Technical Bias: Bearish

Key Takeaways

Euro was hammered against the US dollar during this past week, which might continue this week as well.

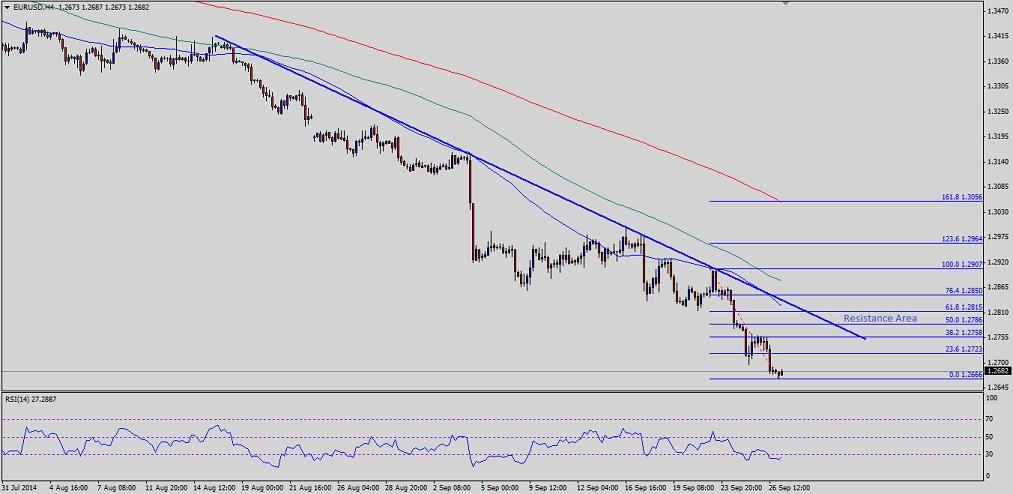

EURUSD pair looks like heading towards the 1.2620-00 support area.

EURUSD support seen at 1.2620 and resistance ahead at 1.2780.

The Euro sellers enjoyed the ride recently, but any major losses from the current levels against the US dollar look tough moving ahead.

Technical Analysis

There is a bearish trend line on the 4 hour timeframe of the EURUSD pair, which acted as a resistance for the Euro buyers on a number of occasions. The highlighted trend line is currently coinciding with the 50 simple moving average (SMA) – 4H. Moreover, the 100 SMA (4H) is also sitting above the bearish trend line. So, if the pair retraces from the current or a bit lower levels, then it might find a lot of sellers around the 1.2800-10 area. The mentioned area also acted as a support recently, so it might turn as a strong barrier in the near term. Moreover, the 50% Fibonacci retracement level of the last leg from the 1.2907 high to 1.2666 low also sits around the mentioned resistance area.

However, there are strong signs of exhaustion emerging, as the 4H RSI is well around the extreme levels which might cause a pullback in the short term. If at all the EURUSD pair slides further, then the next level of interest is around the 1.2620 area. Any additional downside should be limited considering oversold readings.

Euro Zone Consumer Confidence

The Euro zone consumer confidence data will be published later during the London session today. The forecast is slated for a decline from -10 to -11. If the outcome is on the positive side, then there is a chance that the Euro might recover some ground moving ahead.

Recommended Content

Editors’ Picks

AUD/USD turns south toward 0.6400 after mixed Australian jobs data

AUD/USD has come under renewed selling pressure and turned south toward 0.6400 after Australian employment data pointed to loosening labor market conditions, fanning RBA rate cut expectations and weighing on the Aussie Dollar.

USD/JPY remains below 154.50 amid weaker US Dollar

USD/JPY keeps losses for the second successive session, trading below 154.50 in Asian trading on Thursday. The pair is undermined by the latest US Dollar pullback, Japan's FX intervention risks and a softer risk tone.

Gold retreats as lower US yields offset the impact of hawkish Powell speech

Gold prices retreated from close to weekly highs during the North American session on Wednesday amid an improvement in risk appetite. The bullish impulse arrived despite hawkish commentary by US Federal Reserve officials.

OMNI post nearly 50% loss after airdrop and exchange listing

Omni network lost nearly 50% of its value on Wednesday after investors dumped the token following its listing on top crypto exchanges. A potential reason for the crash may be due to the wider crypto market slump.

US stock continue to stumble as traders rethink rates

US stocks grappled with uncertainty on Wednesday in the wake of a cautious string of commentary from the US Federal Reserve officials. The S&P 500 is currently experiencing its longest non-bullish streak in months.