Technical Bias: Bullish

Key Takeaways

Euro jumped higher against the Canadian dollar recently and looks set for more gains in the short term.

German consumer price index will be released later during the London session which might cause moves in the EURCAD pair.

EURCAD has resistance around 1.4350 and support at 1.4150.

Euro climbed higher against a basket of currencies recently and managed to maintain gain Intraday especially against the Canadian dollar.

Technical Analysis

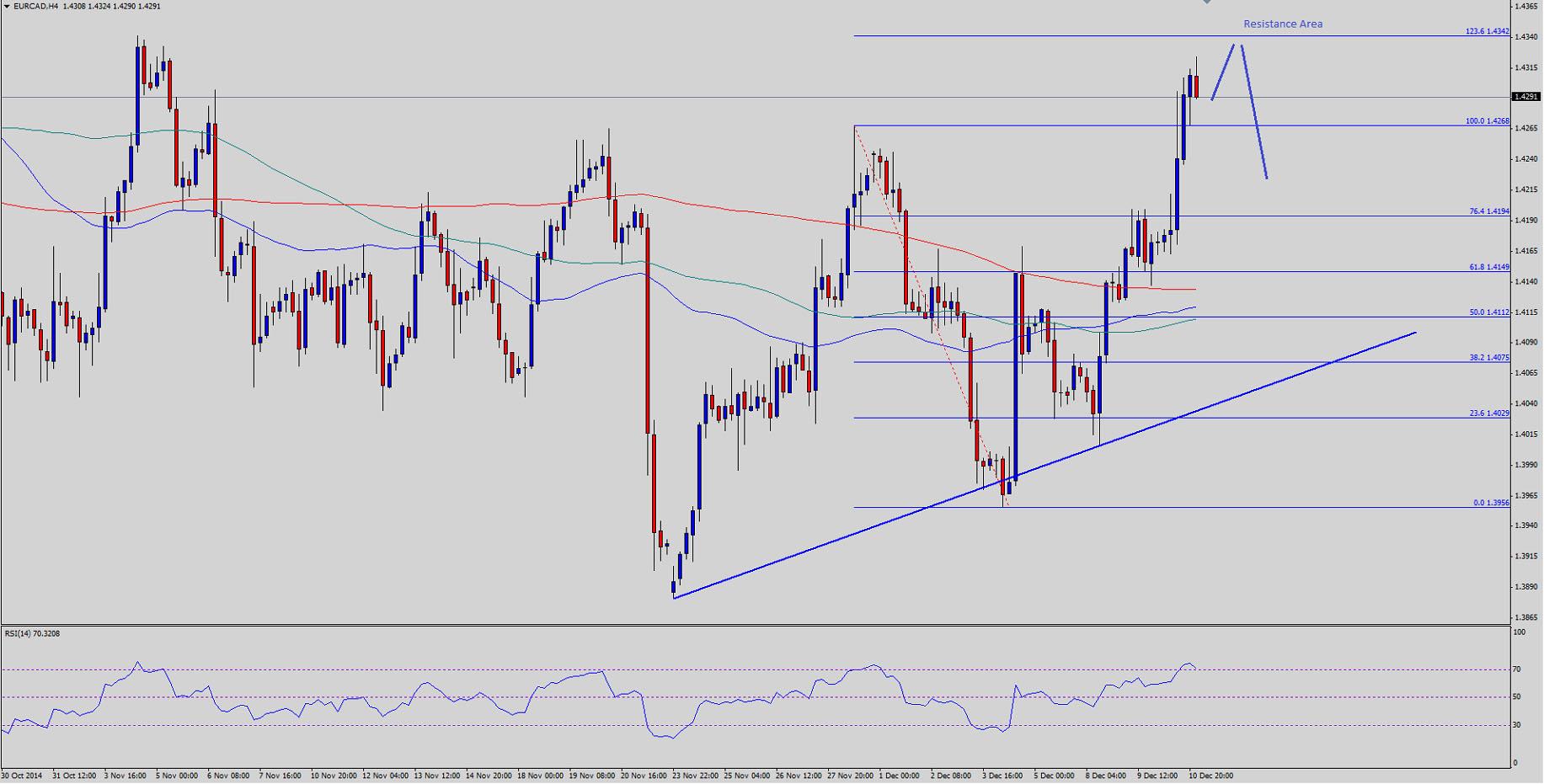

The EURCAD pair successfully managed to settle above all three important simple moving averages (200, 100 and 50), which can be considered as a bullish sign in the near term. Yesterday, the pair spiked around the last swing high of 1.4268 on a couple of occasions. There is a chance that the pair might head towards the 1.236 extension of the last leg from the last leg from the 1.4268 high to 1.3956 low. In that situation, the Euro sellers are likely to appear and protect further upside in the pair. The 4H RSI is around the overbought reading, which is warning sign moving ahead. A break above the 1.4350 level might signal more gain towards the 1.4400 resistance area.

On the downside, there are a lot of support areas starting with the 200 SMA (4H), which is sitting just above the 100 SMA. The most important support can be seen around a critical bullish trend line forming on the 4 hour chart of the EURCAD pair. Basically, any major correction lower from the current levels might be considered as a buying opportunity.

German CPI Report

Later during the London session, the Germany consumer price index released by the Statistiches Bundesamt Deutschland. The forecast is slated for an increase of 0.6% in November 2014, down from the last reading of 0.8%. If the outcome exceeds the expectation, then there is a chance that the Euro might continue heading higher in the near term.

Recommended Content

Editors’ Picks

AUD/USD favours extra retracements in the short term

AUD/USD kept the negative stance well in place and briefly broke below the key 0.6400 support to clinch a new low for the year on the back of the strong dollar and mixed results from the Chinese docket.

EUR/USD now shifts its attention to 1.0500

The ongoing upward momentum of the Greenback prompted EUR/USD to lose more ground, hitting new lows for 2024 around 1.0600, driven by the significant divergence in monetary policy between the Fed and the ECB.

Gold aiming to re-conquer the $2,400 level

Gold stages a correction on Tuesday and fluctuates in negative territory near $2,370 following Monday's upsurge. The benchmark 10-year US Treasury bond yield continues to push higher above 4.6% and makes it difficult for XAU/USD to gain traction.

Bitcoin price defends $60K as whales hold onto their BTC despite market dip

Bitcoin (BTC) price still has traders and investors at the edge of their seats as it slides further away from its all-time high (ATH) of $73,777. Some call it a shakeout meant to dispel the weak hands, while others see it as a buying opportunity.

Friday's Silver selloff may have actually been great news for silver bulls!

Silver endured a significant selloff last Friday. Was this another step forward in the bull market? This may seem counterintuitive, but GoldMoney founder James Turk thinks it was a positive sign for silver bulls.