Technical Bias: Bullish

Key Takeaways

Euro surged higher against the Australian dollar and broke an important resistance area.

Any correction from the current levels might be considered as a buying opportunity.

EURAUD support seen at 1.4100 and resistance ahead at 1.4300.

The Euro managed to gain traction against the Australian dollar, as the latter one got weakened against almost all major currencies. Moving ahead, more gains are likely in EURAUD.

Technical Analysis

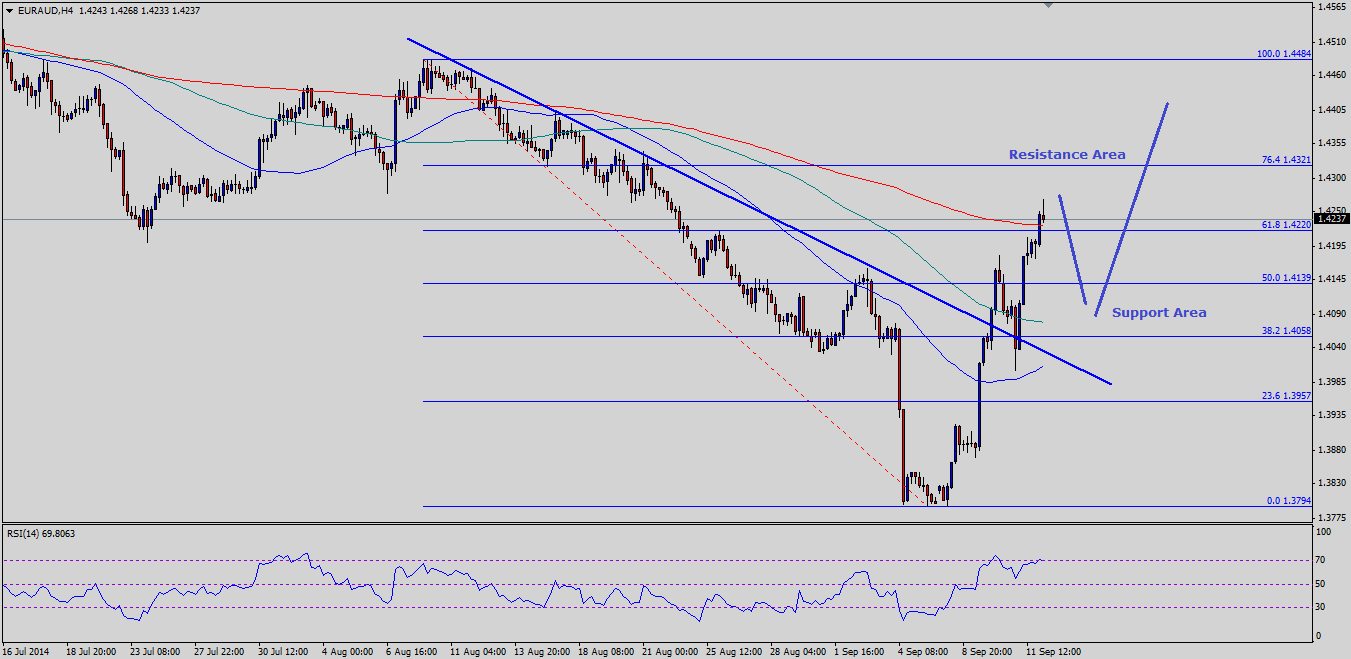

There was a major trend line on the 4 hour timeframe for the EURAUD pair, which was broken earlier during this week. This particular break can be considered as significant, as it opened the doors for further upside acceleration towards the last swing high. Currently, the pair is trading above the 61.8% Fibonacci retracement level of the last drop from the 1.4484 high to 1.3794 low. However, the pair is struggling to close above the 200 simple moving average (SMA) – 4H. So, there is a chance that the pair might move a bit lower from the current levels. On the downside, the broken trend line area might provide support in the near term. The most important point to note here is that the 100 SMA (4H) also sits around the same area. So, there is a major support around the 1.4100-1.4080 area. Any further downside should be limited unless the Euro starts moving lower.

The 4H RSI is around the extreme levels, which means a correction might be on the cards. On the upside, the 76.4% fib level might act as a resistance around the 1.4300-1.4320 levels.

Euro Zone Industrial Production

Later during the London session, the Euro zone industrial production data will be released by the Eurostat. If the outcome surpasses the expectation of a 0.5% gain, then the Euro might climb further in the near term.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated below 1.0700. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD declines below 1.2500 as USD rebounds

GBP/USD declined below 1.2500 and erased the majority of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold drops below $2,320 as US yields shoot higher

Gold lost its traction and turned negative on the day below $2,320 in the American session on Thursday. The benchmark 10-year US Treasury bond yield is up more than 1% on the day above 4.7% after US GDP report, weighing on XAU/USD.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.