Key Takeaways

- Euro slides against the US dollar, but manages to hold ground against the Australian dollar.

- There is a major resistance around the 1.4430 level, which might act as a pivot zone for the pair.

Technical Analysis

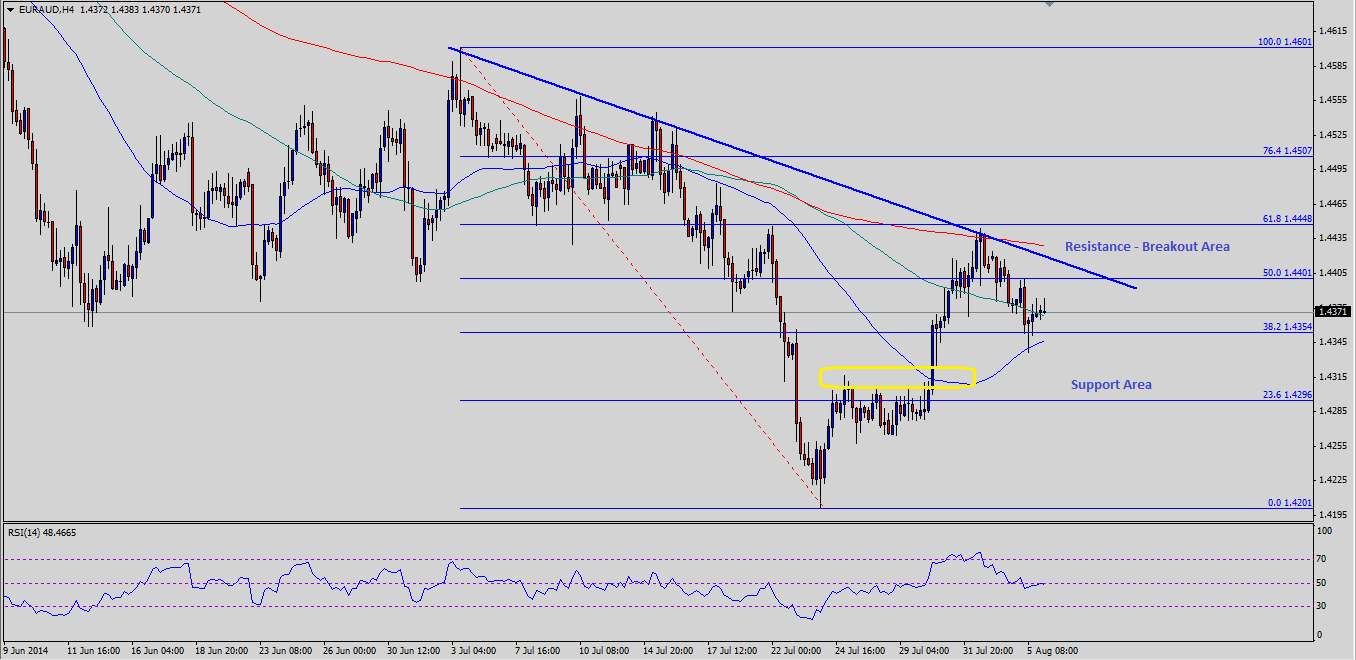

There is an important bearish trend line formed on the 4 hour timeframe for the EURAUD pair, which acted as a barrier a number of times. Moreover, the most important point is that the same trend line is now coinciding with the 200 simple moving average (SMA) - 4H. So, the Euro buyers are having a tough time to break the 1.4420-30 resistance area. The pair recently tested the mentioned area, but failed to break it and traded lower. This failure also occurred right around the 61.8% Fibonacci retracement level of the last drop from the 1.4601 high to 1.4201 low. So, technically it holds a lot of importance. However, the pair found buyers around the 50 SMA (4H). Currently, the pair is trading around the 100 SMA (4H), and if it manages to close above the same, then a run towards the 1.4430 resistance zone is very likely. If Euro sellers fail to defend the mentioned resistance area, then a move towards the last high of 1.4601 might be on the cards.

On the downside, the EURAUD pair remains supported by the 50 SMA (4H). Any further losses might take the pair closer to the previous swing zone of 1.4300.

Overall, as long as the pair is trading above the 50 SMA (4H) the chance of a move higher is more compared to a drop lower.

Recommended Content

Editors’ Picks

EUR/USD climbs to 10-day highs above 1.0700

EUR/USD gained traction and rose to its highest level in over a week above 1.0700 in the American session on Tuesday. The renewed US Dollar weakness following the disappointing PMI data helps the pair stretch higher.

GBP/USD extends recovery beyond 1.2400 on broad USD weakness

GBP/USD gathered bullish momentum and extended its daily rebound toward 1.2450 in the second half of the day. The US Dollar came under heavy selling pressure after weaker-than-forecast PMI data and fueled the pair's rally.

Gold struggles around $2,325 despite broad US Dollar’s weakness

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

Germany’s economic come back

Germany is the sick man of Europe no more. Thanks to its service sector, it now appears that it will exit recession, and the economic future could be bright. The PMI data for April surprised on the upside for Germany, led by the service sector.