Market Overview

Wall Street posted another positive close which included a record high for the Dow Jones Industrial Average as markets gained around half a percent into the close. The gains came despite a slight miss on the industrial production numbers, whilst the Fed’s Beige Book noted that the economy was growing at a moderate pace. Attention was on Janet Yellen again, but she maintained a similar line in front of the House Financial Services Committee as she had the day before.

There was also the news that the US and EU would be introducing a new round of sanctions on Russia which is bringing Ukraine back into focus for investors. The new sanctions include those on corporate firms such as Rosneft, in addition to energy, defence and financial companies. The negative sentiment hit Asian markets which were mixed to slightly lower overnight, with the Nikkei held back by a slight strengthening of the yen overnight. European indices are also trading slightly lower in early exchanges today.

It has been a fairly mixed start to the day in forex trading, with major pairs showing little real trend. The dollar is fluctuating, but is weaker against the yen, but is gaining against the Kiwi dollar which continues to pull back towards 0.8650.

Traders will be looking out for the final reading of Eurozone CPI which is announced at 10:00BST. The expectation is that it will stay at +0.5% from the flash number a couple of weeks ago, which would not do much for the euro as the inflation figure sitting at such a low level will only encourage the potential use of QE by the ECB. Today also has the weekly jobless claims for the US at 13:30BST which are expected to rise slightly to 310k from 304k last week.

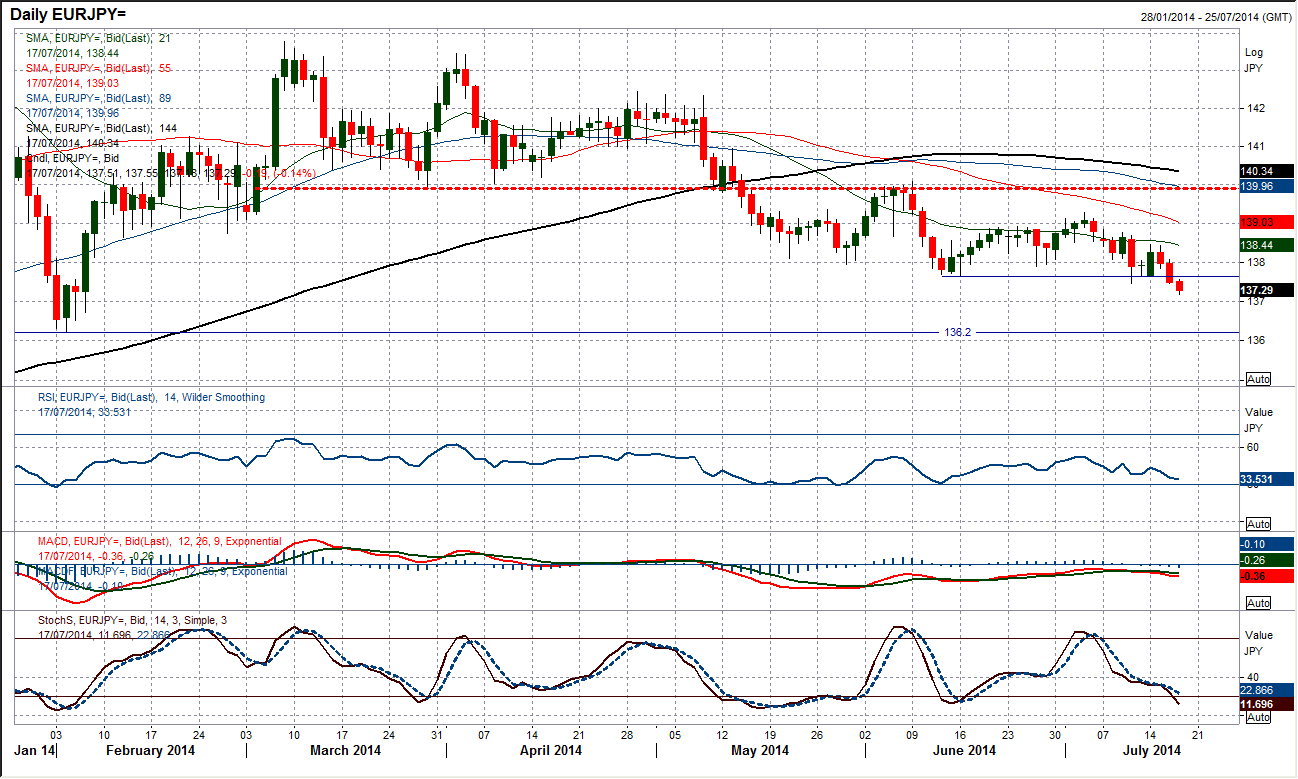

Chart of the Day – EUR/JPY

The support at 137.60 has finally been broken and the move seems to be decisive today. After the minor recovery was scotched a couple of weeks ago the sellers have been in control and now a downside break opens a test of the 136.32 key February low. The moving averages are all falling in bearish sequence. Moreover the momentum indicators are all in bearish configuration but also have further downside potential too. The intraday hourly chart does not give much hope to the euro bulls either, with the old support around 137.60 now turning into the new resistance. The preferable strategy would probably now be selling into a pullback rally towards a band of resistance 137.60/137.85. There would be much that needs to happen now for the bulls to be encouraged, but the first being a move above the resistance of the 21 day moving average (currently 138.44) and the reaction high at 138.45. The outlook does not look good for the euro.

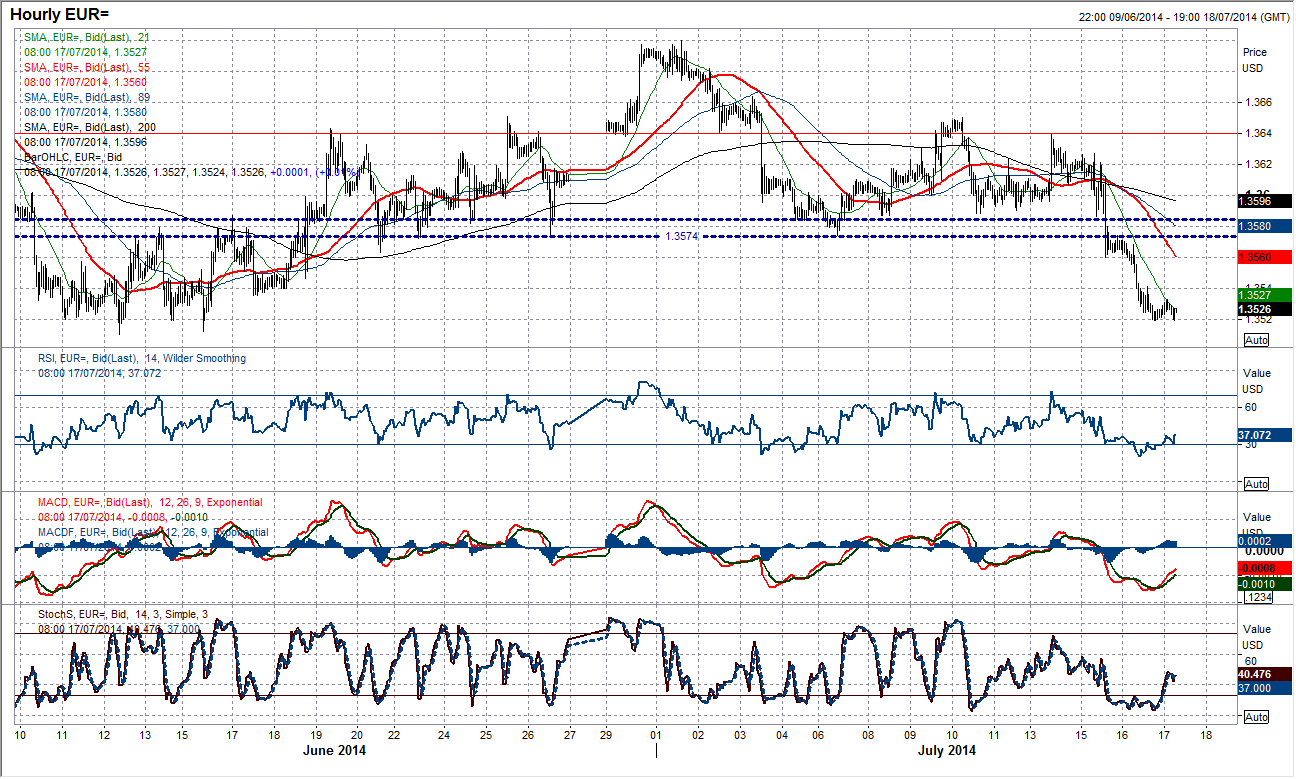

EUR/USD

After a second straight big bearish candlestick, the euro is set for a test of the key low around $1.3500 which was hit on the day that the ECB announced its easing measures. The outlook for the euro is increasingly weak, with all moving averages now falling in bearish sequence and momentum indicators not only in bearish configuration but also with further downside potential. The intraday chart shows that a slight consolidation has taken hold overnight around $1.3520 but any bounce or recovery should now be seen as a chance to sell. There is minor resistance around $1.3560 but the main bod of near term ceiling is now in the old band of support which has turned into resistance at $1.3574/$1.3585. I see further pressure on $1.3500 in due course before a test of the key February low at $1.3475. It would now take a breach of the reaction high at $1.3650 to suggest an improving outlook now.

GBP/USD

Despite the bullish outside day on Tuesday which saw Cable break to a new multi-year high, with a sedate trading day yesterday, consolidation threatens to take hold once again. This move is helping to unwind the momentum indicators, whilst the 21 day moving average has become supportive at $1.7095. Taken amidst the backdrop of the dollar strength against other major currencies that would suggest that Cable is holding up extremely well and that this consolidation is a pause for breath before further gains will be seen. The support band is now between $1.7060 and $1.7100 to build from. The intraday chart shows the hourly moving averages are supportive and the momentum indicators remain positive. In consolidations such as this, it can be difficult to time a breakout, but the dips are being bought into and there is a good support building up for the next upside break above $1.7991 on Cable. A break below $1.7060 would be a touch disappointing for the bulls, but there is further support at $1.7000 too.

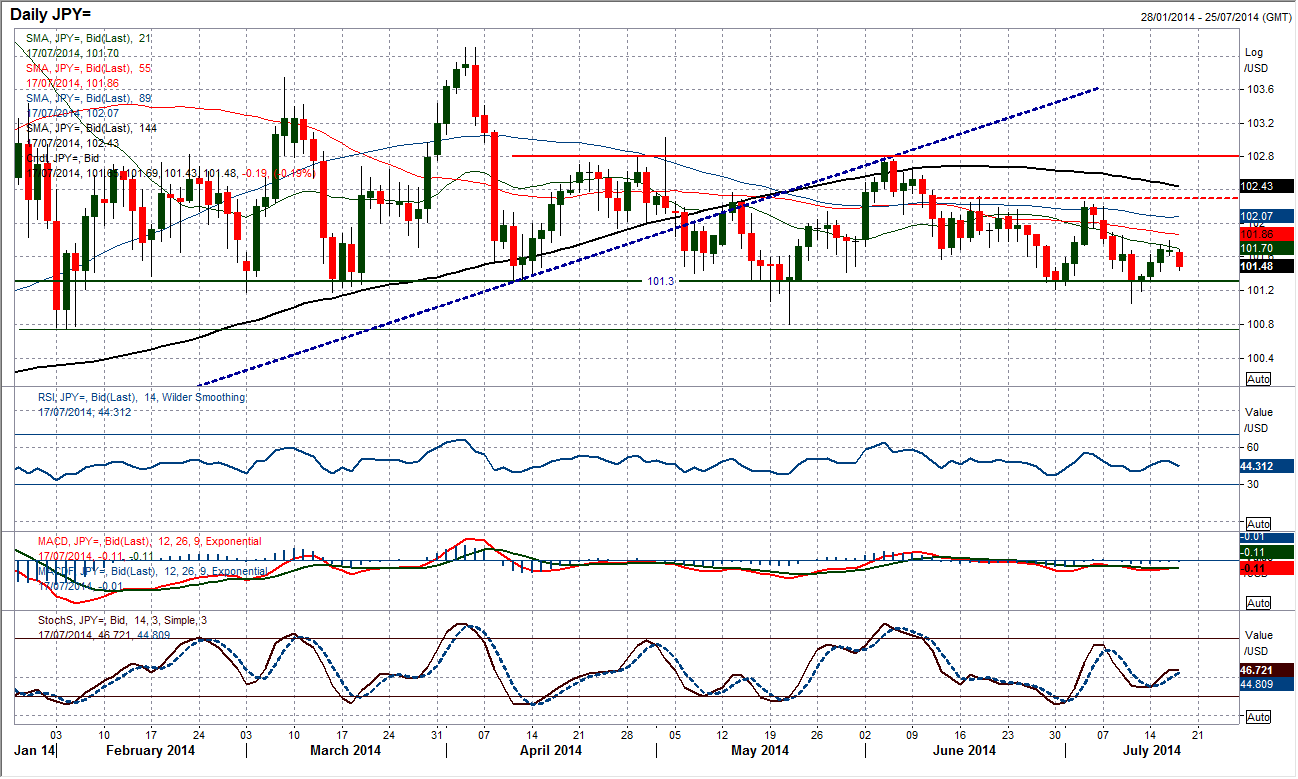

USD/JPY

With the rally into its fourth day, I have been saying that 101.80/102.00 would be a good “sell zone”, but unfortunately the selling pressure has taken hold just before Dollar/Yen managed to get there and overnight Asian trading as seen the rate drop back again. If this is the end of the rally then the bulls are beginning to lose faith much earlier than expected and this does not bode too well for the support band around 101.30. The momentum indicators seem to be taking on a more negative configuration, whilst the moving averages are now all falling in bearish sequence. The closing low support remains 101.30 but the intraday lows come in just above 101.00 so there is downside potential now. I would still be looking at a move into 101.80/102.00 as an opportunity to sell. I see the bears remaining in control now until a breach of the reaction high at 102.30.

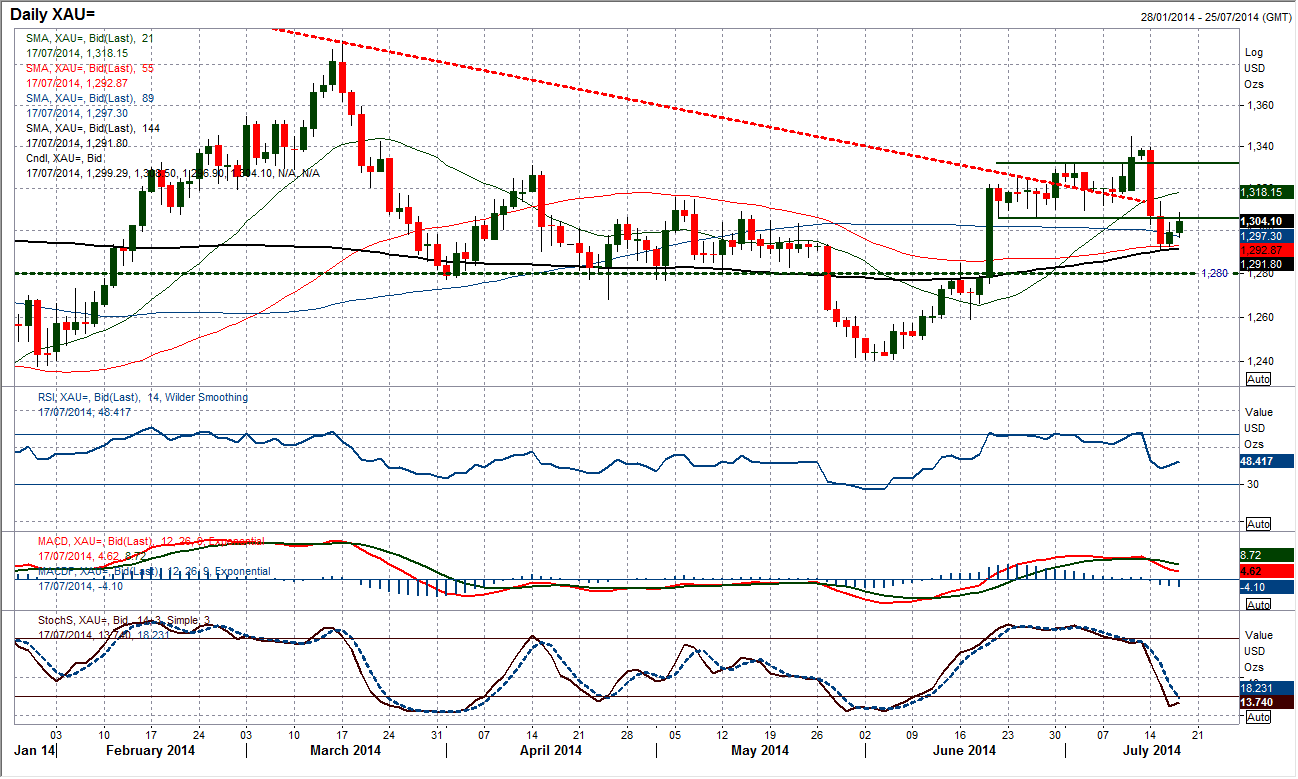

Gold

After the sharp sell-off formed support at the 144 day moving average (currently $1291.80) the rally in gold that has built over the past two days is testing the breakdown level around $1306. This is the first of two old supports (the second being $1310) that are now the basis of new resistance. The reaction to these resistances is key to the near term outlook. The price is still settling down following the sharp downside break which theoretically implies a near term move back towards $1280. However if $1306/$1310 can be breached then this would represent a strong reaction by the bulls. My feeling was that we would get a move back towards $1280 before the support kicked in and gold headed higher again as the longer term indicators are turning more positive. It looks like the bulls are supporting sooner than I thought. The 144 day moving average continues to be an excellent basis of support. The intraday hourly chart shows resistance levels above $1310 are at $1320 and $1325.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AUD/USD posts gain, yet dive below 0.6500 amid Aussie CPI, ahead of US GDP

The Aussie Dollar finished Wednesday’s session with decent gains of 0.15% against the US Dollar, yet it retreated from weekly highs of 0.6529, which it hit after a hotter-than-expected inflation report. As the Asian session begins, the AUD/USD trades around 0.6495.

USD/JPY finds its highest bids since 1990, approaches 156.00

USD/JPY broke into its highest chart territory since June of 1990 on Wednesday, peaking near 155.40 for the first time in 34 years as the Japanese Yen continues to tumble across the broad FX market.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.