Technical Bias: Bullish

Key Takeaways

US dollar dumped post FOMC meeting minutes despite positive indications from the Fed members in the minutes released.

Euro breaks key resistance against the US dollar to trade higher.

EURUSD support seen at 1.3620-30 and resistance ahead at 1.3660.

The Euro moved lower against the US dollar post FOMC meeting minutes release, but later the reversal in U.S. yields took the US dollar lower against all major currencies, including the Euro.

Technical Analysis

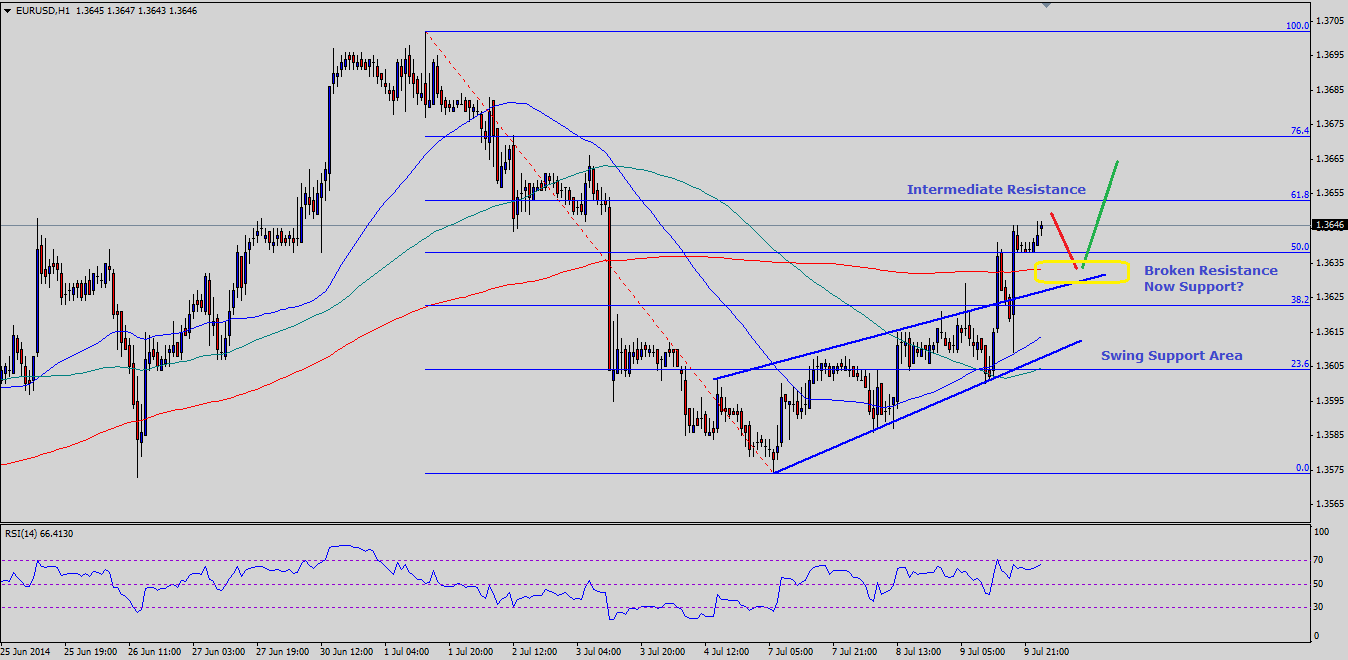

There was a critical triangle forming on the hourly timeframe for the EURUSD pair, which was holding the upside in the pair. Moreover, the 200 hourly simple moving average (SMA) was sitting just above the highlighted triangle, which was adding to the bearish pressure. However, the Euro buyers managed to break both barriers and closed above the crucial 1.3630 resistance zone. This particular break has set the tone for additional gains in the pair. If the pair moves a bit lower from the current levels, then the broken resistance zone might act as a support around the 1.3630 level, which also coincides with the 200 hourly SMA. If buyers fail to hold the mentioned support level, then a move back towards an important swing support area at 1.3600 is possible in the near term.

However, the chance of a bounce from the 1.3630 level is quite high, and if that happens, the pair might challenge the 61.8% fib retracement level of the last drop from the 1.3702 high to 1.3574 low. Any further strength might take the pair towards the last high of 1.3702.

French CPI and ECB Monthly Report

Today during the London session, the French Consumer Price Index (CPI) will be released by the French National Institute for Statistics and Economic Studies. The forecast is slated for a small rise of 0.2% in the French CPI. Moreover, the European Central Bank's (ECB) monthly report will also be published, which would highlight current and future economic conditions. Both these events can cause some swing moves in the Euro.

Overall, as long as the pair stays above the 200 hourly SMA more gains are likely moving ahead.

Recommended Content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.