Technical Bias: Short-term Bullish

Key Takeaways

- Euro gained some momentum this past week and it looks set for a short-term spike higher.

- EURUSD has a monster resistance around the 1.1200 level where sellers are likely to appear.

- Euro area Consumer Confidence will be released by the European Commission, which is expected to come in at -5.95 in March 2015.

Euro traded higher this past week against the US dollar, but buyers might struggle to maintain strength as there are several hurdles on the way up for EURUSD.

Technical Analysis

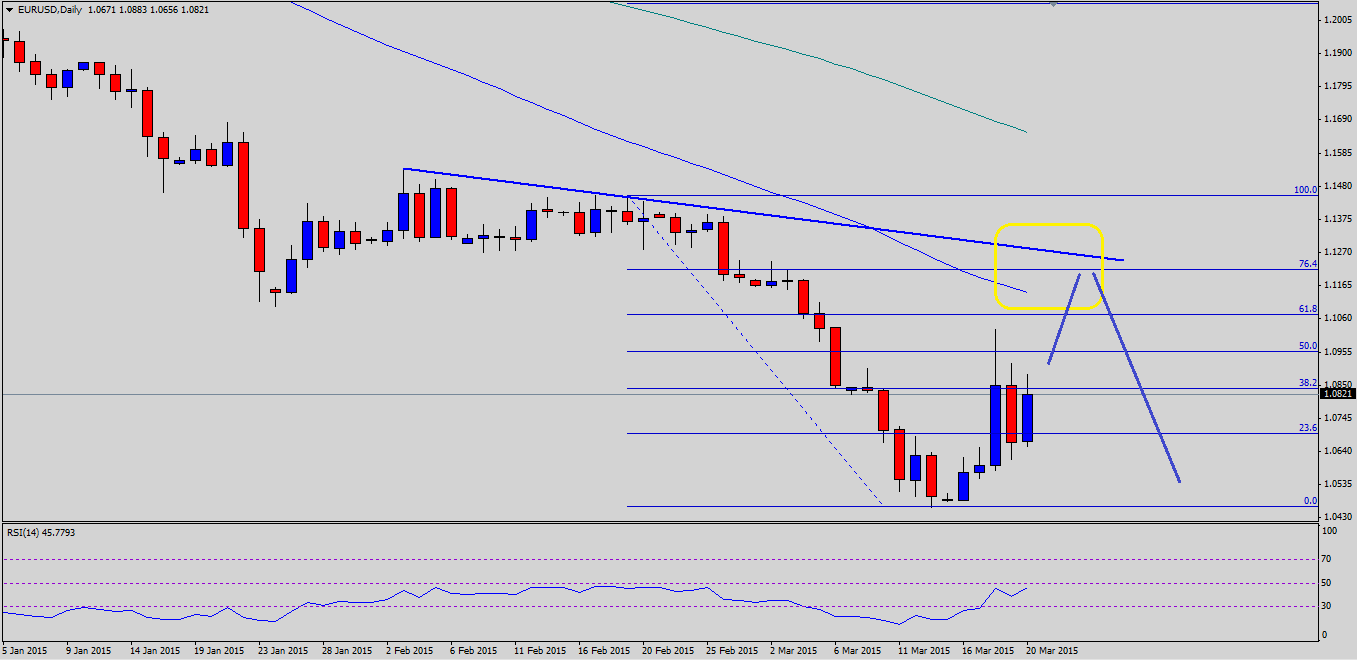

There was a strong support in EURUSD around the 1.0500 area where the Euro sellers struggled to take the pair lower. There is a very critical bearish trend line formed on the daily chart of the EURUSD pair, which is likely to act as a hurdle in the near term. The most important thing to note that the 50-day simple moving average is sitting just below the highlighted bearish trend line. This is not all the 61.8% fib retracement level of the last drop from the 1.1451 high to 1.0467 low is positioned around the stated area. Let us see how the pair reacts in the near term if it reaches around the highlighted resistance area.

If the EURUSD fails to move higher, then it might head back towards an important support area around the 1.0650 levels.

There is one more point to note is the fact that the daily RSI is heading towards the 50 swing level.

Euro Area Consumer Confidence

Later during the NY session, the Euro area Consumer Confidence will be released by the European Commission. The forecast is lined up for a reading of -5.95 in March 2015, compared to the preceding reading of -6.70.

Trade Idea

One might consider selling rallies in the EURUSD pair around 1.10-12 as long as the pair stays below the 50-day SMA.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated below 1.0700. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD declines below 1.2500 as USD rebounds

GBP/USD declined below 1.2500 and erased the majority of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold drops below $2,320 as US yields shoot higher

Gold lost its traction and turned negative on the day below $2,320 in the American session on Thursday. The benchmark 10-year US Treasury bond yield is up more than 1% on the day above 4.7% after US GDP report, weighing on XAU/USD.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.