Market Overview

Financial markets and nervous investors continue to be influenced by the geopolitics of Ukraine and Russia. Yesterday’s announcement that the US and EU would be moving to Stage 3 sanctions (against financial, defense and energy sectors has turned the mood once more towards caution. Wall Street closed just under 0.5% lower, despite more strong results from the likes of Merck and Pfizer (however, a late announcement of results from Twitter caused a stunning 35% gain after-hours and this could help drive a market rebound today). Asian markets were mixed with the Nikkei slightly higher following the continued weakness of the yen. European markets are going with the cautious angle with concerns over the sanctions, and are trading slightly lower.

There is very little movement on the majors in forex trading early today, although the incredible run higher for the dollar shows little sign of stopping quite yet. This comes ahead of a big day for the US with regards to its economy. It could be a volatile afternoon as we get a first look atQ2 GDP which is announced at 13:30BST. The strong employment and PMI readings have suggested the US will have grown at an annualised 3.0% in Q2. Furthermore the Federal Reserve is set to announce its latest monetary policy update and is expected to taper asset purchases by another $10bn to now sit at $25n.

Meanwhile the euro traders will certainly be watching out for the German CPI data which is announced around 13:00BST, but is expected to fall from 1.0% down to $0.8%, which would not bode too well for Eurozone-wide flash inflation that is released tomorrow.

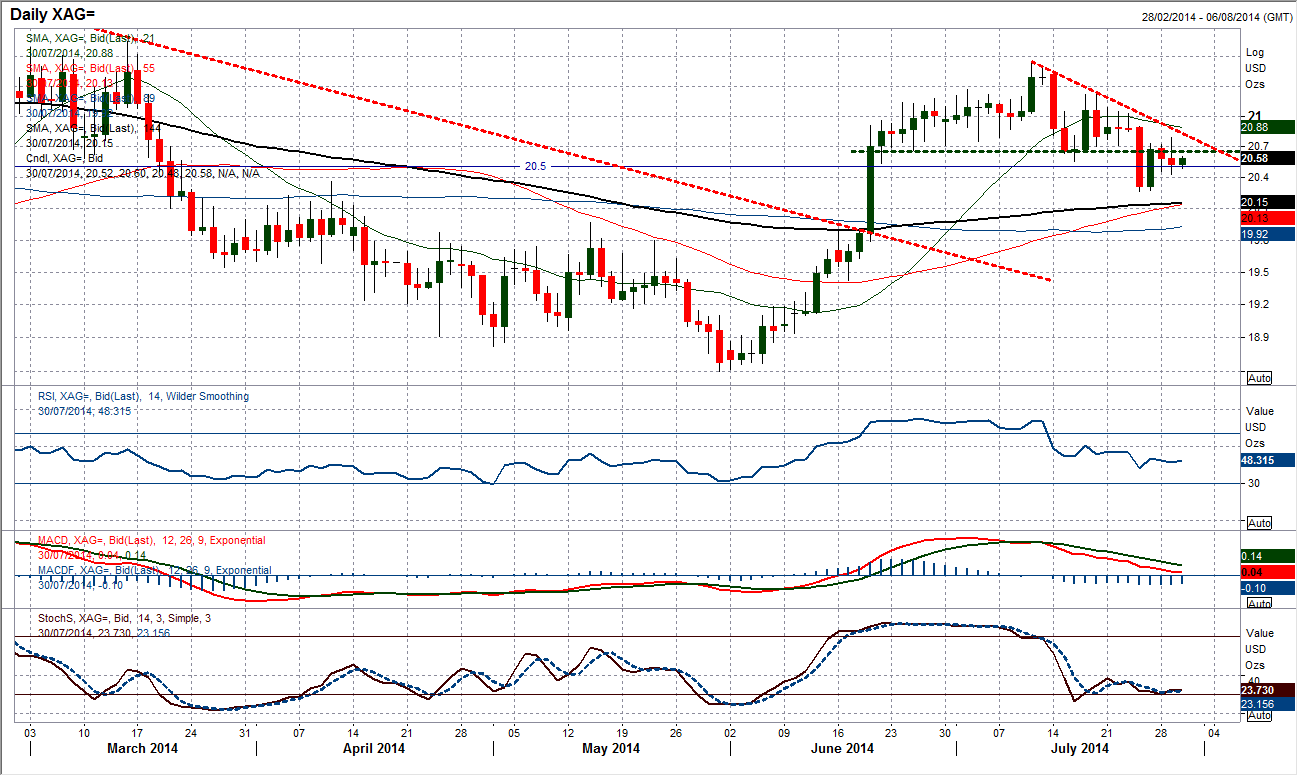

Chart of the Day – Silver

As a technical chart, this correction in silver is far better defined than it is on gold. There is a definite downtrend that has formed since the rally high at $21.55. The near term concern would also be the completion of a small top pattern below $20.55 which implies $19.55, whilst this 3 week downtrend is also pulling the shares lower at $20.77. However, I have spoken previously above the key pivot level around $20.50 and despite the spikes of a few days ago, this pivot is still holding true. Momentum indicators have unwound to take any of the overbought momentum away and the bulls will start to look for the rising 55, 89 and 144 day moving averages just below to start to provide support. The reaction low at $20.26 could be key to the near term outlook now as if this support holds then perhaps these longer term supports can also begin to haul silver higher again. However in the meantime the near term trend appears to be your friend, and that is lower.

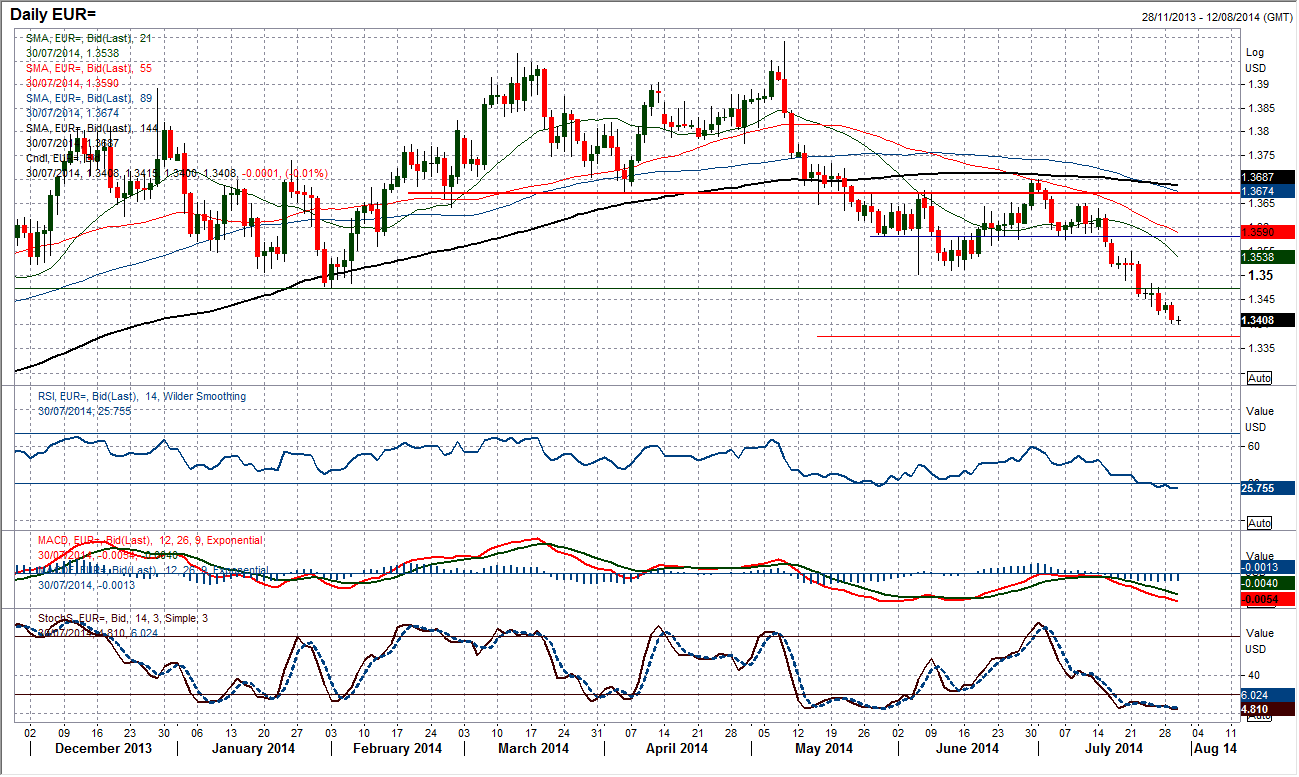

EUR/USD

It almost goes without saying, but the outlook for the euro remains incredibly weak. It is now within striking distance of the $1.3375 implied target from the double top pattern completed in May and there appears to be very little that will stop it from hitting this first target. Rallies continue to be sold into and downside momentum is growing. Despite the RSI now being at its lowest level since June 2012, the force of the stepped decline is decidedly with the bears now. There may be the occasional minor rally within the decline that lasts for maybe 40 to 50 pips, but the sellers just use this as another opportunity to hit the euro once more. The latest resistance comes in at $1.3440 and then above there $1.3475. Below the $1.3375 target the next key low is the November 2013 support at $1.3295. The prospect of a technical rally is clearly growing with the RSI at such a stretched level and it may need a catalyst. Non-farm Payrolls are on Friday, whilst the ECB monetary policy is not until next Thursday. It could be a while yet.

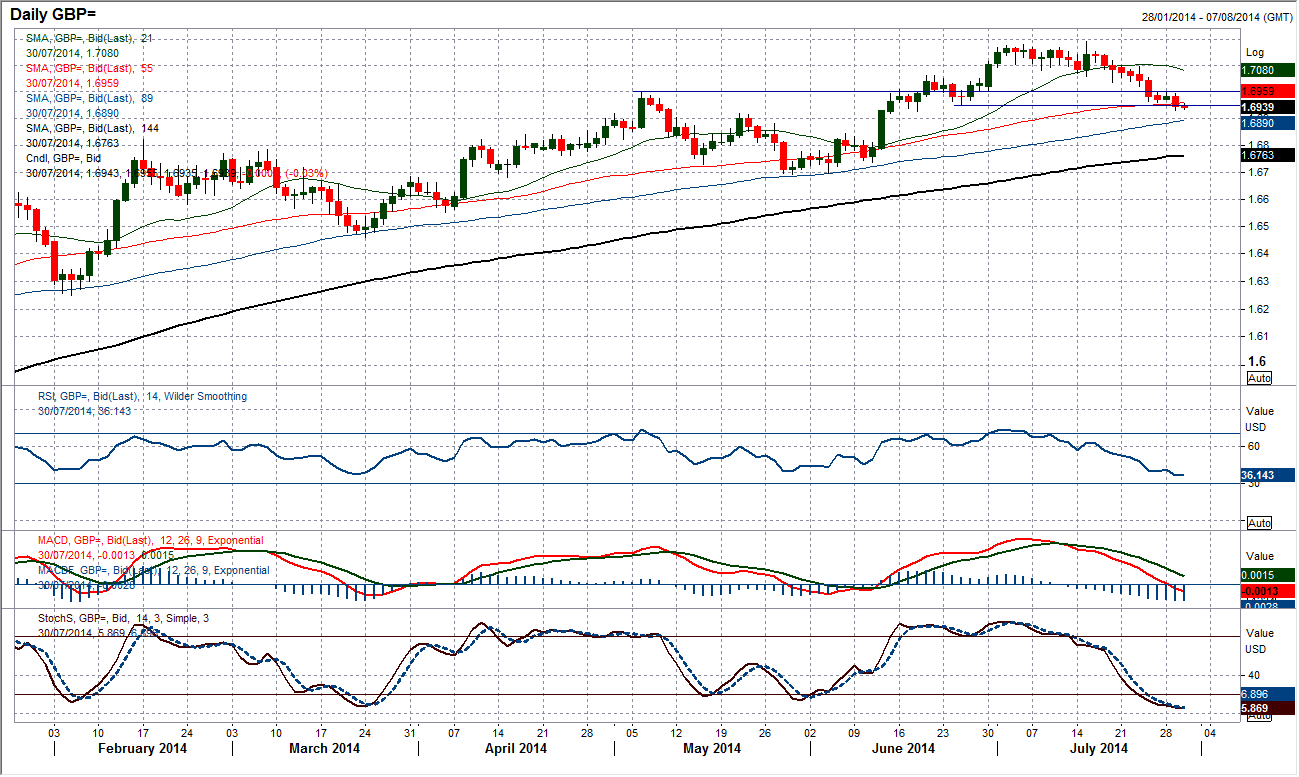

GBP/USD

Since hitting a multi-year high at $1.7191, Cable has now corrected 250 pips in just over two weeks, which is quite some move. Whilst I remain positive on a longer term basis the strength of this correction is leading me to question how Sterling bulls might be able to recover control once more. Another disappointing day for Cable continues this drag lower towards the support of the 89 day moving average (now $1.6890) which remains the key basis of support for the major corrections. There is also a band of support around $1.6900. This is now my expectation, that support will begin to form soon, but whether it is a mere consolidation is difficult to say. Normally in bull markets, as Cable has undoubtedly been in for the past year, the support is formed sooner than expected, but this correction has been different and has got me worried for the health of the long term bull run. There is intraday resistance at $1.6960 and then at $1.7000.

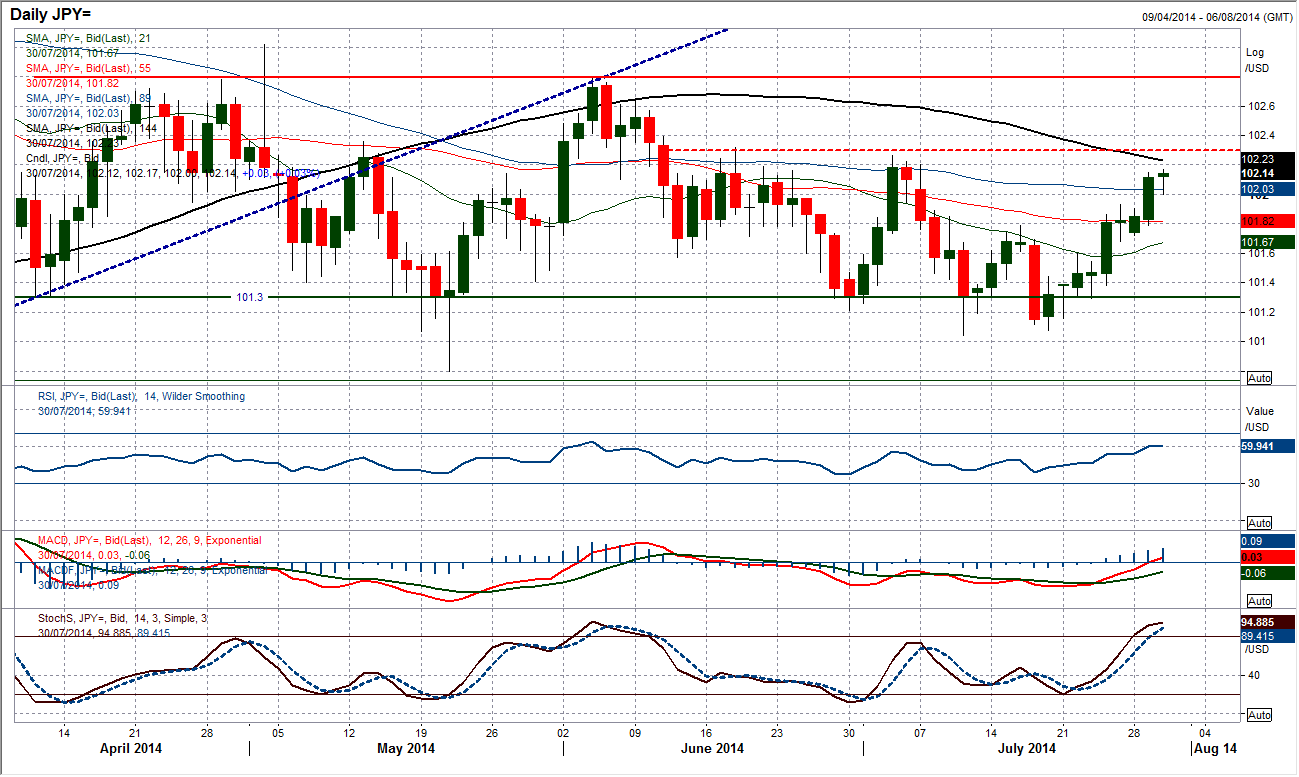

USD/JPY

Waiting for the bears to resume control is a bit like waiting for a delayed train. You constantly expect it to be coming soon but you never really know when. That is a bit what this rally has been like for Dollar/Yen. Into its ninth day since hitting a low at 101.08 the rate is now 100 pips higher and the recovery has been strong. However now the overhead supply in the band 102.20/102.32 is fairly sizeable. There is also the falling 144 day moving average (now 102.23) which has become a basis of resistance. I might sound like a broken record, but this is where the recovery is likely to start to come up against resistance which could ultimately see the bears regain control.

However, looking on the intraday hourly chart the trend remains strong and near term momentum is positive. Anyone running a long position should stay close to any profits, whilst those tempted for a short should ideally wait for a sell signal that would probably now include a breach of the support at 101.80.

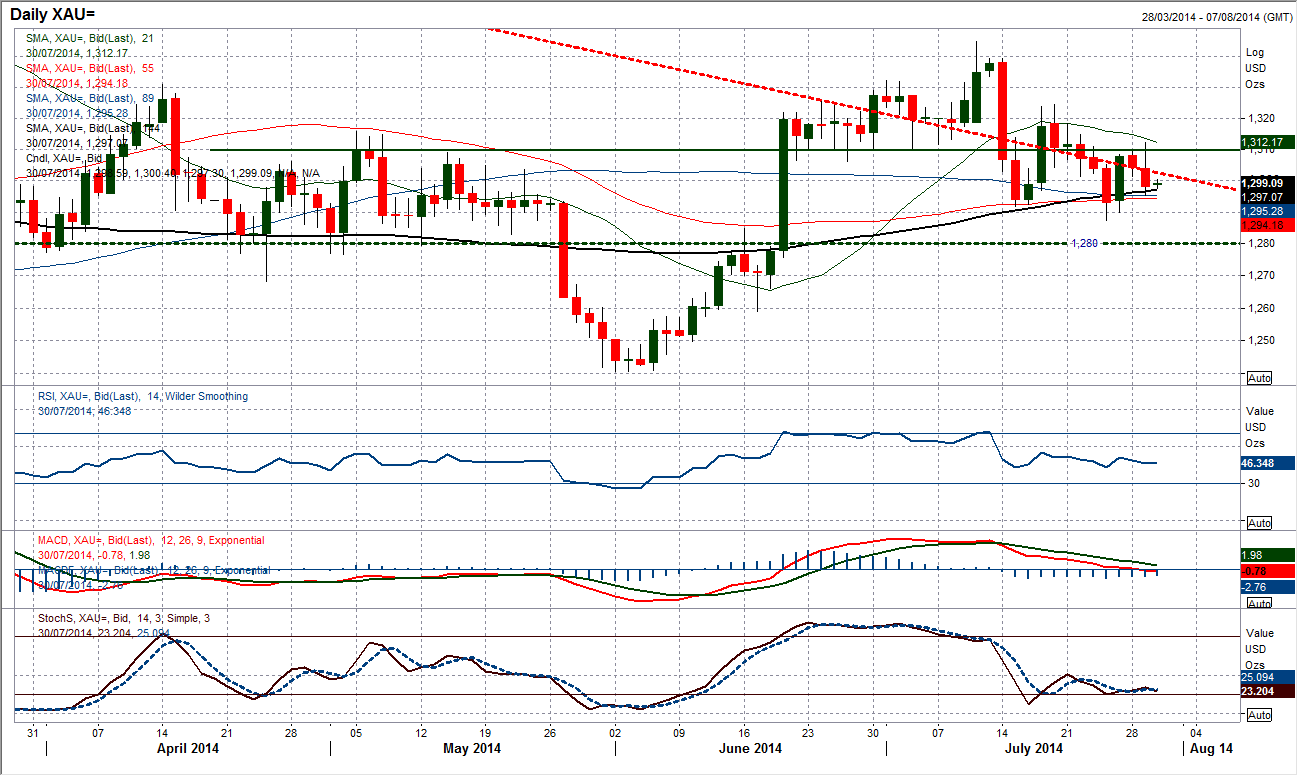

Gold

The technical appraisal of gold uses the 144 day moving average ($1297) which is an excellent gauge for the longer term outlook. The price has spent the past week trading around the longer term technical indicator which continues to rise. The long 21 month downtrend has been broken, whilst the momentum indicators remain in positive configuration. This tells me that when normal trading resumes, the longer term outlook is positive.

However, near term news-driven trading is in control and is making for a lack of trend and a lot of false signals. A bearish outside day yesterday would normally open the downside, but it is difficult to trust this signal. The announcement of increased sanctions on Russia is likely to stoke up the price once more. Near term trading gold needs to be done with one eye on the news. The key support comes in at $1291.70 and then $1280; whilst yesterday’s high at $1312.10 is near term resistance prior to $1324.44.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.