Market Overview

Investors that had been cautious in front of the FOMC decision last night would have been grateful. Janet Yellen’s first chairing of the FOMC came as the committee ditched its forward guidance of 6.5% unemployment, but the biggest focus was on when the FOMC may begin to start tightening interest rates. The committee moved from expecting 0.75% at the end of 2015 to 1.0%. Yellen also said that the period between the end of asset purchases (at the current rate of tapering, seen as the end of 2014) and the first interest rate hike could be six months. This makes the first tightening in June 2015. This shift caused selling pressure to hit indices and a significant strengthening of the dollar. Wall Street closed around three quarters of a per cent lower, while Asian markets were also sharply lower (cue wails of discontent from emerging economies over the Fed’s inconsiderate policy). European equity indices are opening lower, although in forex trading currencies are threatening to retrace the initial bout of dollar strength.

The European Council begins a two day meeting today, with expectation of an extension of the sanctions on Russia which is likely to include broadening the number of individuals subject to asset frees and visa restrictions, whilst also the possibility of ending Russia’s membership of the G8.

Aside from the Swiss National Bank interest rate decision at 08:30GMT, there is not too much for European traders to get their teeth into, so the FOMC could continue to hang on peoples’ minds. The US data is limited to Weekly Jobless Claims at 12:30GMT whilst there is also Existing Home Sales and Leading Indicators at 14:00GMT

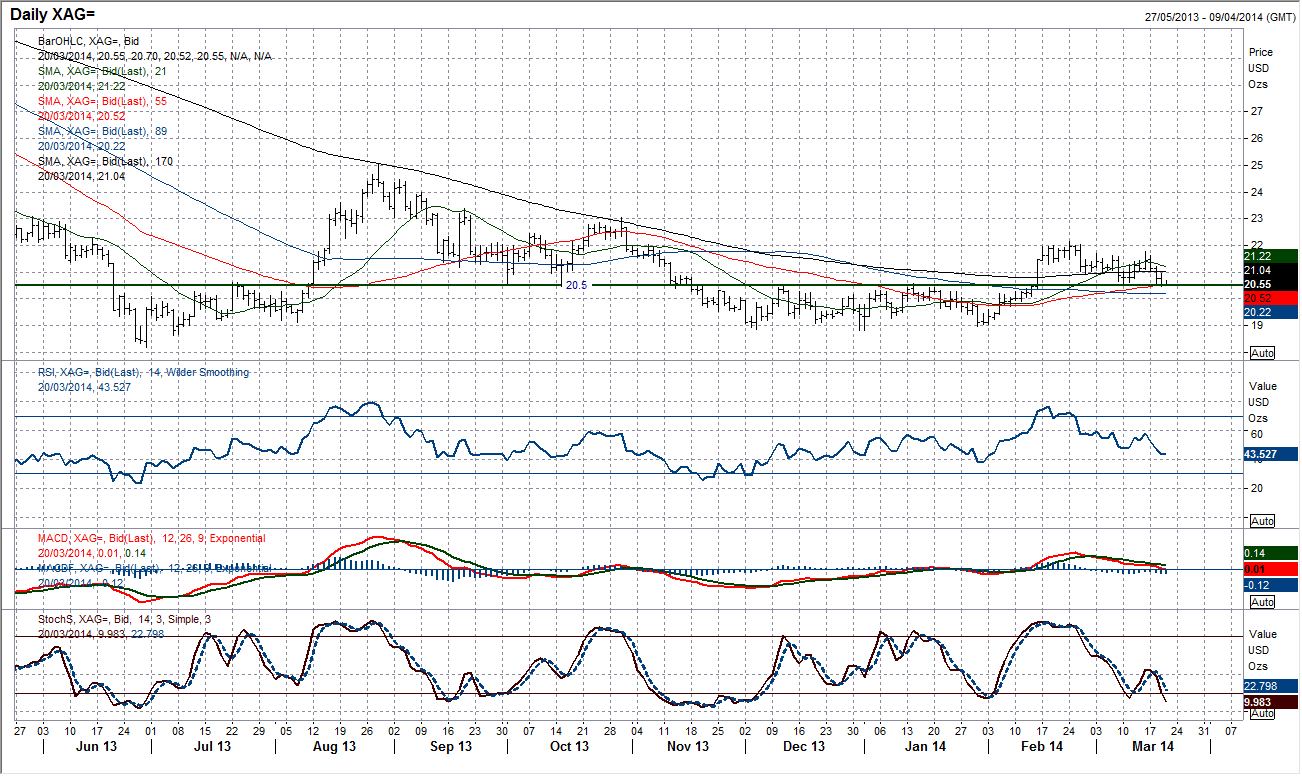

Chart of the Day – Silver

The silver chart has not been as bullish as gold on the way up in recent weeks, but equally has not been as bearish on the way down. Silver has now just unwound to the strong band of support around $20.50 which has for several months acted as a strong pivot level. The technical indicators on the daily chart also suggest that this could become a good opportunity to buy once more. The MACD lines remain above neutral and the price is still trading above the rising 55 day moving average which has been a decent gauge. The intraday hourly chart shows a break of the 4 day downtrend, which could be an early sign of the selling pressure beginning to abate. For now the momentum does remain with the sellers , however there are several reasons for the bulls to once more become interested around these levels.

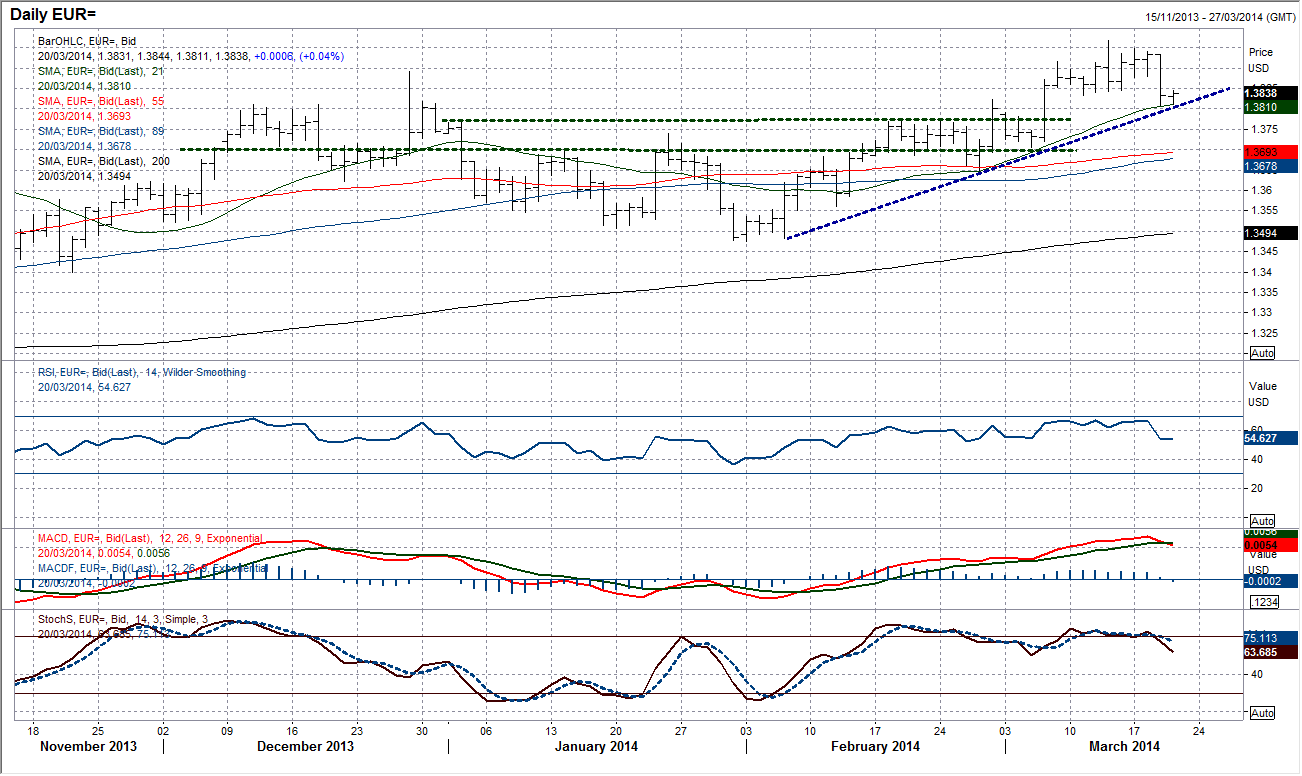

EUR/USD

The Dollar strengthened significantly yesterday evening as the statement from the FOMC was announced, pulling Euro/Dollar sharply lower. However the damage as yet on the daily chart has been fairly limited. The rate is merely back to the support of the rising 21 day moving average (currently $1.3810) which has supported the big corrections on Euro/Dollar in the past 6 weeks and also the support of a 7 week uptrend. There is also support around some old breakout highs as well. A consolidation has set in during the Asian trading hours and for now the daily RSI has once more been supported above 50. For the moment then this looks like an opportunity to buy. The intraday chart shows a low in place at $1.3808 and the retracement has since begun. There is little resistance until the old lows around $1.3877.

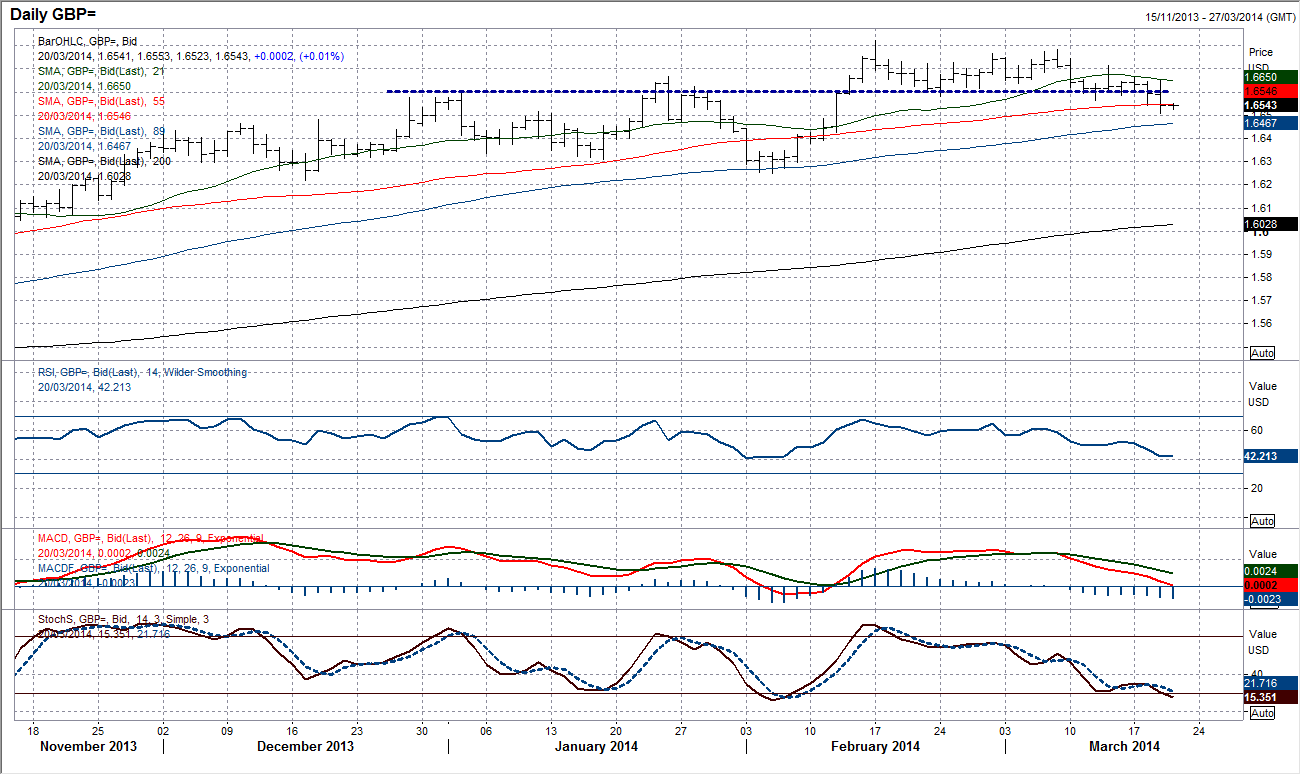

GBP/USD

The indications in the last few days has been that pressure had been increasing to the downside with a series of lower highs. Now with the help of the FOMC yesterday the has been a decisive near term deterioration. The daily chart now shows the falling 21 day moving average as being the barrier to a recovery, whilst momentum indicators continue to suggest a correction. However on the medium term basis this still looks to be a correction within the uptrend with the MACD lines still above neutral and the price trading above the rising 89 day moving average (currently $1.6467) and until this changes we remain cautiously positive over the medium term. Overnight, the support has formed at $1.6506 and a retracement is underway. There is a resistance band $1.6578/$1.6583 which could hold up any recovery.

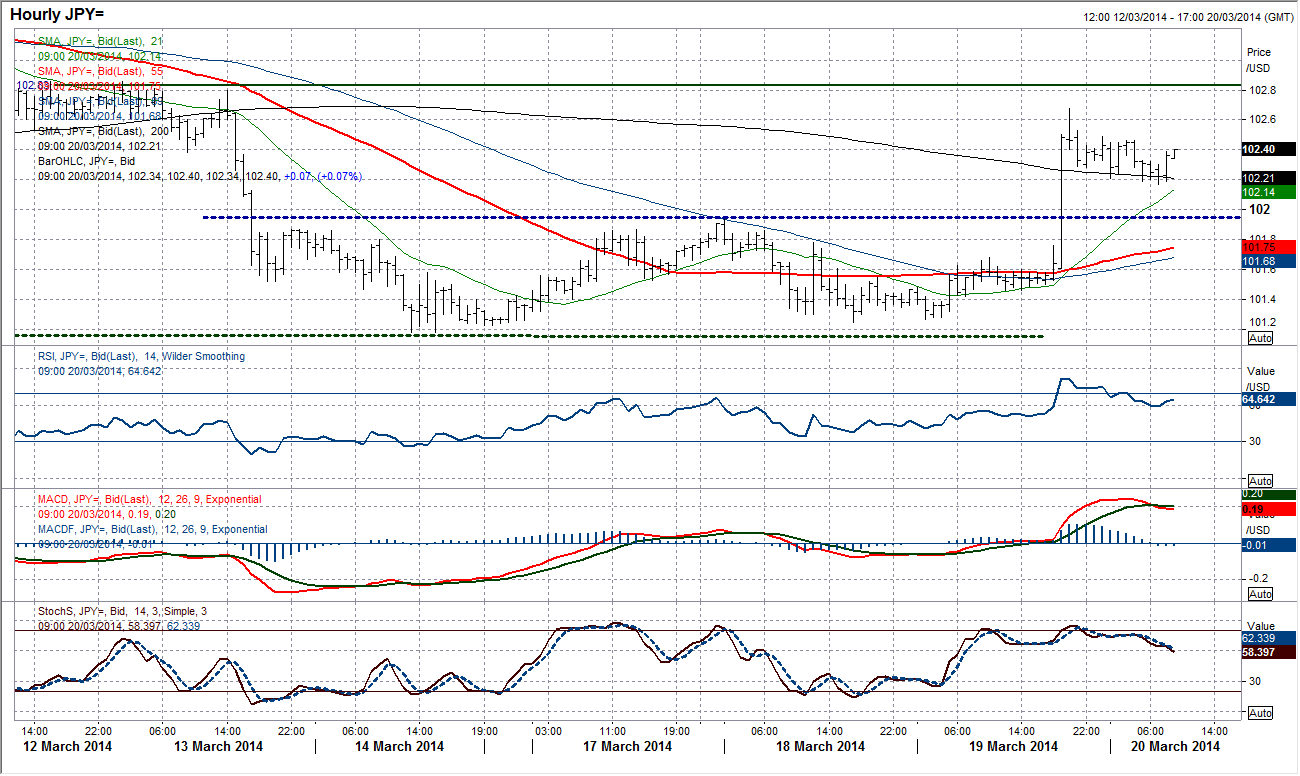

USD/JPY

The sharp FOMC related dollar recovery has merely re-affirmed the ranging phase that Dollar/Yen currently trades in. On the daily chart the support at 101.17 has been significantly bolstered but the old 102.83 pivot level once more comes back into play. Daily momentum indicators are once again neutral. On the hourly intraday chart, overnight the rate hit a high at 102.68 which was almost to the pip the 101.70 implied target from the break higher of the base pattern above 101.95. Dollar/Yen is though now engaging in a retracement of this move as momentum indicators unwind. The previous resistance now becomes the immediate support at 101.95. Once the rate settles down following the retracement the signals suggest that the dollar bulls are in control and will begin to look to push Dollar/Yen higher once more.

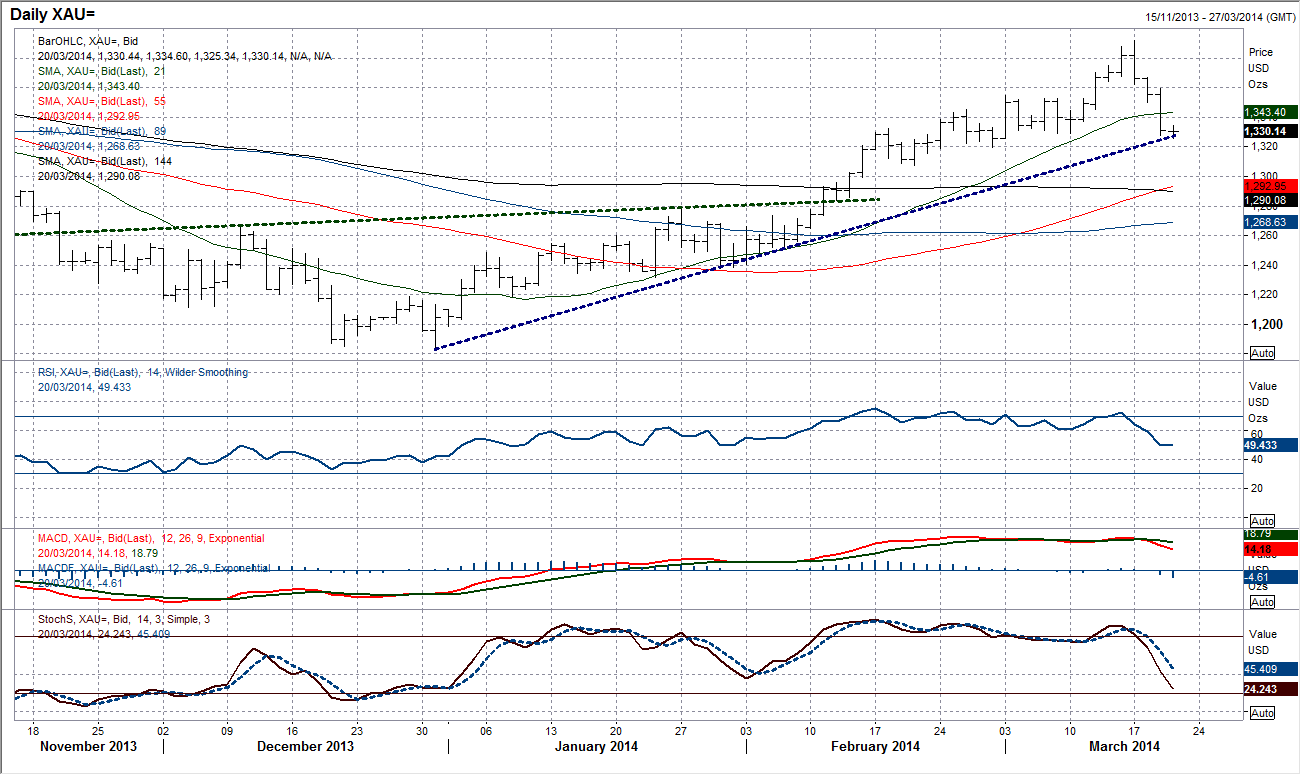

Gold

The sharp correction in gold was certainly not helped yesterday by the strength of the dollar and now the gold price is back to a near term test. The uptrend on the daily chart that has been in place since the December low is now being seriously tested. The 21 day moving average which had supported the corrections within the uptrend has now been breached and the momentum indicators are all in correction mode. Gold is now back into the support band $1319.61/$1328.86 and a breach of the low would open for a move back towards $1300. The intraday chart shows that although there has been a low in place at $1325.34 a retracement rally is struggling at the resistance of the falling 21 hour moving average (currently around $1334). With a 3 day downtrend intact and hourly momentum indicators firmly in bearish configuration, selling into any bounce is still the best option.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.