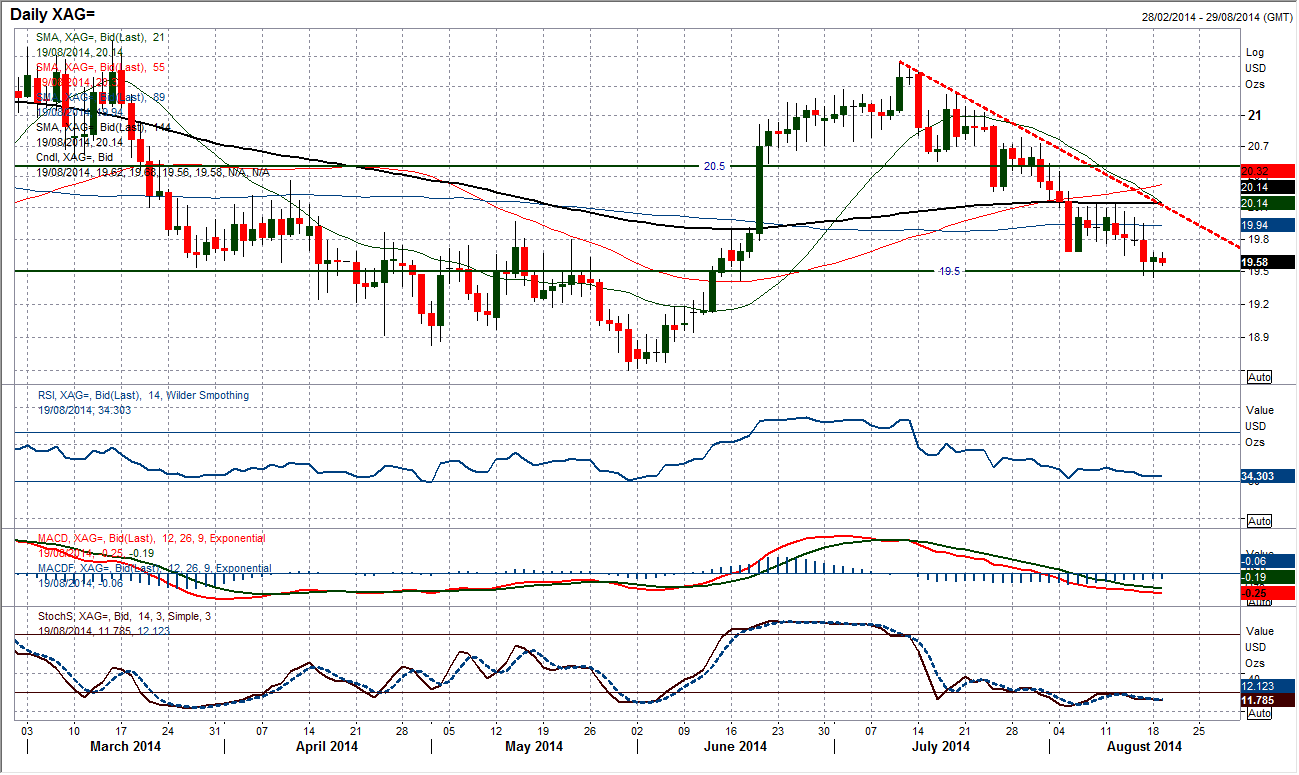

Chart of the Day – Silver

Over the past five weeks the price has been in a solid downtrend, consistently forming a series of lower highs and lower lows , with bouts of consolidation resolving to the downside. The latest breakdown of support at $19.69 has put the band of support around $19.50 under immediate threat. This support band is the last real support until $19.00 and the key low at $18.60. Momentum indicators are now in negative configuration and the price is trading below all moving averages. There is scope for a minor rebound within the downtrend which currently comes in around $20.10. However the overhead supply now from the previous mini-range $19.69/$20.14 is likely to prevent too much further upside before the selling pressure resumes. The outlook for silver looks increasingly weak.

EUR/USD

A bad day for the prospect of a euro recovery yesterday has brought the key near term supports back into range. The weakness brings into focus that this potential recovery is by no means a sure thing. The momentum indicators may be bullishly diverging, but this can go on despite a price that continues to fall. Currently the price is moving in a broad sideways range but there is still little appetite for the bulls to get on any consistent run higher. For this reason, whilst I am expecting a euro technical rally, it would be unwise to go long without any confirmed buy signals. I would need in the least a consistent basis of support above $1.3400 and if possible a move above $1.3445. Until that happens then we are likely to see the continued retracement of any bullish intent. A breach of $1.3330 would open the November low at $1.3295.

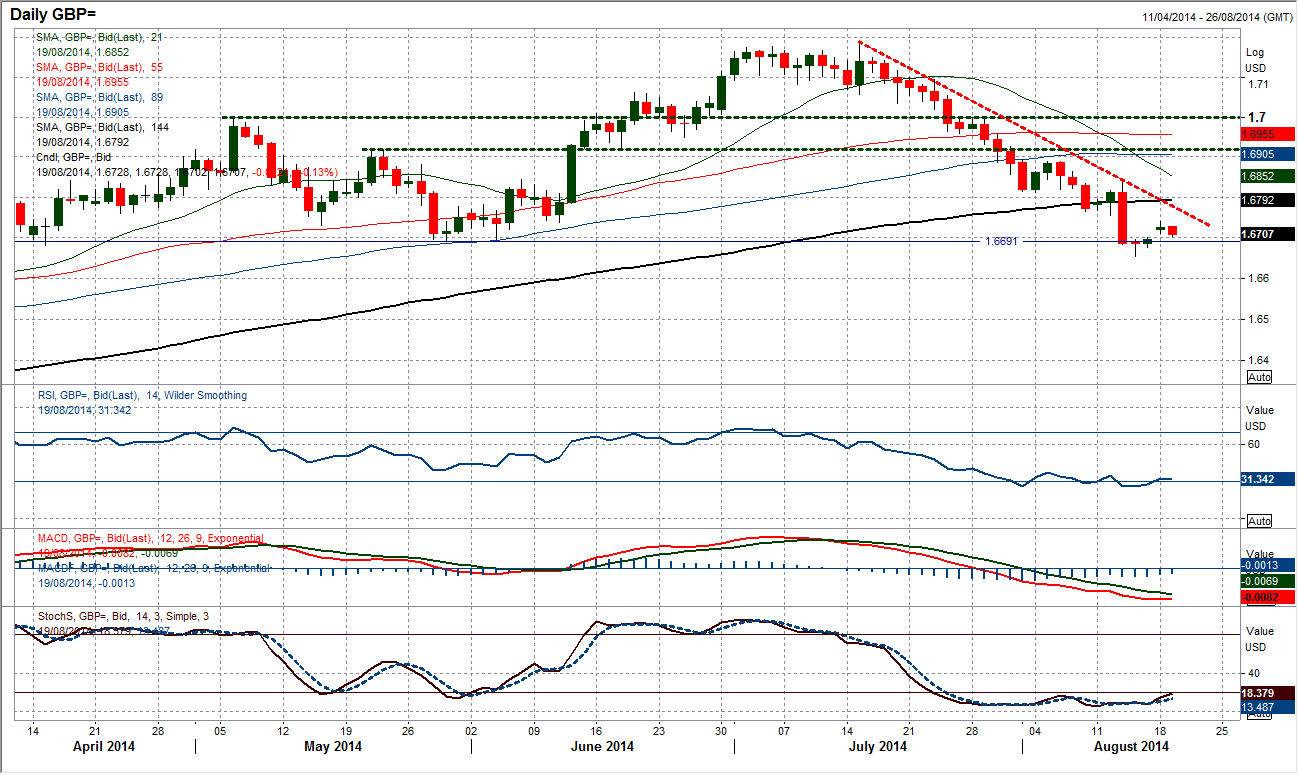

GBP/USD

It was a strange day yesterday as after the opening gap higher (you can get gaps on forex after the weekend), as there was then a very tight range. This tight range has continued overnight as though the market is now in wait and see mode. The inflation readings for both UK and US could be the reason and why I do not expect this period of tight trading to continue for too much longer today. The big week downtrend resistance comes in now at $1.6778, with initial price resistance at $1.6754. Also despite the gains of yesterday, the momentum indicators are still in bearish configuration and suggest that this rally is another chance to sell for a retest of the recent low at $1.6654. It would take a breach of resistance at $1.6842 to change a negative outlook on Cable.

USD/JPY

The dollar bulls bounced back yesterday and look to have resumed full control with a strong green candlestick suggesting increased positivity once again. This move has now left a higher reaction low at 102.12 as the bulls prepare themselves for another test of the resistance at 102.70 and more importantly the top of the 3 month range at 103.00. A close above 102.80 would range up the pressure near term too. The moving averages continue to improve and are also supportive. With momentum indicators also with a bullish bias, the top of the range could come under pressure. Whilst trading above 102.00 this remains the basis of support and a breach would change the positive outlook within the range.

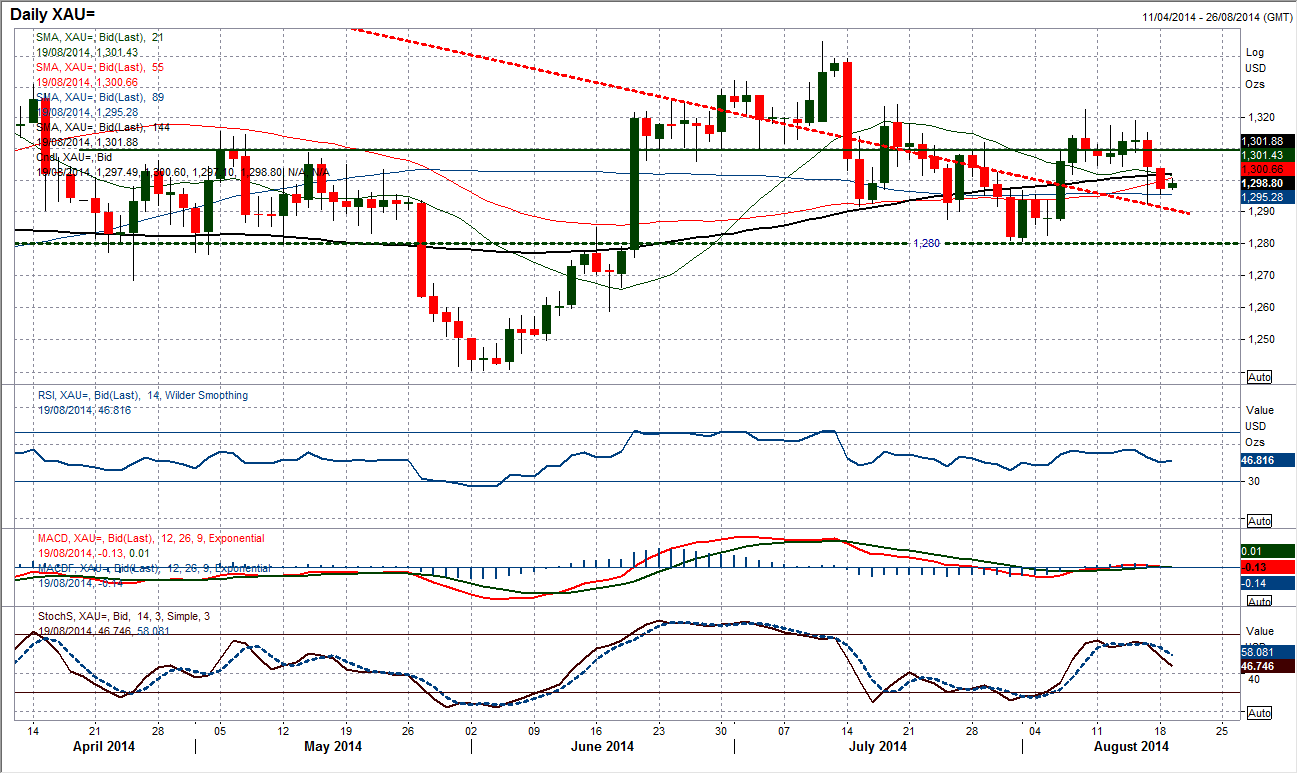

Gold

The gold chart remains very messy on a near to medium term basis. There is little or no trend to speak of, moving averages are all broadly directionless, whilst momentum indicators are giving little or no steer. The breakdown of the short term range above $1305 has put the bulls on the back foot once more and price action yesterday suggested that there was the potential for a retracement back towards $1280 key support. The reaction though has dragged the price higher again. There is a sense that $1300 is a bit of a line in the sand here, both psychological and also price wise. A consistent failure to hold on would certainly increase the pressure on $1280. The old support at $1305 is also new resistance.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.