Market Overview

A pretty disappointing start to the week shows little signs of any significant recovery today. Markets on Wall Street all closed lower on little news of any significance, although yesterday’s disappointing German industrial data may have had a spill over effect. Asian markets were mixed to lower overnight too as the Nikkei struggled after the yen gained strength. The European markets are trading fairly mixed in early exchanges, but German trade data has disappointed early today and the start of US corporate earnings season may also begin to occupy thoughts.

There is also little to go on in forex trading, with the dollar basically flat against most major currencies. The dollar has been engaged in a sizeable rally in recent days since the Non-farm Payrolls and perhaps it is time for a pause for breath. The only exceptions to this are the Aussie and Kiwi dollars which have both climbed to a three day high.

Traders will be picking the bones out of the German trade data which has just been released and showed an improvement in the trade balance only due to the fact that imports declined more than exports, which is not good news. Later this morning there is UK manufacturing production at 09:30BST (5.6% expected). Furthermore, there could be some action Stateside, with the Fed’s Kocherlakota due to speak today at 18:45BST.

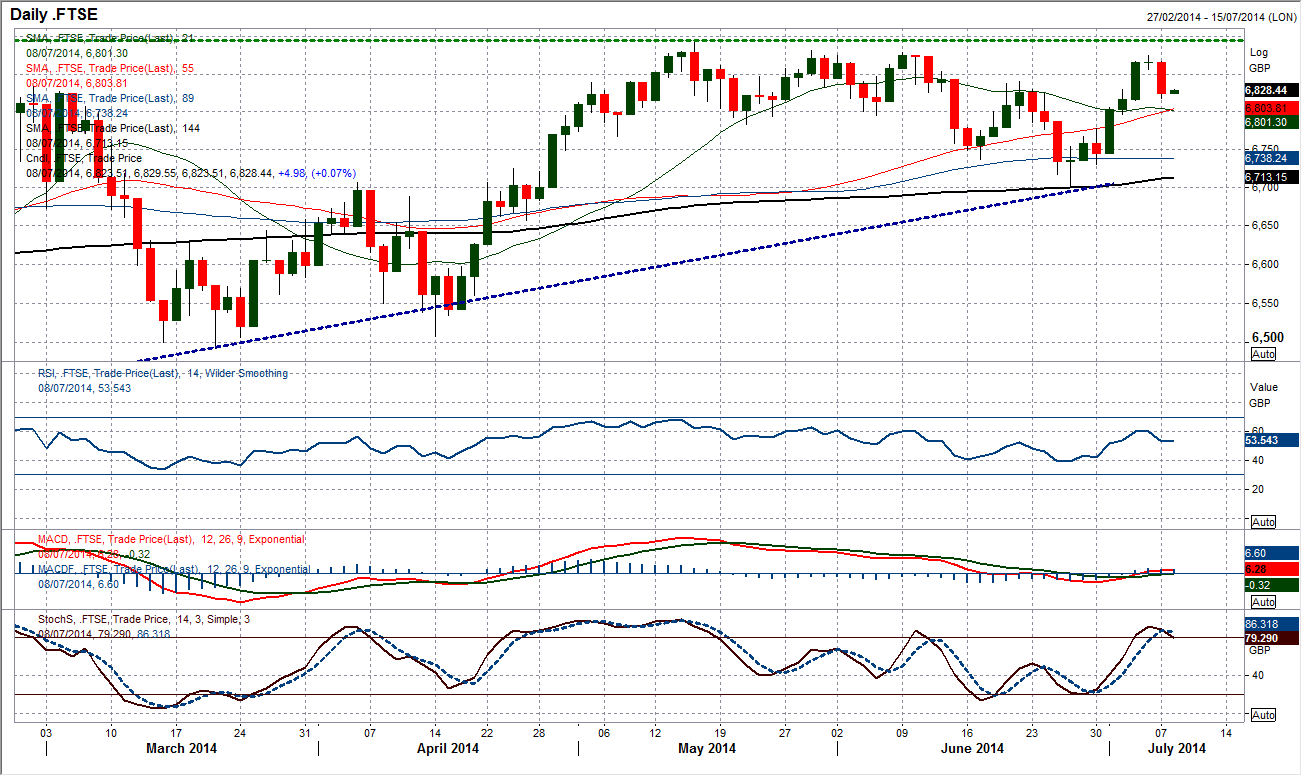

Chart of the Day – FTSE 100 Index

Since May, every time the FTSE 100 has approached the key 14 year high resistance, there has been a daily candlestick posted that induces a correction. In May it was a bearish key one day reversal at the 6895 high, in June it was a “hanging man” (or gravestone doji) and now, in the last three days an “evening star” candlestick formation (a strong bull candle followed by a doji and then a strong bear candle). On the previous occasions of these corrective signals towards the key resistance, there has subsequently been a period of correction. This latest corrective formation has come with the Stochastics in overbought territory and could once again be the beginning of another corrective phase for the FTSE 100. Resistance on the daily chart comes in at 6875 and 6895, with 6840 now a minor old support turned resistance. Support comes in at 6810 and then more prominently at 6780.

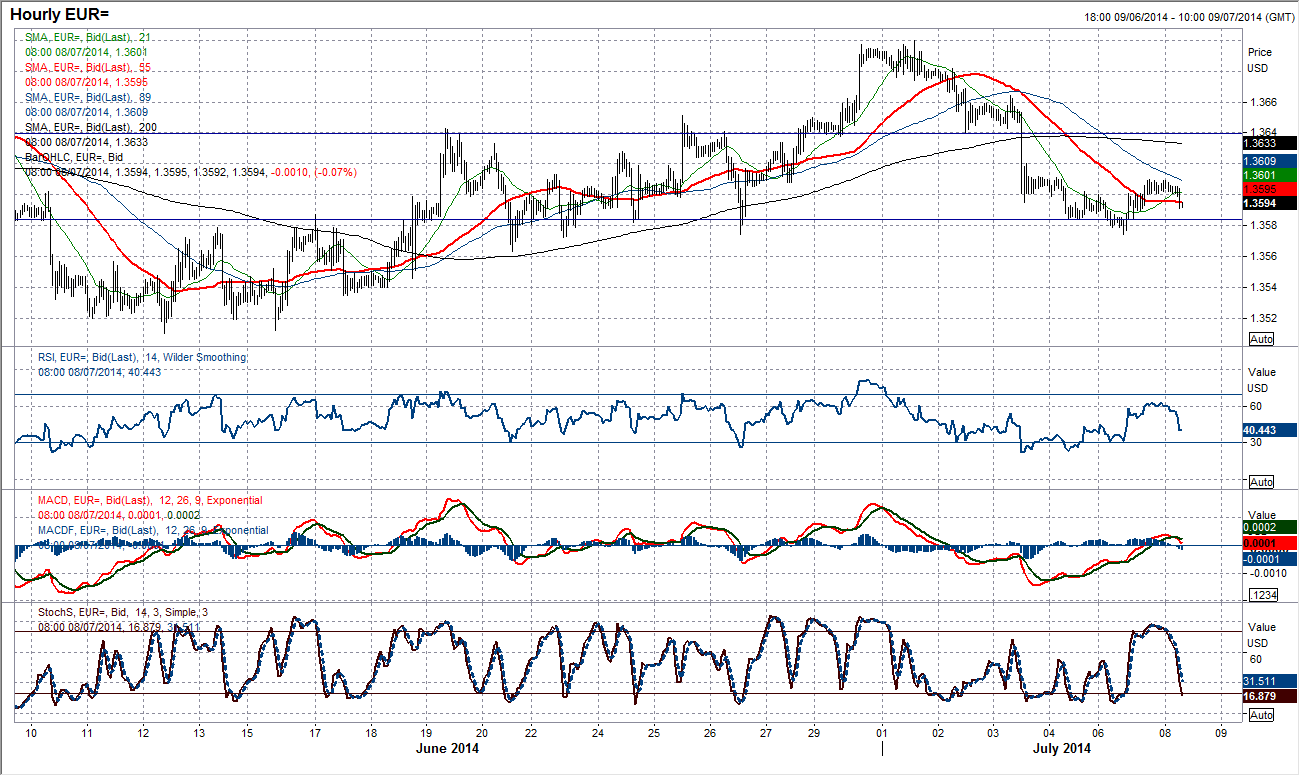

EUR/USD

Signs of support yesterday for the Euro as another low has been posted at $1.3574. Once again the bulls are returning to support around the key near term floor around $1.3585. This may just be a brief period of respite for the euro after four days of selling pressure. The momentum indicators remain in fairly weak medium to longer term configuration and it is likely still that any rallies will continue to be sold into. In the past few hours there is some minor consolidation under $1.3620 but the intraday hourly chart suggests that the respite may not last for too much longer either, as the hourly MACD lines crossover with the Stochastics also in decline. There is a more significant level of resistance at $1.3640 to cap the gains, whilst the 200 hour moving average which had provided support during the rally could also be resistance around $1.3633. Expect further pressure on $1.3585 in due course.

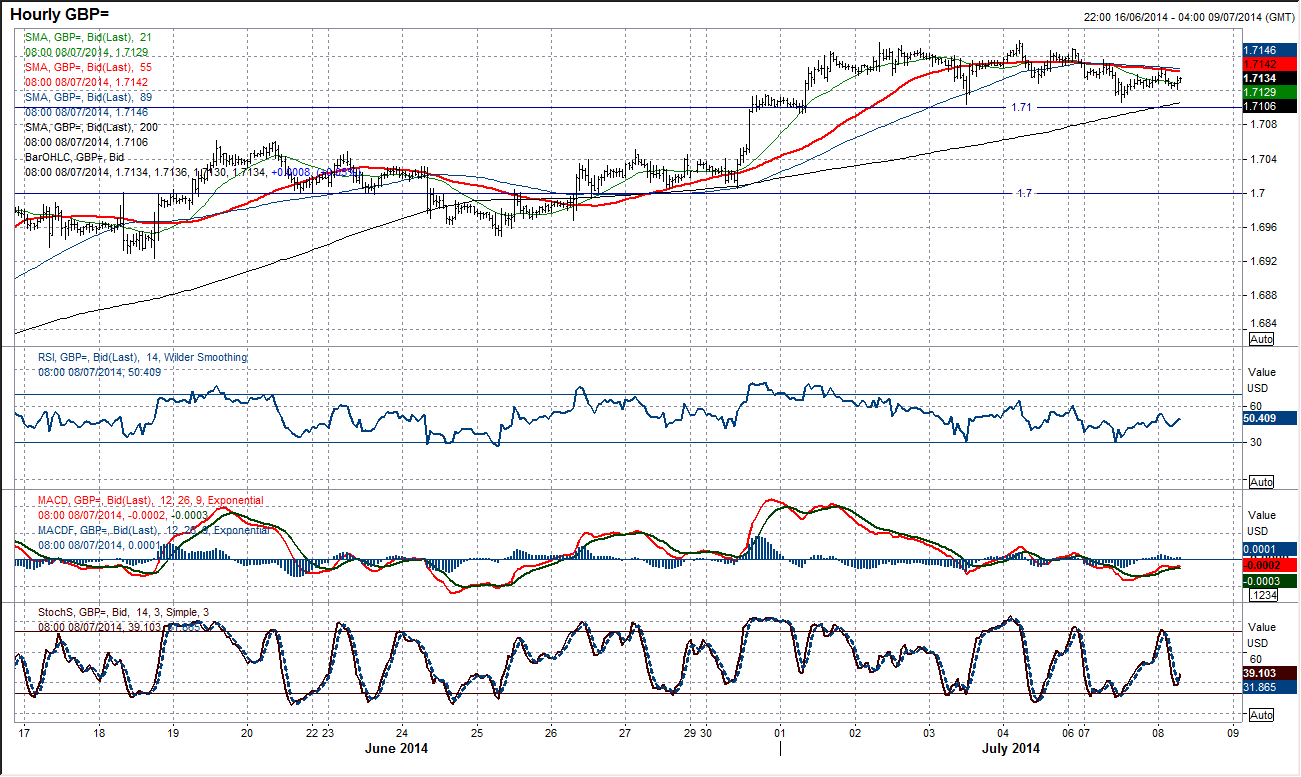

GBP/USD

The consolidation of Cable continues. However there is a drift underway which is threatening to test the near term support at $1.7100. The daily chart shows that any decline would be a minor correction and would actually end up being a good opportunity to buy as there is good support between $1.7000/$1.7060. All moving averages are advancing strongly, with daily momentum in positive configuration. However there is more of a warning sign on the intraday hourly chart as a breach of $1.7100 would complete a small top and imply $1.7030 (the middle of the support). The price action is currently more of consolidation than correction however the last couple of days has seen a series of lower highs posted which reflect the slight drift backwards on the daily chart. Cable very much remains a long term buy, it just remains to be seen whether you can get the nice correction towards $1.7030 before the buying pressure resumes once more.

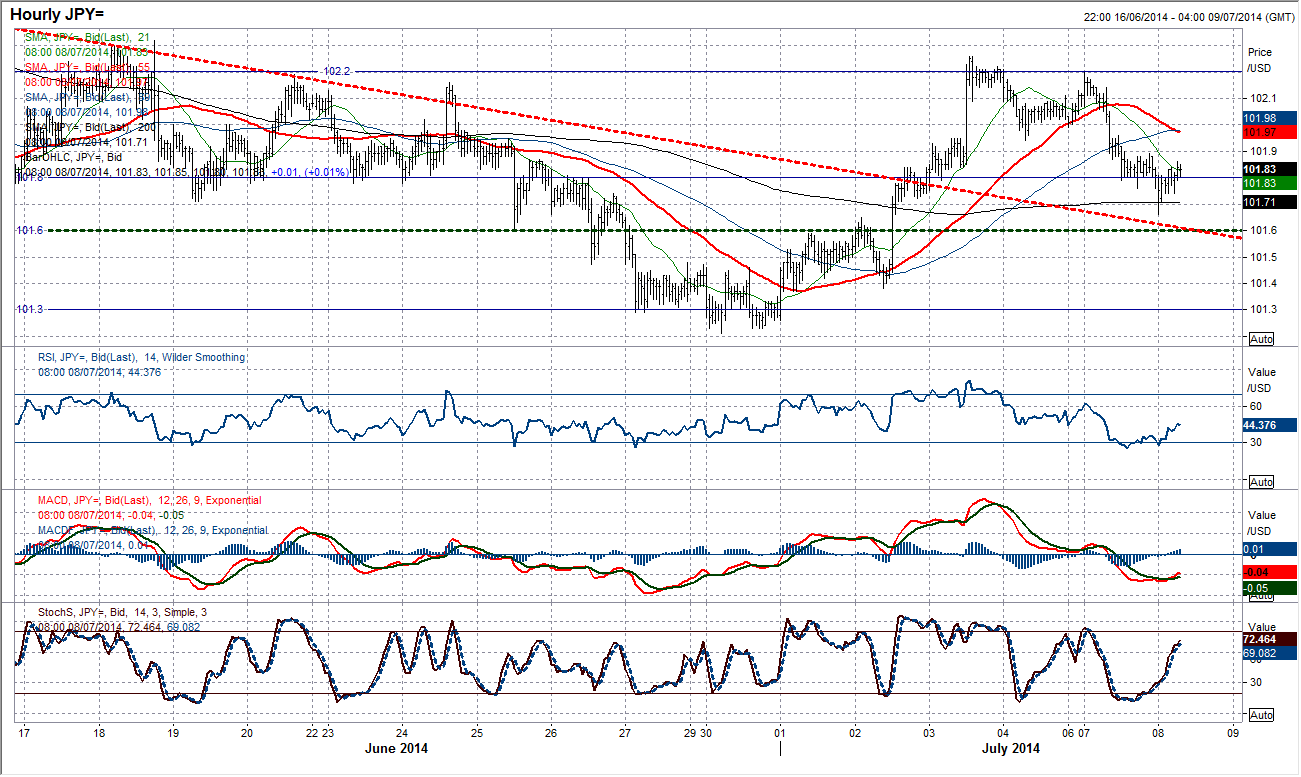

USD/JPY

The neutral configuration of so many technical indicators on Dollar/Yen makes its analysis rather tricky. What seems to be the case is that it will tend to move for three or four days in a direction before retracing the move. Moving averages have just begun to take on a slight bearish leaning once again, but nothing that would warrant any conviction. Furthermore the momentum indicators give us little else either. The act also that it is trading under the 102 level which I see as pivotal also suggests the bears have got a slight element of control again. The intraday hourly chart is scarcely more useful with a small top pattern that has already reached its 101.70 implied target. Unless you are looking for 20 to 40 pips in any one direction, then this is a very difficult trade. Support levels come in at 101.60, 101.40 and 101.20, while the resistance to watch for is 102.00 and 102.20.

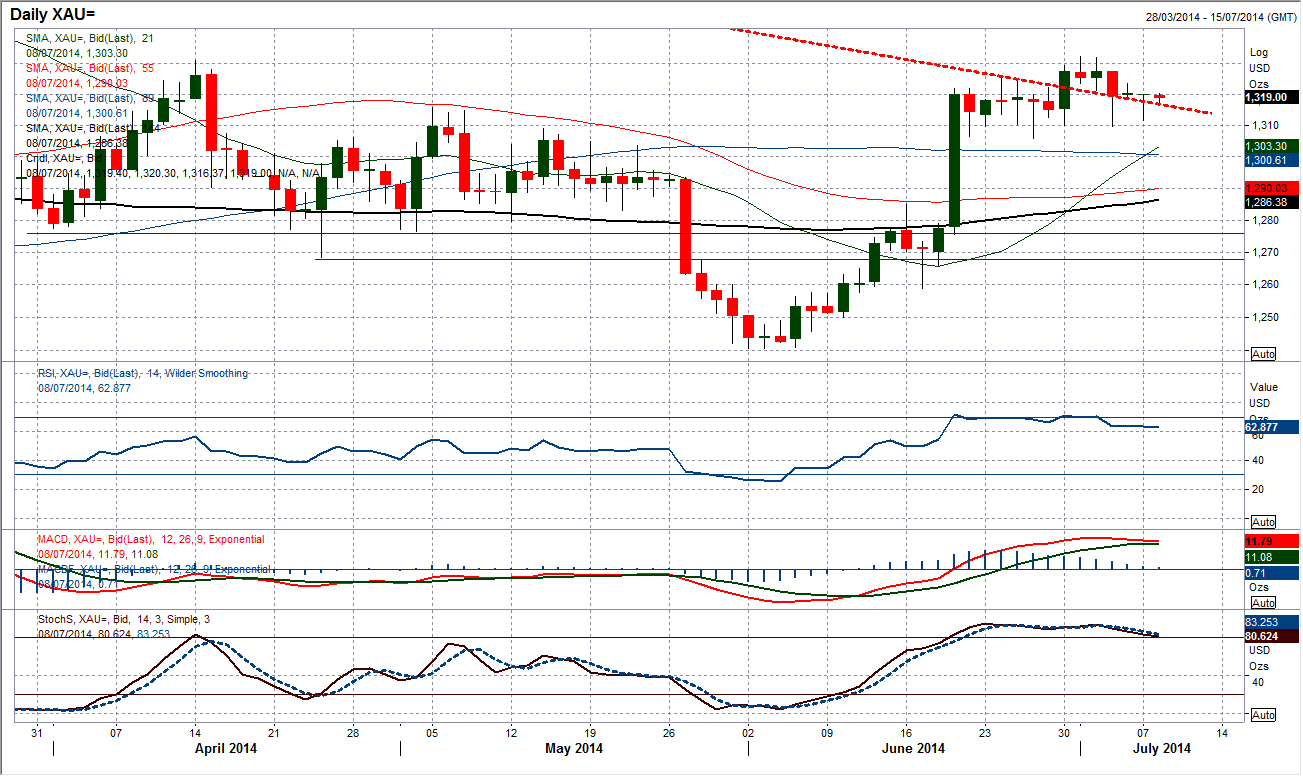

Gold

There is a lot of uncertainty in the gold price that has built up over the past few days. An initial move higher that looked to be driving an upside break of the primary downtrend has failed to follow through and a couple of “doji” candles (opening and closing at the same level) denote a lack of conviction. The gold bulls will be concerned with this as the daily momentum indicators are rolling over, with the RSI almost at a 3 week low, MACD line threatening to crossover and Stochastics on the brink of a sell signal. Yet the consolidation continues and on the intraday hourly chart seems to be fairly solid. The support at $1310 remains intact and $1306 (which is the near term key support that if broken completes a top pattern) is fairly well protected. There is a hint of negative configuration about the hourly momentum, but there seems to be an element of wait and see now. Resistance levels come in at $1325 and $1332.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AUD/USD jumps above 0.6500 after hot Australian CPI data

AUD/USD extended gains and recaptured 0.6500 in Asian trading, following the release of hotter-than-expected Australian inflation data. The Australian CPI rose 1% in QoQ in Q1 against 0.8% forecast, providing extra legs to the Australian Dollar upside.

USD/JPY hangs near 34-year high at 154.88 as intervention risks loom

USD/JPY is sitting at a multi-decade high of 154.88 reached on Tuesday. Traders refrain from placing fresh bets on the pair as Japan's FX intervention risks loom. Broad US Dollar weakness also caps the upside in the major. US Durable Goods data are next on tap.

Gold price cautious despite weaker US Dollar and falling US yields

Gold retreats modestly after failing to sustain gains despite fall in US Treasury yields, weaker US Dollar. XAU/USD struggles to capitalize following release of weaker-than-expected S&P Global PMIs, fueling speculation about potential Fed rate cuts.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday. Most people expect the stablecoin to be backed by gold, considering BRICS nations have been accumulating large holdings of the commodity.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Fed might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.