Market Overview

Despite upbeat US economic data which included a final GDP reading for Q4 at 2.6% annualised and a strong weekly jobless claims number, Wall Street had another disappointing close. Sentiment however was more upbeat in Asian trading as Chinese Premier Li Keqiang said that there would be targeted measures by the Chinese government to aid the economy. The hopes of fresh stimulus from the Chinese have helped to bolster Asian markets throughout the week and have once more done the same with the Japanese Nikkei 0.5% higher.

Japan was also helped by in line inflation and upbeat retail sales, prior to next week’s hike in the sales tax rate from 5% to 8%. The expectation is that the Bank of Japan will help combat the tax rise with further monetary stimulus measures, but maybe not until they get a gauge of the impact of the tax.

European traders have started the session in cautious mood, with several data releases which can drive forex trading today. The final reading of UK GDP will be announced at 09:30GMT, although no change from the previous 2.7% is expected. The German CPI data is released at 13:00GMT and could give an indication of the key Eurozone inflation data on Monday. Expectation is for German inflation to fall to 1.1% from 1.2%, while trader will be looking for any sign that the ECB may have to start to properly consider further easing measures. The final University of Michigan Consumer Sentiment number is released at 13:55GMT.

Chart of the Day – EUR/JPY

The outlook for Euro/Yen is deteriorating once more. Having traded sideways in a band between 140.41 and 141.97 for almost two weeks, yesterday the downside support of the range was broken. The daily chart is not showing too much of a bearish shift as yet, although the daily momentum indicators are in corrective configuration. It is more on the intraday hourly chart where this is evident. The breakdown yesterday coincided with the moving averages all turning lower in bearish sequence, while the hourly momentum studies are taking on a more bearish configuration and there is a downtrend that has formed over the past two days. Breaking the support of the range implies further correction towards 139.00 which would suggest a retest of the key lows seen in February and early March.

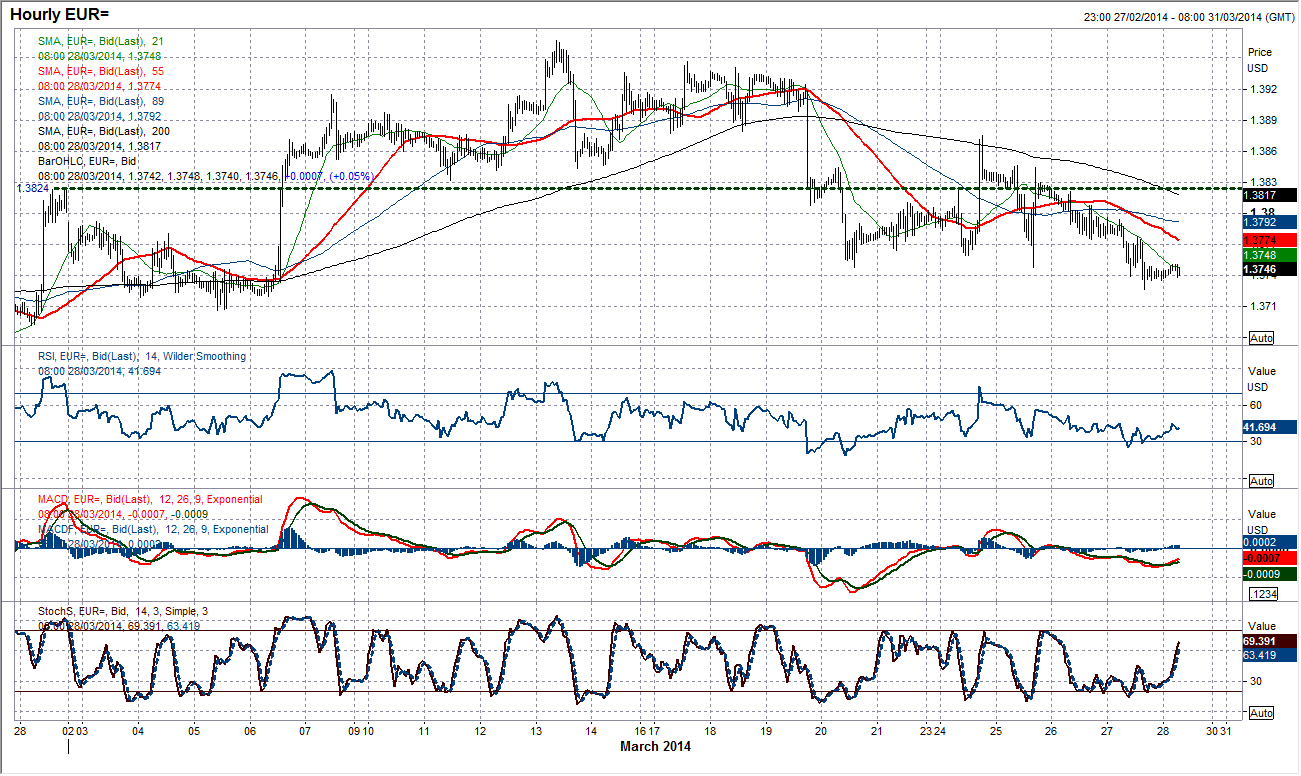

EUR/USD

The Euro continues to lose ground against the dollar and the slide towards the $1.3700 near term target is now within touching distance. The daily chart shows yesterday’s breach of support at $1.3748 opening the next support which comes in around $1.3700, although the next key reaction low is not until $1.3641. The daily momentum indicators are all in a corrective configuration. The intraday hourly chart shows that over the past couple of days rallies have been consistently used as a chance to sell, with the 21 hour moving average used as a good basis of resistance. With the rate struggling overnight to make it back above $1.3848 which was the previous floor, the initial pressure looks to be growing to the downside once more. There is also a reaction high at $1.3778.

GBP/USD

There has been a significant improvement in Sterling in recent days which has dragged Cable out of correction mode. The daily chart shows momentum indicators such as the RSI and Stochastics improving once more, while the 89 day moving average is the basis of support. To confirm the improving outlook, the rate now needs to overcome the barrier of the 21 day moving average (at $1.6617) which has acted as the basis of resistance in the past two weeks. On the intraday hourly chart the importance of the Fibonacci retracement levels can be seen, as the 38.2% level at $1.6603 once more becomes supportive. This is also important for the recovery, as a break back below would put pressure quickly back on the reaction low at $1.6553. However, for now the recovery is progressing, with hourly momentum indicators in positive configuration. So if Cable can hold above $1.6603 then the outlook continues to improve and further recovery gains above $1.6647 will be seen.

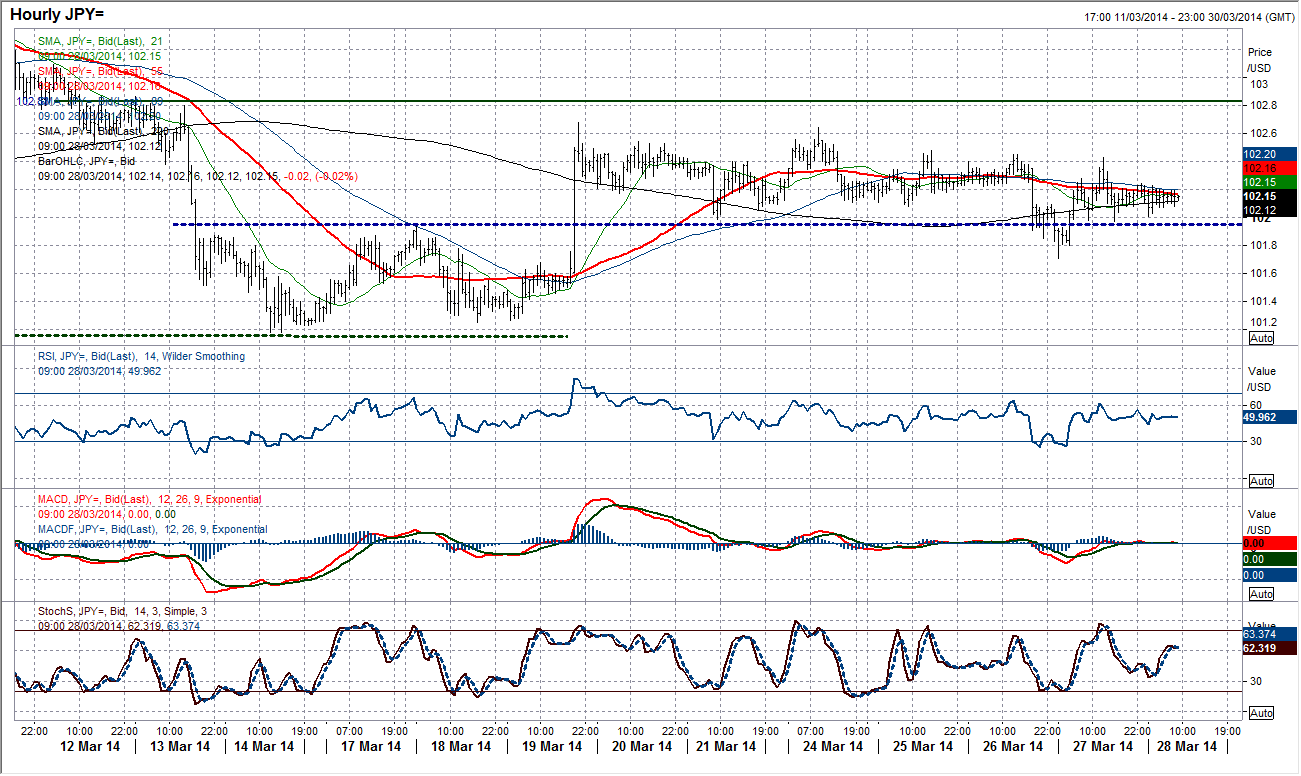

USD/JPY

After the briefest of hints at a directional move yesterday, Dollar/Yen has settled back into what has become its familiar sideways, rangebound state. Even the announcement of Japanese inflation data could not break the tedious equilibrium that has been evident for the past 7 sessions. The daily momentum indicators have almost completely flatlined. The only interesting thing to day about the daily chat is that the 144 day moving average is providing a basis of support at 101.33 and the falling 21 day moving average is the basis of resistance at 102.52. Even the intraday chart is now moving sideways, with moving averages converged and flat. There is an argument to say that there is a slight downside bias with the break lower seen yesterday, while there is resistance at 102.48. However the indecisive nature of this chart makes it very difficult to call either way. The key intraday support is at 101.71, although 101.95 is also once more doing a job.

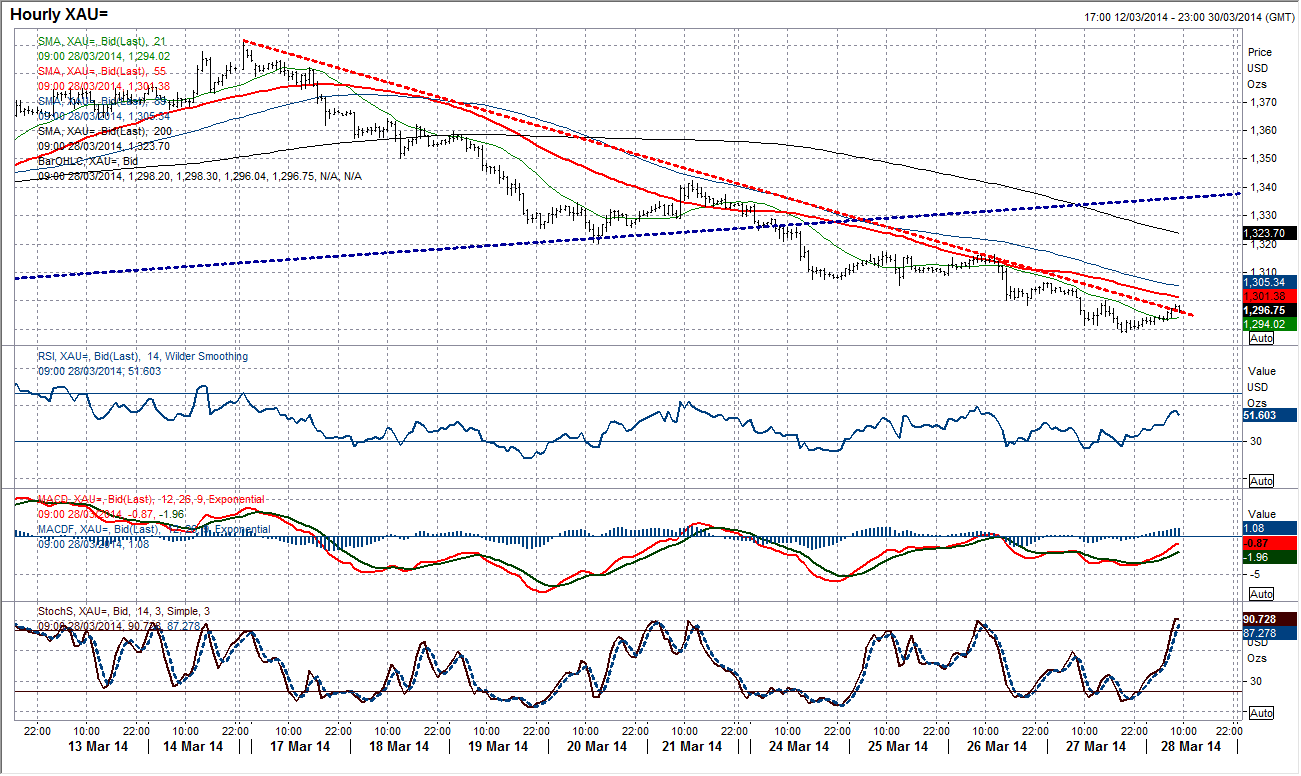

Gold

The downtrend over the past 9 days continues to drag the gold price lower. Once more though, the overnight Asian trading has seen a slight uplift back towards the downtrend which, although is shallowing, still leaves the gold price finding resistance at the previous breakdown. The latest reaction high is at $1300.00. However, the bulls will be given hope with yesterday’s low of $1288.80, hitting very close to the 50% Fibonacci retracement of the $1184.50/$1391.76 bull run at $1288.13. This is the first key support to come in since the failure of $1307.46.

However, with the hourly momentum indicators still in bearish configuration. Unless the gold price can hold a break above $1300.00 then rallies will continue to be used as a chance to sell.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.