Market Overview

Wall Street closed slightly lower last night as uncertainty over the geopolitical events in Ukraine continued to play out. A loss of around 0.2% on the S&P 5000 took some of the shine off earnings that have so far tended to impress the market. Some signs of progress overnight though with the Russian separatists willing to allow the repatriation of bodies and access to the site, in addition to the potential for developments over a ceasefire in Gaza, have helped to cheer Asian markets. Although the Nikkei 225 played catch-up following a public holiday on Monday, it was able to post decent gains of around 0.8% with a weakening yen also boosting sentiment. European markets are trading with slight early gains today as the FTSE 100 looks to wipe off the 21 point loss from yesterday.

Forex trading is once again showing a mixed bag this morning. The weakness in the yen (which is dragging Dollar/Yen higher) suggests a slight improvement in risk appetite, with the Australian dollar also rallying. This comes amidst slight losses for the euro, Swiss franc and the Canadian loonie.

After a slight miss on the expectations of Swiss trade (with imports stronger than expected), traders will now be turning their attention towards the US CPI data which is announced at 13:30BST (2.1% expected YoY for June). Furthermore there is housing data with the US House Price Index (at 14:00BST and +0.2% exp) and the Existing Home Sales (at 15:00BST which is expected to improve by 2.0% to 4.99m).

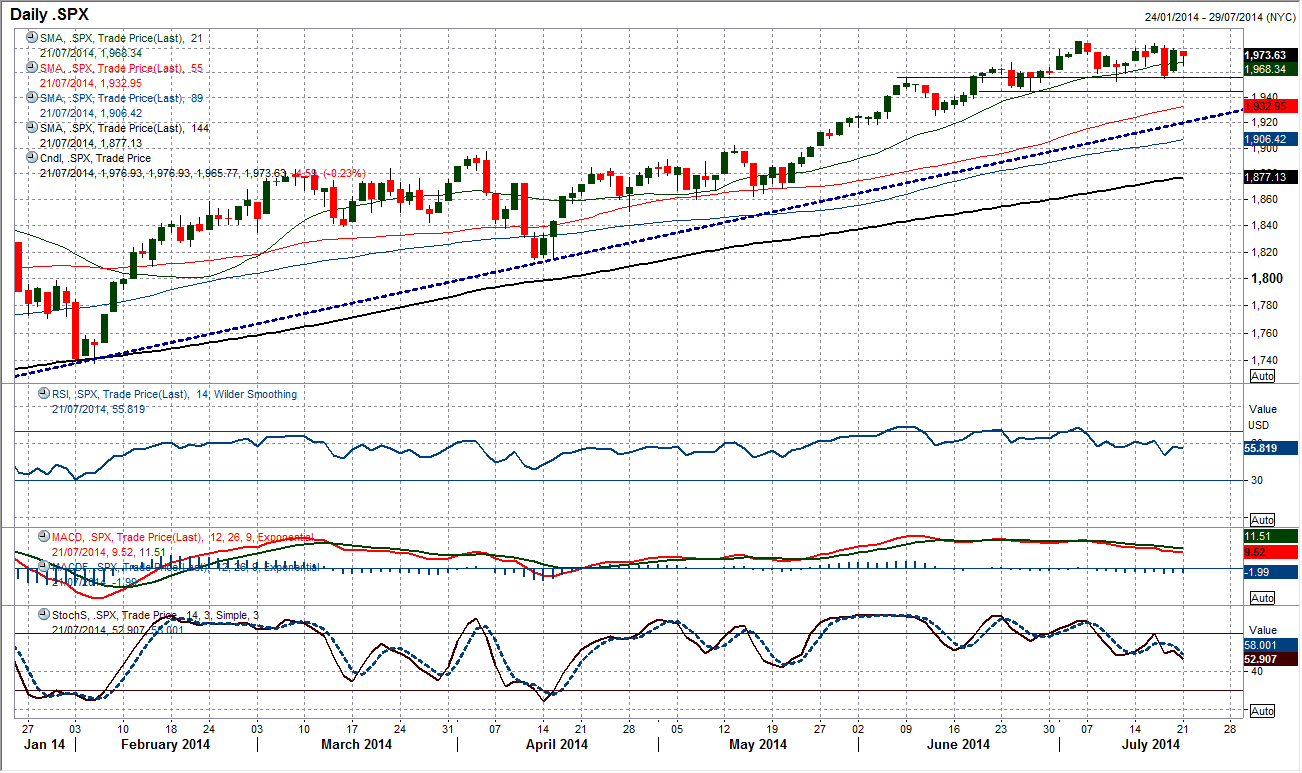

Chart of the Day – S&P 500

Despite the geopolitical events such as the plane crash in Ukraine and conflict in Gaza which have hit stock markets around the world, the S&P 500 has been relatively insulated. With this in mind, US equities have remained strong and a retest of the all-time high at 1986 is a very real possibility. The strength of the stepped decline means that there is good support now in the band 1945/1955. Momentum indicators are unwinding without any real bearish signals, whilst moving averages are supportive and the uptrend that dated back to November 2012 is at 1920. Expect the support band 1945/1955 to continue to underpin the chart and an assault on the 1986 all-time high before 2000 is reached. There is little reason to suggest anything other than a strategy of buying into weakness.

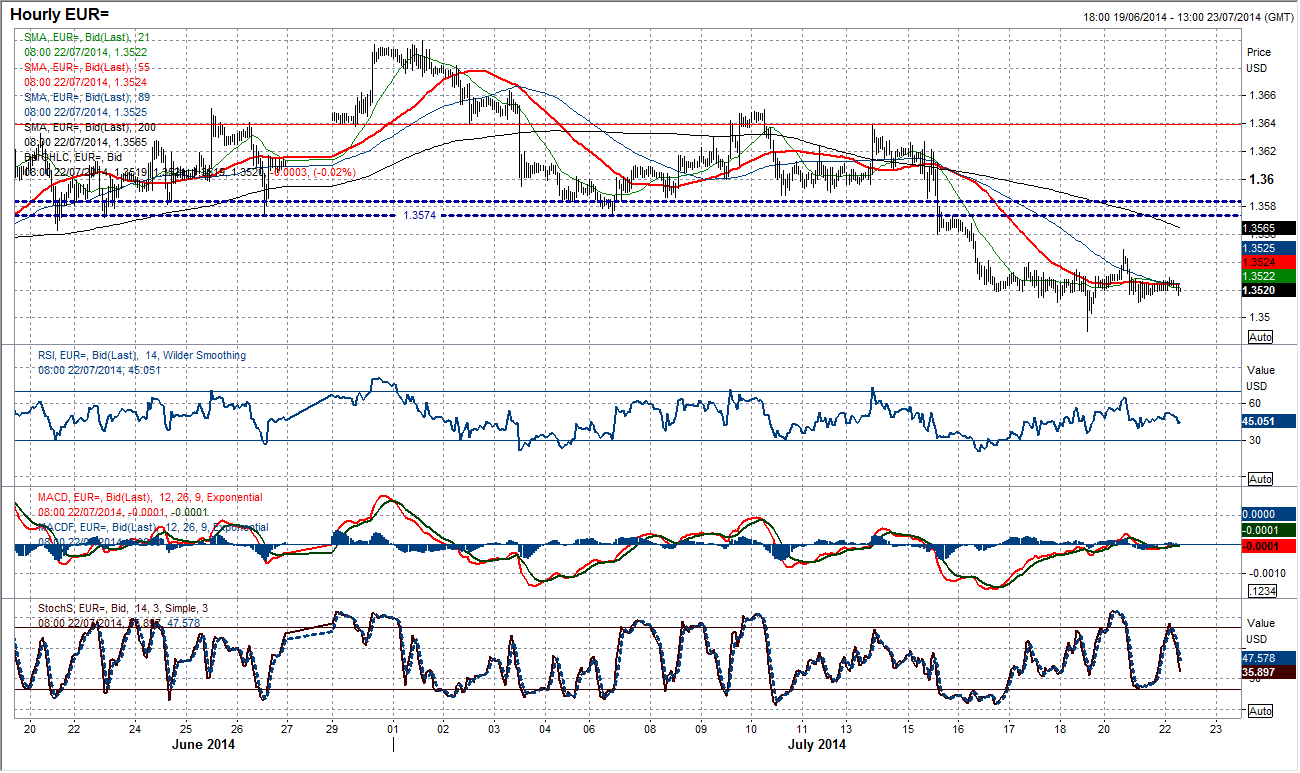

EUR/USD

A sense of calm has taken over the euro in the past few days as the rate becomes almost anchored around $1.3520. With such low volatility and lack of direction it is difficult to ascertain the next move in such a scenario. It is clear that traders are waiting for something and that would be the next move in the geopolitical developments over flight MH17. I would though still say there are two scenarios that could play out. Firstly, immediate continued decline (possibly with increased sanctions on Russia) below $1.3500 and a test of $1.3475 the key February low, or secondly which is more likely given the sharp recent falls, a rebound that unwinds some of the weakness that takes the euro back into the resistance around $1.3575. At this point the technicals will take over again and there will be further weakness. I still see selling rallies as the only viable way to play EUR/USD.

GBP/USD

The consolidation drift shows little sign of abating yet, but the top of the support band $1.7000/$1.7060 which I believe is going to be a good “buy-zone” continues to be bought into. There have now been three dips below $1.7060 in the past five days and each time the buyers have returned. The momentum indicators have used this slight drift lower to unwind any overbought momentum and are now approaching levels that would be considered to be good buying opportunities once more, with the RSI around 53. The intraday hourly chart may perhaps hold a clue for resumed upside. The falling 55 hour moving average (now $1.7080) has been the basis of resistance over the past three days and if Cable starts to trade above it , it would suggest that the near term corrective downside pressure is beginning to abate. The old support around $1.7100 also capped the rally from yesterday so would also be seen as a ceiling. A break back above would re-open $1.7150 and then the high again at $1.7191. There is minor support at $1.7034.

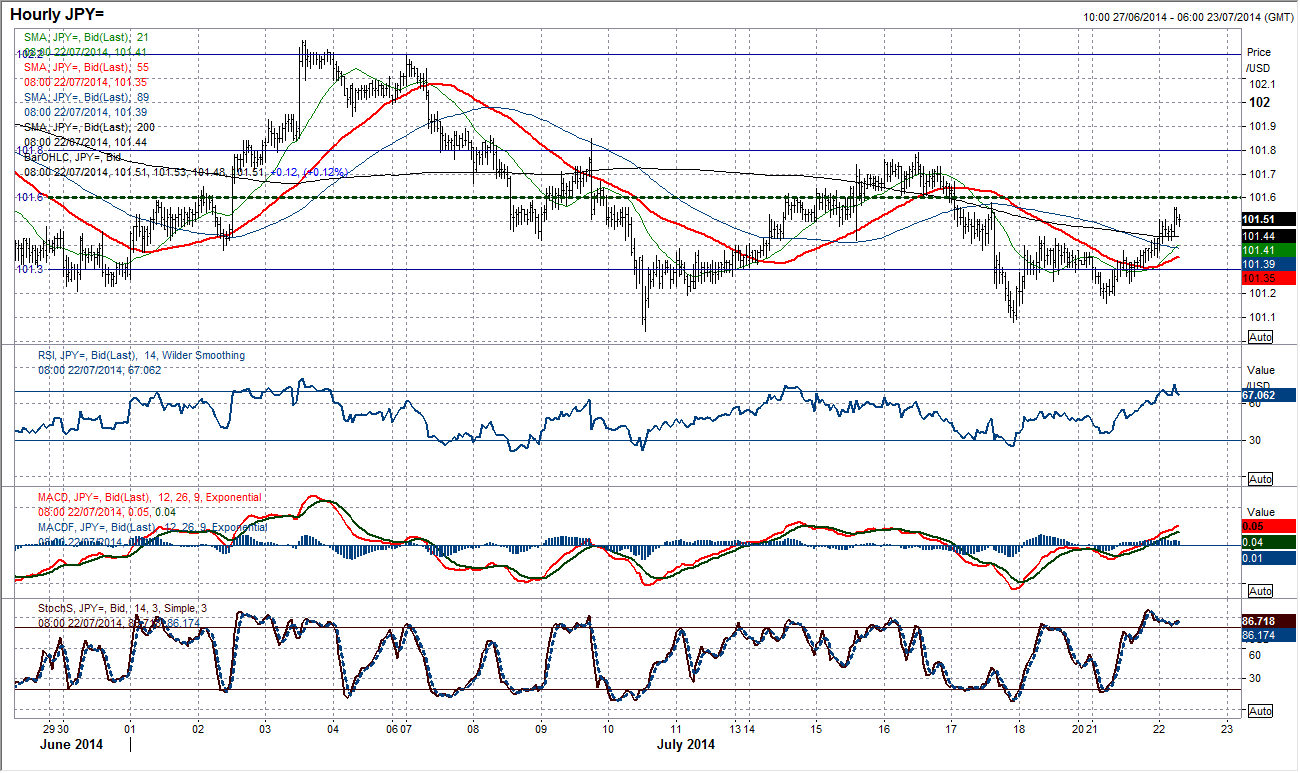

USD/JPY

Although Dollar/Yen is apparently under downside pressure, there is no consistent run of losses that the sellers can get their teeth into, because there always tends to be a recovery that takes hold. The problem for the bulls is that the recoveries tend to only last for a few days before the downside resumes again. This is likely to be the situation once again. A rally is into its third day now but it is once again being faced by the barrier of the falling moving averages (the 21 day ma now at 101.61 capped the most recent bounce, while the 89 day ma at 102.05 capped the early July bounce). Also the momentum indicators are all in bearish configuration and just look as though any rallies are a chance to sell. The intraday chart shows a resistance band 101.60/101.80, with anything up to around 102.00 liekly to be a good chance to sell. Expect further pressure on the recent lows 101.08 and below in due course.

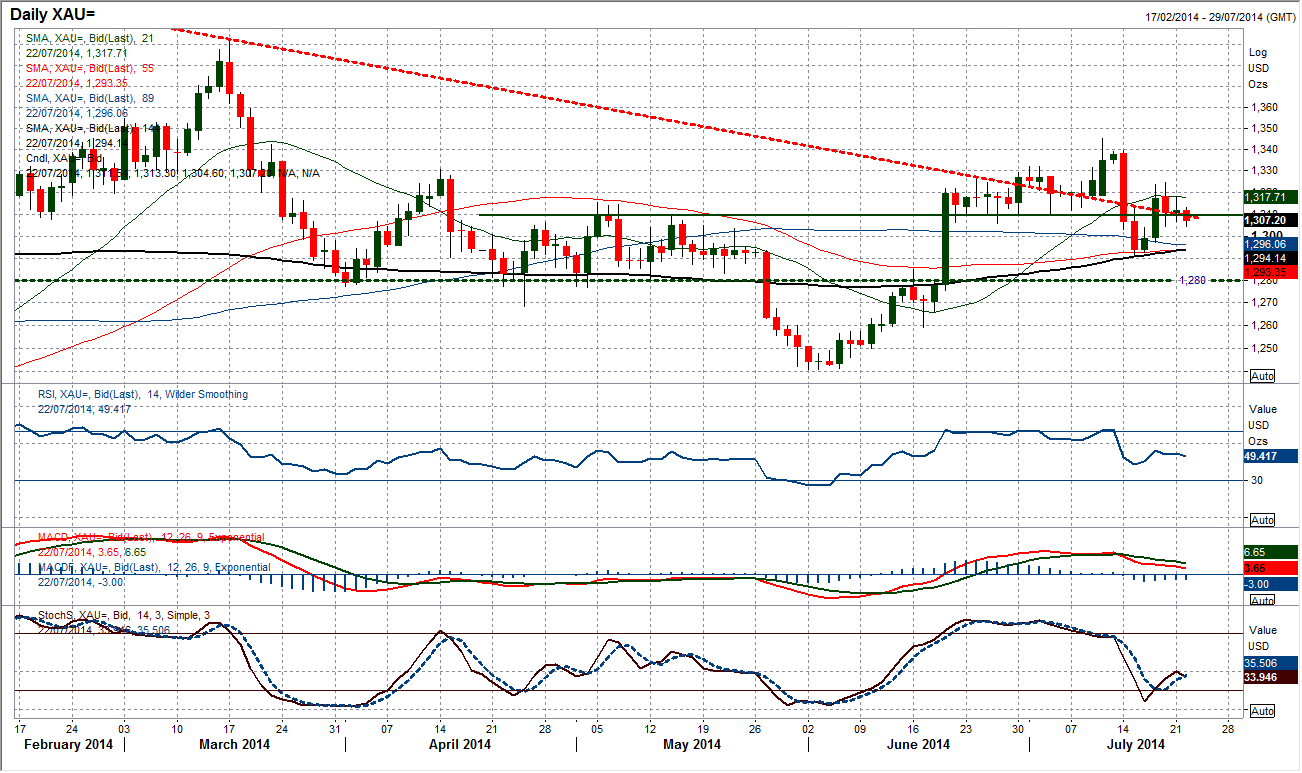

Gold

The choppy trading in gold in the past couple of weeks shows that macro-events are driving the gold price. However once the events settle down, it still looks as though the longer term outlook for gold is beginning to improve. In the meantime though the price may fluctuate according to events (the news that the Russian separatists have handed over the black boxes to the Malaysians will calm tensions somewhat, but the prospect of further sanctions on Russia could then help support gold). Technically though the support of the rising 144 day ma at $1294.14 is ever rising and there is further support underneath at $1280. The longer term bull configuration of the momentum indicators, the broken downtrend since October 2012 and the supportive moving averages suggests that corrections are a chance to buy now. Initial resistance comes at $1324.44.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold climbs above $2,340 following earlier drop

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.