Key Takeaways

- Canadian dollar fell against the US dollar post BOC interest rate decision to trade as high as 1.0791.

- Despite the dovish statement published by the Bank of Canada, the Canadian dollar managed to gain ground later.

- USDCAD support seen at 1.0700 and resistance ahead at 1.0790.

Correction Complete?

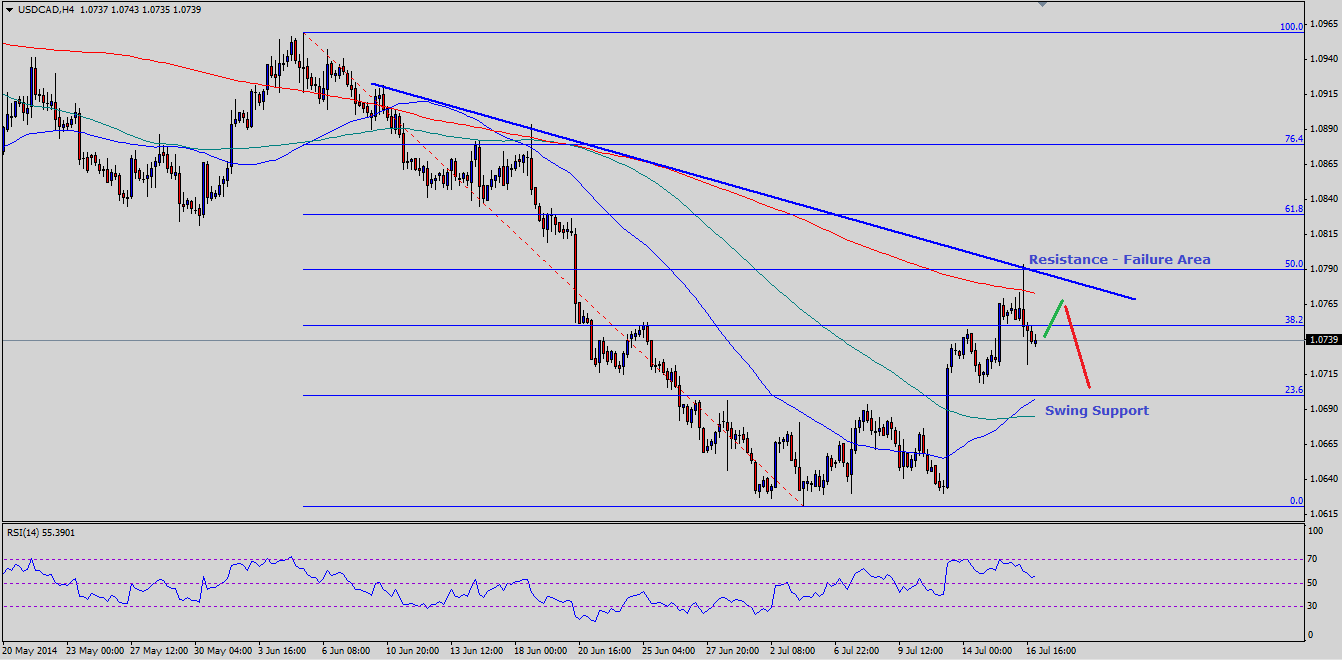

There is an important bearish trend line formed on the 4 hour timeframe for the USDCAD pair, which acted as a barrier for the pair on a couple of occasions. However, the most critical point was that the trend line also coincided with the 50% Fibonacci retracement level of the last drop from the 1.0959 high to 1.0620 low. The USDCAD pair post the news release climbed towards the 50% fib level, failed to gain momentum above the same and fell sharply. Moreover, the pair also failed to close above the 200 simple moving average (4H), which adds to the theory that the pair might have completed the current wave sequence and could move lower again. However, this can only be considered as valid if the pair breaks the 100 SMA (4H) and settles below it. If the pair manages to climb higher again, then it might face resistance around the 200 SMA (4H), followed by the same pivot area at 1.0780-90. A break above the mentioned levels could lead the pair towards the 1.0900 resistance area.

On the downside, the most important support area can be seen around a critical confluence area of 100 and 50 SMA (4H), which could act as a barrier for the US dollar sellers in the short term. So, as long as the pair respects the mentioned confluence area more upside cannot be denied.

Recommended Content

Editors’ Picks

AUD/USD risks a deeper drop in the short term

AUD/USD rapidly left behind Wednesday’s decent advance and resumed its downward trend on the back of the intense buying pressure in the greenback, while mixed results from the domestic labour market report failed to lend support to AUD.

EUR/USD leaves the door open to a decline to 1.0600

A decent comeback in the Greenback lured sellers back into the market, motivating EUR/USD to give away the earlier advance to weekly tops around 1.0690 and shift its attention to a potential revisit of the 1.0600 neighbourhood instead.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Bitcoin price shows strength as IMF attests to spread and intensity of BTC transactions ahead of halving

Bitcoin (BTC) price is borderline strong and weak with the brunt of the weakness being felt by altcoins. Regarding strength, it continues to close above the $60,000 threshold for seven weeks in a row.

Is the Biden administration trying to destroy the Dollar?

Confidence in Western financial markets has already been shaken enough by the 20% devaluation of the dollar over the last few years. But now the European Commission wants to hand Ukraine $300 billion seized from Russia.