Market Overview

After an uninspiring session yesterday, last night’s slightly negative handover from the Wall Street on the back of weaker than expected housing data suggests more of the same today. A decline of a quarter of a percent for the S&P set the tone for Asian markets, while the Nikkei 225 fell by around a percent after the yen strengthened again. The saving grace came from the tech sector after Apple shares (around 2.8% of the S&P and over 11% of the NASDAQ) jumped 8% after hours as it posted strong results and boosted its dividend. This could boost sentiment on Wall Street today, while European markets are trading higher at the open.

Forex trading has been tough in the past day or so, with little real conviction being taken. The Reserve Bank of New Zealand hiked interest rates by 25bps to 3.0%, as expected, which has helped the Kiwi dollar higher, and is a rare mover today. The fx majors are struggling for direction, although the Japanese yen is beginning to make ground once more against the dollar.

Traders will be looking for the German Ifo Business Climate number at 09:00BST with 110.5 expected, while US data is largely confined to the weekly jobless claims at 13:30BST with a slight rise to 310k expected.

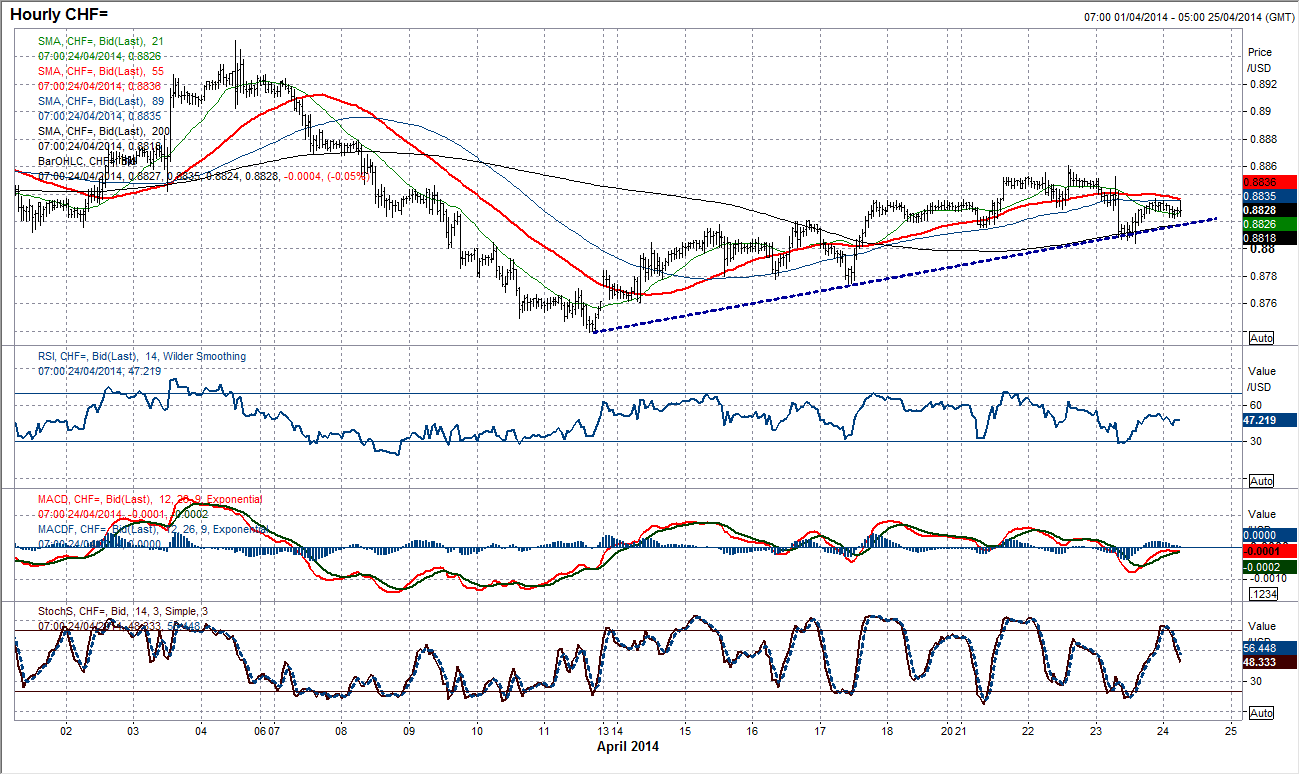

Chart of the Day – USD/CHF

The dollar rally looks to be running out of steam in the near term. The 7 day recovery on the daily chart looks to have merely been an exercise in unwinding bearish momentum as Dollar/Swiss again rolls over. The major trends on the daily chart are all negative and the moving averages cap the upside. Daily momentum indicators showed a lack of conviction in the recovery and are turning negative once more. Despite this, the intraday hourly chart shows the recovery uptrend is still intact, just. However, the hourly momentum indicators are deteriorating, while the 89 hour moving average which had been a good gauge of support for the recovery is becoming a basis of resistance now. The immediate resistance is yesterday’s reaction high at 0.8836, however 0.8853 and 0.8861 are firmer levels. Expect pressure to now be put on the 0.8804 low before a retreat towards the support at 0.8775.

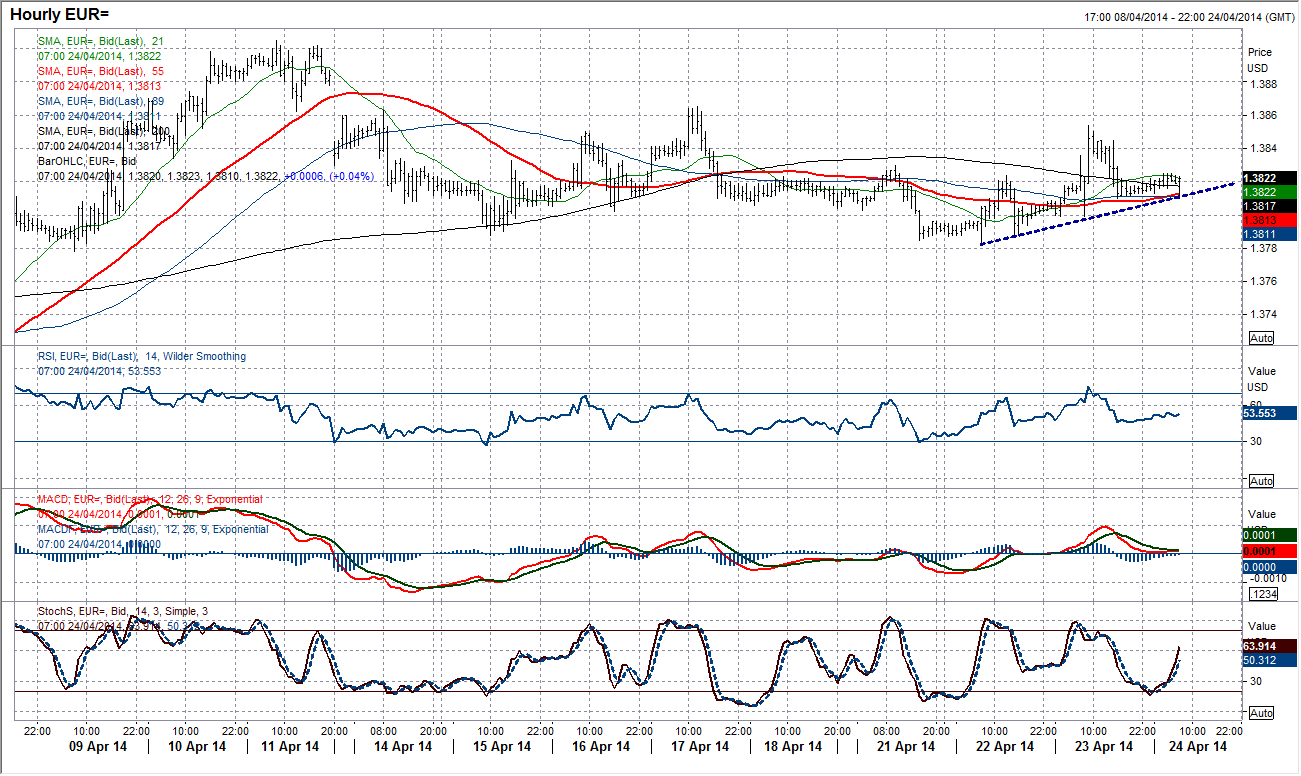

EUR/USD

It is a slow and not entirely pain free process for the Euro over the last couple of days. The daily chart has shown a couple of positive candlesticks now which shows progress to the upside. However the last eight candles on the daily chart have been littered with a series of long upper tails, suggesting attempted bullish breaks continue to be hauled back. A move above $1.3865 resistance may encourage a new upside trend, but it is tough going currently. Yesterday’s intraday upside break was reversed at $1.3854 and this is now the near term barrier. Despite this there is a shallow uptrend that has formed on the hourly chart and hourly moving averages are now gradually turning up. Intraday momentum also shows a positive skew and this all suggests that these dips should be bought into for tests of these resistance levels. Yesterday’s low at $1.3799 is the immediate support with the near term recovery being aborted below $1.3883.

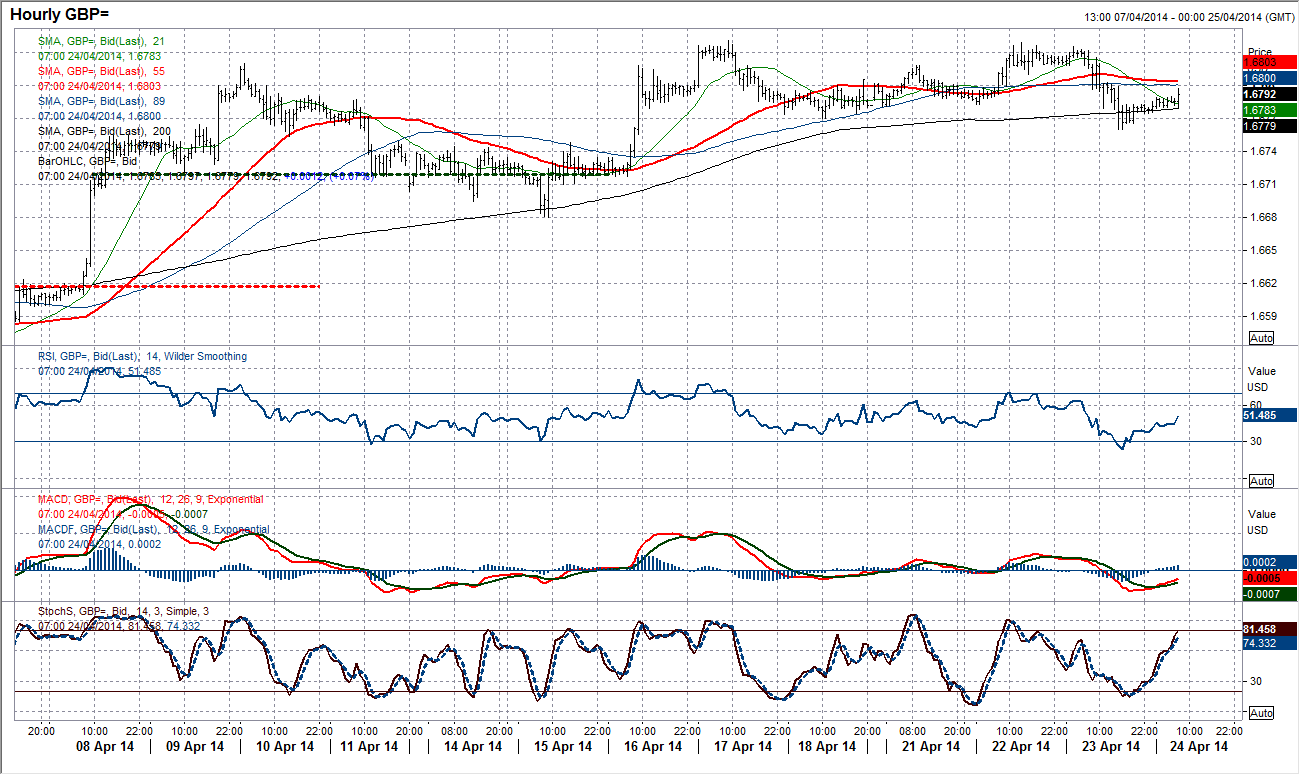

GBP/USD

The concerns I had yesterday of a tiring of the upside move were reflected in the day’s trading, which saw a fall below the near term support at $1.6770 and a five day low. This is not to say that there will now be a huge correction (which I do not believe there will be) but that trading in Cable is becoming a bit messy for the time being. Stretched momentum and a reluctance to push back above $1.6841 as resulted in an uncertain period, with intraday moving averages flattening off and hourly momentum giving mixed signals. I sense that there could be days of sideways consolidation compounded by false breaks ahead which will make it difficult to decisively call Cable. The bull long term trend suggests the ultimate move will be to the upside but the bulls are struggling to back the move at the moment.

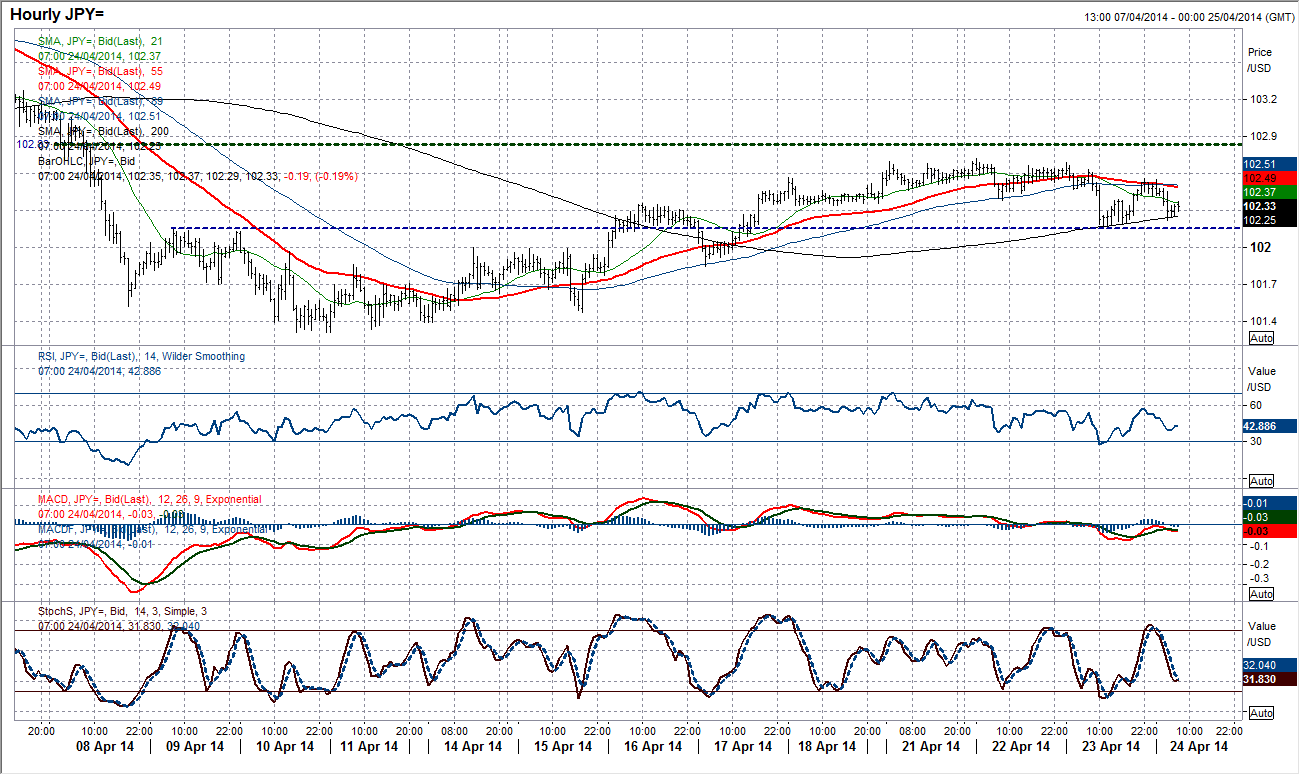

USD/JPY

My caution for the recovery in Dollar/Yen that I conveyed yesterday was right as the series of higher lows was broken by the first negative candle was posted for 9 sessions. The daily momentum indicators are now rolling over and pressure is increasing on the downside. The deterioration looks to have been confirmed overnight as Asian trading has pushed the rate back towards yesterday’s low again. There is now a lower high in pace at 102.56 and intraday momentum indicators have taken on a far more negative configuration over the past 36 hours. The 89 hour moving average (currently 102.501) which had been supporting the recovery has now rolled over and provided the basis of resistance. To reiterate yesterday’s outlook, care should be taken with long positions now.

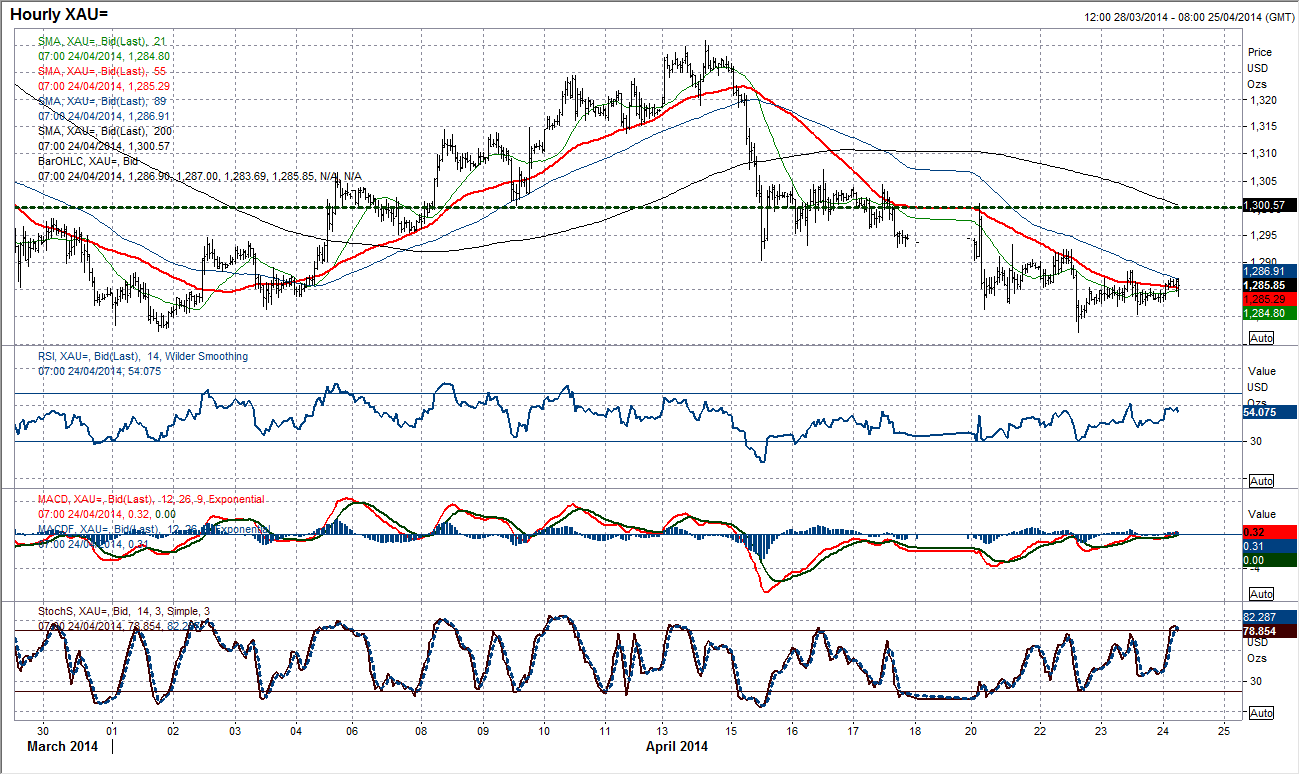

Gold

The price continues to trade around the support of the 144 day moving average (currently $1282.49) and although the bulls are hanging on by the skin of their teeth, the support around $1277, for now, remains intact. We have subsequently formed a consolidation in the past day or so. The intraday chart shows the hourly moving averages now looking to flatten off, while there is also a light higher low in place at $1280.44. However, this is the extremely early stages of any potential recovery and we should not get too carried away yet. A move above $1288.61 would hint at an improvement, while a move above the $1292.50 reaction high would also be a key near term barrier removed. This is one to watch while the consolidation plays out and the bulls decide whether to back a recovery or retreat for the hills once more. We wait and see.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD consolidates recovery below 1.0700 amid upbeat mood

EUR/USD is consolidating its recovery but remains below 1.0700 in early Europe on Thursday. The US Dollar holds its corrective decline amid a stabilizing market mood, despite looming Middle East geopolitical risks. Speeches from ECB and Fed officials remain on tap.

GBP/USD advances toward 1.2500 on weaker US Dollar

GBP/USD is extending recovery gains toward 1.2500 in the European morning on Thursday. The pair stays supported by a sustained US Dollar weakness alongside the US Treasury bond yields. Risk appetite also underpins the higher-yielding currency pair. ahead of mid-tier US data and Fedspeak.

Gold appears a ‘buy-the-dips’ trade on simmering Israel-Iran tensions

Gold price attempts another run to reclaim $2,400 amid looming geopolitical risks. US Dollar pulls back with Treasury yields despite hawkish Fedspeak, as risk appetite returns.

Manta Network price braces for volatility as $44 million worth of MANTA is due to flood markets

Manta Network price is defending support at $1.80 as multiple technical indicators flash bearish. 21.67 million MANTA tokens worth $44 million are due to flood markets in a cliff unlock on Thursday.

Investors hunkering down

Amidst a relentless cautionary deluge of commentary from global financial leaders gathered at the International Monetary Fund and World Bank Spring meetings in Washington, investors appear to be taking a hiatus.