Market Overview

I thought that the testimony of Janet Yellen to the Senate Banking Committee would be a significant event this week, and the reaction of the markets suggest that we were not disappointed. Despite her written testimony giving little new information, alluding to her caution of the economic recovery, the significant slack in the labor market and below target inflation; when it came to her answering questions there were one or two minor hints at what might be to come. Her assertion that conditions could change quickly was perhaps a hawkish hint some were looking for. This all resulted in a highly volatile reaction, with stocks paring gains, the dollar finding strength and a sharp sell-off in gold. Wall Street which had been higher following positive results from Goldman Sachs and JP Morgan, fell away to close lower.

The response of Asian markets has been fairly mixed today, with the dampening takeaway from Yellen being balanced by news that China’s GDP for Q2 came in at 7.5% which is very slightly higher than the 7.5% expected. European markets are trading slightly higher early today after yesterday’s weak session. The data out of China is boosting the sentiment for the natural resources sectors.

Forex trading continues to show a stronger dollar, which is trading positively against all of the major pairs as the greenback remains supported after Yellen’s comments from yesterday. Traders will be looking out for the UK unemployment data which is announced at 09:30BST and is expected to show a further drop of 27,000 in jobless claims and the rate to fall to 6.5%. Janet Yellen testifies to the House Financial Services Committee today but the reaction should be fairly muted with traders having heard what she had to say yesterday.

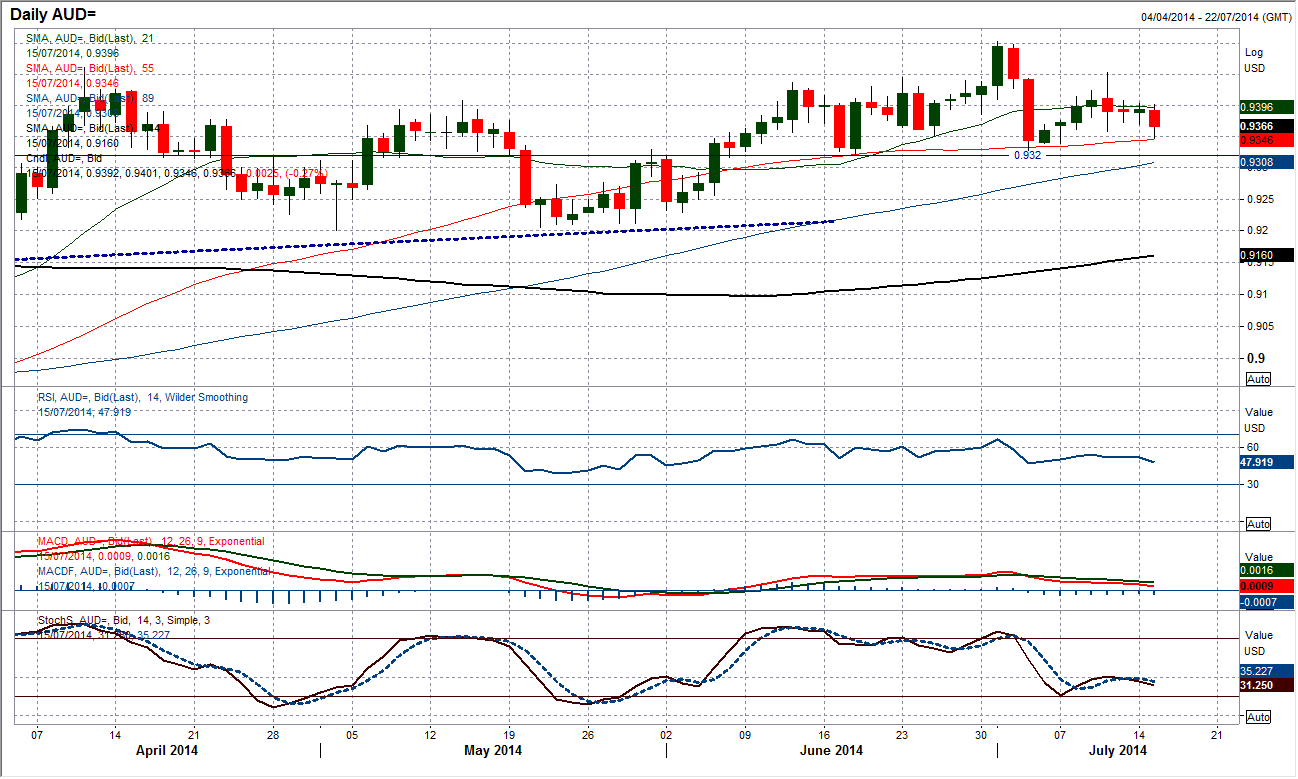

Chart of the Day – AUD/USD

Are we in the process of seeing a turnaround? Maybe, with the key pivot around 0.9320 having twice proved to be the basis of support, this floor is threatening to turn into a potential neckline of a head and shoulders top pattern. The strengthening dollar in the last few days has had a bearish influence on momentum indicators, with the RSI losing impetus and below 50, the Stochastics are also looking increasingly corrective. Now today, even amidst encouraging Chinese growth data, the Aussie dollar is weakening and is now within striking distance of 0.9320. A close below the pivot would at least suggest a test of the key support around 0.9200 and technically imply a correction back towards 0.9140. The intraday hourly chart shows there is now a minor resistance band between 0.9360/0.9400 where rallies are being sold into as the downside pressure mounts. Now, remember this pattern has not yet completed and 0.9320 has been a good support previously. I would wait for completion before calling a breakdown.

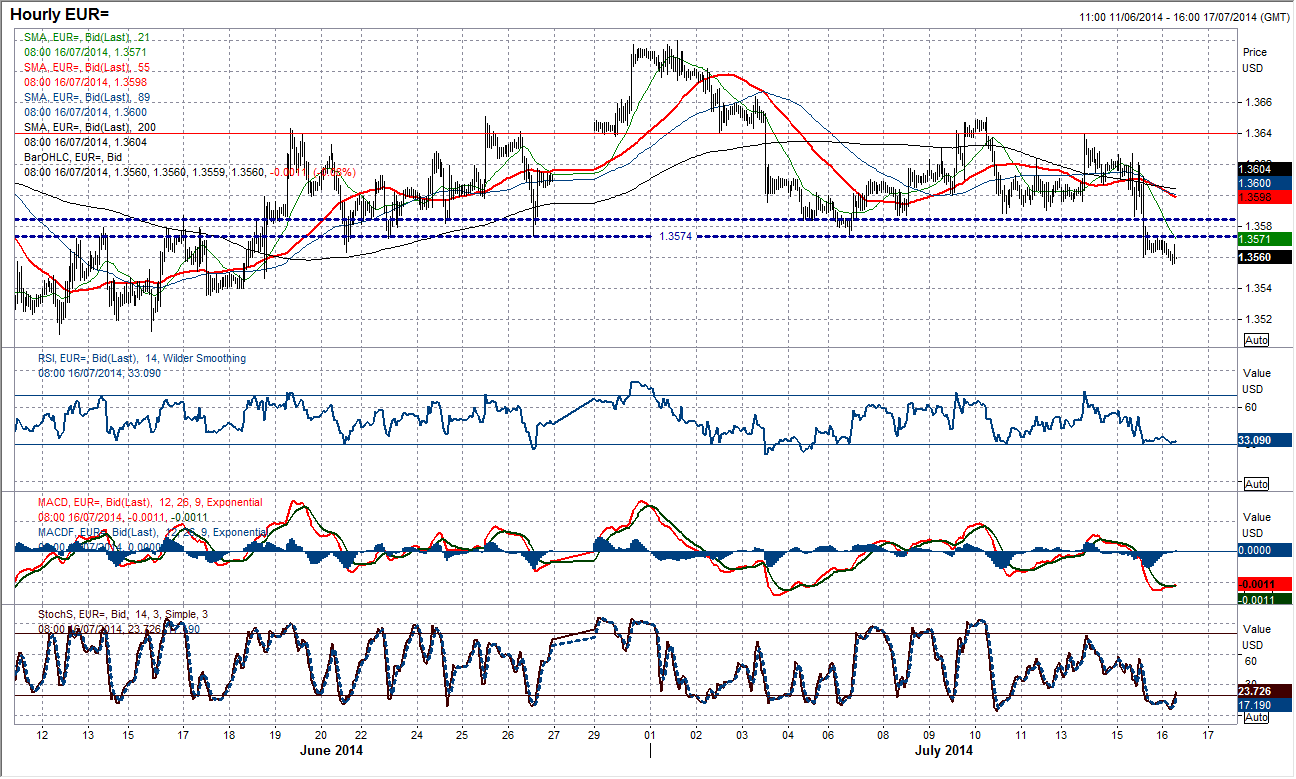

EUR/USD

A big breakdown of the support at $1.3574 was seen yesterday during the testimony by Fed President Janet Yellen has completely turned around the outlook once again. This move ends a consolidation that had lasted for almost 4 weeks and could now signal the start of a period of downside pressure towards $1.3500. The momentum indicators all suggest the bearish momentum is there for the move with the MACD lines just turning lower from neutral having renewed downside potential. The 55 day moving average is now being seen as the basis of resistance at $1.3655, but the old support band $1.3574/$1.3585 is now the resistance area and any recovery into there and up towards $1.3600 should be seen as a chance to sell. The intraday hourly chart still shows the resistance around $1.3640 in place that could be used for the basis of a stop.

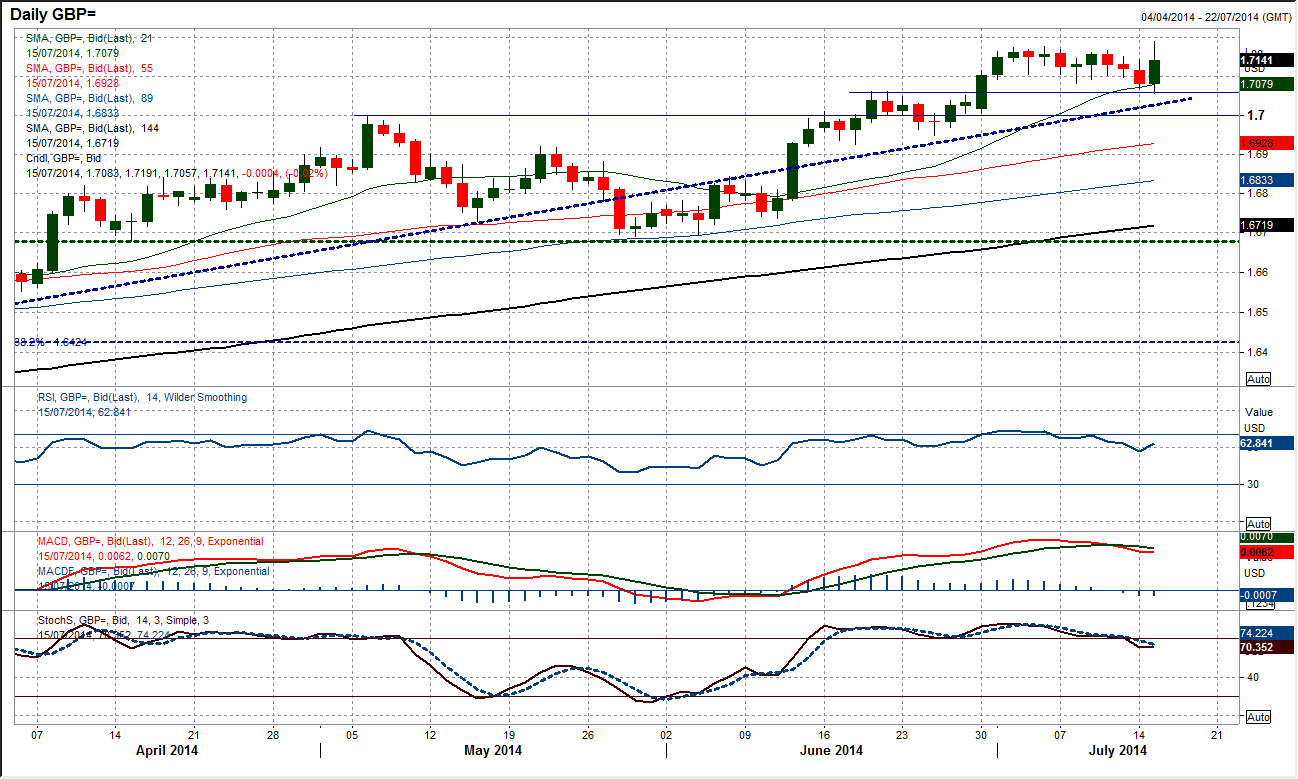

GBP/USD

I have been saying that the support band $1.7000/$1.7060 would be an ideal buy-zone and yesterday that seemed to be the case as Cable just dipped to $1.7059 before making sharp gains following the sharp increase in UK inflation. The move took Cable into new multi-year highs once more before calming down during Janet Yellen’s testimony from $1.7191 into the close. The minor disappointment that the breakout could not be sustained is tempered by the fact that the upside break shows a willingness for the buyers to still support Cable and suggests that as the rate settles again there should be further appetite for long positions. The bullish outside day on the daily chart is certainly a strong pattern and the support now in place around $1.7060 has been ever more strengthened. A corrective drift has taken shape over the past few hours but there is a basis of support around $1.7100 which the bulls will be eying. Once more this correction should be a chance to buy. Even if $1.7060 were to be breached there is still much support back towards $1.7000.

USD/JPY

The dollar rally continues, but for how long? Well if the last few months is anything to go by the move probably has not got too much more to go before the sellers gain control once more. The technical indicators on the daily chart are suggesting that rallies are seen as a chance to sell, with the latest bounce now up towards the resistance of the moving averages. The 89 day ma (currently falling at 102.07) seems to have been the basis of resistance in the last two dollar rallies, whilst momentum indicators remain in a configuration suggesting that the bears are ready to return very soon. The intraday chart shows that a key resistance band comes in around 101.80, whilst 102.00 has in the past acted as a consistent pivot level. The key reaction high that would need to be taken out to suggest a potentially sustainable recovery was underway is up at 102.30, however I would be looking to sell into this rally in the range 101.80/102.00.

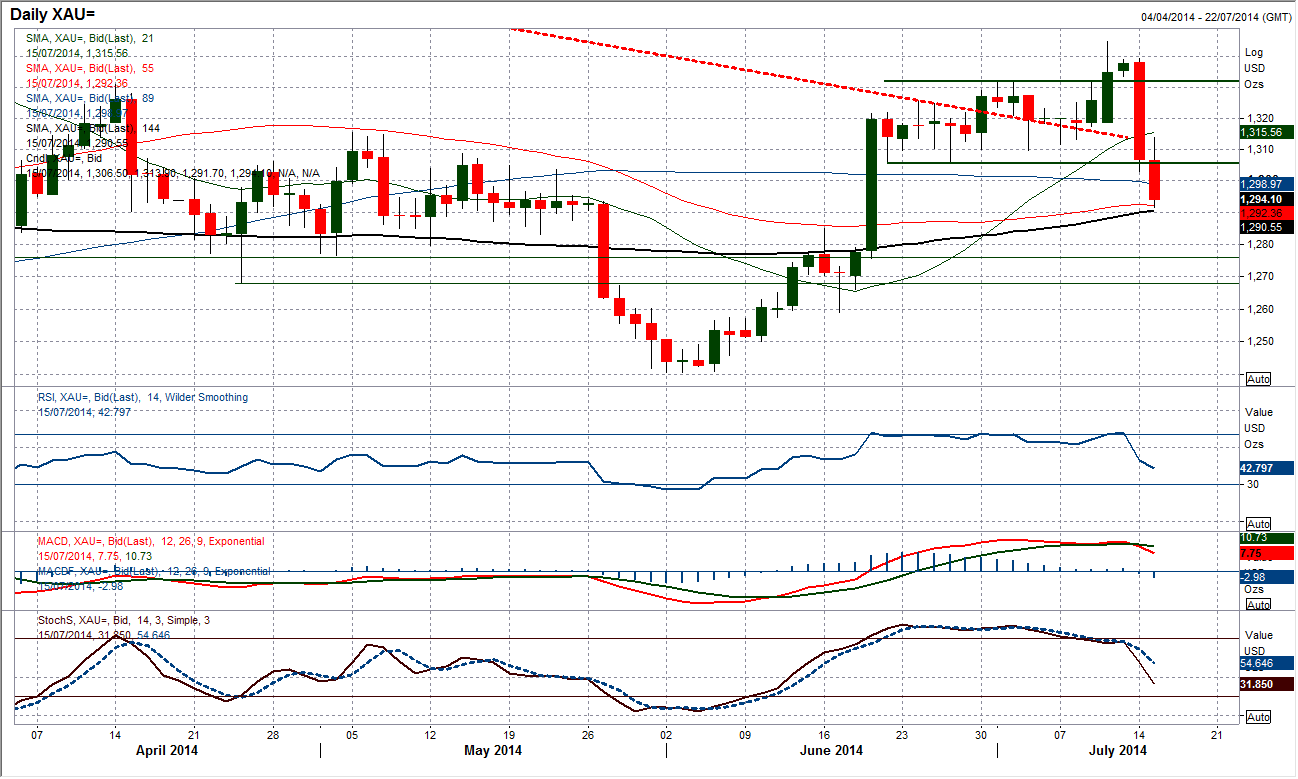

Gold

That is the thing with gold, there tends to be a period of almost inactivity for several days and then suddenly a burst of price action which has seen gold shed $43 in just two days. The manner of the sudden bearish downside break below $1306 support and then instantly below the $1300 psychological support suggests that someone has unloaded a large holding and now taken out a lot of stops around $1300 in the process. The technical outlook has taken a hefty blow, however the support of the 144 day moving average (at $1291.20) has again been used as a low. This is the only factor that has saved me from turning negative on gold again. The low from yesterday at $1291.70 now becomes a key near term support as there has been a degree of buying pressure that has re-entered in Asian trading today. It will be interesting to see how $1300 is negotiated by the bulls as an instant move back above would be positive, but the old support at $1306 now becomes new resistance and this could cap the gains. With the sharp losses of the last couple of days still fresh it may be wise to let the dust settle before seeing if the outlook is now going to put further pressure on $1291 and the 144 day moving average and there is going to be a move back towards the 1280 support area.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.