Market Overview

The improved appetite for risk that has been evident over the past week has continued overnight, with central banks once more the focus for investors. A programme of mini-stimulus measures from the Chinese State Council was announced overnight to increase spending on railways and housing along with a series of small business tax breaks. Although investors still anticipate the People’s Bank of China to cut the reserve requirement ratio, investors in Asia took the news positively. This came on the back of further record highs on Wall Street for the S&P 500 after positive news in the ADP employment report heightened expectations of a strong Non-farm Payrolls report on Friday.

Trading in Europe has again begun on the positive side, with indices looking to continue to push higher, while forex trading is currently showing slight gains for the major pairs with Cable and Dollar/Yen higher, although the commodity pairs are slightly lower.

The key data release to be mindful of today is undoubtedly the ECB rate announcement (12:45BST) and Mario Draghi’s press conference (13:30BST). Despite Monday’s decline in inflation to 0.5%, the consensus is not forecasting any change in policy. However the real action could come in the press conference where Draghi could try and jawbone the Euro lower by talking about the potential for future easing plans. Expect high volatility this afternoon in the Euro based forex pairs.

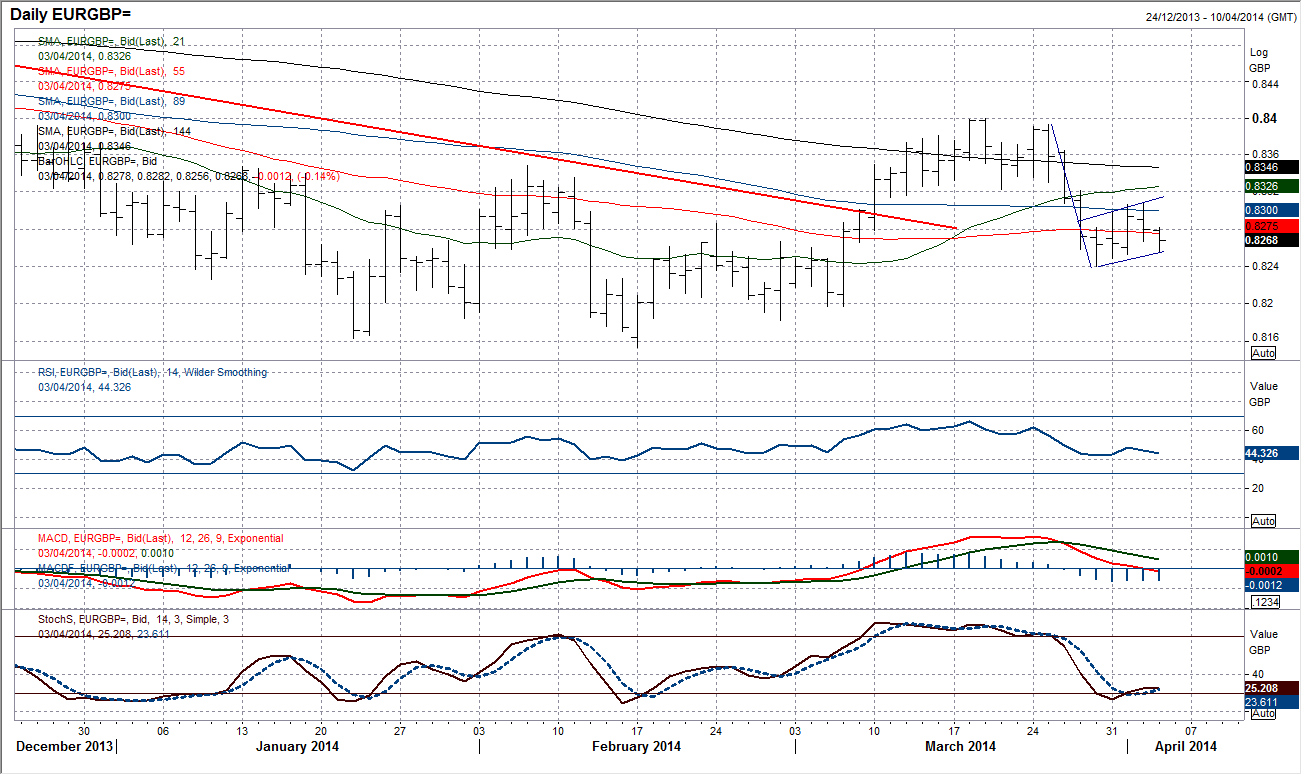

Chart of the Day – EUR/GBP

For a couple of weeks, having looked as though the Euro would start to build a recovery, the picture is looking far more glum again and Euro/Sterling appears to be under pressure again. Although the target of £0.8255 from the small top pattern completed below £0.8323 has now been achieved, the price action over the past couple of days suggests that this 5 day consolidation could become a bearish flag pattern, making it in a sense a half-way house. Daily moving averages are providing a barrier to gains once more and momentum indicators are falling away. A move below £0.8240 would signal the downside break that would suggest further downside towards £0.8182. The intraday chart also reflects the increasing pressure the Euro is coming under, trading below all moving averages and hourly momentum indicators in bearish configuration. The big caveat today would be with the ECB and Mario Draghi giving a hawkish press conference. So watch out around 12:45BST and 13:30BST for heightened price volatility.

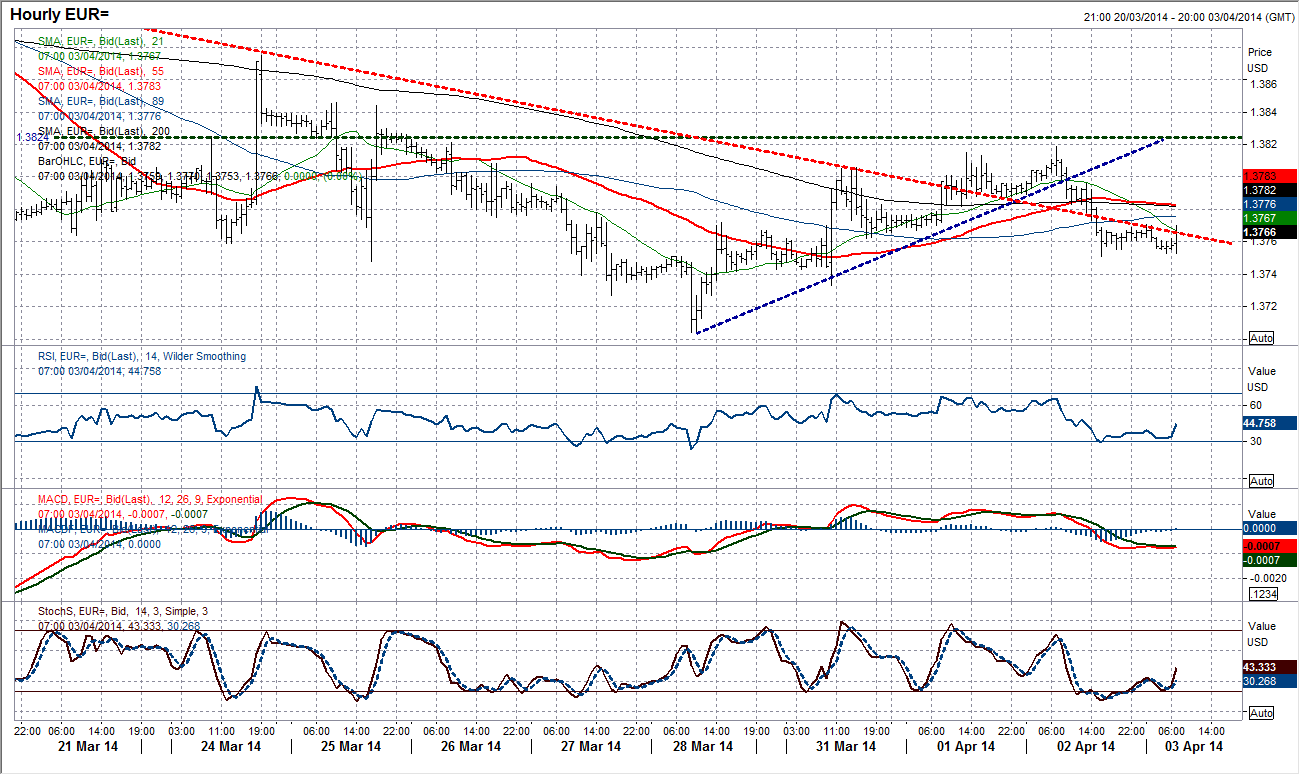

EUR/USD

The trading band between $1.3700 and $1.3824 was bolstered yesterday as the Euro fell back from $1.3819 and maintains a largely neutral outlook on the daily chart. However, a bearish key one day reversal (where the high of the day is above the previous high only to close below the previous low) suggests that there could be an increase in selling pressure building up. The hourly intraday chart shows a breach of the support at $1.3762 and a fall back below the old downtrend. With the 21 and 55 hour moving averages having fallen over, where previously they could have been seen as a basis of support they will now become a barrier to the recovery. Expect further pressure on the reaction low at $1.3733 today. There is though clearly a significant amount of volatility that can be expected today with the ECB rates decision at 12:45BST followed by the press conference at 13:30BST both of which could completely change the outlook of the near term chart.

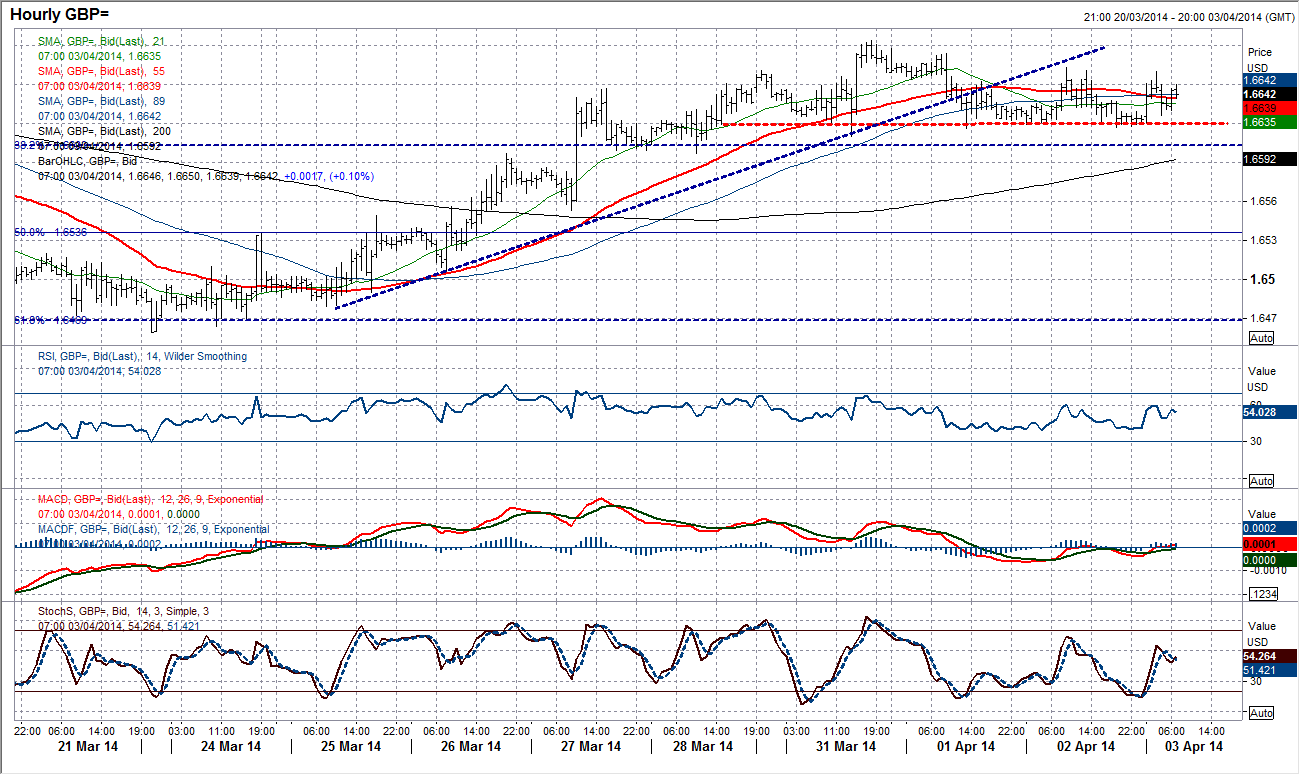

GBP/USD

The rally on the daily chart has just run out of steam, with Cable yesterday seeing a day of consolidation.. I talked previously about the potential for an intraday top pattern which would complete below the support band at $1.6610/20, and this support has so far remained firm. However the pressure is mounting. The hourly moving averages have flattened off, while the momentum indicators are on the weaker side of neutral and the price has spent much of the past two days testing the support band. A move below the 38.2% Fibonacci retracement level at $1.6603 would confirm the top which would imply a correction back towards $1.6540. However, this is still the formative stage and pre-empting a top would not be wise as the consolidation could turn out to be a continuation pattern. A rally and hold above the resistance at $1.6663 would improve the outlook once more.

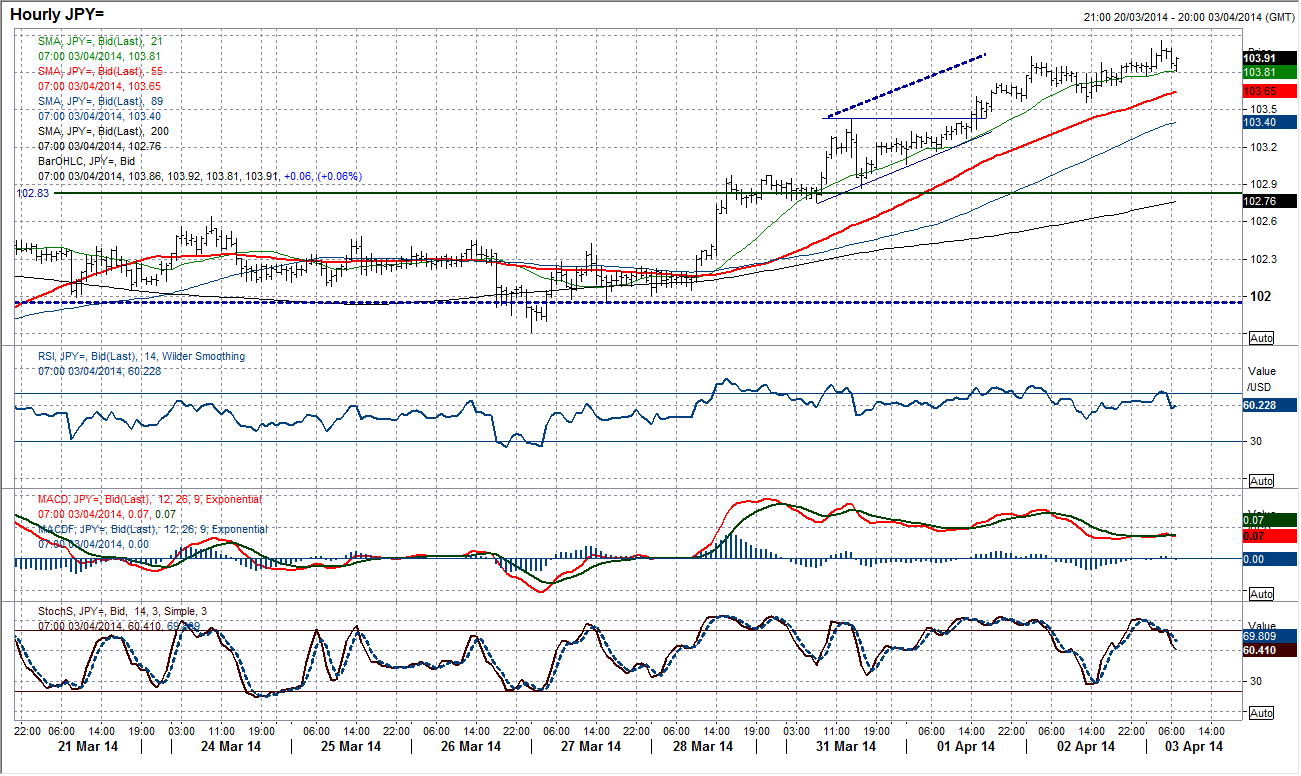

USD/JPY

Having broken above the key resistance at 103.75 the next key resistance is not until 104.83 which was a key high in January. This leave the way open for further gains. The daily momentum indicators are in positive configuration with the RSI around 65 with further upside potential. The intraday hourly chart shows an equally positive outlook with a series of higher lows and overnight the rate having broken higher above yesterday’s peak at 103.93. Hourly momentum indicators remain in positive configuration, although perhaps not as strong as they were a couple of days ago. A near term stochastic sell signal could suggest another correction within the run higher is due. The recent corrections have reversed back below the 21 hour moving average (currently 103.81) and there is good support above yesterday’s low at 103.53. Until the rate breaks below the previous day’s low (the current one is 103.53) then the chart continues to suggest using corrections as a chance to buy.

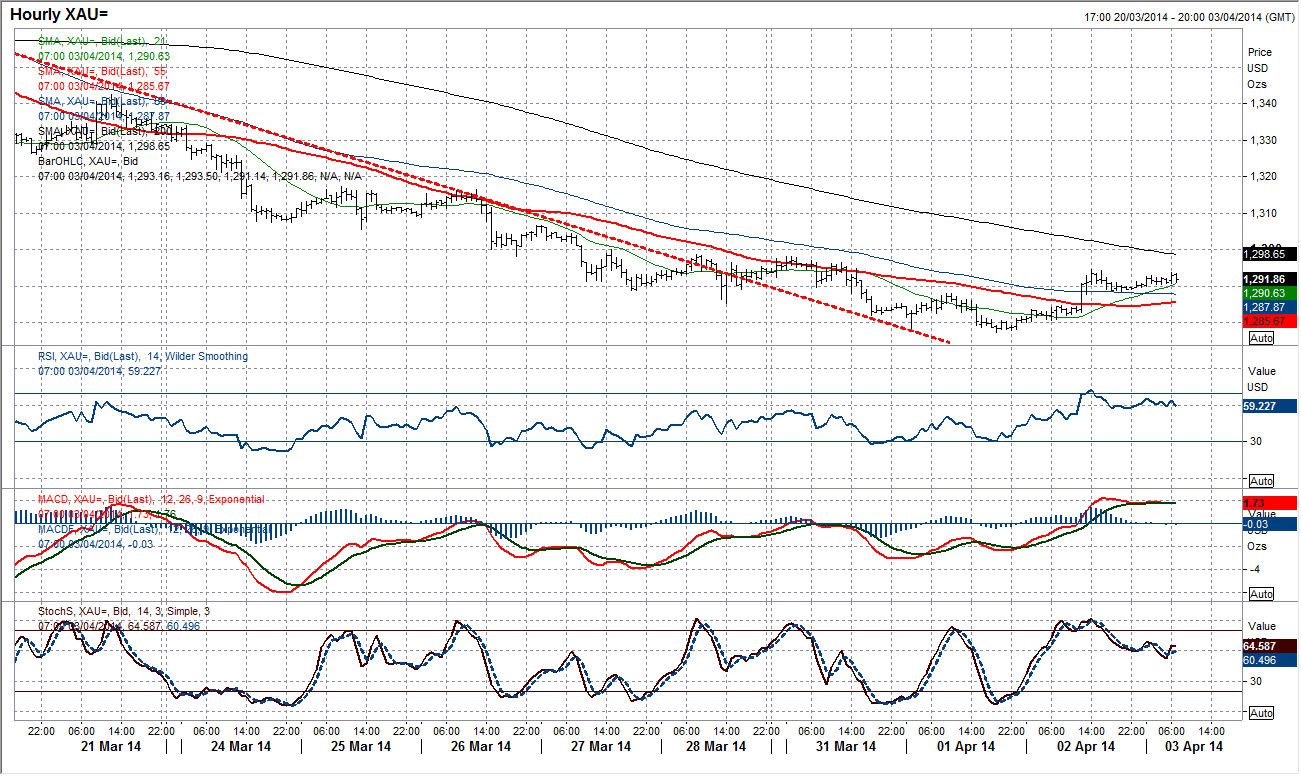

Gold

Finally some signs of respite for the gold bulls. Yesterday was the first day in 8 sessions that gold has broken above the previous day’s high. The breaking of this sequence has coincided with the daily low also above the previous day’s low as the price has affirmed the support at $1277.29. Overnight the Asian trading has consolidated this move and now the possibility of a recovery can be considered. I have talked previously above the broken downtrend on the intraday chart and the role that the 55 hour moving average could not play. The price has now broken above the 55 hour moving average which is also beginning to turn positive. Hourly momentum indicators are also increasingly positive. If the price can now build from the $1288.84 overnight low then a test of the key resistance at $1300.00 could be seen.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

GBP/USD stays weak near 1.2400 after UK Retail Sales data

GBP/USD stays vulnerable near 1.2400 early Friday, sitting at five-month troughs. The UK Retail Sales data came in mixed and added to the weakness in the pair. Risk-aversion on the Middle East escalation keeps the pair on the back foot.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Israel vs. Iran: Fear of escalation grips risk markets

Recent reports of an Israeli aerial bombardment targeting a key nuclear facility in central Isfahan have sparked a significant shift out of risk assets and into safe-haven investments.