Market Overview

After the concern that Banco Espirito Santo in Portugal could drag the European banking system through the mire once more and derail the bull market, there has been an element of calm that has come over the markets on Monday morning. Wall Street closed higher to end the week, and with now deterioration in Portugal or stories of contagion, with Asian markets slightly higher today and European markets trading positively in early changes. The risk aversion that had threatened to take hold last week is now beginning to reverse, with gold almost 1% lower in Asian trading. Furthermore, investors have US corporate earnings to get stuck into which will take the focus off Portugal.

Ahead of a week laden with key economic data, it would seem as though forex trading is fairly steady moving into the European session, with no real moves, although the dollar has got the slight ascendency against sterling and the Canadian loonie.

Despite what lies in wait in the days ahead, there is little economic data due today. The only real data of any note ill be the Eurozone industrial production which is due at 10am (+0.5% exp).

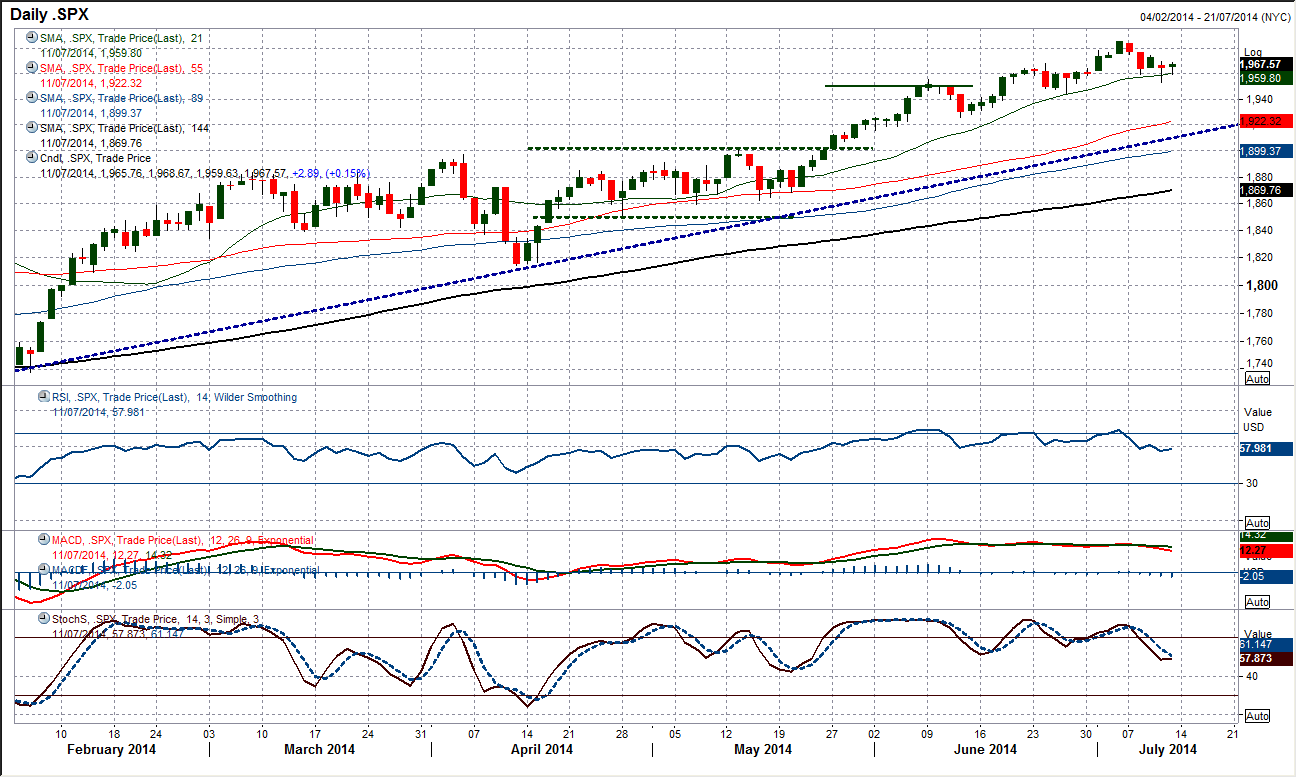

Chart of the Day – S&P 500

If you were trading S&P 500 in isolation you can be forgiven for wondering what all the fuss was about last week. For several weeks, the 21 day moving average (currently 1960) has been a great basis of support for the minor corrections and once more a break into new high ground has consolidated back to find support again before the next leg higher. The daily momentum indicators are all in strongly bullish configuration and there is little reason not to believe that this will not be the case once again for a move above the recent high at 1986. Although a consistent breach of the 21 dma would be an early warning system, the support of the previous reaction low at 1945 is the key near term level to watch. Although the S&P 500 has remained strong, the major European indices have retreated to all test their primary uptrends. For the S&P 500 this is way down at 1910. That would be the risk if this sequence of higher lows were to be broken.

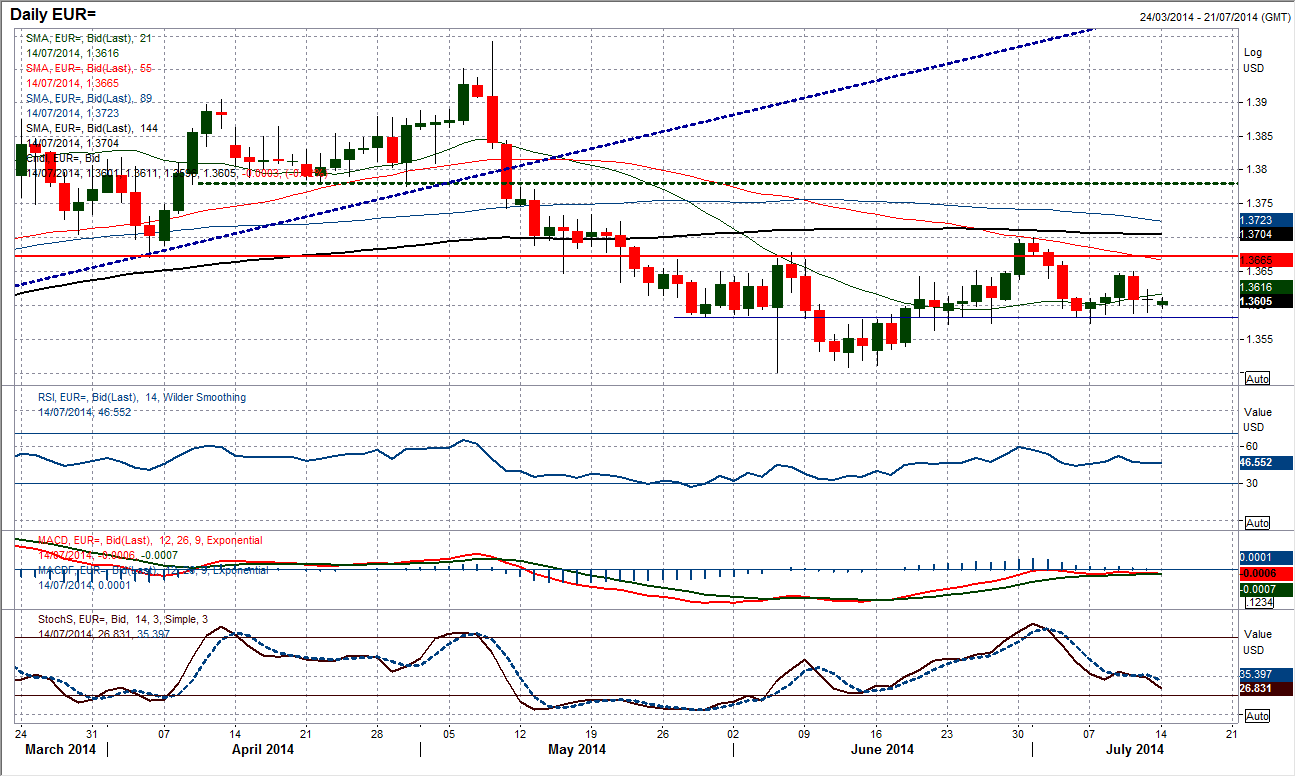

EUR/USD

Friday’s session was fairly circumspect as traders attempted to evaluated the potential risk posed from developments in the Portuguese banking system. This was reflected in the “doji” candlestick that was formed (opening and closing at the same level). The mood that resulted in this uncertain candle has filtered into the new week, with very little movement in the Asian trading and trding around the $1.3600 level. The big plus for the bulls has been that the key support band $1.3574/$1.3585 remains intact and the longer this continues without being breached the more confident they will become. However, despite momentum indicators not being overtly negative there is a distinct negative slant as they have merely unwound back to neutral and look set to deteriorate once more. Moving averages are falling away with the 55 day ma (at 1.3665) a basis of resistance now. I would continue to play rallies towards $1.3640 as a chance to sell. The bears remain in control until a decisive break above $1.3700.

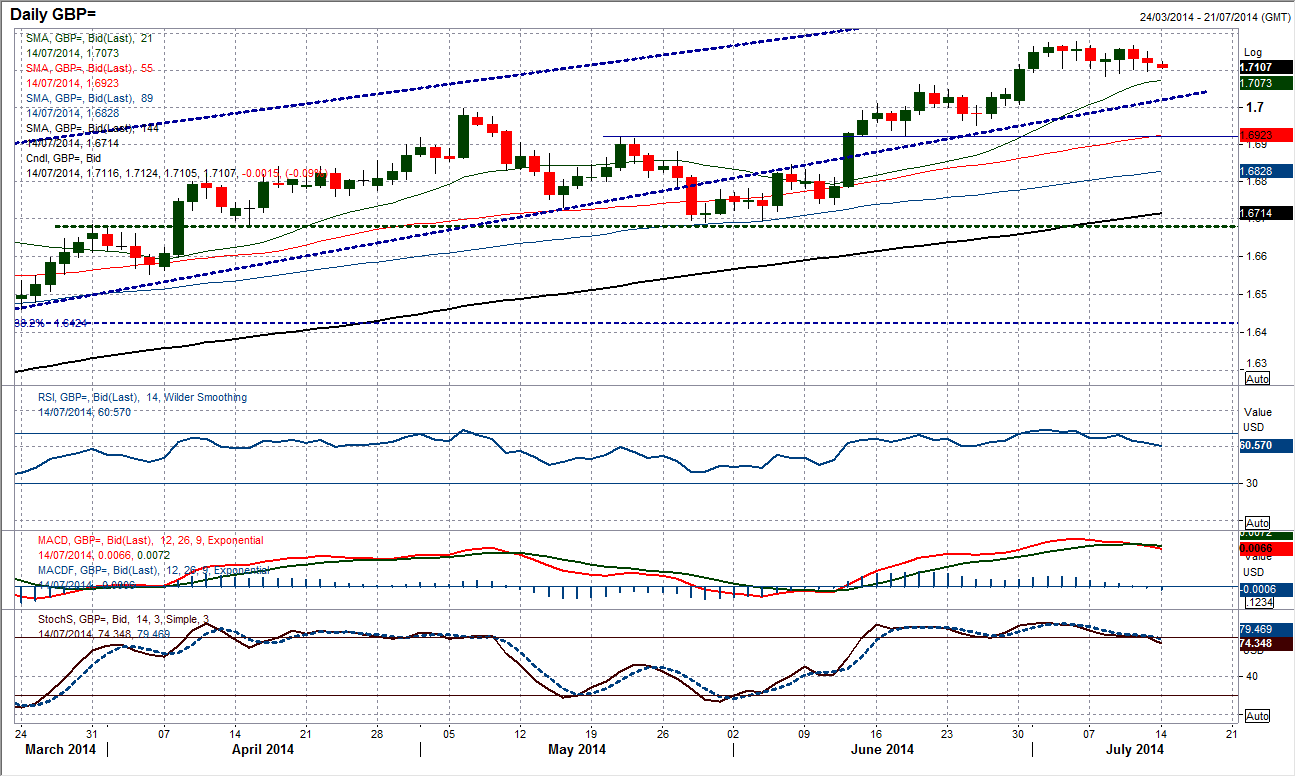

GBP/USD

The sideways consolidation continues to see the rate drift over the past two weeks. Interestingly now though, the momentum indicators have now certainly started to reverse. This does suggest that the near term bulls are struggling and could mean pressure on the $1.7000 support area. However shorting into such a strong trend would be a risky strategy as the next bull leg (which I expect to take the rate into new multi-year highs) could move at any time. The ideal scenario would be for an unwind into the support of the old breakout high around $1.7060 which would give a chance to buy again. However the longer Cable remains supported above $1.7100 the less likely this is to happen. Moving averages are now catching up as is the support of the old uptrend channel. Intraday indicators are fairly neutral and reflect the consolidation over the past week. A move above $1.7150 near term could stir the bulls into action for a breach of the $1.7179 high once more.

USD/JPY

IT seems as though the dollar bulls are living to fight another day as once again despite a second day of severe pressure, Dollar/Yen fails to close below 101.30. However the celebrations should wait because the bear forces are mounting. All moving averages are falling in bearish sequence and the momentum indicators which had been neutral are now far more negatively configured. I expect that any rally may well be short lived before the bears take hold once more. The intraday hourly chart shows resistance around 101.40 is being tested, but even if this is breached, there is significant overhead supply at 101.60, 101.80 and then 102.00. The hourly momentum indicators are merely unwinding from an oversold position and already suggest the bears could be set to return. Selling into strength looks to be the best strategy for further pressure on 101.30 in due course.

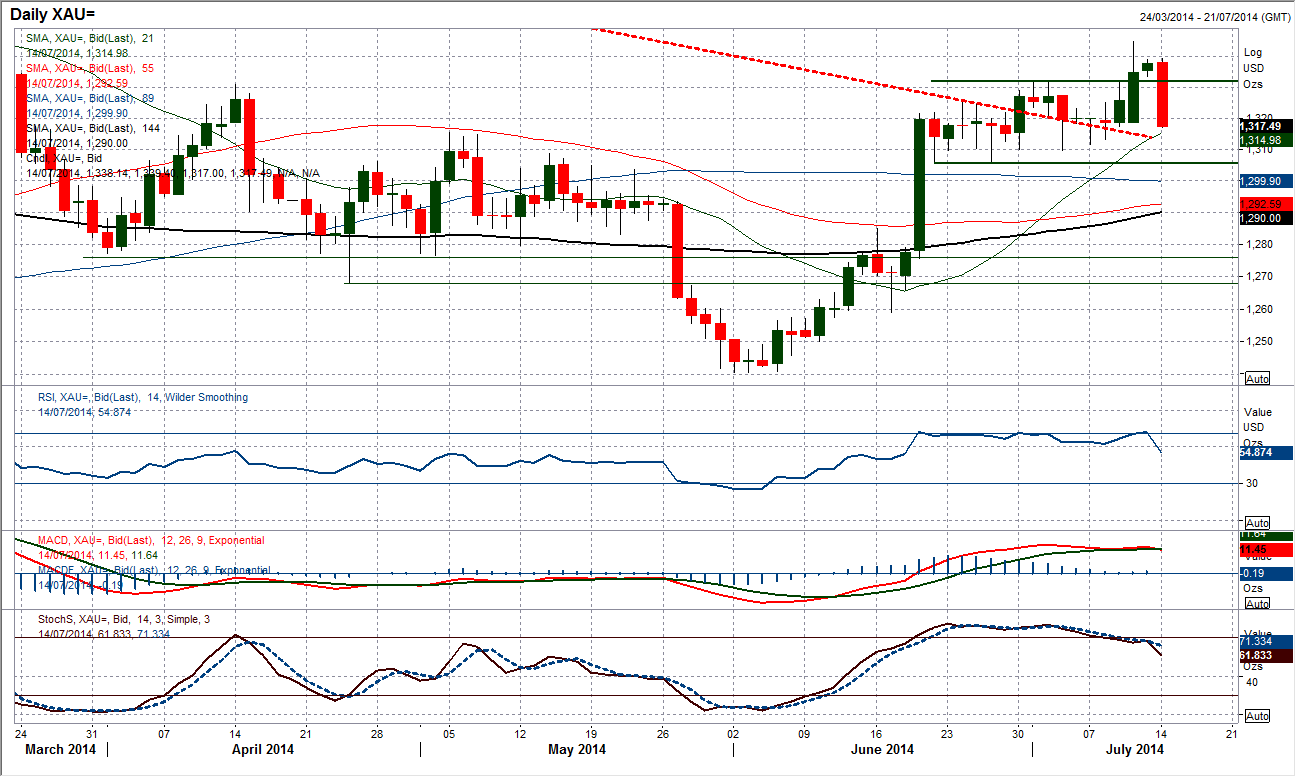

Gold

The first test of the breakout is underway for gold as early weakness in Asian trading has pulled the price back into the old range. Already below the $1332 breakout support, the intraday hourly chart shows the support at $1325 has been breached and this key for the bulls to consider themselves in control. Not only is this below price support but also below the 200 hour moving average. The daily chart shows the mid-point of the range comes in around $1320 which is around a pivot level too and this is now being tested. If this point is also breached throughout today then the bulls would have lost control of the breakout and the lows of $1306/$1310 will come into focus again. Momentum indicators are now falling away with this deterioration this morning which is a concern also for the bulls. It is probably best to see how things settle before gauging how to play this one today.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.